NVIDIA (NVDA) Reports Better-Than-Expected Q3 Earnings, Boosting Trading Volume

Key takeaways:

- NVIDIA reported Q3 FY2025 revenue of $35.1 billion, rising 17% quarter-over-quarter and 94% year-over-year, fueled largely by continued strength in its Data Center business.

- GAAP earnings per diluted share grew to $0.78, up 111% from the year-ago period, while the company set new records in several operating segments.

- Strategic AI hardware launches and rising global enterprise demand remain central to NVIDIA’s operational achievements this quarter.

- NVIDIA’s share price saw increased trading volume, with mixed analyst recommendations and a strong overall outlook linked to continued AI leadership.

Records Broken: NVIDIA Posts Stellar Q3 Revenue and Operational Results

NVIDIA delivered a highly anticipated financial update for the third quarter of fiscal 2025, reporting record revenue of $35.1 billion for the period ended October 27, 2024. This marks a 17% jump from the preceding quarter and a staggering 94% increase from the same period the previous year. The company’s Data Center segment stood out, accounting for $30.8 billion in revenue — a 112% rise year-over-year — buoyed by strong global demand for Hopper platform products and anticipation around Blackwell AI computing solutions.

On the earnings front, GAAP earnings per diluted share hit $0.78, up 16% from Q2 and more than double the prior year. Non-GAAP earnings per share reached $0.81, an increase of 19% quarter-over-quarter and 103% year-over-year. These milestones reflect NVIDIA’s operational efficiency, fueled by strategic advancements in AI technologies and robust customer adoption across enterprise, cloud computing, and AI-centric industries.

NVIDIA’s CEO, Jensen Huang, highlighted that “demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training, and inference.” The ongoing surge in industrial robotics and “agentic AI” adoption by enterprises further underscores NVIDIA’s business momentum this quarter.

AI Hardware Expansion and Global Partnerships Power Performance

NVIDIA’s results extend beyond financials, underscoring a wave of successful hardware launches and ecosystem development. The company is ramping up full-scale production of the Blackwell AI platform, meeting growing demand from cloud service providers, hyperscale customers, and research institutions. These advancements support ongoing breakthroughs in physical AI, robotics, and country-scale AI infrastructure.

Strategic partnerships remain critical, with NVIDIA deepening collaborations with leading technology firms and government stakeholders worldwide. The company announced new generative AI models and expanded Omniverse integrations, driving new applications in autonomous vehicles, robotics, and smart infrastructure. Initiatives like Project DIGITS and NVIDIA Media2 aim to democratize next-generation AI technology for researchers, students, and content creators globally.

