"These are the BEST fundamentals for HIGHER uranium prices I've ever seen in the 40 years working in this industry."

- CEO of the #1 uranium royalty company in the world

Ticker REVEALED Below

The Big Idea In 60 Seconds:

Invest in the only royalty stock that can earn cash from dozens of uranium mines at the same time

This 40-year uranium vet claims:

Disclosure: Owners, members, directors and employees of Katusa Research have/may have stock or option position in any of the companies mentioned: URC, UROY. Katusa Research receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article. This content was reviewed and approved by Uranium Royalty Corp. Please read our Full RISKS and DISCLOSURE here.

You’re about to discover the only uranium company that can profit from dozens of uranium mines all at the same time.

SPECIAL SITUATIONS ALERT

The company holds 18 interests…

But their goal is to become like Franco-Nevada… the gold royalty giant started in 1983… and owns interests in 437 gold mines.

Meaning, this uranium company needs to 20X their current holdings.

And they have time.

With little competition.

Uranium Royalty Corp.

(UROY:NASDAQ / URC.TSX)

The only uranium royalty company in the world.

- They have launched an impressive portfolio out of the gate.

- And, they’re still young, just 6 years old.

The stock trades on both the Canadian and US stock exchanges.

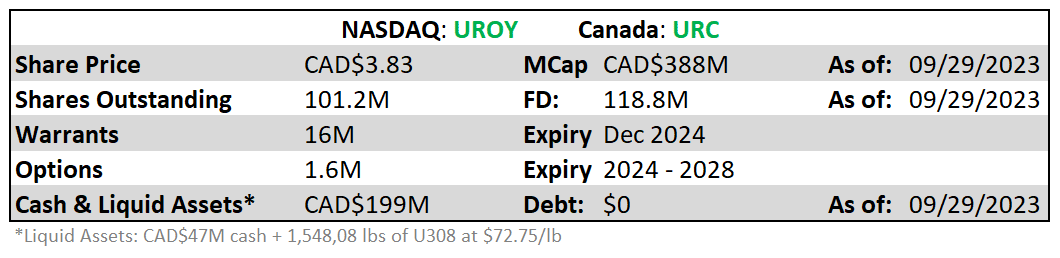

However, analysts have put forth a price target of $5.42 USD as of Sept 27, 2023… which would represent a gain from its current Nasdaq share price.

Legal Note: You can see analyst targets on the NASDAQ site right here.

H.C. Wainwright tagged UROY with a price target of $5.42 as of Sept 27, 2023

That is not a guarantee, that’s simply what outside analysts have projected based on their detailed valuations of the underlying assets and disclosed publicly on.

Today, you’ll see what makes Uranium Royalty Corp. (UROY | URC.TSX) not just an interesting company to potentially invest in… but one that’s needed in this current energy environment.

The company was started by the owners and executives of one of the most well-known uranium companies in the world… Uranium Energy Corp.

They have already secured multiple deals with interests in the largest global uranium companies like Cameco Corporation (NYSE: CCJ), France’s Orano, and the African producer, Paladin Energy Limited (ASX: PDN).

After this brief, you’ll understand why Uranium Royalty’s CEO, Scott Melbye, calls this new bull market in uranium, “The best supply and demand fundamentals, and investment thesis, I’ve seen in 40 years”, in the space.

- Also, discover how uranium is cleaner and safer than oil and coal, and learn how uranium provides energy security with the geopolitical forces at work in Russia and China.

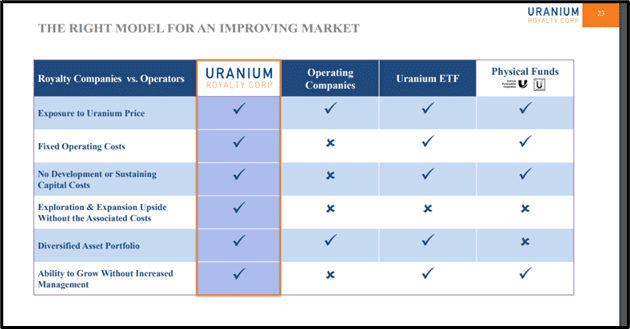

- You’ll see why Uranium Royalty provides the “royalty company advantages” that have become so evident in the Base and Precious Metals industries.

First,

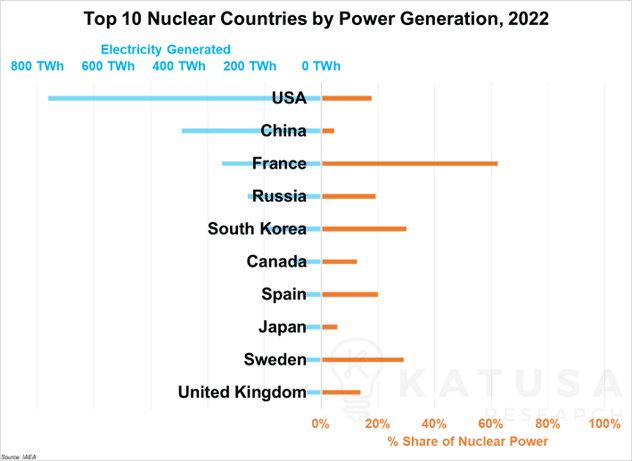

Did you know the USA is the #1 producer of nuclear energy on the planet?

Close to 1 in 5 homes get their electricity from nuclear power.

However, it represents over 50% of the carbon-free energy produced in the United States (twice the contribution of wind and solar).

The US produces more nuclear power than anyone… and it’s growing again.

Here’s the problem...

The U.S. generates the most electricity from nuclear power of any country… but they rely on close to 100% of their uranium needs from foreign suppliers (~50% coming from Russia, Kazakhstan, and Uzbekistan).

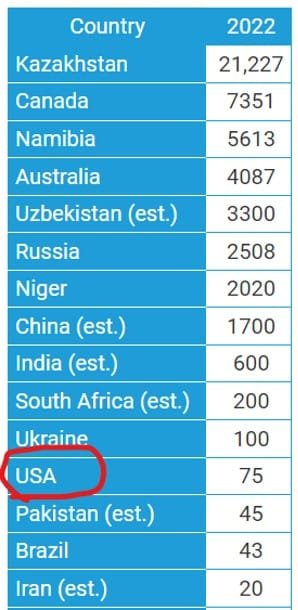

In fact, the United States sits near the bottom of the heap in terms of uranium-producing countries, despite enormous mineral resources and leading global production in 1980.

The US doesn’t produce enough uranium for its needs.

They produce just 0.35% of the uranium that Kazakhstan mines.

