Sponsored

NASDAQ: SUUN | CBOE CA: SUNN

Disclosure: Owners, members, directors and employees of Katusa Research have/may have stock or option position in any of the companies mentioned: PowerBank Corp. Katusa Research receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article.

This content was reviewed and approved by PowerBank Corp..

FEATURED

Discover how a simple, “boring” technology is quietly transforming the energy landscape and outpacing coal, gas, and wind.

The Energy Source Taking the U.S. by Storm

Meet the Fastest Growing Energy Technology in North America - and the Company Right Smack in the Middle

A New Opportunity in Energy

POWERBANK

(SUUN.NASDAQ)

For most of its brief existence, the solar power industry has proven to be a relatively poor investment. Dozens of companies have come and gone, raising billions then barely turning a profit prior to declaring bankruptcy.

But the secret to investing success is not finding the right sector or the right company. The secret is investing at the right time.

That’s the difference between investing in:

- MySpace vs. Facebook,

- Skype vs. Zoom,

- BlackBerry vs. Apple, or

- Pets.com vs. Amazon.

For the U.S. solar industry, the timing is finally right. Right now, it’s hitting an ultra-rare inflection point in technological progress, in adoption, and most importantly, in profitability.

There are, of course, no guarantees in investing. But this company is unique.

And when the stars align between a sector becoming mature and a company becoming profitable: that’s where opportunity is found.

To understand why now is the right time to focus on solar, you have to start with a crucial question:

Where the Hell Did All the Power Go?

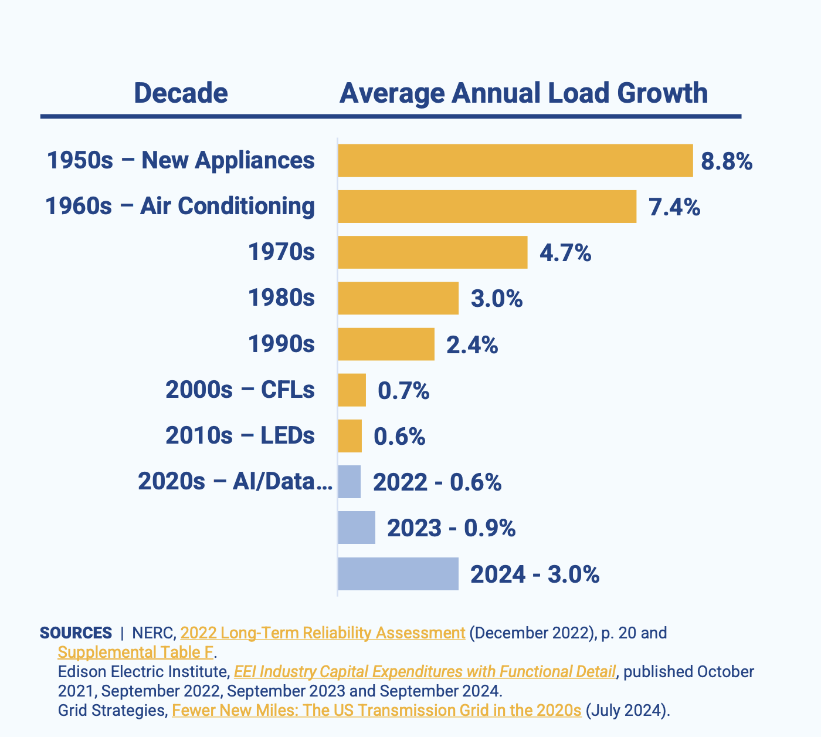

For the past quarter-century, annual peak load growth in the United States has been minimal, at about 0.6%. Even with a growing population, energy efficiencies and other changes kept demand from growing very much.

In 2023, that changed. Annual peak load growth jumped 50%—then another 300% in 2024.

It’s expected to stay there through at least 2030.

AI data centers, manufacturing hubs, crypto mining, and the electrification of everything are all devouring energy at unprecedented rates, forcing power prices skyward.

You’ve probably already seen that on your power bill.

