Katusa Research

Special Situations Alert

Insiders own 19% of this NYSE listed stock with 240 mining royalties secured in just 4 years…

And in this report, you will see why I believe him when he told me:

In 2019, after completing the largest gold merger ever at that point…

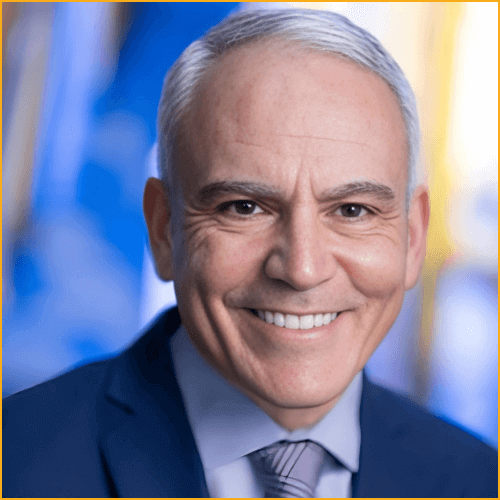

David Garofalo, a man who’s spent his entire career in the metals and mining sector including building mines from scratch for the biggest mining companies on the planet…

Had a light bulb moment.

Precious metal lending was already dry-as-a-bone pre-2020…

Now, higher interest rates have only made funding new gold mines even harder.

Staying in the ‘development and exploration’ space was a dangerous game to keep playing. And David knew it.

Cannibalization in the industry is already happening…

This company boasts an impressive portfolio of 240 secured mining royalties. These royalties have the potential to generate substantial revenue and cash flow, providing a solid foundation for growth and profitability. As you can imagine, the revenue potential is immense.

It is trading for less than 50% of the net asset value of the assets in its portfolio, based on analyst consensus estimates. This indicates a significant potential for value appreciation as the market recognizes the underlying worth of its assets.

This company has a winning formula that sets it apart from its competitors. By combining cutting-edge technology, strategic partnerships, and a deep understanding of the gold market, this company has unlocked a recipe for success.

NOTE: PLEASE READ OUR FULL TESTIMONIAL AND RETURNS DISCLOSURES

Copyright © 2024 Katusa Research. All rights reserved.