Still, there are already 92 nuclear reactors up and running in the U.S. pumping out ~20% of the country’s electricity.

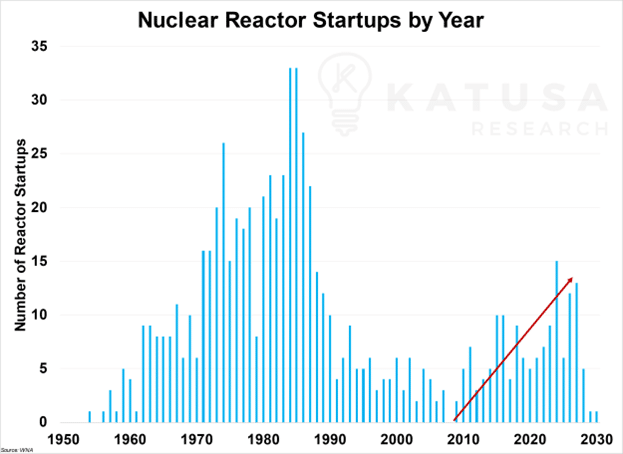

But since Chernobyl and Fukushima, the construction of nuclear reactors state-side has slowed to almost nothing.

Until now…

NPR reported, that in July 2023, the state of Georgia just put a new, large, nuclear reactor, Vogtle Unit 3, online after years of delays. It’s in the process of loading fuel to prepare for its grid connection.

The first nuclear reactor was put online in the U.S. in 40 years.

These are the United States' first nuclear reactors put online in 40 years.

These two are in addition to the 67 similar-sized reactors that have come online around the world in the past ten years. 60 more have broken ground and are under construction.

However, there are new types of advanced ‘mini’ reactors emerging that could revolutionize the way clean energy is generated and distributed.

They are called small modular or advanced reactors (SMR). They’re easier to build, constructed in factories, and shipped on-site, scalable for on and off-grid applications, and possess enhanced safety designs.

Companies such as TerraPower, NuScale, X-Energy, and GE-Hitachi are planning to construct and start up their projects in Wyoming, Idaho, Texas, and Ontario by or before 2030.

The Infrastructure Bill and Inflation Reduction Act have earmarked 9 figures to help preserve existing nuclear capacity in the U.S. and promote the construction of more.

The timing is excellent as reactor startups are seeing a boom not seen since the 70s.

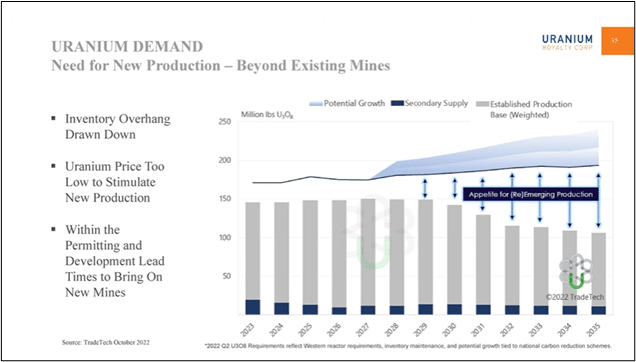

All of these reactors will require millions upon millions of pounds of uranium to fuel them, and we are already starting from a structural supply deficit.

This will require a great deal of new mine developments to move forward around the world, and Uranium Royalty Corporation (UROY) as a capital provider to the uranium industry is eager to invest in that needed growth.

Low uranium prices in recent years failed to incentivize the required pipeline of new mine projects.

But that’s changing:

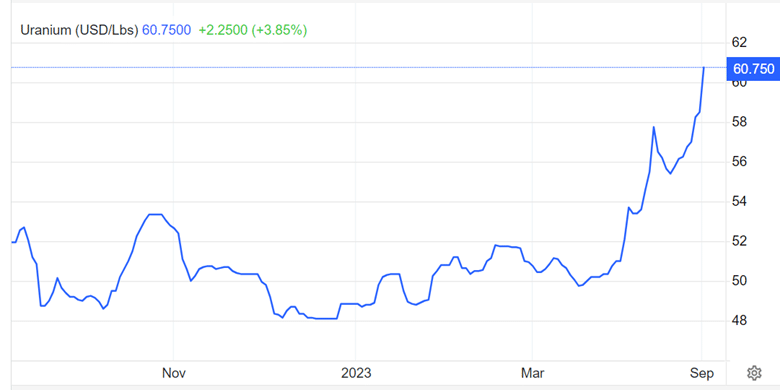

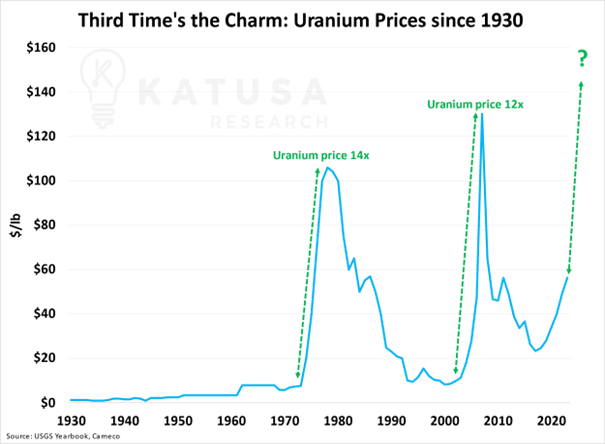

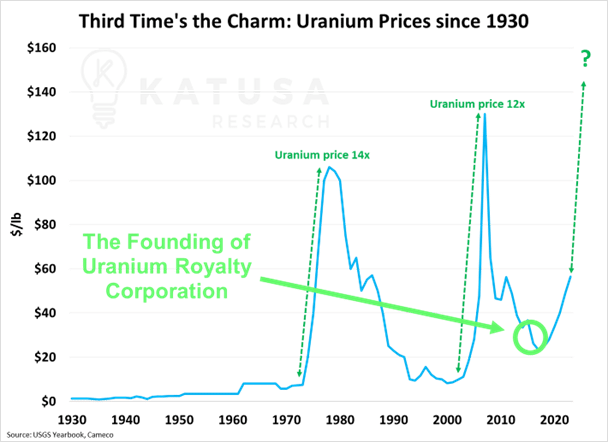

Uranium’s Decade-Long Bear Market Just Flipped

Low prices made it harder to finance and build mines to pull the uranium out of the ground.

Why the CEO of Uranium Royalty Corporation calls this the “best fundamentals in uranium I’ve ever seen in 40 years”

(and he says will lead to higher uranium prices)

Scott Melbye

CEO, Uranium Royalty Corp

Scott Melbye’s home base is in Colorado.