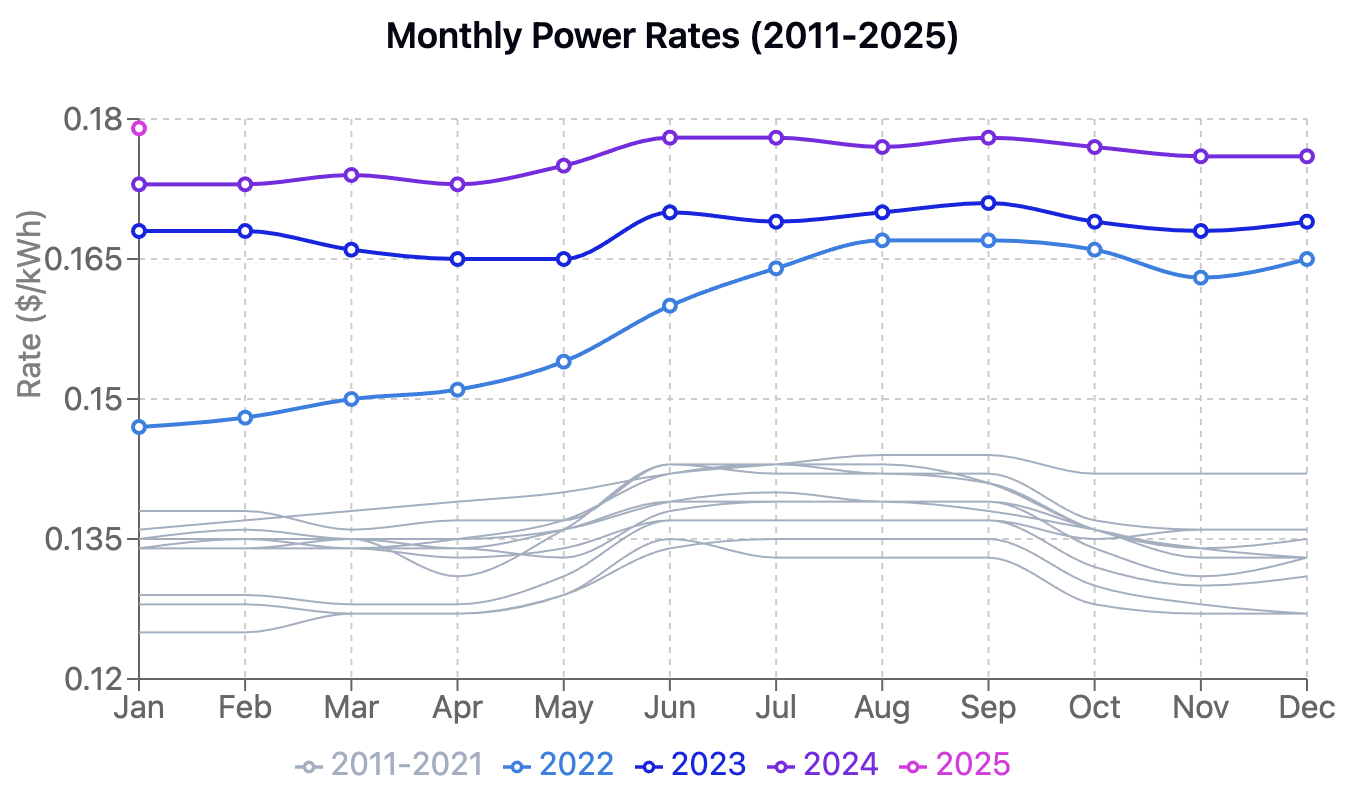

From 2011-2021, average electricity rates in the United States stayed in a tight range, barely fluctuating with the seasons.

In 2022, they electricity rates started to rise—and they’ve risen every year since. January 2025 (usually the cheapest time of year for energy) hit a new all-time high.

For consumers, the prices increases are an inconvenience. But for AI data centers, manufacturing hubs, and especially utilities, that’s the least of their worries. Because they’re running out of power altogether.

Data centers in Virginia, for example, are facing a wait of up to seven years just to get hooked up to the grid.1

Georgia Power is warning of limitations in its ability to provide power to all customers. And these are not isolated incidents:

- JLL Managing Director Andy Cvengros:

“Across the board, we are seeing power companies say, ‘We don’t know if we can handle this.’”

- CBRE Data Center Solutions Lead Pat Lynch:

“Utility shortages in the face of these data center demands are happening in almost every market.”

Tech companies and manufacturers have a choice. They can face an existential threat, threatening even the progress of AI, or they can spend tens of billions finding an answer to the energy problem.

They’ve opted for the latter, and they’ve identified a clear frontrunner that finally provides the energy trifecta: cheap, fast, reliable energy. And it’s not even close.

Solar’s Day in the Sun Has Arrived

Think about how simple this is in a simple example…

Get some sand and glass. Put them on a stick and stick it in the sun. Harvest free energy for the next quarter-century or so.

That’s the value proposition offered by solar.

But two decades ago, it remained one of the most expensive forms of energy on the planet, rendering it mostly useless as a form of power.

