NVIDIA (NVDA) Analyst Predicts 40%+ Upside on Data Center Demand – Latest Targets and Risks

Key takeaways:

- Nvidia reported Q2 2025 data center revenue of $26.3 billion, marking 154% growth and driving record profit margins.

- The company’s market cap reached $4 trillion, positioning Nvidia as a dominant force in AI infrastructure and data center solutions.

- Analysts predict 40%+ stock upside, forecasting robust demand for enterprise-grade AI GPUs and sustained data center expansion.

- Major risks include sales concentration among only three clients, making up 53% of data center revenue, but institutional investor confidence remains strong.

Nvidia’s Leap: Setting New Standards for AI and Data Center Tech

Nvidia’s recent performance demonstrates the company’s continued ascent as an undisputed leader in the AI hardware and data center GPU market. By Q2 2025, Nvidia’s data center segment surged to $26.3 billion in revenue, a 154% year-over-year jump from the previous year. This remarkable growth was not an isolated event—just two years prior, all of Nvidia’s data center sales hovered near $14.5 billion per quarter, illustrating how demand for high-powered GPU solutions has transformed the sector.

This operational momentum reflects Nvidia’s dominant presence in enabling AI workloads, cloud compute, and enterprise applications. The launch of their H100 and next-generation Blackwell GPUs has helped the company expand its reach from hyperscaler data centers, like AWS and Google Cloud, to sovereign cloud zones across Europe and the Middle East. Nvidia’s commitment to research and development is also substantial, with R&D spending reaching $10.5 billion in 2025—25% higher than last year—focused on accelerating new AI and autonomous computing platforms.

Notably, Nvidia’s FY2025 revenue topped $88 billion, with net margins above 50%. The company’s free cash flow rose to $28 billion, fueling aggressive innovation and share repurchases. Major partnerships with OpenAI, Meta, Amazon, and Google underpin its strategic position at the heart of AI infrastructure—and over 75% of Fortune 500s now deploy Nvidia’s solutions in mission-critical cloud and enterprise environments.

Data Center Demand: Fueling Explosive Growth and Market Leadership

Nvidia’s influence extends far beyond traditional chipmaking. CEO Jensen Huang described data centers as “AI factories,” and Nvidia’s GPUs are now the backbone of global AI deployments. In June 2025, Nvidia became the first company to reach a $4 trillion market valuation, outpacing Amazon, Alphabet, and briefly surpassing Apple. This achievement underscores not just investor confidence, but Nvidia’s ability to pivot from a pure hardware supplier to an AI platform company.

The market for data center GPUs is projected to balloon from $121.6 billion in 2025 to $295.2 billion by 2032, with Nvidia commanding a leadership stake through continual innovation in photonics, server architecture, and software. The expansion of AI training clusters by Azure and Oracle and the adoption of Nvidia’s Grace Hopper Superchips by government agencies further amplify growth prospects.

Despite intense competition, Nvidia’s unique integration of hardware and software platforms sets it apart. Gross margins of 76%, operating income at $46 billion, and institutional ownership exceeding 70% all signal investor conviction in the company’s capacity to sustain high profitability and seize new opportunities.

Stock Outlook: Analyst Targets and Price Movement Analysis

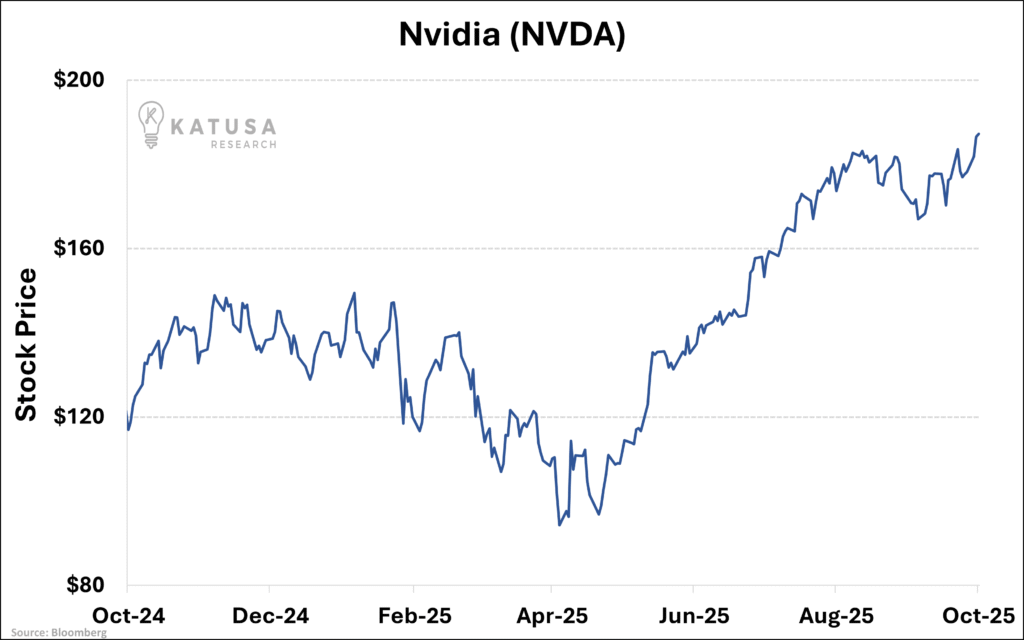

Analyst coverage for Nvidia remains resoundingly bullish. Several leading Wall Street analysts have recently raised their price targets by 40% or more, citing explosive data center revenue growth and robust enterprise demand. Forward P/E ratios in the 60–75 range highlight premium valuation—yet many analysts argue these multiples are justified given Nvidia’s unparalleled earnings growth and its pivotal role in the global AI infrastructure shift.

In the past 12 months, Nvidia stock delivered a 240% return for shareholders, outperforming Apple, Microsoft, and Amazon by a wide margin. Earnings per share have surpassed $15, with annual EPS growth that beats all major technology competitors. Analysts recommend accumulating the stock, anticipating ongoing upside as GPU deployments and software adoption scale to new highs.

The consensus remains that Nvidia has room to grow further, with projected demand for GPUs and AI chips outpacing supply and stretching well into the next decade. Institutional buying activity continues to swell, reinforcing both short- and long-term bullish sentiment among retail and professional investors.

Risks: Market Concentration and Customer Dependence

No story of growth is complete without consideration of risks. Nvidia’s Q2 2025 earnings revealed that more than half of its data center revenue—about $21.9 billion—came from just three major customers. If any of these clients were to reduce spending or change providers, Nvidia’s revenue could face sudden pressure. While the probability of an immediate shift is low, the scenario demands attention as the company continues to scale.

Another potential risk is the broader competitive environment. As hyperscalers invest in building proprietary chips, Nvidia must continue to innovate and deliver unmatched value, lest it cedes ground to emerging rivals. The company’s focus on full-stack infrastructure, including photonic interconnects and modular servers, is a strategic response to this threat.

Nevertheless, institutional investors maintain confidence, with over 70% of NVDA shares held by major funds. Nvidia’s sizable cash reserves ($36 billion) and robust profitability offer financial flexibility to weather disruptions, invest in next-gen solutions, and maintain dividend and buyback programs for shareholders.