But that’s not usually where you’ll find him.

This 40-year vet of the uranium industry was just in Australia looking at mines out there.

- He also jetted to Canada to check out new opportunities. (Canada holds the highest-grade uranium in the world).

- He had planned a trip to Africa even as Niger hostilities ensued. He’ll be back there soon.

The point is Melbye is a true ‘boots on the ground’ CEO.

And he’s telling anyone who listens that the ‘time is now’ for uranium to come into a new bull market.

It’s already started. His reasons?

Catalyst #1

Uranium Supply SHOCK Incoming

At the moment, the world consumes around 195 million pounds of uranium.

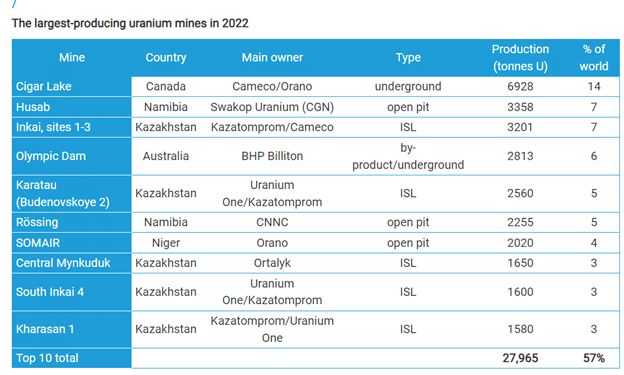

Currently, only 144 million pounds are being mined from Kazakhstan, China, Canada, and others.

- Meaning, countries must make up more than 50 million shortfall from their precious inventories, and have been doing so for several years.

That can work for a time…

However, eventually, as inventories fell… and demand rose... more miners would need to produce to balance the market. Speculative buyers like Sprott Physical Uranium Trust, Yellow Cake plc, and others, only hastened this excess inventory drawdown.

Over the next decade, countries will need more and more supply.

However, due to the bear market over the last decade, many miners went offline as low uranium prices didn’t incentivize the needed investments to maintain production or start new operations.

Cameco is the largest publicly-traded uranium company in the world and despite having the world’s richest high-grade mines, both of their flagship mines were shut down for an extended period.

Until now…

In 2023, they’re back up and producing from the McArthur River and Cigar Lake Mines (two operations that Uranium Royalty Corp. is fortunate to have among its 18 interests).

Restarting projects takes time, and Cameco is one of the fortunate ones with existing, permitted, and licensed operations with competitive costs on a global scale, so it is not surprising that Cameco is one of the early movers.

Supply can’t keep up with demand due to draining inventories and a shortfall in production. More uranium must be mined.

The challenge is the world probably needs 8-10 additional new mines, or restarts to close the gap on consumption. Unlike more efficient and mature commodities like copper, gold, or silver, the uranium market does not have a large queue of projects waiting in the wings to come online.

Melbye claims once uranium prices hit “$60”... we’ll only see a limited response of the more competitive miners coming back to produce (largely restarts of standby mines).

The real threshold for new production, requiring large capital investments and the heavy lift of permitting and licensing, is likely more than $75 or $80 per pound… and no price will shorten that regulatory lead-time on permitting and licensing.

We’ve hit $60… and prices are climbing.

In the 1970s when uranium was enjoying one of its early bull markets… we saw very similar setups as we did today:

- Energy crisis

- Arab oil embargo

- Nuclear war threats

- Higher inflation

Similar points are in play now.

Yet, if supply comes back, what are the chances Western mines can pull the uranium-producing reins from a behemoth like Kazakhstan and Russia?

That leads to Melbye’s second fundamental shift.

Catalyst #2

Russia Invading Ukraine Disrupted the Entire Energy Industry

- Russia is the #1 enricher of uranium. 39% of all uranium enrichment is done there.

- Kazakhstan is the #1 producer of natural uranium. 40% of all uranium is produced there.

Nuclear fuel requires mined uranium to be enriched before use.

Following the breakup of the Soviet Union, Russia and its allies made great inroads in capturing Western business from subsidized State-owned enterprises. Surprising to many, the United States, sources 20-25% of its enrichment services from Russia.

Not ideal especially as the U.S. backs Ukraine in the war.

European countries and the UK also grew over-reliant on these supplies in similar percentages.

This has become a visible national security threat as Russia controls over 20% of America’s energy (from nuclear power).

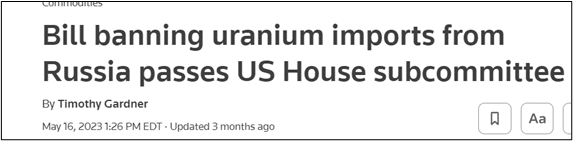

In early 2023, both the U.S. House of Representatives and U.S. Senate passed bills out of committee, on a bipartisan basis, that would ban Russian uranium and revitalize the American domestic nuclear fuel cycle through the American Nuclear Fuel Security Act.

The House will hopefully pass similar legislation and bring the bill to the President’s desk for signature into law by 2023 or 2024.

What will the U.S. do if they can’t import uranium? Where will they get it?

Melbye notes uranium and nuclear power is one of the few initiatives both Democrats and Republicans agree on.

“I have not seen this degree of bipartisan support in my 40 years in the nuclear industry and it represents a historic opportunity.”

“When we’re lobbying on the Hill, we receive enthusiastic responses from both the House and Senate, the Right and the Left.” Melbye states.

Getting away from Russian uranium dependency isn’t just an American statement either.

27 other countries in Europe are joining the call:

The solution is becoming obvious (and urgent) on how to wean these dozens of countries off the Russian uranium kick.

There’s really only one answer…

Find, develop, and mine new sources of Western uranium and build new fuel cycle facilities to convert and enrich uranium, completely independent of Russia (and China for that matter).

The uranium supply and demand fundamentals were already compelling before the geopolitical events in Ukraine unfolded.

The demand side is driven by a growing realization of nuclear energy’s role in decarbonization and clean energy is a global mega trend happening right now.

Catalyst #3

Green Energy is needed NOW.

(Uranium is our largest carbon-free power source and the only one that can run 24/7)

July 2023 was the hottest month on record… and by a fair margin.

The warning bells for cleaner energy to help global warming have never been louder.

Uranium produces the cleanest energy with the maximum reliability. This “fog” coming out of a nuclear reactor isn’t smoke and pollution…

It’s purified water that has been converted to steam to drive a turbine in an electrical generator!

A study was done that if every coal plant was actually a nuclear reactor from 1965-present, we would’ve saved over 81 million lives from pollution-caused deaths.

