The Silent Rotation of 2026

Get real-time alerts right away. Follow on X: @KatusaResearch and @MarinKatusa

I stopped watching stock prices last month.

Instead, I’ve been tracking something more valuable: questions.

Not what retail traders type into Google… what institutional desks are searching on Bloomberg terminals. What complex queries are flooding high-level AI systems.

The divergence is massive and it tells you everything about where money moves in 2026.

- Retail searches: “Best AI stocks.” “Nvidia price target.” “ChatGPT subscription.”

- Institutional searches: “SMR regulatory approval timeline.” “Uranium spot price supply deficit.” “Data center PPA 2026.”

Do you see the gap there? The retail tourists are chasing software. The owners are hunting for power.

There are three big trends and asymmetric setups unfolding right now, all hiding in plain sight.

Let’s get you up to speed into the right investment ideas before the ball drops for 2026.

Trend #1: You Can’t Print Energy

The AI Boom is over.

The AI Power Panic has begun.

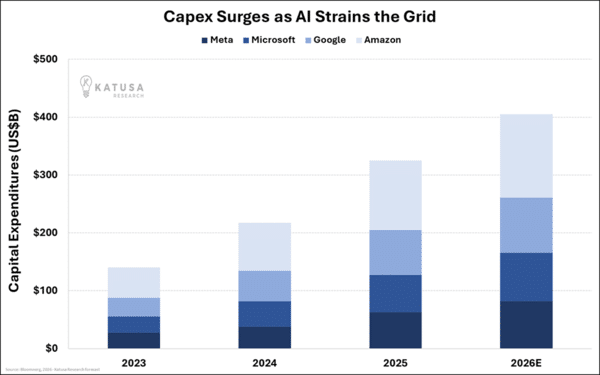

Data centers are projected to consume 165% more power by 2030. But the grid is old, broken, and maxed out. In Virginia alone, data centers already eat 26% of the state’s electricity. A quarter of the power of one state, gone.

You can’t run 2026-level AI on a 1970s grid.

And nobody in Silicon Valley thought of asking until it was too late.

There’s a secret bidding war happening but it’s not for chips.

It’s for baseload power.

Microsoft, Amazon, and Google are quietly securing nuclear energy contracts because they know the truth: No power, no AI.

Microsoft is restarting Three Mile Island. Amazon signed nuclear PPAs. Google is buying SMR capacity before most investors know what SMR stands for.

- Note: Refer to our “Brother-in-Law Indicator” to see if something has gone mainstream.

And Meta is going a step further and creating its own Electricity Trading arm.

I’ve been pounding the table on this for two years…

In 2026, the best-performing asset won’t be the chipmaker. It will be the only fuel dense enough to keep the lights on without boiling the planet.

Uranium, Nuclear and Enrichment.

Trend #2: The Ledger of Everything

- Retail searches: “Next 100x meme coin.” “Solana airdrops.”

- Institutional searches: “ERC-3643 compliance.” “BlackRock tokenized fund liquidity.” “Treasury bill tokenization yields.”

The dog coins are a distraction. Crypto stopped being a casino and its rails are becoming the backend of Wall Street.

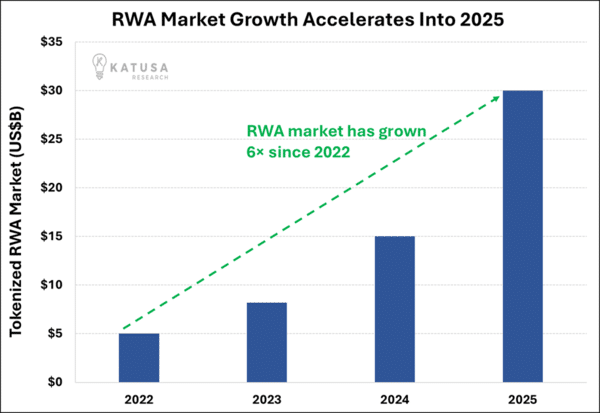

This is the year of RWA — Real World Assets.

We’re moving from trading meme coins to trading tokenized Treasury bills, gold, and real estate. You haven’t heard about this because it’s incredibly early.