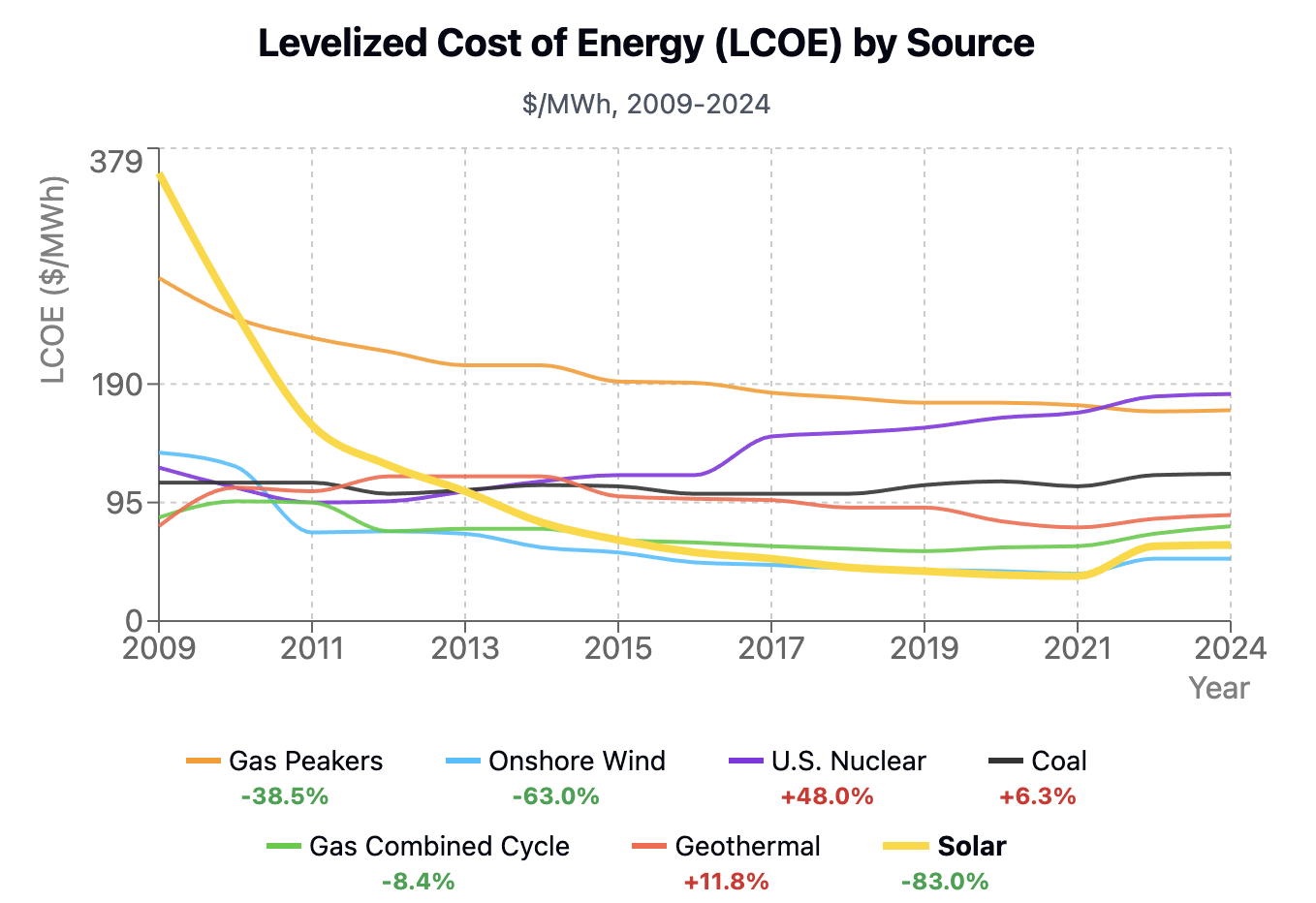

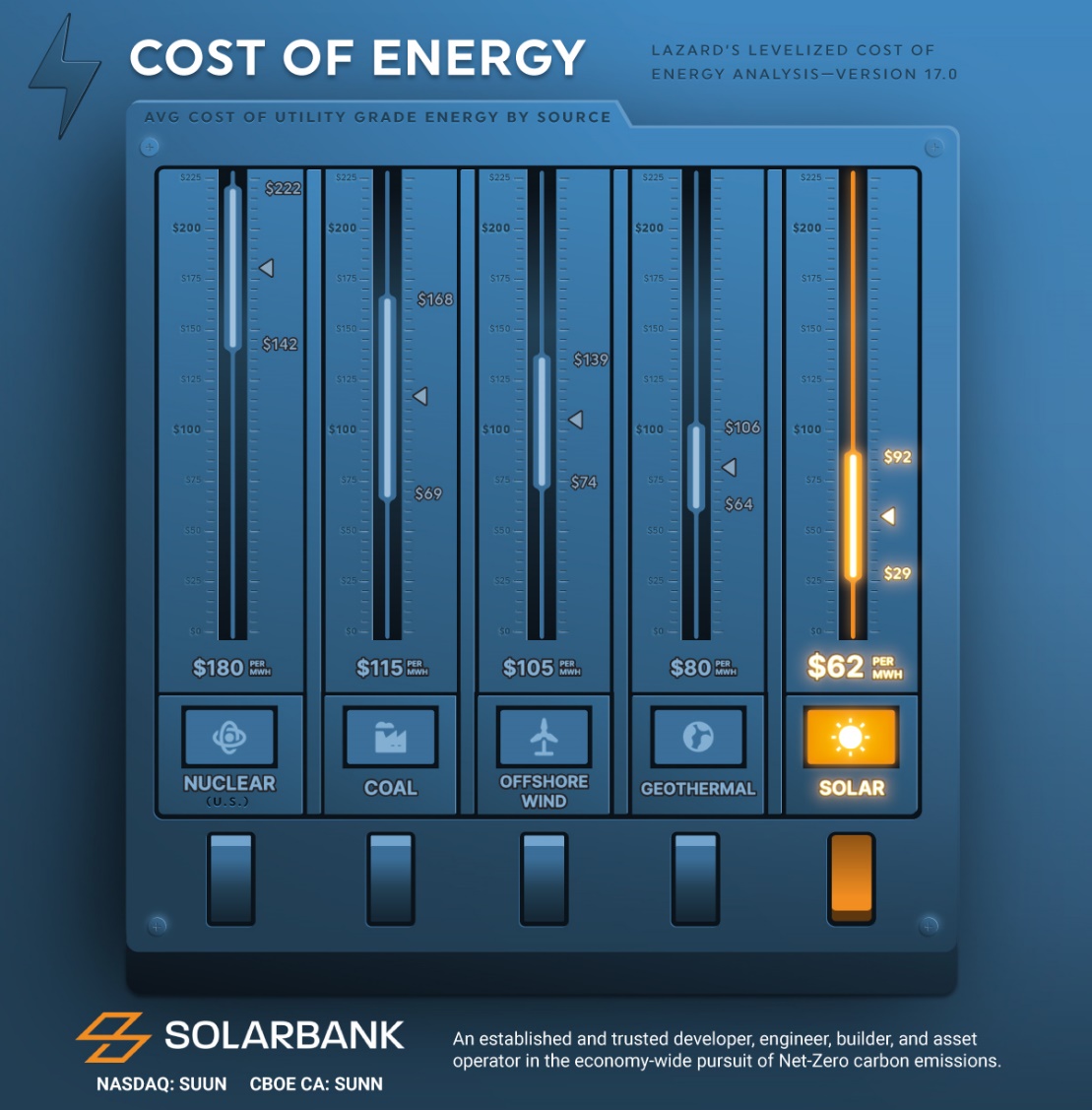

That hasn’t just changed: it has almost completely inverted. Solar’s levelized cost of energy (LCOE) has dropped faster than every other electricity source.

Between 2010–2023, the LCOE of solar fell by 70%. And the cost of a typical solar farm fell by an additional 21% in 2024 alone.

- Solar has plummeted from one of the most expensive forms of renewable energy to one of the cheapest in 20 years.2

Solar costs are expected to keep dropping—at least another 31% by 2035. But the current price drops are already enough.

Bloomberg NEF lead solar analyst Jenny Chase says:

“Solar panels [are] getting so cheap that we’re just putting them everywhere.” Where exactly is “everywhere?”

- Cemeteries in Europe are getting the solar panel treatment.3

- Solar panels are being used as garden fences in the Netherlands.