That’s how many innocent victims coal pollution has claimed.

4,000 people die every day in China thanks to their non-stop factory smog. It’s poison.

Fossil fuels kill an estimated 7 million people per year.

It’s devastating.

On the flip side, it’s estimated that since 1971, nuclear power has prevented nearly 64 gigatons of carbon equivalent from destroying our planet.

That’s the same number as if they burned coal non-stop for 35 years. Nuclear power prevented that carbon footprint.

After construction is complete, nuclear power is a zero-emission clean energy source.

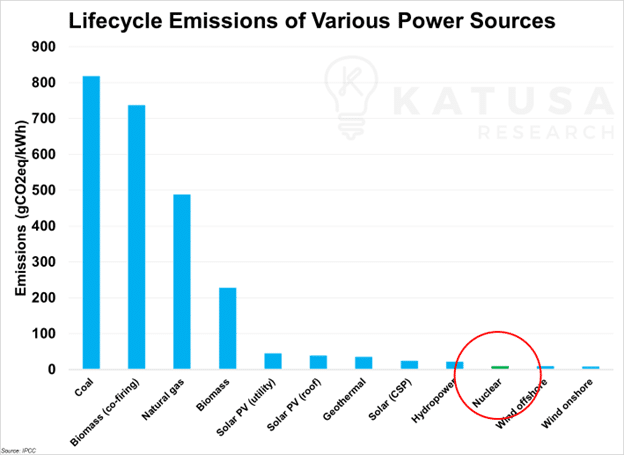

See…

Nuclear power is the cleanest, most effective energy there is.

The emissions from nuclear power are as low as wind.

Whether its carbon-free strengths or its 24/7 baseload supplies, nuclear is realizing a growing role in global energy policies.

As “baseload” power, it is the ideal complement to renewables when the wind is not blowing and the sun is not shining and its fuel cost advantages provide an ideal hedge against high natural gas prices… nuclear is always there, working behind the scenes.

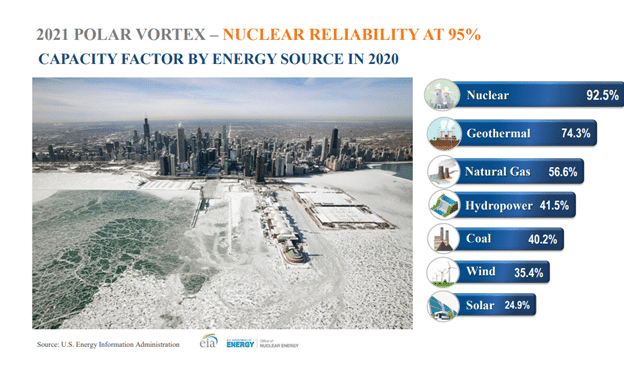

It’s nearly triple the reliability of wind and solar.

Bill Gates said in an interview, “Wind and solar just don’t create the solution we need”. Instead, Gates is backing nuclear power.

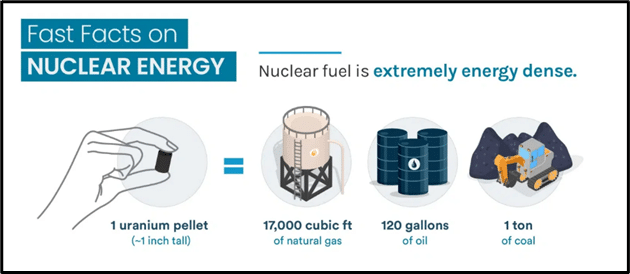

In terms of actual electricity produced, uranium fuel boasts the highest “energy density”…

It would take one ton of coal to equal the energy output of one small pellet of enriched uranium. That pellet is as small as your thumbnail.

Meaning, that you’re using multiples less of uranium to produce nuclear power than you would burning coal to produce energy.

You need way less uranium than gas, oil, and coal for the same amount of energy.

As mentioned, Chernobyl and Fukushima slammed the brakes on nuclear progress at a global level. Germany started shutting down nuclear plants right away (and they have followed through). Most other countries paused nuclear development.

However, there’s the misconception that using uranium and nuclear power is ‘dangerous’.

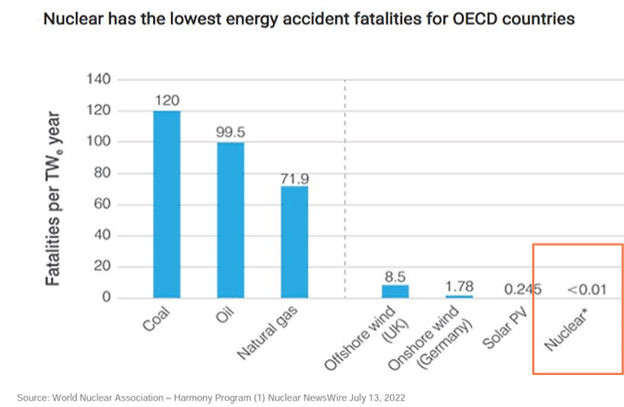

Over the past half-century, they’ve studied which energy source was indeed the most dangerous to humans.

The results were surprising:

Nuclear energy has a similar safety record to that of wind and solar (actually safer)!

Accident fatalities have been tracked by major energy sources in the OECD countries since the 1970s, and measured by the terawatts of electricity produced during this period.

The safest form of energy has been nuclear power.

Deaths from oil, coal, and natural gas have been orders of magnitude higher.

It’s a shame more people don’t know these facts, but it is also why Elon Musk believes nuclear plants are “extremely safe”.

For some time, coal, oil & gas have had a foothold in the energy space, especially in America.

However, the government continues to put more and more pressure on the industry to clean up their act.

For example, President Biden proposed taxing oil companies on their windfall profits.

And clean air standards passed at the State and Federal levels are forcing coal-fired power stations to shut down (phasing out what was America’s largest source of electricity).

Amir Adnani, founder of Uranium Royalty Corp (alongside Scott Melbye) was on Fox Business saying, “Biden has made it clear he’s not backing oil”.

The US produces more nuclear power than anyone… and it’s growing again.

The embrace of clean-air, nuclear, and uranium in U.S. Congress, and the Biden Administration, is in recognition of the urgent need to replace lost energy supplies brought about by their reduced reliance on fossil fuels.

A tangible example of this is the establishment of the National Strategic Uranium Reserve by the U.S. Department of Energy at the end of 2022.

The government’s scrambling to stock uranium reserves is an early indicator of a renewed value placed on getting uranium outside the control or influence of Russia and China.

