Rivian (RIVN) Stock Bounces on Analyst Double Upgrade—New Targets Point to 25% Upside

Key takeaways:

- Rivian receives a double analyst upgrade and higher price targets, pointing to a possible 25% upside for investors.

- Company showcases strong Q2 2025 operational results—outpacing many peers in delivery growth and factory efficiency.

- Recent analyst actions have shifted sentiment towards a more positive stance, with price targets reaching as high as $21.00.

- Stock price jumped following the news, reflecting renewed institutional and retail interest in RIVN.

Rivian on the Move: Strong Deliveries and Efficiency Gains Highlight 2025’s Momentum

Rivian Automotive continues to post impressive operational metrics in 2025, reinforcing its position as a competitive force in the electric vehicle market. The EV maker delivered more than 36,000 vehicles year-to-date through Q2 2025, up roughly 14% over the same period last year—a signal of both robust demand and improved manufacturing processes. The company’s Normal, Illinois plant has increased its run-rate capacity to approximately 75,000 units per year, an uptick from 60,000 at the start of 2024.

In addition to higher output, Rivian has improved its gross margin by nearly 7 percentage points year-over-year and narrowed its quarterly net loss, reflecting better cost controls and supply chain management. The R2 SUV, launched in June 2025, has quickly gained pre-orders, adding confidence to management’s guidance for full-year deliveries to exceed 75,000 units. These operational wins, paired with commitments to reduce cash burn and target adjusted EBITDA break-even in late 2026, have resonated with both retail and institutional investors.

Analyst Double Upgrade Ignites New Optimism in RIVN

In mid-September 2025, investor sentiment around Rivian got a substantial lift after two major Wall Street firms upgraded the stock within the same week. Most notably, Mizuho upgraded Rivian’s rating from “Neutral” to “Buy” and increased the 12-month price target from $12.00 to $14.00, citing operational execution that beat expectations. Stifel Nicolaus also moved its price target to $16.00 from $13.00 and shifted its rating to “Buy.”

By September 24, 2025, the broader analyst community had raised the ceiling, with some price targets reaching as high as $21.00. The average 12-month price target among 24 industry analysts stood at $14.07, with a consensus rating of “Hold.” Five analysts rated the company a “Buy,” compared with three “Sell” and sixteen “Hold” recommendations, a clear improvement in bullish outlook versus just one quarter earlier.

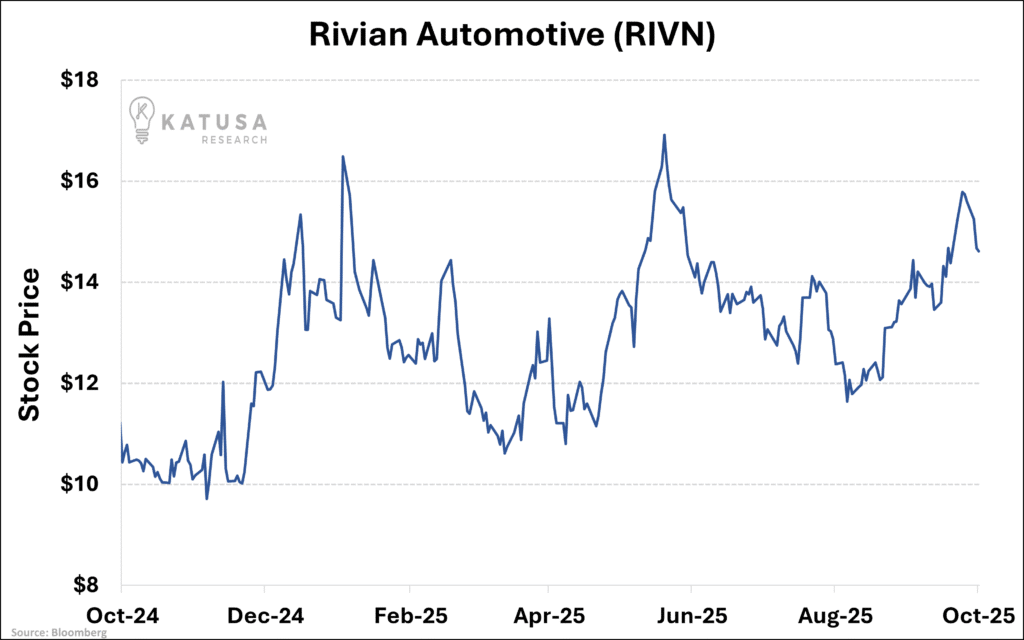

Since then, Rivian’s share price has slipped from $15.79 to $14.61 as of October 1, 2025. The pullback reflects short-term profit-taking after the rally, combined with renewed concerns about EV sector demand softness and high interest rates pressuring growth valuations.

Price Action: Investors Respond Quickly to Wall Street Upgrades

News of the double upgrade triggered a swift reaction in RIVN shares, which surged as much as 1.7% intraday and closed at $15.79 on September 24, 2025. Trading volume came in more than 40% above the 30-day average. Since then, the stock has pulled back to $14.61 as of October 1, 2025, as profit-taking set in and broader concerns about EV demand and financing conditions weighed on sentiment.

While short-term sentiment remains mixed—analysts’ average target of $14.07 suggests a modest downside from current levels—several firms see outsized upside if Rivian can hit its operational milestones. The top price target of $21.00 implies roughly 43% above current trading levels, making RIVN an intriguing candidate for both growth-focused retail investors and institutions seeking high-beta exposure in the EV sector.

What’s Next for Rivian—Profitability in Sight?

As Rivian enters the last quarter of 2025, all eyes are on delivery performance, cost management, and product rollout. The slated expansion into new international markets by early 2026 and the upcoming launch of its second-generation delivery van for Amazon could further lift revenue and unit economics. Meanwhile, management reiterated during the recent earnings call their commitment to cash flow discipline—aiming for positive adjusted EBITDA as early as Q4 2026.

For now, Rivian stands out as both a turnaround and growth play. Institutional ownership remains above 60%, signaling strong conviction. As analysts and investors adjust models based on recent upgrades and improving fundamentals, volatility is likely to persist. For investors willing to accept risk for potential double-digit upside, RIVN will remain a closely watched ticker on screens worldwide in the months ahead.