- Germany created a new word (balkonkraftwerk, meaning “balcony power plant”) to describe the millions of Germans putting solar on their balconies.4

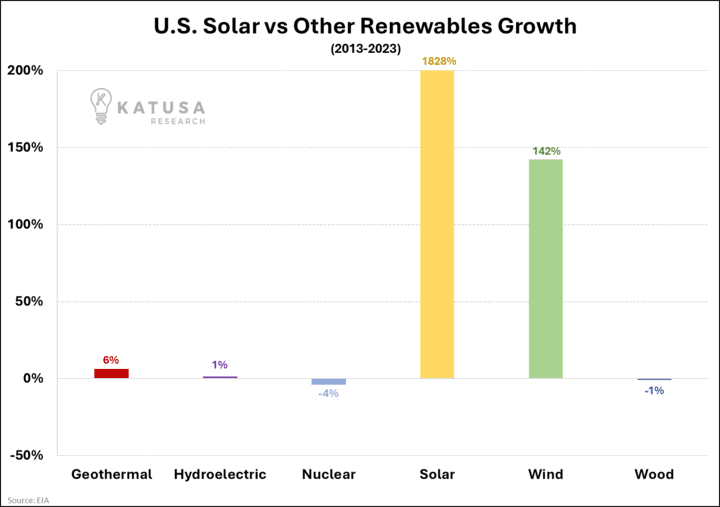

Elon Musk said just a few months ago that “solar power will be the vast majority of power generation in the future.” For the U.S., that’s coming true, with solar being the fastest-growing form of power from 2010-2023.

Even so, every solar bear likes to hammer the same nail into the solar coffin: solar is relatively useless when the sun isn’t shining. Right?

Wrong. They’re forgetting that solar is only half of the technology. And solar’s better half is finally reaching its own maturity.

The Infamous “Duck Curve” Is Dead on Arrival

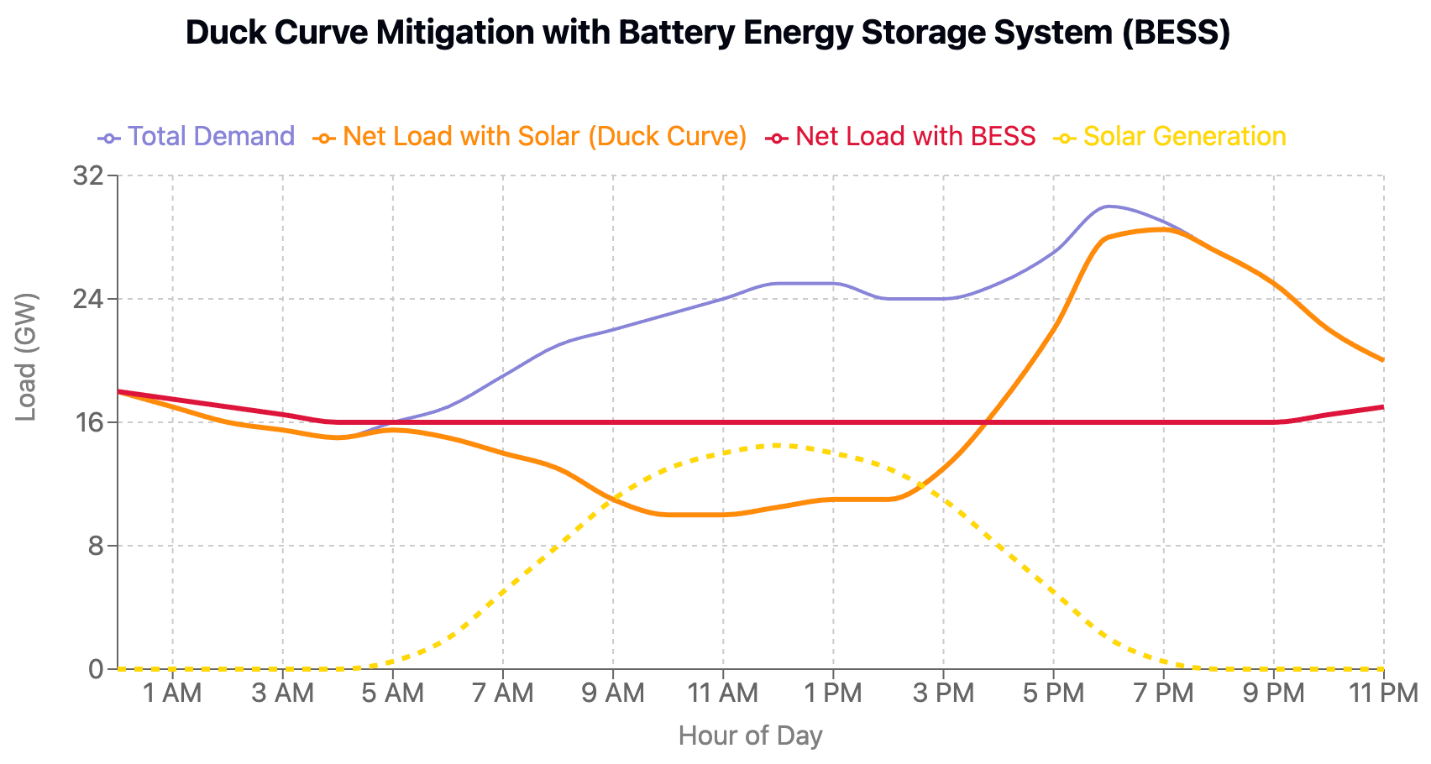

You’ve probably heard of the “duck curve”—the curve created by solar reducing the energy load during the day, but dying off just as energy needs spike and the sun sets.

Until very recently, the duck curve has limited solar to only a small percentage of energy generation.

But the duck curve has died—and BESS (Battery Energy Storage Systems) killed it.

Pair solar with batteries, and it forms something very nearly resembling baseload power, as you can see in the red line below.

BESSs are experiencing similar price drops to solar, falling by 33% in 2024, to $104/MWh.

They’re expected to cross the critical $100 threshold in 2025, falling to $93. And by 2035, BloombergNEF sees energy storage reaching $53/MWh.