Many aren’t talking about this in the news as this is happening right now, in the world’s largest nuclear power program, with little fanfare.

This flight to safety in the Western world will place a premium on uranium mines in the U.S., Canada, Australia, and some operations in Africa that are free of Chinese control or political strife.

In North America, Canada can tout the largest and highest-grade mines (and Uranium Royalty Corp has interests in the top two mines).

Plus, with the US producing the most electricity from nuclear power… and desperately seeking a revitalization of its domestic uranium fuel cycle, Uranium Royalty Corp’s extensive interests there will also prove to be strategic in nature…

Beyond North America, there will be a global resource race to produce, enrich, and supply uranium for the coming uranium boom over the next decade.

That’s where Uranium Royalty Corp. (UROY) is taking a slice… with every uranium sale

Here’s the story of how the only uranium royalty company started.

Amir Adnani and Marin Katusa (a widely-respected resource investor) were enjoying New Year's Eve with their families in 2017.

Katusa had predicted in 2016 that uranium prices were set to drop even lower.

By 2017, they had bottomed…

And it was during their New Year’s barbeque, that Adnani and Katusa came up with an idea while there was blood in the streets for uranium. Their idea:

“We have a chance to buy mines at dirt cheap multiples”, they concluded.

Adnani’s company, Uranium Energy Corp. (one of the fastest-growing uranium companies in the world) had already pursued this strategy and owned mines that the government had permitted for use.

Katusa and Adnani knew each other as Katusa had invested pre-IPO in Uranium Energy Corp. (UEC)… and the stock 6X’d from Katusa’s buy-in when the stock first went public.

However…

Buying up a mine, permitting it, regulating it, getting it ready… alone… can cost hundreds of millions of dollars.

That’s before a shovel even hits the dirt to dig the site to begin extraction (which costs another 8-9 figures).

There had to be a way to not put all your eggs in one basket.

Every mine does NOT work out. Some end up losing money. It’s a risky venture.

Companies need financing from Day 1.

There were already debt options for miners to borrow to buy and develop their mines…which comes with high interest rates in today’s markets.

Other mining companies would go public and raise money selling stock… which dilutes the owners’ shares.

What other options do they have?

That’s when Adnani and Katusa… two resource financing experts… looked to other mining sectors to see how they approach the high costs of mining.

It hit them like a ton of bricks…

You have Franco-Nevada, Wheaton, Royal Gold, and others using a streaming and royalty model.

At the time, there were zero streaming and royalty companies in the uranium space.

Today?

There’s now only one.

Uranium Royalty Corp. (UROY) started at the very bottom of the most recent uranium market cycle

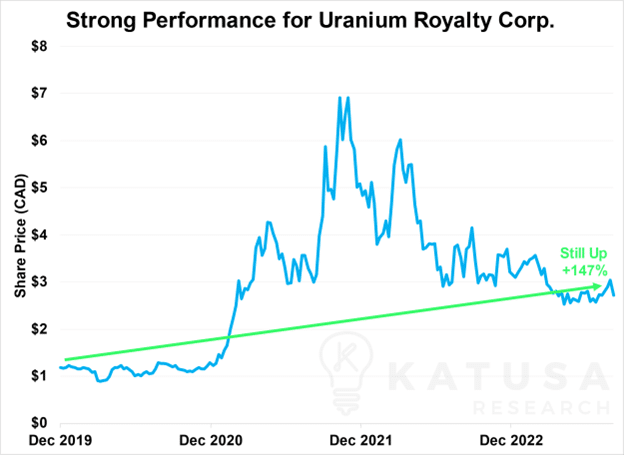

By 2019, Uranium Royalty went public on the Canadian stock exchange under URC.

In 2020, UROY went public on the Nasdaq. It’s up 147% since IPO as of this writing.

In 2021, the company was the world’s best-performing royalty company among the broader resource sector, approaching CDN$7.00 per share.

Uranium Royalty Corp (UROY) has soared since its IPO and stayed! Unlike other resource stocks.

The stock is still half of where it was in 2022. And uranium prices were lower than they are now.

Melbye stepped in as CEO to build out the interests in the portfolio. As of now, there are 18. However, Melbye didn’t stop there.

To show investors he truly believes in the price of uranium over the long-term…

He’s invested over $65M into actual, physical yellowcake uranium.

UROY bought the uranium close to the bottom of this cycle at an average cost near $43/lb. Melbye’s smart move has resulted in capital gains for their physical uranium holdings.

Holdings that can be liquidated at any time, but only in the most disciplined manner.

Still, as deal flow picks up in the uranium space, Melbye is eager to invest aggressively in new royalties and streams.

Because with a royalty model, the payouts can be huge.

UROY is set to receive cash ‘for life’ from all mines they invest in. Of course, not all mines will work out over the long term… some will outperform expectations while others will underperform.

But the diversification across potentially dozens of mines in the future is the BEAUTY of the royalty model.

Melbye isn’t shy to share that once uranium prices start booming, there will be competitors in the uranium royalty space. If the model is that good (and it is), UROY won’t be the sole player for long.

As of now, however, UROY has a 6-year head start on all the competition.

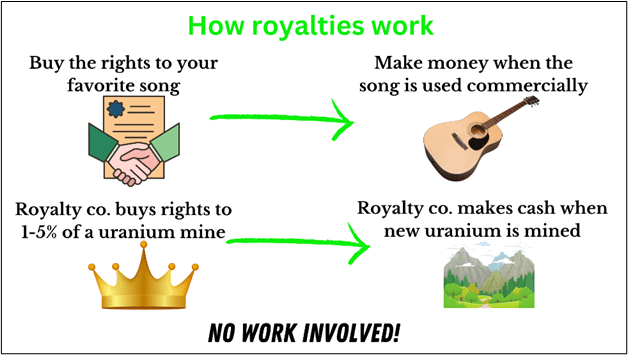

What is a uranium royalty company?

Think of a royalty company as if you bought the rights to a song before it became famous.

As few radio stations spin the record, you’re not receiving much in royalties from owning the rights to the song.

Then, suddenly… one day, that song goes viral. Millions and millions of people start downloading it, and streaming it on Spotify, a cereal company wants to use it in a commercial.

Those song rights are suddenly producing more revenue as the song is replayed again and again.

The royalty checks get bigger. The checks fluctuate based on how many ‘plays’ the song outputs.

With a gold royalty, oil royalty, and, in UROY’s case, a uranium royalty…

The company invests in a mine to help finance the development or expansion of an operation with the objective of bringing it into production.

In return, the royalty company receives cash distributions based on the output of the mine in perpetuity.

