The 3 “Tells” That Will Move Energy Stocks Before Any Handshake Does

- Peace trades through spreads, not speeches. The Brent-Urals gap at $5-10 still signals friction. Watch for sustained spreads under a single-digit number—that’s when Russian oil truly returns.

- Trump weaponized India’s trade deficit. $87 billion in U.S. exports vs. $4 billion to Russia forced Delhi to pressure Moscow. Tariff threats moved more than tanks.

- Europe built LNG panic infrastructure. 78 bcm added in under 3 years, but pipeline gas costs 40% less. When gravity returns, only sub-$35 breakeven barrels survive.

Trump just forced Putin to the negotiating table.

Not with missiles or sanctions, but with a threatened 100% tariff on Indian goods.

The whole story is hiding in three simple charts that most investors haven’t connected yet.

- Let me show you why a spread between two oil grades matters more than any press conference in Geneva.

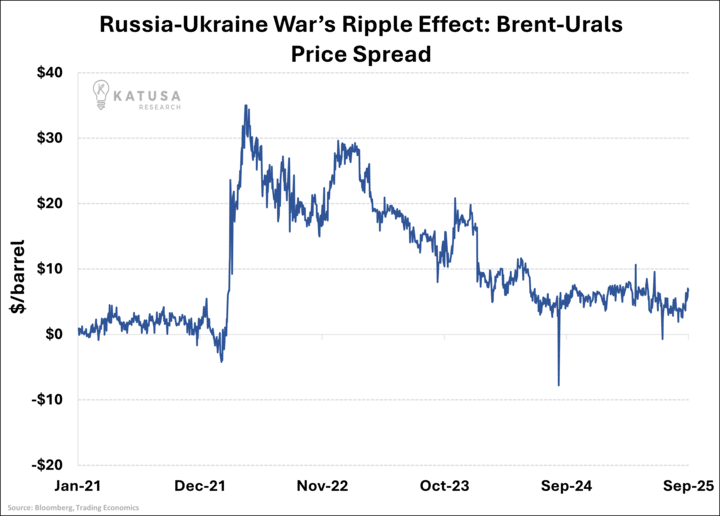

Before February 2022, Russian Urals crude and global Brent crude were like twins—trading within a couple dollars of each other.

Then war broke out. Sanctions hit.

The spread exploded past $30 per barrel as buyers fled Russian oil. Today? We’re sitting at $5-10 which is better than the crisis, but here’s what matters: that gap is still five times wider than normal.

This spread is your early warning system (Tell #1).

When Russian oil starts trading at near-parity with Brent for weeks straight, peace is getting priced in. And when that happens, every energy company in Europe faces a reckoning.

Why? Because European refineries are like kitchens built for a specific recipe. Hundreds of billions in infrastructure designed to cook heavy, sour Urals crude.

They’ve spent three years forcing different ingredients through their systems at higher costs.

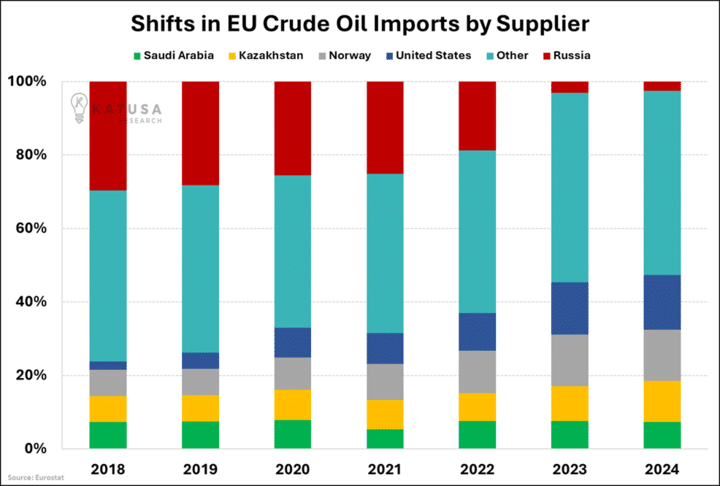

The evidence is already in the import data.

Russia supplied over a quarter of Europe’s oil in 2018. By 2024, it was nearly zero. The U.S. rocketed from dud to 15% market share. Norway surged to 14%.

Watch what happens when peace talks get serious.

Those American and Norwegian barrels will quietly lose market share to “other” sources.

The oil will flow through Turkey, through ship-to-ship transfers, through creative paperwork—the same shadow channels that kept Russian oil moving to Asia throughout the war.

