Copper at $6: The Squeeze Has Just Begun

Fifty percent.

That’s how much more copper the world will need by 2040.

S&P Global just released their January 2026 copper report, and the numbers hit like a freight train. Global demand climbs from 28 million metric tonnes today to 42 million by 2040.

The supply side, you ask?

Without major intervention, we’re staring at a 10 million tonne shortfall.

Washington figured this out last November. They quietly tagged copper a “critical mineral.” And the government doesn’t hand out that label for fun.

They did it because copper is the connective artery linking physical machinery, digital intelligence, infrastructure, and defense systems. Without it, the electrified future doesn’t happen.

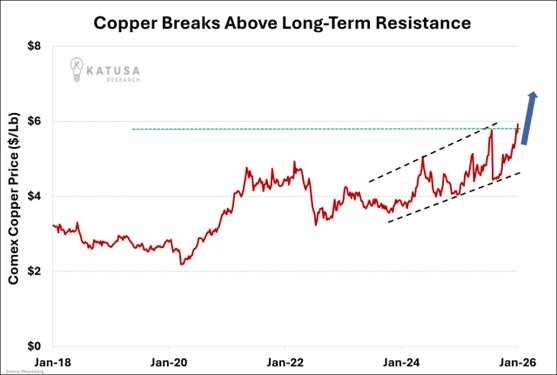

Copper Price Records

The story is heating up now with the price touching a single day record of $6.

If this price holds and closes this month above $6, a major copper bull cycle is underway.

It’s the environment we’ve been talking about for almost 2 years, as the arteries of AI and compute.

Four Forces Hitting at Once

I’ve spent two decades tracking resource cycles, and this one feels different.

The demand isn’t coming from one place, it’s coming from everywhere.

AI eats electricity.

When ChatGPT launched in November 2022, data centers used about 5% of US power. By 2030, S&P Global says that number hits 14%.

These facilities will triple their share in just five years.

Each megawatt of AI data center needs 30 to 47 tonnes of copper. Power distribution. Cooling systems. Server racks. The works.

The AI training centers in China run even higher because they build with double redundancy across all equipment. More backup means more copper.

Ozempic Copper Inventories

JPMorgan pegged data center copper demand at 110,000 extra tonnes just for 2026.

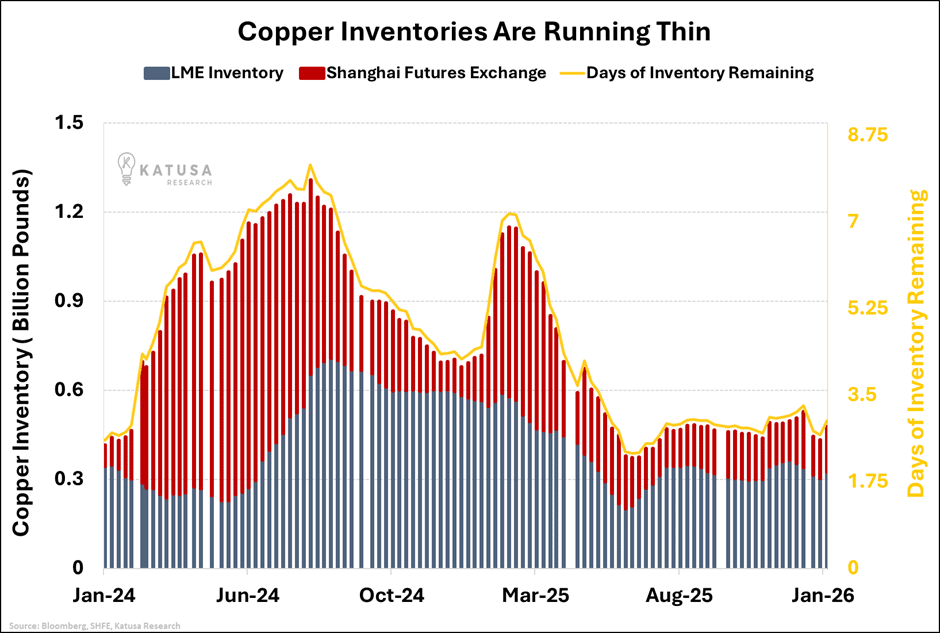

In 2025, tariff fears pushed U.S. buyers to accelerate COMEX copper imports, tightening global availability. That pull drained inventories worldwide.

By January 2026, U.S. copper stockpiles were so low they would last only about three days if no new copper arrived. That’s down from just over seven days a year before.

