Making and Losing Fortunes on Machine Gun Roulette

“Marin, you’re crazy. This is where the money is.”

If I had a Bitcoin for every time I heard someone tell me this across a boardroom table, on the phone, or from an email… I’d have a $20 million crypto wallet. At least.

And for the record, I actually quite like my wallet I’ve had for 10 years.

Originally I wanted to write the subject line as “Making and Losing Fortunes on African Roulette”. But using those words might get me in trouble with the Politically Correct Police.

I’ve done many deals and made many investments in Africa. And I’ve had many pitches from entrepreneurs, investment bankers, and blatant crooks that the next big gold, copper, cobalt, oil, etc… project is in this remote part of Africa just ripe for a big return.

Here’s why investing in parts of Africa is a game of Russian Roulette – with machine guns…

One of my favorite indicators when putting my own money on the line is one I call the “AK-47 Indicator”.

In fact, I wrote a whole essay about it that you can find right here.

Here’s what I wrote …

I’ve learned the hard way that if you’re interested in making money, you need to trade excitement for boring old rule of law and a simple respect for the business.

The places where people with AK-47s walk the streets tend to be the places that have very few of the roads, bridges, power lines, railroads, and ports needed to transport raw materials. That kind of infrastructure is critical for turning resource deposits into free cash flow.

The places where people walk around with AK-47s also often lack contract laws, property rights, and worst of all, respect for human life.

Now I want to show you how a fortune is made and lost in an AK-47 nation.

Strap yourself in and let’s take a flight to the Democratic Republic of the Congo. (Except for the 14 of my readers that already live there – just stay where you are. Yes,believe it or not, I have 14 subscribers in the Democratic Republic of the Congo)…

Back in late June 2017, my top analyst dug deep into the financials of the giant mining company Glencore. Deep in those company documents on a Saturday afternoon in the office, he fired me an email that said he found another tiny company that’s going to produce about 25% of current global cobalt production.

I believe his exact words in his email to me were “It’s f***** monstrous”.

And he was right.

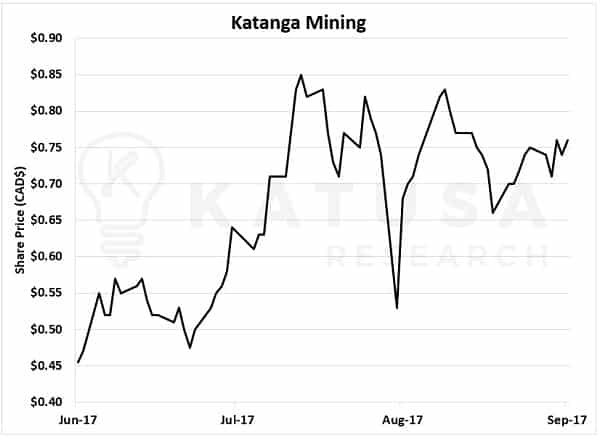

Shares of this newly discovered company were trading at 50 cents at the time. It was trading severely undervalued for the asset this tiny company owned.

I was almost tempted to send out an alert to my subscribers to let them know about this find before word got out in the investment banking and newsletter world.

But I didn’t.

My AK-47 Indicator came to mind immediately.

We spent the next couple of weeks digging deeper and deeper in due diligence. All the while the shares of the company started to creep higher, and higher. The fear of missing out (FOMO) was tiptoeing in.

And this is where the story (and stock price) started to kick into overdrive.

On August 2nd, 2017 I released my monthly issue of Katusa’s Resource Opportunities, titled “Becoming a Key Supplier in the Booming Electric Car Industry”. In this issue, I published analysis on this tiny company in question – Katanga Mining.

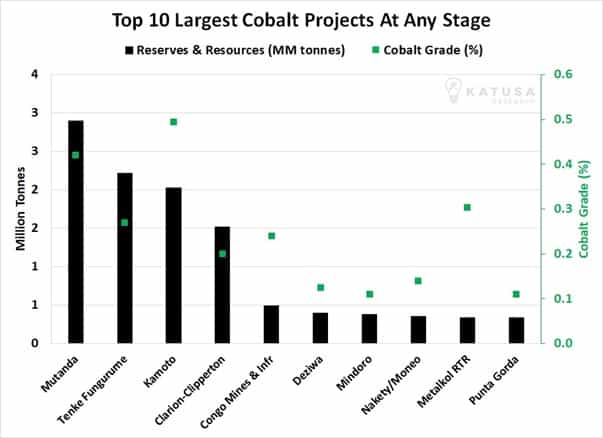

Katanga counted Glencore as a substantial shareholder and held some incredible cobalt reserves. As I’ve said many times before, cobalt is an important metal in the electric vehicle revolution.

But before I revealed the ticker to subscribers, I made a big, bold disclaimer NOT to purchase anything because of a couple of red flags I saw with the company.

One of the big ones (other than being in an AK-47 nation) was an accounting problem.

Here’s what I wrote to subscribers…

In the press release put out On July 31st, 2017, Katanga stated it was working with management and outside council on a financial review. A financial review examines the historical accounting of the company. I pride myself on my ability to look at a company or a project and determine its economic feasibility. I use countless advisors to make sure I understand the geology and engineering requirements of a deposit. However, the one thing I cannot control is if the books are cooked. Accounting fraud is a very serious offense.