- As with solar, U.S. BESS installations have rapidly increased, doubling every year since 2020.5

And those BESSs are best paired with solar, creating an entirely new type of renewable energy.

Yayoi Sekine, head of energy storage research at BloombergNEF, says:

“We’ve seen and expect that solar-plus-battery projects are going to become more commonplace.”

In 2023, about 26% of solar had a BESS alongside it. By 2026-2027, the EIA projects that will grow nearly 50%.

- With the duck curve solved via solar + BESS, solar has become the cheapest, fastest to deploy, most reliable form of energy.

Like it or not, that’s making solar + BESS the dominant energy technology of the 21st century. And the United States has gotten onboard extremely quickly.

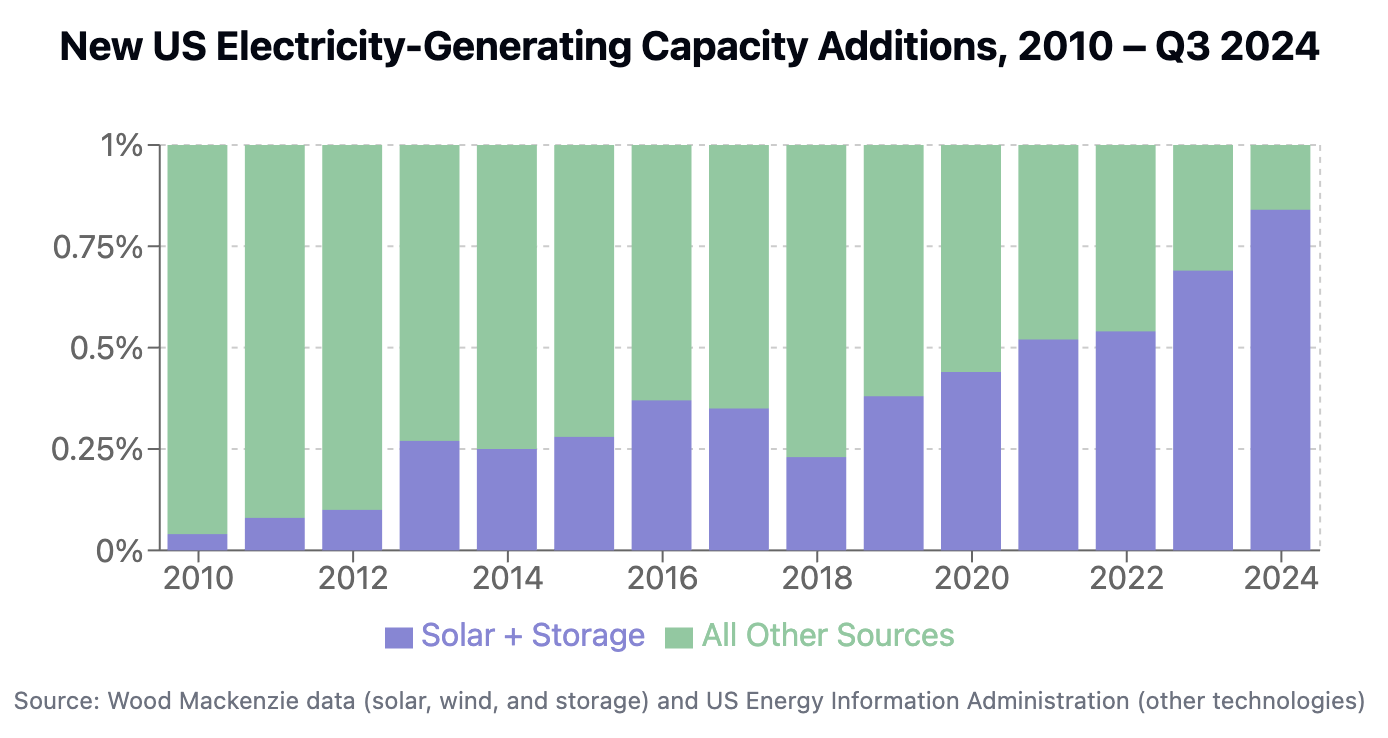

In fact, most new energy capacity in the U.S. is coming from just two sources: Solar + BESS.

But the United States still needs a lot more solar + BESSs.

Right now, 5% of energy generation comes from solar, with a target of 40% by 2035. If that target is to get hit, it would require building 3.5x as much solar as was built in 2024, every year for the next decade.

And there’s a company that has spent years preparing for just this moment.

Katusa Research Special Situations Alert:

PowerBank Corporation (SUUN.Nasdaq)

A Renewable Energy Pick for the 21st Century

PowerBank is still under the radar for right now, by design. But the CEO is making it difficult not to pay attention.

Because they’re finally unveiling the last step in their master plan—one that started a quarter-century ago.

In 2000, PowerBank founder and CEO Dr. Richard Lu was working for Enbridge, a century-old company.

For most of its brief existence, the solar power industry has proven to be a relatively poor investment. Dozens of companies have come and gone, raising billions then barely turning a profit prior to declaring bankruptcy.

But the secret to investing success is not finding the right sector or the right company. The secret is investing at the right time.

That’s the difference between investing in:

- MySpace vs. Facebook,

- Skype vs. Zoom,

- BlackBerry vs. Apple, or

- Pets.com vs. Amazon.

For the U.S. solar industry, the timing is finally right. Right now, it’s hitting an ultra-rare inflection point in technological progress, in adoption, and most importantly, in profitability.

There are, of course, no guarantees in investing. But this company is unique.

And when the stars align between a sector becoming mature and a company becoming profitable: that’s where opportunity is found.

To understand why now is the right time to focus on solar, you have to start with a crucial question:

Where the Hell Did All the Power Go?

For the past quarter-century, annual peak load growth in the United States has been minimal, at about 0.6%. Even with a growing population, energy efficiencies and other changes kept demand from growing very much.

In 2023, that changed. Annual peak load growth jumped 50%—then another 300% in 2024.

It’s expected to stay there through at least 2030.