Think of it like a dividend except the royalty is based on sales/production.

UROY invests in a mine…

UROY now has the rights to a certain percentage of the revenue or profits for life, or until UROY sells the rights to another business or the mine closes.

Here’s why royalty companies are attractive to mining companies

Miners have a few options when they need to finance their digs:

- Debt

- Raise capital from stock sales (whether public or private)

- Royalties

Melbye spends much of his time meeting with the CEOs and CFOs of uranium miners and developers as many are not fully aware of the development capital potential of the royalty model.

Thus, many of these executives don’t understand that the royalty structure may be in many cases their lowest cost of capital alternative.

In other cases, UROY buys existing royalty and stream rights from third parties who are content to take an upfront “cash out” for a future stream of revenues from a mine.

Some also take shares in UROY, rather than cash, to stay invested in the upside of the uranium/nuclear energy story.

By reading this page today, you already know more about royalties than many CFOs.

Melbye is flying internationally monthly in an aggressive effort to get Uranium Royalty’s name out there to as many uranium mining companies as possible who will come to him first for their capital needs.

Again, at the moment, there are zero competitors.

Melbye knows that will change, which is why he’s knocking on every door so uranium companies trust UROY first before any new company sets up shop.

(First mover advantage is huge for UROY).

Back to the three financing methods uranium mining companies have…

What if an executive didn’t have to take on high-interest debt with looming debt payments…

And, didn’t have to keep chopping up their company for parts and giving away shares… not to mention, if public, they’re at the whims of the public sentiment, they have stricter regulations, more reporting, etc.

What if, instead, they received massive $30-50 million dollar checks, and, in return, all they needed to pay out was 1-5% of their future gross or net revenue to the royalty company?

Suddenly, that royalty company becomes a partner. A partner who wants that mine to succeed as much as the founders.

That is something special.

Founders keep their equity and can chase off the greedy shark lenders.

Instead,

They have royalty partners who only make money when the founder starts making money. Win-win.

For the royalty company, it’s a cash payment for life.

Yes, they must wait for production to take off…

But UROY isn’t taking on the cost and stress of huge workforces, land holdings, planning, permits, digging, and reclamation. It’s straight capital injections in exchange for a small slice of future cash flows.

The royalty model for uranium is only available with UROY.

By only investing and not taking on the struggle of managing the mine, UROY can diversify across dozens and dozens of mines.

UROY investors aren’t betting everything on a handful of mines. Some could fail and the portfolio still has a shot at performing well.

The goal?

To become the Franco-Nevada of the uranium space.

Franco-Nevada has 437 royalty interests.

Here’s the cherry on top:

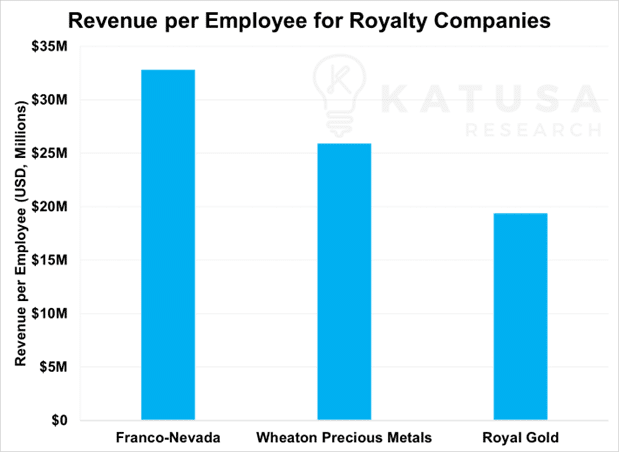

Royalty companies are some of the most efficient businesses on the planet.

Franco-Nevada generates over $1.6 billion in gold royalties today.

- Franco-Nevada has just 40 employees.

Papa John's, the pizza company, does just a little more revenue at $2 billion in sales… and they have 12,000 employees!

That’s a lot of G&A overhead for Papa John's. UROY doesn’t need any of it.

The US produces more nuclear power than anyone… and it’s growing again.

Royalty companies keep expenses down.

- Royal Gold has 31 employees.

- Wheaton Precious Metals has 41 employees.

- Uranium Royalty Corp has 13 employees, but only 3 of them are full-time employees right now.

As they buy more interest, that headcount isn’t ballooning.

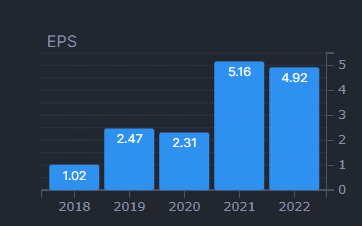

It’s why Franco-Nevada’s profits just continue to soar to record highs.

What profits look like for a gold royalty company… because this business model is efficient.

UROY is using the same playbook and putting it to work right now.

Their first royalties are hitting the bank account soon.

Uranium Royalty Corp (UROY)

Top Royalty Projects:

UROY holds royalty interests in the world’s two top uranium mines, McArthur River and Cigar Lake, in the rich Athabasca Basin of Saskatchewan, Canada.

MCARTHUR RIVER:

World’s #1 uranium mine – Ore grades 100X the world average, licensed for 25 million pounds per year. 2023 production targeting 15 million pounds. Owned and operated by Cameco and Orano. Production had been shut in as part of Cameco’s production cutbacks but returned to operation in 2022.

UROY swooped in to invest while the mine lay dormant in 2021. This interest and that of Cigar Lake were purchased from Reserve Oil and Minerals of Albuquerque, New Mexico.

They were an early exploration partner in the Athabasca Basin in the 1980s and were willing to take cash and shares in UROY in exchange for their interest.

Perfect timing, as in February 2022, Cameco announced they reopened the mine to produce.

UROY has elected the right to take its Gross Revenue Royalty in the form of a physical uranium book transferred to its account at Cameco’s Blind River, Ontario facility. UROY royalty interest is currently paying out.

At an annual rate of 18 million pounds and a $70 per pound market, this interest will cash flow over $1 million per year (1% GRR on 9% share).

The largest high-grade uranium deposit in the world.

CIGAR LAKE:

Cigar Lake/Waterbury Lake was the top-producing uranium mine in the world in 2022 with McArthur River only returning to operation in Q4 2022.

UROY investors get royalties from the largest producing mines.

It is the world’s second-highest-grade mine and produced 14% of the world’s total uranium in 2022.

Cigar faced operating challenges during the COVID pandemic with production output coming in fits and starts. This is now fully behind owners/operators Cameco and Orano and is producing 18 million pounds in 2023.

World’s top producer in 2022.

