Ok this week I will introduce my two part series on Bitcoin vs Gold.

To all the crypto players out there, I am on your side.

But what I am going to share this week – and conclude next week – will shock the Bitcoin world… using advanced math to prove that the model many of the talking heads and crypto gurus are using, is actually wrong.

I’ll get to that shortly. But first… let’s cover where we’ve been.

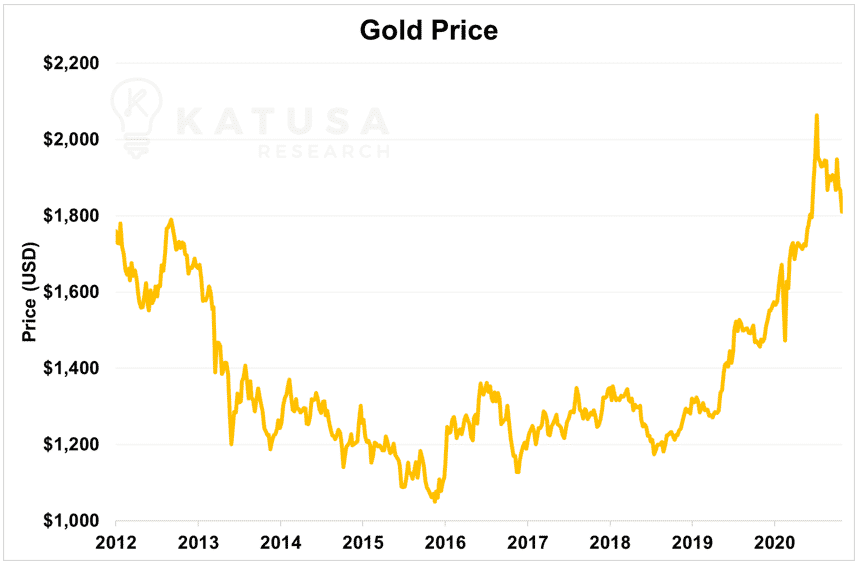

It was just mere months ago that gold broke to new all-time highs of $2,089. Though it has pulled back since then, gold has since settled in at a level not seen in a decade.

Birds of a Feather Flock Together…

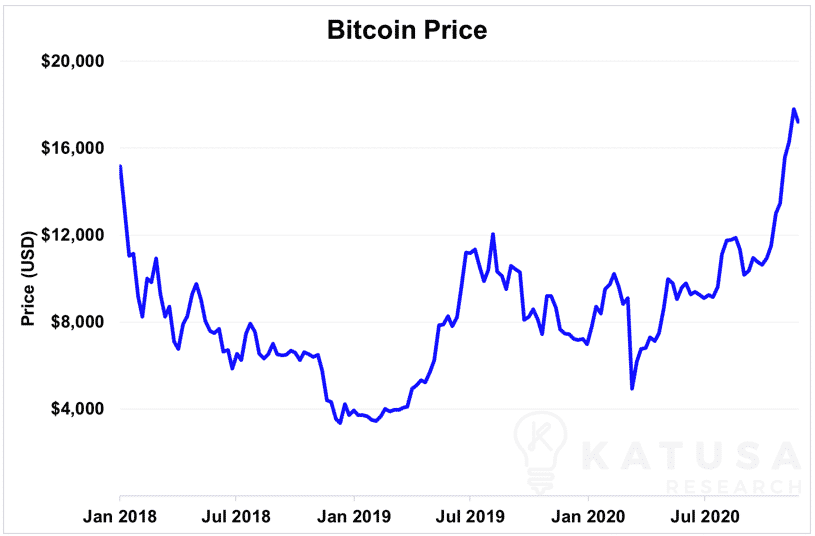

Just earlier this week, Bitcoin managed the same, punching its way back up to set a new record high of its own at $19,850.

That’s just a hair shy of the much talked about $20,000 mark.

In fact, a chart of its recent performance looks strangely familiar…

But Bitcoin didn’t pick up the nickname “Digital Gold” without a reason, and the two have a lot more in common than you might think.

Cryptocurrencies – Commodity or Currency?

How should we classify cryptocurrencies like Bitcoin?

Are they commodities or currencies?

Technically, they’re both of the above. Which makes them unique among most asset types.

- Case in point, Bitcoin functions as both a medium of exchange and a commodity with a theoretically finite supply. You could even call it a security, in the loosest sense of the term.

That said, there’s one fundamental shortcoming of cryptocurrencies that doesn’t apply to stocks, bonds, or government-issued currencies: In the unlikely scenario that the market for a particular cryptocurrency collapses it will be worth exactly nothing, regardless of the cost (energy, equipment and time) to create the coin.

At the end of the day, cryptocurrencies are a bunch of zeroes and ones.