AI data centers, manufacturing hubs, crypto mining, and the electrification of everything are all devouring energy at unprecedented rates, forcing power prices skyward.

You’ve probably already seen that on your power bill.

From 2011-2021, average electricity rates in the United States stayed in a tight range, barely fluctuating with the seasons.

In 2022, they electricity rates started to rise—and they’ve risen every year since. January 2025 (usually the cheapest time of year for energy) hit a new all-time high.

For consumers, the prices increases are an inconvenience. But for AI data centers, manufacturing hubs, and especially utilities, that’s the least of their worries. Because they’re running out of power altogether.

Data centers in Virginia, for example, are facing a wait of up to seven years just to get hooked up to the grid.1

Georgia Power is warning of limitations in its ability to provide power to all customers. And these are not isolated incidents:

- JLL Managing Director Andy Cvengros:

“Across the board, we are seeing power companies say, ‘We don’t know if we can handle this.’”

- CBRE Data Center Solutions Lead Pat Lynch:

“Utility shortages in the face of these data center demands are happening in almost every market.”

Tech companies and manufacturers have a choice. They can face an existential threat, threatening even the progress of AI, or they can spend tens of billions finding an answer to the energy problem.

They’ve opted for the latter, and they’ve identified a clear frontrunner that finally provides the energy trifecta: cheap, fast, reliable energy. And it’s not even close.

Solar’s Day in the Sun Has Arrived

Think about how simple this is in a simple example…

Get some sand and glass. Put them on a stick and stick it in the sun. Harvest free energy for the next quarter-century or so.

That’s the value proposition offered by solar.

But two decades ago, it remained one of the most expensive forms of energy on the planet, rendering it mostly useless as a form of power.

That hasn’t just changed: it has almost completely inverted. Solar’s levelized cost of energy (LCOE) has dropped faster than every other electricity source.

Between 2010–2023, the LCOE of solar fell by 70%. And the cost of a typical solar farm fell by an additional 21% in 2024 alone.

- Solar has plummeted from one of the most expensive forms of renewable energy to one of the cheapest in 20 years.2

Solar costs are expected to keep dropping—at least another 31% by 2035. But the current price drops are already enough.

Bloomberg NEF lead solar analyst Jenny Chase says:

“Solar panels [are] getting so cheap that we’re just putting them everywhere.” Where exactly is “everywhere?”

- Cemeteries in Europe are getting the solar panel treatment.3

- Solar panels are being used as garden fences in the Netherlands.

- Germany created a new word (balkonkraftwerk, meaning “balcony power plant”) to describe the millions of Germans putting solar on their balconies.4

Elon Musk said just a few months ago that “solar power will be the vast majority of power generation in the future.” For the U.S., that’s coming true, with solar being the fastest-growing form of power from 2010-2023.

Even so, every solar bear likes to hammer the same nail into the solar coffin: solar is relatively useless when the sun isn’t shining. Right?

Wrong. They’re forgetting that solar is only half of the technology. And solar’s better half is finally reaching its own maturity.

The Infamous “Duck Curve” Is Dead on Arrival

You’ve probably heard of the “duck curve”—the curve created by solar reducing the energy load during the day, but dying off just as energy needs spike and the sun sets.

Until very recently, the duck curve has limited solar to only a small percentage of energy generation.

But the duck curve has died—and BESS (Battery Energy Storage Systems) killed it.

Pair solar with batteries, and it forms something very nearly resembling baseload power, as you can see in the red line below.

BESSs are experiencing similar price drops to solar, falling by 33% in 2024, to $104/MWh.

They’re expected to cross the critical $100 threshold in 2025, falling to $93. And by 2035, BloombergNEF sees energy storage reaching $53/MWh.

- As with solar, U.S. BESS installations have rapidly increased, doubling every year since 2020.5

And those BESSs are best paired with solar, creating an entirely new type of renewable energy.

Yayoi Sekine, head of energy storage research at BloombergNEF, says:

“We’ve seen and expect that solar-plus-battery projects are going to become more commonplace.”

In 2023, about 26% of solar had a BESS alongside it. By 2026-2027, the EIA projects that will grow nearly 50%.

- With the duck curve solved via solar + BESS, solar has become the cheapest, fastest to deploy, most reliable form of energy.

Like it or not, that’s making solar + BESS the dominant energy technology of the 21st century. And the United States has gotten onboard extremely quickly.

In fact, most new energy capacity in the U.S. is coming from just two sources: Solar + BESS.

But the United States still needs a lot more solar + BESSs.

Right now, 5% of energy generation comes from solar, with a target of 40% by 2035. If that target is to get hit, it would require building 3.5x as much solar as was built in 2024, every year for the next decade.

And there’s a company that has spent years preparing for just this moment.

Katusa Research Special Situations Alert:

PowerBank Corporation

(SUUN.Nasdaq)

A Renewable Energy Pick for the 21st Century

PowerBank is still under the radar for right now, by design. But the CEO is making it difficult not to pay attention.

Because they’re finally unveiling the last step in their master plan—one that started a quarter-century ago.

In 2000, PowerBank founder and CEO Dr. Richard Lu was working for Enbridge, a century-old company.

He observed how Enbridge had transformed itself from a single 500-mile pipeline in a remote part of Canada into a multibillion-dollar energy giant sprawled across North America.

From Enbridge, Dr. Lu became vice president at Toronto Hydro, the largest municipal electricity distribution company in Canada.

As its chief conservation officer, Dr. Lu was in charge of energy efficiency, demand response, and alternative energy.

For most of its brief existence, the solar power industry has proven to be a relatively poor investment. Dozens of companies have come and gone, raising billions then barely turning a profit prior to declaring bankruptcy.

But the secret to investing success is not finding the right sector or the right company. The secret is investing at the right time.

That’s the difference between investing in:

- MySpace vs. Facebook,

- Skype vs. Zoom,

- BlackBerry vs. Apple, or

- Pets.com vs. Amazon.