Operating costs for the mine are at just $15.98/lb. This also makes Cigar Lake one of the lowest-cost uranium projects around.

UROY holds a Net Profit Interest royalty on Cigar, which means that it makes money on the net income generated from the uranium mined after all exploration and development costs are deducted. Meaning, after the expense bucket is drawn down, UROY takes a 10-20% cut of the bottom line on a 3.75% share of the project.

That’s for the life of the mine (including any expansions or extensions of the project.)

If and when uranium prices soar, those royalty checks will grow.

Melbye says Cigar Lake could be generating $5M in annual cash flow within 3 years, but it all depends on how much is produced by the owner/operators and what prevailing prices they are receiving on the sale of that production.

Alongside McArthur, both mines have the reserves and licensed capacity to supply 17% of the projected global uranium demand.

As we see more nuclear reactors go online… and countries scrambling to find new uranium sources in the West… these mines will continue to be top in class and become increasingly important in the global uranium space.

These are just 2 of the 18 interests Uranium Royalty Corp. (UROY) holds.

Again, as uranium prices climb, these projects become more profitable, plus more interest can be up and produced faster.

These interests will continue to compound and pile up.

The team behind Uranium Royalty Corp has over 150+ years of experience in the uranium and resource financing space.

They had the foresight to start UROY at the very bottom of the bear market.

Now, they’re putting their foot on the gas.

It is the world’s second-highest-grade mine and produced 14% of the world’s total uranium in 2022.

Cigar faced operating challenges during the COVID pandemic with production output coming in fits and starts. This is now fully behind owners/operators Cameco and Orano and is producing 18 million pounds in 2023.

Scott Melbye - CEO

Melbye’s the President, CEO, and Co-Founder of Uranium Royalty Corp.

He’s spent 40 years in the uranium space.

21 years at the largest uranium company, Cameco, including being President of the entire USA operation.

Also, the Executive Vice President at Uranium Energy Corp. (UEC) working alongside the founder, Amir Adnani.

Melbye is spending much of his time on planes, meeting with miners and developers to seek out new royalty investments. He is a frequent speaker at international conferences and is constantly sharing the UROY story with retail and institutional investors to raise awareness of this exciting company.

He’s also the President of the Uranium Producers of America and was the Chair of the World Nuclear Fuel Market.

Melbye was also an advisor to the national uranium company of Kazakhstan (the world’s largest uranium producer). He also managed the global marketing and sales activities of Russia’s Uranium One, the top three uranium producers controlling 50% of Kazakh production.

Alongside Melbye is his Co-Founder:

Amir Adnani - Founder

Adnani founded Uranium Energy Corp. (UEC) in 2005, which is one of the fastest-growing uranium companies in the world.

He also is the Co-Chairman of GoldMining Inc. A public company worth over $150M and acquiring gold assets in North America.

Fortune named Adnani a top “40 under 40” entrepreneur. Ernst & Young nominated him as “Entrepreneur of the Year.”

You’ll find Adnani, when not running his multiple ventures, speaking at prestigious conferences in the resource space including the Milken Institute Global Conference and the International Economic Forum of the Americas.

He’s also regularly quoted in the Wall Street Journal, Bloomberg, CNBC, and Fox Business for his thoughts on uranium and the future of energy.

Leveraging his experience running Uranium Energy Corp. (UEC), Adnani creates partnerships for Uranium Royalty Corp.

That’s partnerships with all the big players in the uranium space:

UROY has secured interests with and through the biggest uranium players in the industry.

A lean UROY team running the only uranium royalty company available.

Even better…

They don’t need the cash!

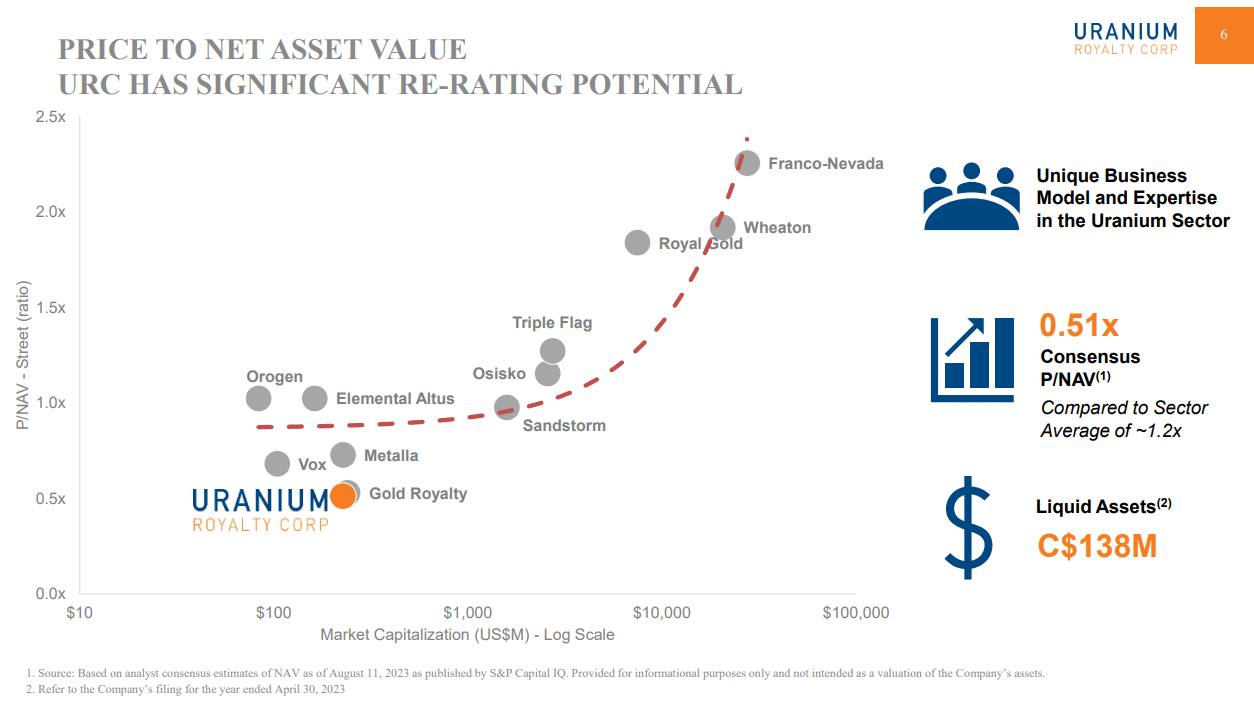

As of this writing, Uranium Royalty Corp has C$138M in liquid assets.