Three years ago, tokenized RWA totaled $5 billion. Today: $30billion. And we haven’t left pilot phase.

We believe 2026 is when this goes from pilot to production.

The plumbing of finance is being ripped out and replaced. The banks aren’t fighting crypto anymore. They’re buying the infrastructure. BlackRock, Goldman Sachs, JPMorgan, they’re not dabbling. They’re deploying.

Now imagine where this goes…

Selling 1% of your house to buy a coffee. Trading a fraction of a New York skyscraper for a bar of gold, instantly. On a Sunday. With zero middlemen..

That’s the rails being built right now.

The GENIUS Act just handed stablecoins their first federal regulatory framework. Bipartisan and signed into law. The compliance boxes are checked and the lawsuits are over. The institutions have permission.

You can monitor search queries for “Tokenized Collateral.” When banks start using crypto tokens as overnight lending collateral at scale, the old financial system is officially dead.

That threshold is already crossed.

The biggest wealth transfer in 2026 won’t be a coin you trade. It will be the network that trades everything else.

Trend #3: The Sovereign Shield

- Retail searches: “Why is inflation high?” “Gold jewelry price.”

- Institutional searches: “Central bank gold accumulation Q4.” “Debt-to-GDP sovereign default risk.” “Non-Cusip safe-haven assets.”

This is the silent trend. The one front page headlines ignore because it breaks the narrative.

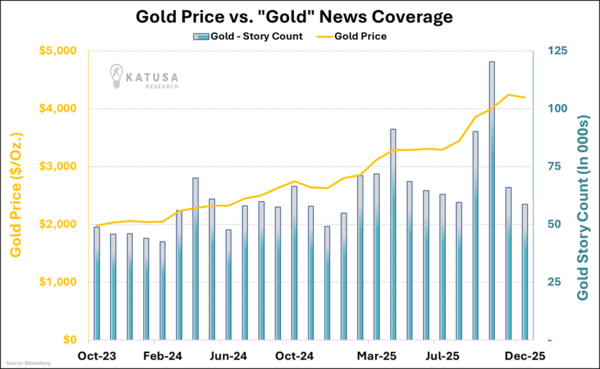

While the S&P and Nasdaq soar, central banks are buying gold at a pace we haven’t seen since the end of World War II. From 2022 to 2024, they accumulated 3,220 tonnes, more than double the prior three-year period.

- The World Gold Council reports 81% of central banks expect to increase reserves further.

That’s among the highest convictions ever recorded.

Why? They can do math…

US debt-to-GDP sits at 124%. Japan is worse. Europe isn’t far behind. These debt loads aren’t sustainable. They’re mathematically unpayable. The people who actually run the monetary system are voting with their vaults.

Gold is an exit strategy from the fiat currency system, not just a trade in 2026.

Stocks AND Gold are at all-time highs. That shouldn’t happen. When stocks boom, gold sleeps.

When they rise together, the market isn’t betting on growth, but on dollar devaluation. Smart money is heavy in tech stocks, but parking profits in gold.

The Signal, or as I call it “The Silence”: Gold is hitting record highs, but Google search volume and news mentions for “gold” is flat. This is the most bullish signal possible.

It means the public haven’t arrived. When your Uber driver asks about gold coins, it’s time to sell.

Right now? I’m still buying the best gold stocks.

The 2026 Trades Start Now

Retail is chasing Nvidia, praying for past glory of alt coins.

That’s yesterday’s narrative.

The smart money moved months ago. They’re buying uranium miners while you debate AI multiples. Building on tokenized rails while you scroll past crypto headlines. Accumulating gold at the fastest pace since Bretton Woods while you watch tech stocks hit new highs.

The Great Rotation of 2026 isn’t growth versus value. It’s infrastructure versus hype. Power versus software. Hard assets versus paper promises.

If you’re still arguing about Nvidia’s price target in March, you’ve already missed it.

Over the coming months, in my premium service – Katusa’s Resource Opportunities…

I’ll be naming specific companies on the right side of each trend:

- The power providers.

- The protocol builders.

- The hard asset accumulators.

It will be the names that don’t show up on CNBC until the move is over.

The window is open. It won’t stay that way.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.