Canada’s Uranium “Ice Tax Premium” – The Grade Mirage Investors Miss

The wind hits you first.

A knife-edge cold that slips under a hard hat and makes steel bite your gloves.

The diesel rumble never stops and pipes hiss as ground-freezing rigs turn rock into permafrost.

Back in the city, you can buy anything with a tap. Out here, every pound of yellowcake is bought with distance, weather, and time. The old way says grade solves everything. The modern world says logistics writes the bill.

This is the part most investors never see. They read “ultra-high grade” and assume “ultra-low cost.”

Then reality shows up with an invoice.

The Line Items Are Not Glamorous, But They Are Decisive

For example, there’s ground freezing to control water at mines like Cigar Lake. Fly-in/fly-out crews. Camps built for –40°C winters and then for +40°C summers. Private haul roads with radiation protocols.

Strict environmental regulation that adds months of permitting and years of monitoring.

Underground mining, already capital and labor-intensive, becomes harder by latitude and climate.

Quick refresher for non-miners…

- Cash cost is the bare-bones operating cost per pound.

- AISC (all-in sustaining cost) is the true, out-the-door cost once you add sustaining capital, logistics and compliance—what it really takes to keep the lights on.

In plain English: cash cost is the sticker price; AISC is the out-the-door price after fees and necessities.

That gap is the standard business model in the great white north.

The Framework: The “Ice Tax Premium”

The Ice Tax is the persistent, per-pound premium that northern projects pay above “cash cost” to exist. With the severe climate conditions, remoteness, environmental, compliance, and capital all factored in.

Put it in one line so you never forget it:

Delivered Cost ≈ All in Sustaining Cost + Ice Tax.

If cash cost ≈ $30/lb and the spreadsheet AISC = $50/lb, and then the actual AISC comes in at $60, the implied Ice Tax is $10+ per lb.

High grade is absolutely essential when you factor in the Ice Tax Premium, but turning potential into profit requires engineering, access, heat, power, people, and time.

Those are not optional. They’re the price of a pound of uranium in Canada.

Evidence, Not Slogans

Where do the cash costs and money actually go?

It goes to freezing systems to hold back water, aviation and camp logistics for remote sites, cold-weather construction, and operating premiums.

The Ice Tax Premium will be a well-known fact for investors when corporations try to build essential infrastructure like a mill in areas that have no basic infrastructure.

It’s not as simple as sponsoring an F1 Team, football team or hockey team.

And then there’s the compliance burden of a stringent Canadian federal and provincial regime. Although Alberta and Saskatchewan are among the best to deal with.

None of this factor in “cost creep.” It’s the operating reality that separates a pretty PEA from a durable operation.

Performance and positioning across North American names tell the same story…

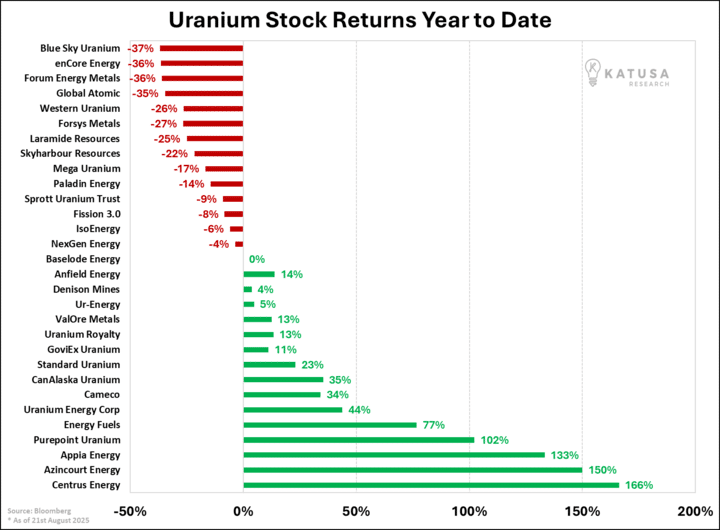

Year-to-date returns have polarized: at the top sits Centrus Energy, while Appia Energy, UEC, Cameco, have posted solid moves.

Dilution 101 (why it matters):

When a company raises equity, your slice of the pie shrinks unless value per share rises faster.

In uranium—where many developers still fund in equity—tracking dilution is how you avoid surprise capital raises.

