Tesla (TSLA) Shares See Increased Trading Following New Battery Tech Announcement

Key takeaways:

- Tesla has announced a new battery technology, featuring aluminum-ion advancements, promising up to 745 miles of range and full charging in just 15 minutes.

- Battery innovations could close the gap between high-performance and standard batteries, benefiting both users and Tesla’s product longevity.

- Despite a new tech reveal, Tesla’s Q2 2025 operational performance saw lower revenues and vehicle deliveries compared to last year.

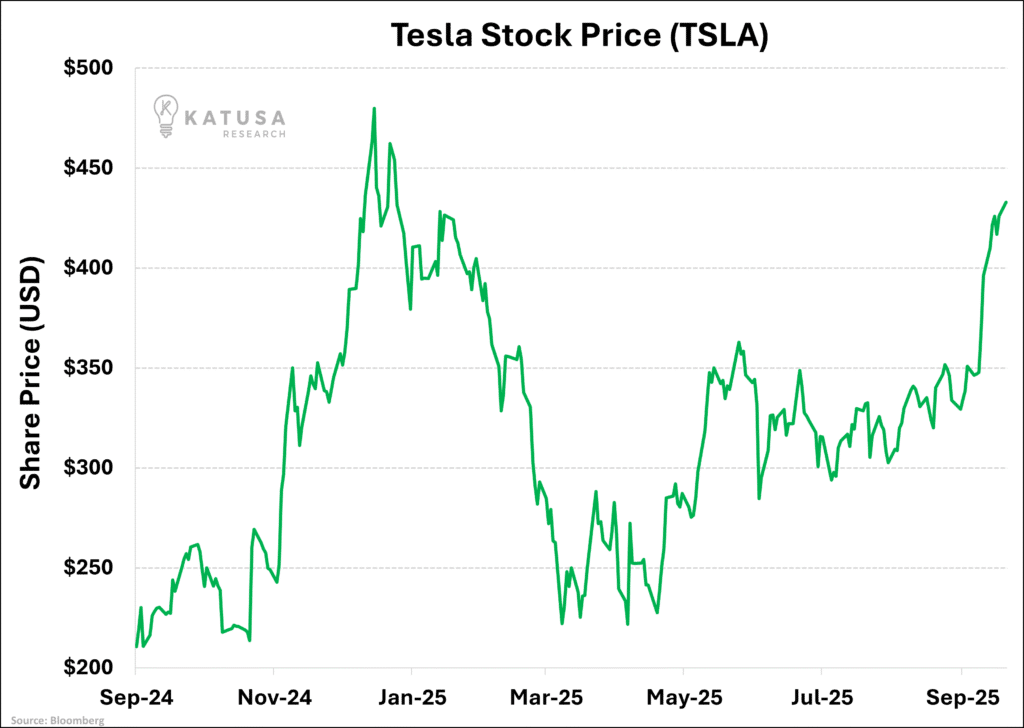

- Tesla’s stock price became more volatile after the battery news, with analysts split on future outlooks amid evolving EV market dynamics.

Next-Gen Battery Breakthrough: Tesla’s Technology Leap

Tesla has unveiled a significant upgrade in battery technology, aiming to boost electric vehicle (EV) performance and user convenience. Announced in late August 2025, Tesla’s new aluminum-ion battery architecture delivers up to 745 miles of maximum range, nearly doubling previous lithium-ion standards. Full charging now can be completed in as little as 15 minutes, aligning EV refueling times closer to traditional gas vehicles.

This innovation addresses two persistent challenges for EV buyers—range anxiety and slow charging. Tesla’s battery leverages aluminum’s natural abundance and high electrical conductivity for faster ion transfer, improving both lifespan and safety. With an estimated lifespan of up to 3,000 charge cycles and early production costs projected to be 30% lower than current lithium-ion batteries, the company is positioned to set new industry benchmarks for cost and reliability. Tesla targets the introduction of these batteries into production vehicles within the next 18 to 24 months.

Tesla’s breakthroughs extend beyond just materials. The company’s recent patent filings revealed proprietary doping techniques for nickel-based batteries, raising retained charge capacity from 83% to nearly 91%. This development allows customers to charge their performance vehicles up to 90% daily—matching the convenience previously reserved for standard battery models. Executives at Tesla emphasized that these advances are not incremental but foundational, sharply closing the gap between the brand’s performance and standard-range offerings.

Operational Highlights: A Mixed Quarter Amid Innovation

While the new battery announcement signals long-term promise, Tesla’s Q2 2025 operations reflect the EV market’s current headwinds. In the latest quarter, Tesla delivered 384,122 vehicles, a 13.5% decline year-over-year. Total automotive revenue fell by 16% to $16.6 billion, and overall revenues dropped 12% to $22.49 billion. The company’s net income attributable to shareholders was $1.17 billion, down 16% year-over-year.

The challenging quarter followed a stretch of rapid growth between 2021 and 2023, as the EV industry now contends with slowing demand, affordability constraints, and stiffer competition from both U.S. and foreign automakers. Notably, Tesla remains committed to a strategy of leveraging operational efficiency and vertical integration—manufacturing

critical components, reducing costs, and adapting quickly to changes in the global auto market.

Despite these pressures, Tesla continues to invest aggressively in innovation, channeling capital into production optimization and new product development, including its battery supply chain and manufacturing technologies.

Price Action: Stock Volatility and Analyst Perspectives

Tesla stock (TSLA) became notably more active after the new battery announcement in late August 2025. The share price initially surged by nearly 5% following the announcement, as investors responded to the long-term potential of the technology. However, the euphoria was tempered by the quarterly earnings report, which highlighted a contraction in both revenue and deliveries.

Analysts remain divided on Tesla’s outlook. Several bullish institutions argue that the battery innovation, if commercialized at scale, could provide Tesla a critical moat against an increasingly crowded EV space. Price targets among these groups range from $290 to $340 per share for the next year, with expectations of margin recovery and renewed consumer interest.

Other analysts remain cautious, warning that near-term valuation pressures and competitive threats from traditional manufacturers could limit upside. They advise investors to closely monitor demand signals, production scaling capabilities, and actual implementation timelines for the new battery technology before making major allocation decisions.

What the Future Holds: Can Innovation Outpace the Challenges?

Tesla’s battery announcement arrives at a crossroads for the company and the global EV market. On one hand, technical achievements such as the aluminum-ion battery and nickel-based doping may place Tesla at the front of the next phase of sustainable transportation. On the other, operational and financial results highlight the present-day realities of an evolving and contested market space.

For both retail and institutional investors, the company’s future will hinge on its ability to scale up new technologies across mass-market models, maintain cost advantages, and adapt to a shifting regulatory and economic environment. As the rollout of new battery platforms accelerates in 2026 and beyond, stakeholders across the investment spectrum will be watching for confirmation that Tesla’s blend of innovation, efficiency, and market positioning can continue to deliver results.