Project Vault: Washington’s $12 Billion Copper Bet

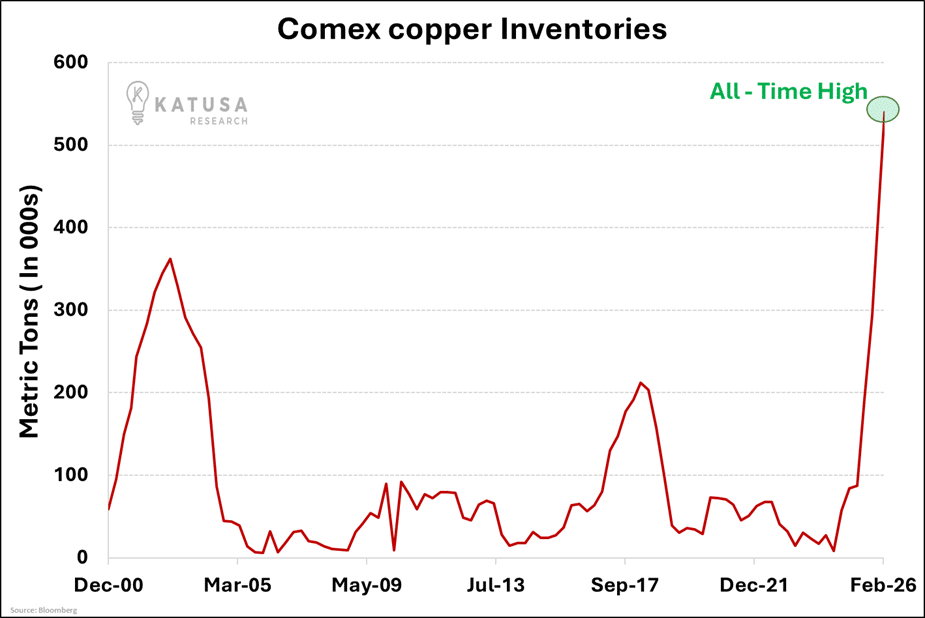

534,000 tonnes.

That’s how much copper sits in US warehouses right now.

Inventories jumped fivefold in twelve months, which is the highest level since 1989.

Trading houses like Mercuria, Hartree, and Trafigura spotted a fat arbitrage between New York and London prices last year.

They shipped everything they could find to American ports while the rest of the world ran dry.

Total US copper holdings now top 1 million tonnes when you count off-exchange storage.

- That covers 7 months of domestic demand and matches the entire annual output of Escondida, the world’s largest copper mine.

Washington Made It Happen With Project “Vault”

Tariff fears pushed US copper prices above London benchmarks and traders exploited the spread. Imports hit 1.7 million tonnes in 2025, nearly double the prior four-year average.

Trump spared refined copper from July’s tariffs. The arbitrage collapsed, but shipments kept coming.

In early February, the administration unveiled Project Vault, a $12 billion critical minerals stockpile funded through public-private partnership.

Robert Friedland stood in the Oval Office for the announcement.

He said copper would “undoubtedly be included.”

Washington added copper to its critical minerals list last November alongside lithium, cobalt, and rare earths with sixty materials making the cut. All 60 tied to energy security and defense.

- When governments hoard industrial metals, prices stop following normal cycles.

Copper held near $6 per pound through January despite recession fears and rate-cut debates.

It touched $14,500 per tonne on the LME, which was a new record. Goldman warned prices overshot fundamentals.

Four Forces Compounding Demand

I’ve tracked copper through three major cycles. This setup looks a bit different for a few reasons…

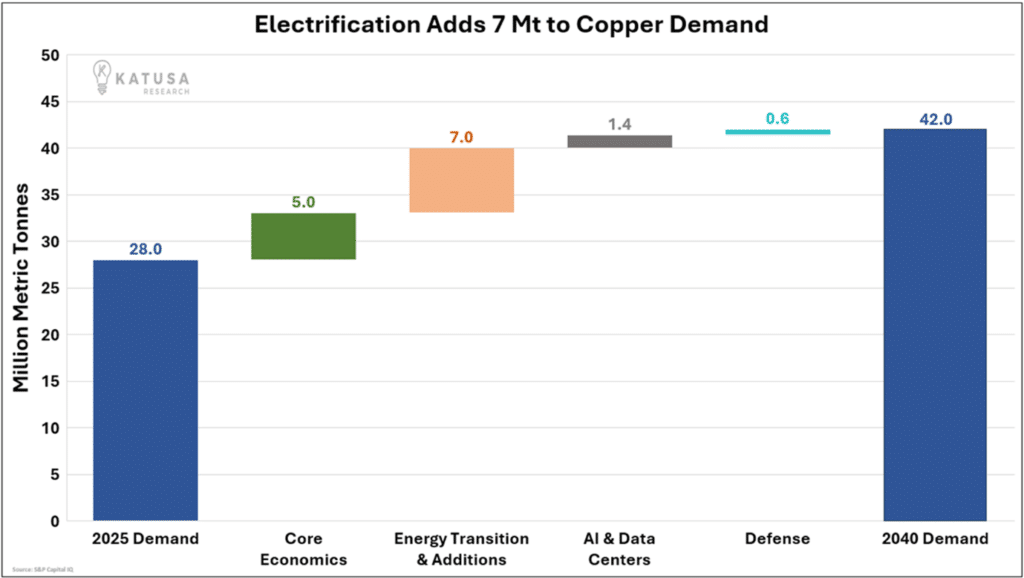

Grid rebuilding is the biggest driver. Global power demand rises nearly 50% by 2040. That means adding 330 Hoover Dams worth generating capacity every year for the next fifteen years.