UROY has enough cash to pursue 3-5 more transactions without any outside capital.

UROY has been targeting investments in the range of $10-50 million, meaning, UROY could fund 3-5 acquisitions tomorrow with their existing financial resources. As shown above, running a royalty company is one of the most efficient business models out there.

More royalty investments do not mean higher and higher expenses.

These are investments that return over many years, and new royalties added to the portfolio compound that growth, just like the Franco-Nevada royal model.

According to company data…

Right now, UROY is valued at 0.51x its net asset value**

An amazing value opportunity in the royalty space (one of the lowest valuations compared to their assets on hand). That’s one of the cheapest valuations in the royalty space. **As of their Sept 2023 company deck.

Gold royalty companies like Royal Gold, Wheaton, and Franco-Nevada trade for 5X more when comparing net asset value.

Sector average dictates a uranium stock should trade for an average minimum of 1.2X its asset value.

UROY has traded at this premium to NAV as recently as 2021, leading all royalty investments in that year. Recent moves in the share price indicate that it may be heading back to those levels.

It’s no surprise large funds have piled in...

- Global X Uranium ETF (URA) has over $1B in assets in its fund === URA invests in Uranium Royalty Corp.

- Sprott Uranium Miners (URNM) also has almost $1B of assets in its ETF === URNM includes Uranium Royalty Corp. in its holdings.

That says something about the potential of UROY.

With UROY being the #1 and only royalty company in the uranium space, they’re definitely gaining the attention of the big institutions.

Having executives like Melbye and Adnani who have been well-known in the industry for 40+ years definitely helps.

To top it all off…

As UROY is a royalty company, there is potential to eventually pay out dividends to shareholders.

Melbye is hyper-focused on growth in the coming years and as such will funnel free cash flow back into new accretive investments… but as a mature royalty company, it is reasonable to expect dividends at some point in the future.

Investing in UROY is like investing in a future dividend payer in the green energy uranium space. (Nothing is guaranteed, but that’s the plan to execute).

There’s a runway for Uranium Royalty Corp. to achieve near-term growth (and eventually dividend income) on their royalty exposure to early investors.

- As existing royalty interests restart or commence production,

- As the business acquires more interest in mines…

- And as uranium prices steadily move upwards…

The outlook looks better and better. It’s why Melbye calls it the “best uranium fundamentals in his 40 years”.

That’s why, right now, he’s looking to be more aggressive. Because…

As uranium prices tick upwards, it’s important to value invest today.

In fact,

Melbye advises that the UROY team is seeking MORE AGGRESSIVE GROWTH

He’s looking at 4-5 projects at this moment which UROY has in its crosshairs.

And these aren’t mines that won’t be up and producing ten years from now…

Melbye says he’s looking at opportunities that can start cash-flowing in the next “3-5 years”.

While there are no guarantees, any one of those acquisitions could be announced shortly.

These royalty deals take some time to put together… but even if Melbye announces one royalty interest acquisition, it’ll be good news for the company.

The faster UROY acquires more royalty interests in the next 3-5 years…

…the greater the free cash flow to reinvest in more growth…

…makes UROY’s outlook to be as bright as ever. Especially as uranium prices set to take off.

At the moment, Uranium Royalty Corp. (UROY) is the ONLY royalty company in the world that can give you:

- Diversification into potentially dozens of uranium projects in the world.

- Connections (and board members) of the top uranium companies in the world.

- Trading for 0.5x its net asset value, which is lower than the 1.2x average for royalty companies.

Put This on Your Radar

Uranium Royalty Corp.

(UROY:NASDAQ / URC.TSX)

On the TSX its ticker is URC. In the US, this uranium royalty company is under UROY.

Further due diligence must be done by every investor before making any investment, especially in a speculative industry like uranium.

As seen today…

- Uranium is needed more than ever as nuclear power becomes more widely embraced and robust growth rates return to this green energy industry…

This is already happening in North America as we now see the first of the small modular reactors being constructed.

Asian nuclear markets, led by China, are growing at rates that will surpass the installed nuclear capacity of the United States.

And in Europe, French Prime Minister, Emmanuel Macron, is pounding the table on nuclear for his country.

The demand for nuclear and uranium isn’t just in Asia or North America. It’s in Europe too.

Nuclear, with 95% “online time”, is more reliable than any other source. It’s clean and it is safe.

Nuclear power has produced trillions of kilowatts of electricity since the 1960s with a safety record that is in the range of less efficient wind and solar.

- Russia’s disrupted the entire uranium industry

More Western sources of mining, conversion, and enrichment must come online. The US government is pushing for harsh sanctions on Russia including cutting off uranium ties.

- Supply and demand fundamentals have never been better

Over recent years, the uranium market has experienced 50-90 million annual shortfalls from what is consumed vs. mined. More uranium production will need to come online, fast!

Uranium Royalty Corp. (UROY) plans to be the leader in finding new mining opportunities, not just in North America, but across the globe.

This is not a recommendation to buy any security.

Rather, there’s a brewing opportunity in the uranium market. The bear market has stretched for over a decade… but now prices are heading up.

A scan of the headlines will show that the media and investment world are waking up to the potential of uranium and nuclear energy.

Investors can bet on specific companies who own individual mines…

Or, they can invest in the only royalty opportunity in the uranium space which is diversified across 18 mines and growing.

(UROY:NASDAQ / URC.TSX)

FREE Report: Uranium and Nuclear Energy Primer for Investors

Disclosures & Disclaimer

Investing in stocks is HIGH RISK. You could lose All of your investment

Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction.

Please do not rely on the information presented by Katusa Research as personal investment advice.

If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor.

The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

Uranium Royalty Corp has sponsored this report.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom.

Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. Katusa Research, its owners, directors, and employees are also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED:

In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research has received cash compensation from Uranium Royalty Corp and is thus extremely biased. It is crucial that you conduct your own research prior to investing. This includes reading the companies' SEDAR and SEC filings, press releases, and risk disclosures. The information contained in our profiles is based on data provided by the companies, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.

Katusa Research, Marin Katusa, and its directors, employees, and members of their households directly own or may own shares of Uranium Royalty Corp (UROY/UROY.TSX). Therefore, Katusa Research is extremely biased. Measures are in place such that no shares will be sold during the active awareness campaign.

HIGH RISK:

The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE:

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS:

Certain information presented may contain or be considered forward-looking statements. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated in these statements. There can be no assurance that any such statements will prove to be accurate, and readers should not place undue reliance on such information. Katusa Research does not undertake any obligations to update the information presented or to ensure that such information remains current and accurate.