Despite what the detractors of fiat currencies say, every bank note and coin minted is backed by the full faith and credit of the issuing government.

This may not mean much if the note is issued by the Reserve Bank of Zimbabwe, but it will be a long time before the U.S. Treasury will run out of things to tax.

That’s to say nothing of commodities like gold, where you actually own a physical asset – even if the intrinsic value of that asset is debatable.

Beyond that, however, Bitcoin and gold serve very similar purposes.

Gold, too, can be used as a medium of exchange – unwieldy as it is, there are services like Glint that allow you to buy and sell things with gold.

My friends at Goldmoney also do the same. I’m cheering for them, because gold is the purest money I know.

- And for all the ESG investors, Gold has a much smaller Green House gas foot print than Bitcoin.

Besides which, Bitcoin itself can be awkward to use as a currency for the average consumer.

I know all of you crypto geeks out there are probably chomping at the bit to disagree with me on this, but let me ask you: how many things in your daily life can you use Bitcoin for?

Can you use it to buy groceries, pay for gas at the pump, order things on Amazon?

Indirectly, perhaps, the answer is yes – by buying things like gift cards with Bitcoin and using them instead. But then you’re not really using Bitcoin itself as the currency, are you?

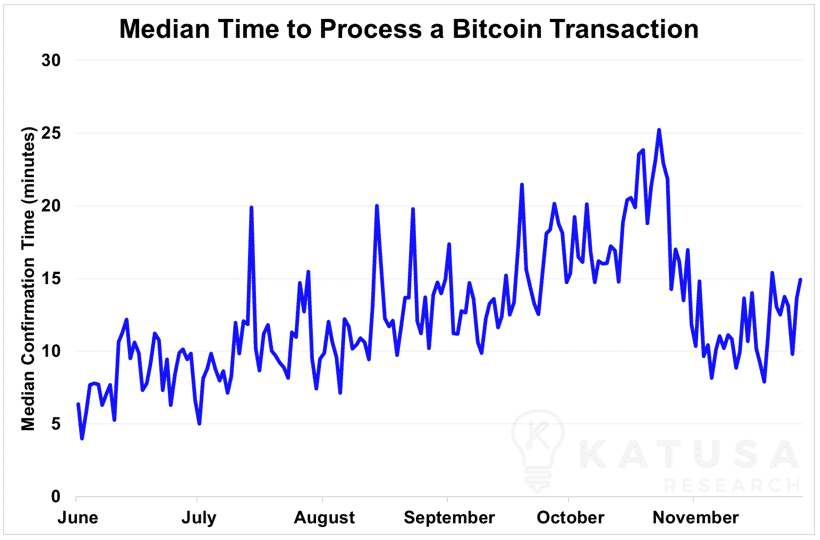

One of the big reasons for this lack of universal adoption is the time it takes to actually make a transaction in Bitcoin…

Can you imagine sitting around at the supermarket waiting for 15 minutes to confirm payment for your groceries? I know I’d have whipped out my credit card instead before the first minute was up.

So rather, much like gold, Bitcoin serves better as a commodity as a store of value.

And as a matter of fact…

- Bitcoin has recently found itself being bought for the same reason gold often is – as a hedge against inflation.

Paul Tudor Jones, the billionaire and famous hedge-fund trader, reported earlier this May that he bought Bitcoin as an inflation hedge in his $22 billion Tudor BVI Fund. This all while central banks around the world were busy printing money to combat the coronavirus-fueled recession.

It was a smart move in hindsight – this was back when Bitcoin was still trading below $10,000.

Of Course, Bitcoin, like Gold, can play a role in your investment portfolio…

You should ignore both the alarmists putting all their eggs in the proverbial “crypto” basket because of their philosophical aversion to fiat currency, as well as the old-school types who haven’t changed their tune in the last ten years about crypto being “just a fad.”

It’s real and it’s here to stay. Just like MMT and more government stimulus is here to stay as is taxing those with assets, wealth and cash.

Different types of financial assets are complementary, rather than substitutes, and serve to add diversification to an investment portfolio.

Besides Paul Tudor Jones, many other prominent hedge fund managers in the world like Stanley Druckenmiller have invested heavily in a combination of Bitcoin, gold and stocks.

Specializing doesn’t mean limiting yourself to one asset class:

- Jeffrey Gundlach, the so-called “Bond King,” owns physical gold.

- Warren Buffett invests heavily in U.S. Treasurys and municipal bonds.

- George Soros didn’t derive his whole $8.6B wealth on shorting the Pound Sterling.

- John Paulson made just as much money trading credit derivatives as he did betting on gold prices.

That said, one thing that’s become increasingly apparent in the last few months is how disconnected Bitcoin can become from the stock market and even gold itself.