Transmission and distribution networks need $7.5 trillion in investment, and underground cables drive most of that growth. Copper dominates underground because it conducts better and resists corrosion.

EV growth compounds the problem. A battery electric car uses 2.9 times more copper than a gas vehicle, including motors, wiring harnesses, battery packs, and charging systems.

China became the first market where EVs outsold gas cars in 2025. Annual EV copper demand hits 6.3 million tonnes by 2040, up from 2.6 million today.

AI infrastructure adds a new layer. Data centers now consumes 5% of US power. By 2030, that share reaches 14%.

- Each megawatt requires 30 to 47 tonnes of copper.

Defense spending rounds it out.

NATO members pledged 5% of GDP on military budgets. Drones, missiles, and communications systems all run on copper-intensive electronics. Militaries will pay whatever copper costs.

S&P Global projects demand is growing from 28 million tonnes today to 42 million by 2040. A 50% increase in a market already running tight.

Supply Can’t Keep Pace

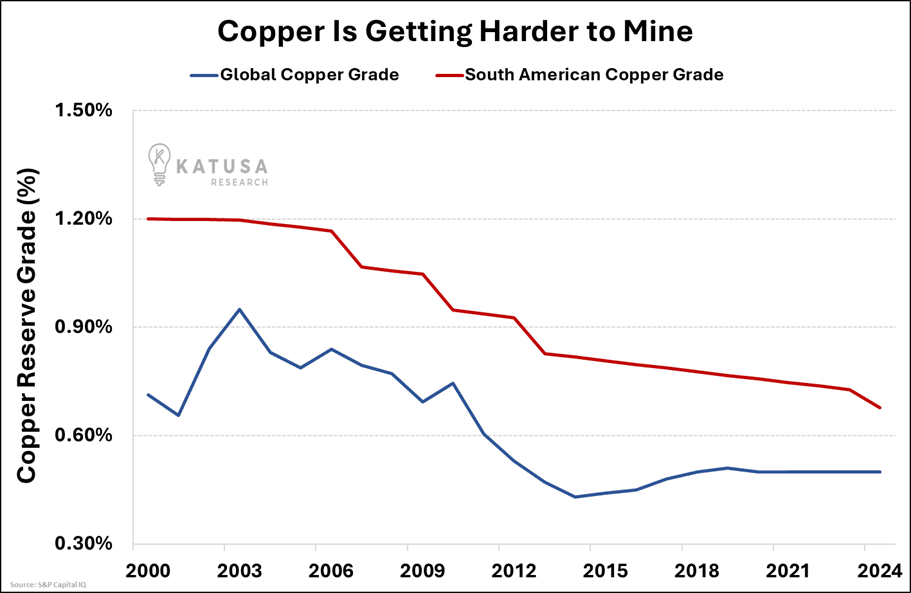

Primary production peaks around 2030 and then declines as depletion sets in.

South American ore grades dropped 44% since 2000. Miners move more rock, burn more fuel, and consume more water just to hold output steady.

Chile produces a quarter of the world’s copper.

Output fell in each of the last five months of 2025 while export revenues climbed on higher prices. Fewer tonnes mined and more dollars spent equals depletion in real time.

New mines take an average of 17 years from discovery to production.

It takes permits, reviews, consultations, legal fights… the pipeline cannot respond to today’s tightness until the mid-2030s.

Even aggressive recycling covers only one-quarter of 2040 demand.

The math points to a 10-million-tonne shortfall by 2040.

That gap only closes through higher prices.

Smelting copper adds another chokepoint…

China controls over 40% of global smelting capacity, and that share keeps growing. Treatment charges collapsed as smelters multiplied faster than concentrate supply.

Weaker operators got squeezed out.

Building Western smelters costs billions and takes years. Nobody wants to build Western smelters while China keeps adding capacity

The Copper Stock I’m Betting On…

Copper trades near all-time highs while governments stockpile and deficits widen. Goldman Sachs calls it overvalued but the market keeps bidding.

I’ve seen strategic metals reprice when supply constraints meet policy urgency. That’s where the new floor ends up higher than the old ceiling.

Many copper deals have crossed my desk this year and most don’t survive due diligence. The ones worth owning share common traits: quality deposits, stable jurisdictions, and catalysts that work without $8 copper.

Just last month, my top copper pick nearly doubled since I first recommended it.

The company holds a joint venture interest in one of the world’s largest copper-gold deposits. The underground expansion is ramping up, and the major next door will need every ounce.

The stock ran hard and I do believe it will run harder as my thesis plays out.

A takeout before year-end wouldn’t surprise me, because the asset is too strategic to leave in small hands.

That’s why I own a significant position.

The reasons are all there: The world needs 50% more copper by 2040, supply peaks in four years and governments are stockpiling.

The math doesn’t work and I’m positioning to capitalize on it.

You can find the name of the stock (and strategy) in my premium newsletter – Katusa’s Resource Opportunities.

Regards,

Marin Katusa

Get real-time alerts right away. Follow on X: @KatusaResearch and @MarinKatusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.