I know things are done differently in the DRC and I think Glencore will sort this mess out. Regardless, there is no reason to jump into the stock until the investigators get to the bottom of it. The risk is far greater than the reward at this point.

My team and I work tirelessly to make sure you have actionable advice. However, if I am not willing to buy the stock given the current issues, why should I recommend that you invest your hard-earned money into the company? I am very cautious and you should be as well.

At the time I published that, the stock rebounded strongly from a big correction and was trading around 70 cents…

The reward in terms of much higher stock prices were very high, along with the risks too.

In the chart below, I detailed how Katanga’s Kamoto project was one of the highest-grade cobalt projects at any stage of development. And the cobalt grades were very high compared to others in the peer group.

Here is a company that ticked all the boxes…

- Experienced management team;

- Glencore was a major shareholder and backer;

- Incredible assets;

- Part of a sector (cobalt) where demand was going to drastically outpace supply in the very near future.

But the location on the map was very important.

So what happened?

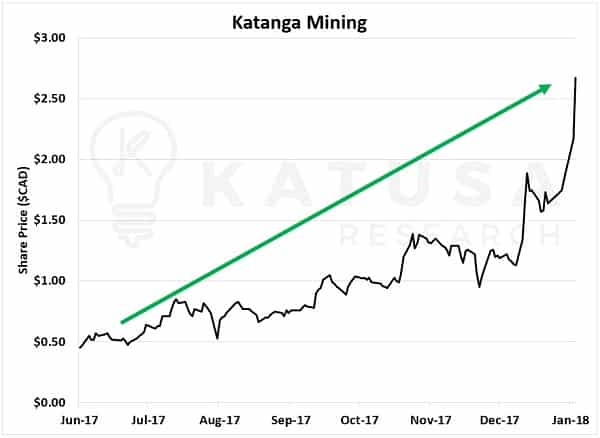

The share price took off like a rocket up from 70 cents to $2.70 in 5 months. That’s a 286% gain.

I didn’t make a single dollar on the sharp rise in the stock price. Why? Because I didn’t feel comfortable investing in a company with potential that had an accounting noose hanging over its head in an AK-47 Nation. And something just didn’t feel right about all the money and interest in cobalt and the Congo all of a sudden. My gut is usually right about these things.

After the company financials were finally released several months later, investors took the stock to the heights shown above.

Cobalt had all the momentum in the world. Money was pouring into early-stage companies. Financings were through the roof.

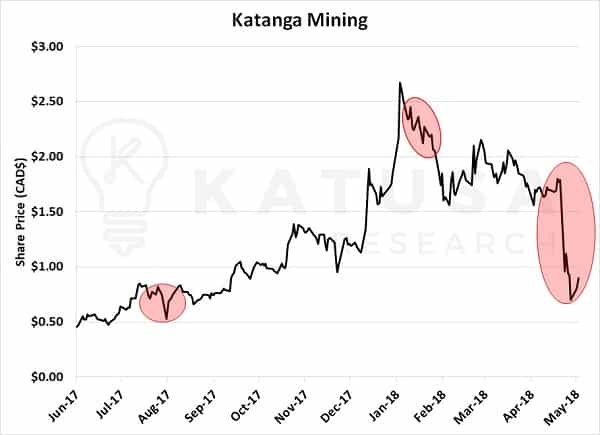

And all that came to a grinding halt on January 25th, 2018.

Congo raised taxes and royalties on metals including cobalt and copper. This didn’t go over well in the mining industry. And it especially didn’t go over well with investors.

Katanga stock started to go stagnant. The red flags I saw with the company only started increasing. But I still LOVED the assets the company had – the Kamoto cobalt project was truly world class. If Katanga could figure out the political situation, shares could appreciate further.

But then another bomb dropped last week. The DRC’s state mining company – Gecamines – was filing legal proceedings against Katanga, with the aim to dissolve the company. Gecamines alleged that Katanga had failed to adequately address its $5 billion in debt.

The stock dropped like a grand piano from a fourth story window.

A few days later, the company was hit with another suit from a former business partner. The former business partner is none other than Dan Gertler, the man who assisted in the start-up of Katanga a decade ago. Dan’s holding company, Africa Horizons Investments Ltd, is entitled to $2.28 billion in future royalty payments.

Shares are extremely volatile and a gambling trader’s dream – up and down 20-30% in a day. But that’s not how I invest.

Did I miss out on massive gains with Katanga? Sure. And it won’t be the last time I miss out on a frantic and uncertain play.

But when I put my hard earned money into a company, I want to ensure I’m backing a winning management team, with world-class assets, in a politically stable environment.

Right now, the Congo is not that kind of environment.

So the next time someone pitches you the next big investment, and it’s in an AK-47 country – really take a long, hard look before you commit your capital.

Regards,

Marin

P.S. I’m not looking for an unrealistic quick score with my money, but I have had my share of exciting overnight winners. When I invest, I put a large amount of money into a company with the prospect of 100-500% returns in 1-3 years. To see what I’m doing with my own money, consider a subscription to Katusa’s Resource Opportunities. To learn more, click here.