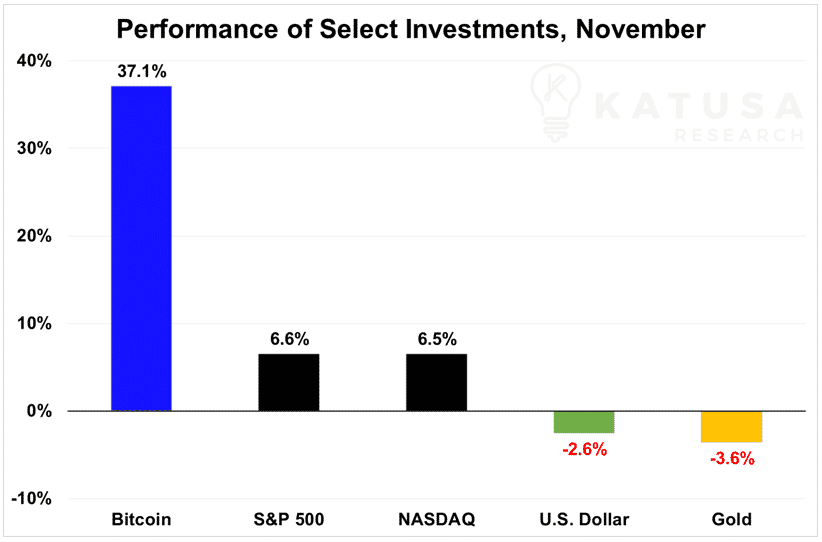

While November 2020 was one of the worst months for gold and USD, Bitcoin instead took the chance to shoot for the moon.

But if Bitcoin’s recent performance has whetted your cryptocurrency appetite, be careful…

Bitcoin Technicals

What happened to the price of Bitcoin last month should make any investor wary.

In the last week of November, rampant buying pushed the price to a near all-time high of $19,330 before the price fell $2,370 over the next three days.

Yet Bitcoin proved its mettle and went on to end the month at a new all-time high of $19,850.

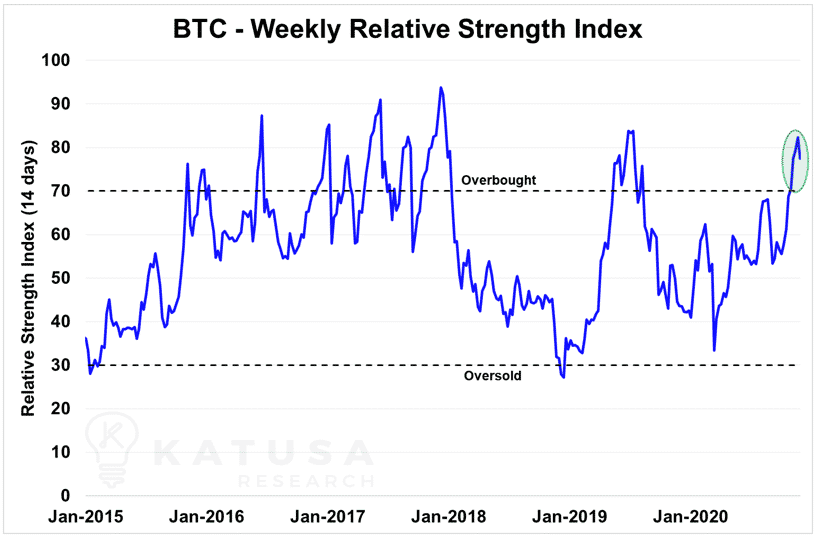

In the chart below, you can see that using the Relative Strength Index (RSI) indicator, Bitcoin has been in overbought territory far more often than oversold territory.

When the price of an asset successively reaches new all-time highs on several consecutive days, it shows you that it’s not the best time to get in at market prices.

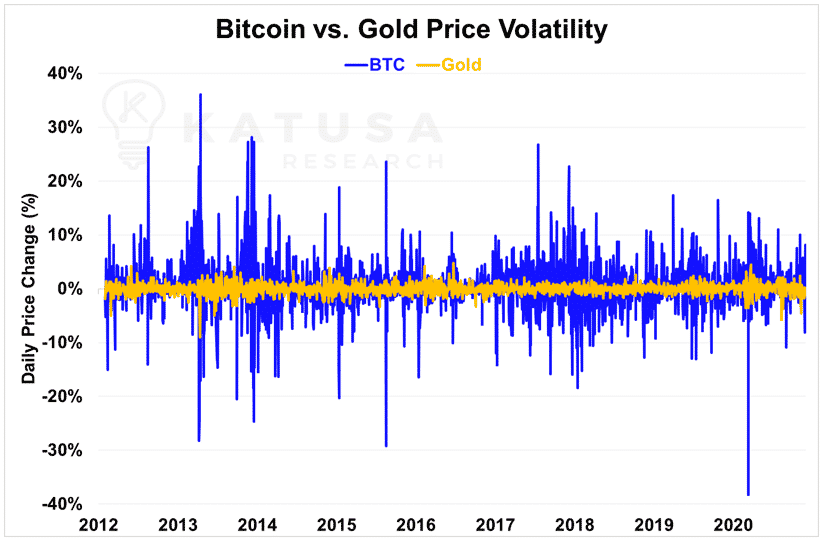

The extreme price volatility shown by Bitcoin in the past, where it has swiftly gained (or lost) over 30% of its value in a single day, undermines its attractiveness as a stable store of value.