For the U.S. solar industry, the timing is finally right. Right now, it’s hitting an ultra-rare inflection point in technological progress, in adoption, and most importantly, in profitability.

There are, of course, no guarantees in investing. But this company is unique.

And when the stars align between a sector becoming mature and a company becoming profitable: that’s where opportunity is found.

To understand why now is the right time to focus on solar, you have to start with a crucial question:

Where the Hell Did All the Power Go?

For the past quarter-century, annual peak load growth in the United States has been minimal, at about 0.6%. Even with a growing population, energy efficiencies and other changes kept demand from growing very much.

In 2023, that changed. Annual peak load growth jumped 50%—then another 300% in 2024.

It’s expected to stay there through at least 2030.

AI data centers, manufacturing hubs, crypto mining, and the electrification of everything are all devouring energy at unprecedented rates, forcing power prices skyward.

You’ve probably already seen that on your power bill.

From 2011-2021, average electricity rates in the United States stayed in a tight range, barely fluctuating with the seasons.

In 2022, they electricity rates started to rise—and they’ve risen every year since. January 2025 (usually the cheapest time of year for energy) hit a new all-time high.

For consumers, the prices increases are an inconvenience. But for AI data centers, manufacturing hubs, and especially utilities, that’s the least of their worries. Because they’re running out of power altogether.

Data centers in Virginia, for example, are facing a wait of up to seven years just to get hooked up to the grid.1

Georgia Power is warning of limitations in its ability to provide power to all customers. And these are not isolated incidents:

- JLL Managing Director Andy Cvengros:

“Across the board, we are seeing power companies say, ‘We don’t know if we can handle this.’”

- CBRE Data Center Solutions Lead Pat Lynch:

“Utility shortages in the face of these data center demands are happening in almost every market.”

Tech companies and manufacturers have a choice. They can face an existential threat, threatening even the progress of AI, or they can spend tens of billions finding an answer to the energy problem.

They’ve opted for the latter, and they’ve identified a clear frontrunner that finally provides the energy trifecta: cheap, fast, reliable energy. And it’s not even close.

Solar’s Day in the Sun Has Arrived

Think about how simple this is in a simple example…

Get some sand and glass. Put them on a stick and stick it in the sun. Harvest free energy for the next quarter-century or so.

That’s the value proposition offered by solar.

But two decades ago, it remained one of the most expensive forms of energy on the planet, rendering it mostly useless as a form of power.

That hasn’t just changed: it has almost completely inverted. Solar’s levelized cost of energy (LCOE) has dropped faster than every other electricity source.

Between 2010–2023, the LCOE of solar fell by 70%. And the cost of a typical solar farm fell by an additional 21% in 2024 alone.

- Solar has plummeted from one of the most expensive forms of renewable energy to one of the cheapest in 20 years.2

Solar costs are expected to keep dropping—at least another 31% by 2035. But the current price drops are already enough.

Bloomberg NEF lead solar analyst Jenny Chase says:

“Solar panels [are] getting so cheap that we’re just putting them everywhere.” Where exactly is “everywhere?”

- Cemeteries in Europe are getting the solar panel treatment.3

- Solar panels are being used as garden fences in the Netherlands.

- Germany created a new word (balkonkraftwerk, meaning “balcony power plant”) to describe the millions of Germans putting solar on their balconies.4

Elon Musk said just a few months ago that “solar power will be the vast majority of power generation in the future.” For the U.S., that’s coming true, with solar being the fastest-growing form of power from 2010-2023.

Even so, every solar bear likes to hammer the same nail into the solar coffin: solar is relatively useless when the sun isn’t shining. Right?

Wrong. They’re forgetting that solar is only half of the technology. And solar’s better half is finally reaching its own maturity.

The Infamous “Duck Curve” Is Dead on Arrival

You’ve probably heard of the “duck curve”—the curve created by solar reducing the energy load during the day, but dying off just as energy needs spike and the sun sets.

Until very recently, the duck curve has limited solar to only a small percentage of energy generation.

But the duck curve has died—and BESS (Battery Energy Storage Systems) killed it.

Pair solar with batteries, and it forms something very nearly resembling baseload power, as you can see in the red line below.

BESSs are experiencing similar price drops to solar, falling by 33% in 2024, to $104/MWh.

They’re expected to cross the critical $100 threshold in 2025, falling to $93. And by 2035, BloombergNEF sees energy storage reaching $53/MWh.

- As with solar, U.S. BESS installations have rapidly increased, doubling every year since 2020.5

And those BESSs are best paired with solar, creating an entirely new type of renewable energy.

Yayoi Sekine, head of energy storage research at BloombergNEF, says:

“We’ve seen and expect that solar-plus-battery projects are going to become more commonplace.”

In 2023, about 26% of solar had a BESS alongside it. By 2026-2027, the EIA projects that will grow nearly 50%.

- With the duck curve solved via solar + BESS, solar has become the cheapest, fastest to deploy, most reliable form of energy.

Like it or not, that’s making solar + BESS the dominant energy technology of the 21st century. And the United States has gotten onboard extremely quickly.

In fact, most new energy capacity in the U.S. is coming from just two sources: Solar + BESS.

But the United States still needs a lot more solar + BESSs.

Right now, 5% of energy generation comes from solar, with a target of 40% by 2035. If that target is to get hit, it would require building 3.5x as much solar as was built in 2024, every year for the next decade.

And there’s a company that has spent years preparing for just this moment.

Katusa Research Special Situations Alert:

PowerBank Corporation

(SUUN.Nasdaq)

A Renewable Energy Pick for the 21st Century

PowerBank is still under the radar for right now, by design. But the CEO is making it difficult not to pay attention.

Because they’re finally unveiling the last step in their master plan—one that started a quarter-century ago.

In 2000, PowerBank founder and CEO Dr. Richard Lu was working for Enbridge, a century-old company.