- Because supply was that tight, buyers in the U.S. had to pay more for copper than the standard global price set in London.

This is because potential Section 232 tariffs keep excess inventories in the country.

The grid needs a massive rebuild.

- The world must add the equivalent of 330 Hoover Dams of power capacity. Every single year. Until 2040.

Transmission and distribution networks need $7.5 trillion in investment over that stretch. Underground cables drive most of the growth. Copper dominates there because it conducts better and resists corrosion.

Subsea cables connecting renewables across borders add another layer. Australia’s AAPowerLink project alone needs an estimated 70,000 tonnes of copper.

EVs multiply the problem.

A battery electric car uses 2.9x more copper than a gas vehicle.

The metal runs through the wiring, battery packs, and motors. You can’t build an EV without copper. Period.

- China became the first market where EVs outsold gas cars in 2025.

Chinese electrics are now grabbing share across Asia, Europe, and Latin America. Global EV copper demand will hit 6.3 million tonnes annually by 2040. Up from 2.6 million today.

And let’s not forget two billion air conditioners. That’s how many get installed between now and 2040.

Each unit needs copper for heat exchangers and coils.

Lee Kuan Yew the former Prime Minister of Singapore, called air conditioning “the single most important invention of the twentieth century.”

The developing world is about to find out why.

Defense spending adds fuel.

NATO members pledged to hit 5% of GDP on military budgets. Modern weapons, drones, and communications systems run on copper-intensive electronics. This demand is inelastic. National security doesn’t negotiate on price.

Mines Can’t Keep Pace

Grasberg’s fatal incident shut their Block Cave zone until mid-2026. Chile crawled forward and Peru dealt with protests.

These aren’t one-off problems. They’re symptoms of something deeper.

- Ore grades keep falling. The easy deposits were mined decades ago. What’s left sits deeper, in harder places, with less metal per tonne of rock.

- Costs climb every year. S&P Global’s data shows it clearly.

- New mines take forever and the average project needs 17 years from discovery to first production. Permits. Reviews. Consultations. Legal fights.

Even if companies threw massive capital at the problem today, real supply wouldn’t arrive until the early 2030s.

The project pipeline can’t respond fast enough.

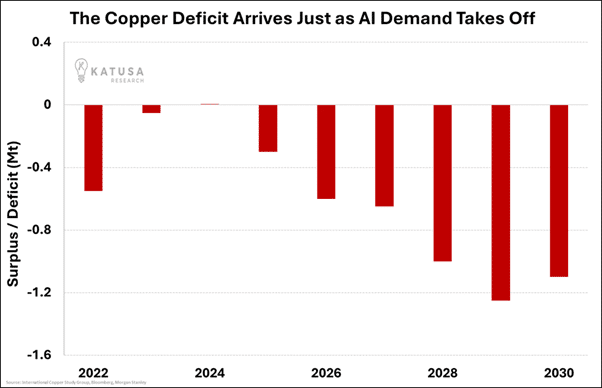

The deficit is widening fast.

UBS forecasts a 230,000 tonne shortfall in 2025. That rises to over 400,000 tonnes in 2026. Nearly four times larger than old estimates.

The chart below shows the gap widening.

And that’s before any supply shocks or demand surprises.

Inventories are paper thin.

LME and SHFE stocks sit near historic lows. They rarely cover more than a few days of global use. Even seasonal builds barely move the needle.

The buffer that absorbed shocks in past cycles is gone. Any disruption moves price fast. The market has no cushion left.

What I’m Buying Now

Copper is flirting with record all-time highs at and above $6 per pound.

The math supports sustained strength through 2026 and beyond where deficits widen and supply risks stay high. A Chinese recovery could pull even more metal into Asia.

Many copper deals have crossed my desk this year and frankly, most don’t make the cut.

The ones that do share common traits. Quality deposits. Stable jurisdictions. Clear paths to production.

- There’s one small cap stock sitting on a copper deposit so rich I expect a major to swallow it whole before year-end.

The asset is too strategic to leave in small hands.

It’s already up nearly 100% in the last few months and I expect it to run more.

I bought a big block of shares.

In this month’s Katusa’s Resource Opportunities, I break down exactly which copper plays I’m positioned in ahead of this cycle…

Including the takeover target trading at a fraction of its in-ground value.

You can become a subscriber right here.

The world needs 50% more of a metal that takes two decades to bring online.

Something has to give.

Regards,

Marin Katusa

Get real-time alerts right away. Follow on X: @KatusaResearch and @MarinKatusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.