- On March 12th earlier this year, Bitcoin lost over 38% of its value in a single day (over $3,000).

Contrast this to the S&P 500, which took one month to decline 33%, between February 19th to March 23rd this year.

Or for a better comparison, let’s check Bitcoin’s volatility against gold’s…

And its volatility means that sudden, large price swings are quite commonplace, both to the upside and downside.

If you’re suffering from Bitcoin FOMO (fear of missing out) – don’t.

If you want to build a position, then you should treat Bitcoin like any other stock or commodity, and only start buying incrementally while the herd is selling.

Where Does Bitcoin Go From Here?

If gold is the barbarous relic, a piece of history from a bygone era – what does that make Bitcoin?

It’s important to distinguish Bitcoin from other cryptocurrencies. For instance, the performance of Ethereum, the second largest cryptocurrency after Bitcoin, has often been driven by the performance of Bitcoin itself.

But this correlation has weakened at times over the past year as the explosive growth of Decentralized Finance (DeFi) – financial services backed by blockchain technology, primarily built on the Ethereum platform – became a new driver of interest in Ethereum.

And like Ethereum, many of the other cryptocurrencies that exist in the marketplace have different use cases – and different value propositions.

Though I stated earlier that Bitcoin is too awkward and unwieldy to use as a currency for day-to-day transactions, the same isn’t necessarily true of other cryptocurrencies.

- I think there’s a good chance that one day, we’ll be able to truly use cryptocurrencies the way they were intended – as the new digital cash of the future.

But even if that day comes, Bitcoin will probably still serve the same role it does now. And that’s as “digital gold”. That means an asset prized for its scarcity, rather than its utility as a currency.

Think of it as the Bitcoin standard, like how Gold was used in the gold standard.

SHOCKING TRUTH: Does Katusa Own Crypto?

Again, I play in the sand box where I have an advantage over others, and that’s gold equities.

Not a single newsletter or fund manager in the sector can come close to my returns. That’s why I focus solely on the resource sector.

But I do have a significant amount of money invested in the crypto space.

I don’t manage it myself. I just don’t have the time to do it.

Instead, I have one of the most knowledgeable teams manage my exposure to crypto. But I do pay attention because it is a lot of money.

But I want to bring your attention to something groundbreaking…

- A math “theory” has recently made its way around the world regarding Bitcoin that is being used by almost all Bitcoin bugs.

I will probably get more hate email next week than combined in the history of my firm for what I am going to publish.

Again, I am cheering for Bitcoin. I have a lot of money in it.

As most of you know, my background is mathematics. So, when someone floats around a fancy math concept, I take a look.

Most guys would take a look at a sports car or a hot super model. But I like looking at math theorems.

- Next week, I will publish in detail, step by step, putting back my old Calculus prof hat on why everyone is using a wrong formula.

I know it’s going to viral.

I know it’s going to get hate.

But to be a successful investor or speculator, you need to understand and challenge the facts.

I am NOT shorting any cryptos or any companies in the space.

All I am trying to do is bring a higher standard to the industry, in the hope to better it forward.

No different when I “urged” a major mine to be the first “smart” mine in North America to get rid of relying on shovel operators and truck drivers communicating to one another on delivery of ore vs. waste rock.

The “old hands” thought the computers and GPS systems had no place in a mine, but it improved production by 7%.

That’s what I plan on here.

I know there will be those who refuse to look at the math, and to those there is nothing I can do.

But if you care at all on educating yourself better on Bitcoin and cryptos, next week’s piece is a must see.

And until then, I suggest you start looking at my favorite time of the year again, when stocks are sold for reasons other than their intrinsic valuations.

That’s right – it’s tax loss selling season. And I’ve just handed my Katusa’s Resource Opportunities subscribers 4 new gold stock buying opportunities to keep an eye out for this Christmas.

If you want to know the best stocks to buy this holiday season – and why I’m personally taking large positions in them, at the same prices as my subscribers – consider signing up right here.

And to all the crypto crew, I look forward to next week..

Until then, stay safe.

Marin Katusa