The Real Disruption Comes in Natural Gas

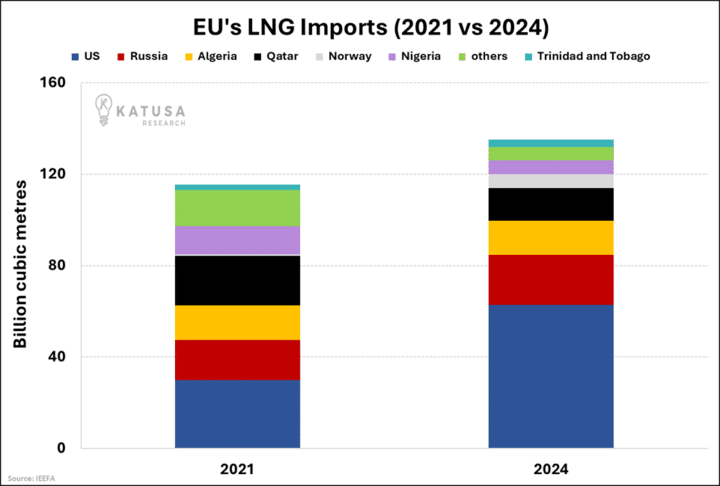

Europe performed an infrastructure miracle after Russia cut pipeline flows—adding 78 billion cubic meters of LNG capacity in under three years.

Floating terminals that usually take five years to plan and build went from contract to cargo in ten months.

Between 2021 and 2024, Europe’s LNG imports rose by 17%, underscoring the bloc’s deliberate shift toward seaborne supply.

The United States emerged as the clear winner in this transition, with its share of Europe’s LNG imports surging from 26% in 2021 to 46% in 2024.

Here’s the trillion-dollar problem…

Russian pipeline gas lands at $6-7 per million BTUs. American LNG delivered to Europe? Try $10-12. That’s a 40-70% premium Europe pays every single day to keep the lights on.

When peace tilts this math back toward pipelines, the entire LNG boom deflates overnight.

Which Brings Us to Trump’s Masterstroke…

He understood what European diplomats missed.

Namely, that India had become Putin’s economic lifeline, buying 2 million barrels daily from Russia and saving $13 billion annually on discounted crude.

But India sells America $87 billion worth of goods each year. Russia? Just $4 billion.

When you’re earning 22 times more from one customer than another, the choice becomes binary.

Trump started with 25% tariffs. When Modi didn’t flinch, he doubled to 50%.

- Then came the nuclear option: 100% tariffs on all Indian goods unless Putin sat down for peace talks. Not on Indian oil imports—on everything from pharmaceuticals to textiles that keep India’s economy humming.

Delhi got the message. Indian diplomats suddenly discovered urgent reasons to discuss “regional stability” with Moscow.

Within weeks, Putin agreed to meet on American soil for the first time since the invasion.

So How Do You Position For Peace Before It’s Announced?

The same way professionals do—by watching what trades, not what politicians say.

- Start with that Urals-Brent spread. Every week it stays under $3, peace probability rises.

The market knows Russian barrels are finding buyers without friction. When that spread holds tight for a month, not days, the game has changed.

Next, track European oil imports by source.

The U.S. and Norway shares will drift lower while “other” origins mysteriously grow. Those are Russian barrels wearing new paperwork. Bureaucrats will insist sanctions remain intact even as the oil flows shift beneath their feet.

Finally, watch LNG import growth rates and regasification utilization. When import growth stalls and spare regas capacity builds, pipeline economics are winning.

When all three signals align—tight spreads, shifting import sources, and LNG momentum stalling—the European energy deck gets reshuffled at warp speed. Prices drop. Margins compress. Dividends that looked safe at $80 oil come under siege at $60.

We’re not buying European energy stocks yet.

Let peace arrive and drive the weak players to the wall first.

But when blood runs in the energy sector, three names top our list:

Company #1 with its $25-30 breakeven Northern European barrels, Company #2’s pure oil focus and falling debt, and Company #3’s balanced portfolio with actual cash flow today.

These tells move together—and hit companies differently. Europe-heavy sellers feel it sooner. Global sellers cushion it better.

Debt, capex timing, and payout policy decide who defends returns and who needs higher prices just to stand still.

We ran that math this month so you don’t have to.

Want the full tiers, entries, and risk triggers? They’re in the September edition of Katusa’s Resource Opportunities.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.