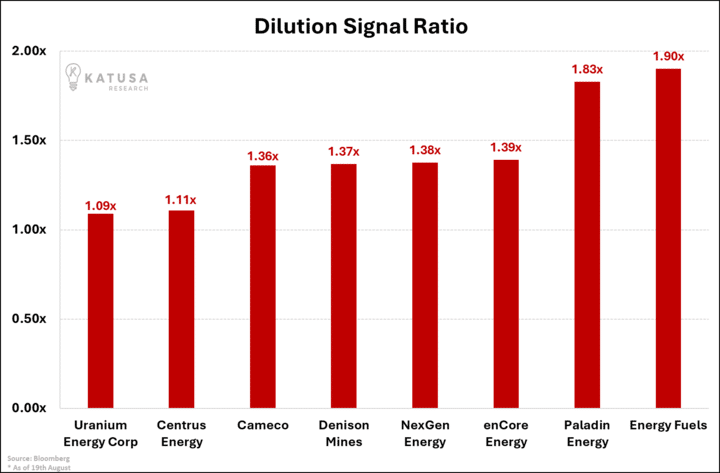

The dilution-signal ratio (current market cap divided by prior-year shares × current price) keeps the math simple…

Under 1.0x shows restraint; over 1.0x, growing share count.

- The lower the ratio, the less the risk of dilution.

On this measure, UEC (~1.09x) and Centrus (~1.11x) lead, while Energy Fuels (~1.90x) sits on the other end of the spectrum. This is a metric you want to be on the left side of the chart.

That is not a judgment; it’s a financing style.

In a sector that still relies on equity, knowing the style saves you from surprises.

The Villain (and It’s Not a Person)

The real antagonist is desktop engineering economics, spreadsheets that trim risk until the tundra adds it back with interest.

Cash cost gets the headline; AISC post Ice Tax Premium arrives later as a footnote; the Ice Tax Premium lingers until post-construction decisions.

Even “contingency” can’t prevent the Ice Tax Premium.

The detailed analysis we run behind the scenes and experience first-hand makes the point cleanly: friction creates fees, and northern pounds carry more friction by design.

Nuance (Where the Old View Still Works)…

Exceptions exist, like brownfield tie-ins that feed existing plants and roads can blunt the Ice Tax. Producers with strong cash and low net debt can ride through delays that would kneecap a thinly financed developer.

And when the tape rips higher, even high-Ice-Tax Premium pounds clear, temporarily. None of that contradicts the framework but it defines where to apply it.

Actionable Rules for Uranium Investors

1. Underwrite AISC, not cash cost. If a deck leads with cash cost, ask for the AISC and compare the spread.

2. Demand a logistics line item. Aviation, camps, heat, roads, freezing, mill, even if you can’t see them, you’ll still pay for them.

3. Stress-test calendars. Winter and compliance add time; time adds cost; cost pressures equity. Bake it in.

4. Prefer balance sheets that float. Net debt/cash and the dilution signal separate survivors from serial issuers.

5. Management. Are they desktop, spreadsheet jockeys more interested in exercising their own options at no cost base, while “managing consultants”? Or do you believe they have what it takes to get out into the Tundra and minimize the Ice Tax Premium?

Here’s a simple implementation for you…

Pick three names you own or watch.

Build a one-page “Ice Tax” check: cash cost, AISC, net debt/cash, last financing terms, dilution signal, any disclosed logistics costs, and include a simple table showing insider buys vs sells.

Why This Changes Behavior

Once you internalize the Ice Tax, you stop paying a “grade premium” that belongs to the marketing deck, not the P&L.

You’ll favor operators who budget for weather and regulation rather than hope they go away. You’ll read balance sheets before superlatives. Most of all, you’ll measure the space between cash cost and AISC and treat it as the real game.

Think back to that floodlit ore body in the cold. Hear the diesel. Feel the sting on your face. That isn’t romance; it’s cost. Mining is tough. Everything and anything that can go wrong will go wrong.

Grade is a headline. Profit is a ledger.

Write the ledger with the Ice Tax Premium, or the Ice Tax Premium will write it for you.

Regards,

Marin Katusa

P.S. If you don’t want to spend the time doing this analysis and visiting the sites yourself – consider getting Katusa’s Resource Opportunities direct to your inbox – and we’ll run the Ice-Tax check—AISC vs. cash cost, logistics, balance sheet, financing risk—and more.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.