Meta Platforms (META) Gains Ahead of Q3 Earnings on Optimism for Strong Results

Key takeaways:

- Meta Platforms will report Q3 2025 earnings on October 29, with consensus expecting strong revenue growth and continued operational momentum.

- The company advanced in AI and ad technology, refreshed engagement across its core social platforms, and secured a $14.2 billion AI infrastructure deal.

- Shares of Meta rose after the earnings announcement, with analysts offering optimistic forecasts and raising price targets.

- Meta’s positive guidance for Q4 and robust year-over-year growth have reinforced confidence among retail and institutional investors worldwide.

Meta Set to Report Q3 Results: Innovation and Expansion in Focus

Meta Platforms will announce its Q3 2025 earnings on October 29, 2025, with analysts expecting continued operational strength and global platform expansion. Consensus forecasts point to revenue above prior-year levels, supported by resilient demand for digital advertising and strong engagement across its flagship apps. Investor attention remains on Meta’s ongoing technology investments, particularly in AI, where the company has committed to multi-billion-dollar infrastructure buildouts expected to drive growth through 2026.

Key areas of focus include advances in content recommendation systems, advertiser tools, and steady gains in daily active users across Facebook, Instagram, and WhatsApp. Analysts forecast daily active users will top 3.19 billion by the end of September 2025, marking another year of meaningful growth. The company’s strategy to deepen AI integration into its ad platforms is expected to enhance engagement and deliver improved targeting capabilities for businesses worldwide.

AI Leadership and Global Engagement Fuel Meta’s Momentum

Meta continues to reinforce its position in artificial intelligence, with investments in generative AI chat services for third-party websites that analysts expect will unlock new revenue streams by 2026. The company’s ongoing push into automation and AI technology is designed to enhance ad recommendation algorithms, deliver more relevant advertising, and improve return on investment for brand partners.

A key area of investor focus remains Meta’s recently announced $14.2 billion partnership with CoreWeave, which will provide advanced cloud and AI infrastructure to accelerate product development cycles and support global reach. Analysts also anticipate strong engagement trends across North America, Europe, and fast-growing markets in Asia and Latin America. This global push is expected to contribute to improved monetization rates, reinforcing Meta’s adaptability in a competitive digital landscape.

Market Reaction: Share Price Jumps, Analysts See Strong Upside

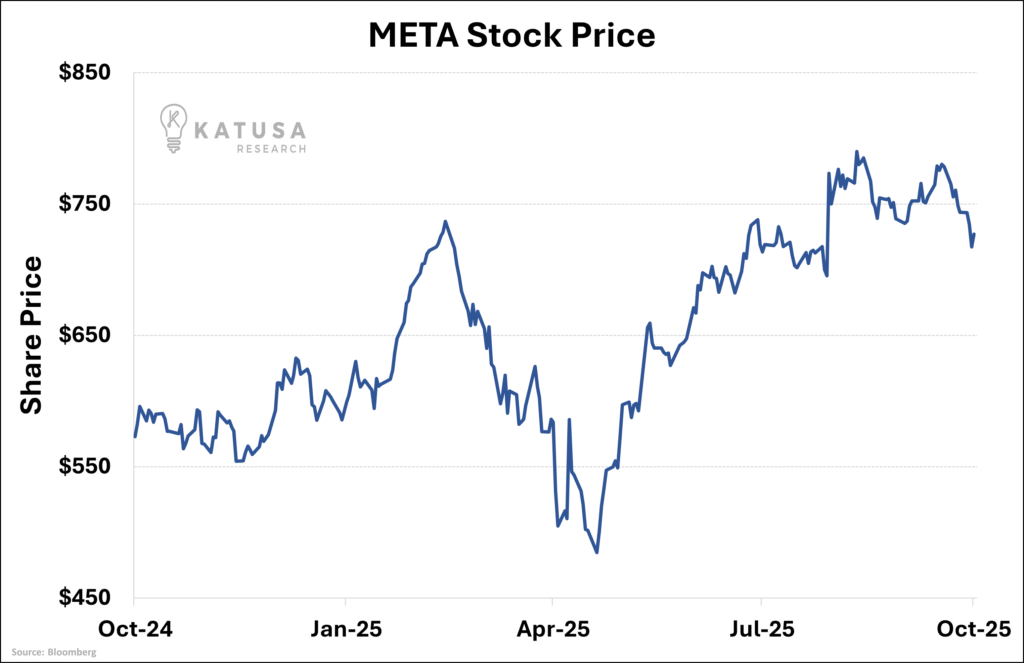

Meta’s shares continue to trade near record highs ahead of the company’s Q3 2025 earnings release later this month. The stock closed at $727.05, up 1.35% on the day, extending its strong year-to-date performance. Investor positioning reflects confidence in the company’s trajectory, with enthusiasm building around its expanding ad platform and AI investments.

Analysts expect Q3 EPS of roughly $6.74, according to consensus forecasts. Several firms have recently raised their price targets, pointing to disciplined expense control, accelerating user growth, and continued strength in the ad business. Anticipation also centers on management’s Q4 guidance, which many expect to highlight sustained margin expansion and capital investment in AI infrastructure.

Analysts broadly recommend Meta as a long-term “buy.” They argue that its dominant social platforms, paired with early-stage leadership in AI, provide the foundation for durable growth through 2026 and beyond. With both retail and institutional investors watching closely, Meta’s Q3 results and outlook remain a key focal point for technology sector allocations.

Positive Q4 Outlook: Navigating Growth and Innovation

Looking ahead, Meta’s management issued positive guidance for Q4 and the full fiscal year, underscoring confidence in their operational strategy and technology investments. The company plans to further deploy AI-powered services and expand advertising formats in international regions, leveraging its broad data footprint and extensive user reach.

For investors evaluating positions, Meta’s consistent performance, expanding AI partnerships, and innovation pipeline present a compelling case for ongoing growth. As the digital economy continues to evolve, Meta’s agility and global presence position it as a leading force in social technology and digital advertising, attracting broad investor interest in both developed and emerging markets.