Price Movement: Share Performance, Analyst Consensus, and Investor Sentiment

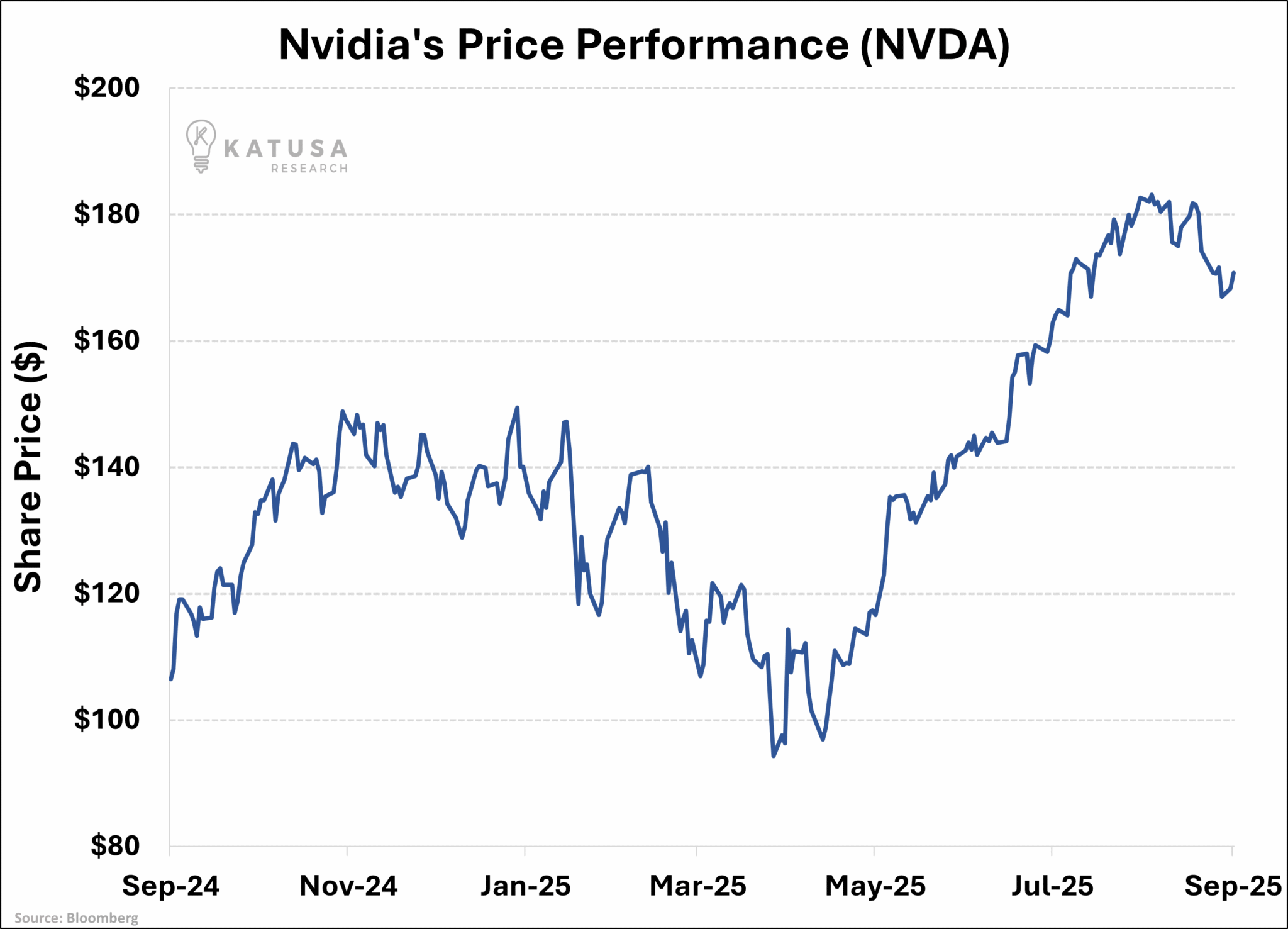

NVIDIA’s Q3 results brought heightened activity to its stock, with trading volumes surging in the days following the announcement. The combination of strong revenue growth and operational excellence contributed to a boost in investor confidence, even as the share price continued to show notable volatility amid broader tech sector trends.

Analyst reactions have generally reflected confidence in NVIDIA’s continued leadership in AI, with many raising their price targets in the wake of earnings. However, price movement analysis reveals that some experts caution against overextension, pointing to high valuation multiples and increased competition in the data center and edge computing markets. The blend of bullish and cautious perspectives suggests that while NVIDIA is strongly positioned, short-term market swings may persist as the broader economic backdrop shifts.

Investment banks and equity research firms largely maintain “buy” or “outperform” ratings, with several upgrading their forecasts to reflect ongoing demand for AI hardware and an expanding pipeline of high-value partnerships. Institutional sentiment remains positive, with many funds increasing their positions in the company given its strategic importance in the AI supply chain.

Looking Ahead: What to Watch in the Next Quarter

As NVIDIA eyes future quarters, management is guiding for Q4 FY2025 revenue of $37.5 billion (plus or minus 2%), signaling expectations for sustained growth. Gross margins are projected to remain strong, with a non-GAAP gross margin target of 73.5%. The next quarterly dividend of $0.01 per share is scheduled for December 27, 2024, for shareholders on record by December 5.

Industry observers are focused on NVIDIA’s execution in ramping up production of its Blackwell platform and expanding into new AI-driven markets like industrial robotics and enterprise workflow automation. For retail and institutional investors, NVIDIA’s ability to maintain technology leadership and generate value through innovation will remain key benchmarks moving forward. With AI adoption surging across broad sectors, the company appears poised to further consolidate its status at the heart of the next computing era.