- https://www.bloomberg.com/news/articles/2024-08-29/data-centers-face-seven-year-wait-for-power-hookups-in-virginia

- https://ourworldindata.org/cdn-cgi/imagedelivery/qLq-8BTgXU8yG0N6HnOy8g/87c475c2-542d-4600-203f-1b63aec07e00/w=1350

- https://interestingengineering.com/energy/solar-panels-cemetery-spain

- https://www.theguardian.com/environment/2024/dec/18/if-a-million-germans-have-them-there-must-be-something-in-it-how-balcony-solar-is-taking-off

- Doubled every year since 2020:

https://www.energy-storage.news/us-bess-installations-surged-in-2023-with-96-increase-in-cumulative-capacity-acp-says/

https://www.eia.gov/todayinenergy/detail.php?id=61202

https://www.eia.gov/todayinenergy/detail.php?id=64586

IMPORTANT DISCLAIMER & DISCLOSURES

Investing in stocks is HIGH RISK. You could lose all of your investment.

Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction.

Please do not rely on the information presented by Katusa Research as personal investment advice.

If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor.

The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

PowerBank Corp. is a paid sponsor of this report.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom.

Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. Katusa Research, its owners, directors, and employees are also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research partner company, New Era Publishing Inc. has received cash compensation in the amount of nine hundred thousand dollars from PowerBank Corp. for a 6 month marketing agreement starting January 1, 2025, and is thus extremely biased. It is crucial that you conduct your own research prior to investing. This includes reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures. The information contained herein regarding PowerBank Corp. has been derived from its SEDAR+ and SEC filings, including scientific and technical information. Information regarding the projects underlying PowerBank Corp.’s interests has been derived from the publicly available disclosure of the underlying operators and owners, including where referenced herein.

Katusa Research, and its directors, employees, and members of their households do not own shares of PowerBank Corp (SUUN.Nasdaq). However, Katusa Research is extremely biased since this is a sponsored editorial.

HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS: This report contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, "forward-looking statements") that relate to the Company's current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as "will likely result", "are expected to", "expects", "will continue", "is anticipated", "anticipates", "believes", "estimated", "intends", "plans", "forecast", "projection", "strategy", "objective" and "outlook") are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. In particular and without limitation, this report contains forward-looking statements pertaining to the Company’s expectations regarding its industry trends and overall market growth; the Company’s growth strategies the expected energy production from the solar power projects mentioned in this report; the number of homes expected to be powered by the Company’s development projects; the reduction of carbon emissions; the receipt of incentives for the projects; the expected value of EPC Contracts; and the size of the Company’s development pipeline. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this report should not be unduly relied upon. These statements speak only as of the date of this report.

Forward-looking statements are based on certain assumptions and analyses made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate and are subject to risks and uncertainties. In making the forward looking statements included in this report, the Company has made various material assumptions, including but not limited to: obtaining the necessary regulatory approvals; that regulatory requirements will be maintained; general business and economic conditions; the Company’s ability to successfully execute its plans and intentions; the availability of financing on reasonable terms; the Company’s ability to attract and retain skilled staff; market competition; the products and services offered by the Company’s competitors; that the Company’s current good relationships with its service providers and other third parties will be maintained; and government subsidies and funding for renewable energy will continue as currently contemplated. Although the Company believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and the Company cannot assure that actual results will be consistent with these forward-looking statements. Given these risks, uncertainties and assumptions, investors should not place undue reliance on these forward-looking statements.

Whether actual results, performance or achievements will conform to the Company’s expectations and predictions is subject to a number of known and unknown risks, uncertainties, assumptions and other factors, including those listed under "Forward-Looking Statements" and "Risk Factors" in the Company’s Annual Information Form for the most recently completed financial year, and other public filings of the Company, which include: the Company may be adversely affected by volatile solar power market and industry conditions; the execution of the Company’s growth strategy depends upon the continued availability of third-party financing arrangements; the Company’s future success depends partly on its ability to expand the pipeline of its energy business in several key markets; governments may revise, reduce or eliminate incentives and policy support schemes for solar and battery storage power; general global economic conditions may have an adverse impact on our operating performance and results of operations; the Company’s project development and construction activities may not be successful; developing and operating solar projects exposes the Company to various risks; the Company faces a number of risks involving Power Purchase Agreements (“PPAs”) and project-level financing arrangements; any changes to the laws, regulations and policies that the Company is subject to may present technical, regulatory and economic barriers to the purchase and use of solar power; the markets in which the Company competes are highly competitive and evolving quickly; an anti-circumvention investigation could adversely affect the Company by potentially raising the prices of key supplies for the construction of solar power projects; foreign exchange rate fluctuations; a change in the Company’s effective tax rate can have a significant adverse impact on its business; seasonal variations in demand linked to construction cycles and weather conditions may influence the Company’s results of operations; the Company may be unable to generate sufficient cash flows or have access to external financing; the Company may incur substantial additional indebtedness in the future; the Company is subject to risks from supply chain issues; risks related to inflation; unexpected warranty expenses that may not be adequately covered by the Company’s insurance policies; if the Company is unable to attract and retain key personnel, it may not be able to compete effectively in the renewable energy market; there are a limited number of purchasers of utility-scale quantities of electricity; compliance with environmental laws and regulations can be expensive; corporate responsibility may adversely impose additional costs; the Company has limited insurance coverage; the Company will be reliant on information technology systems and may be subject to damaging cyberattacks; the Company may become subject to litigation; there is no guarantee on how the Company will use its available funds; the Company will continue to sell securities for cash to fund operations, capital expansion, mergers and acquisitions that will dilute the current shareholders; and future dilution as a result of financings.

The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for the Company to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this report are expressly qualified in their entirety by this cautionary statement.

Disclosure: Owners, members, directors and employees of Katusa Research have/may have stock or option position in any of the companies mentioned: PowerBank Corp., SUUN, SUNN. Katusaresearch.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article. This content was reviewed and approved by PowerBank Corp. Please read our Full RISKS and DISCLOSURE here.