Katusa Research

Special Situations Alert

Sponsored

IN THIS REPORT

Insiders own 19% of this NYSE listed stock with 240 mining royalties secured in just 4 years…

And in this report, you will see why I believe him when he told me:

In 2019, after completing the largest gold merger ever at that point…

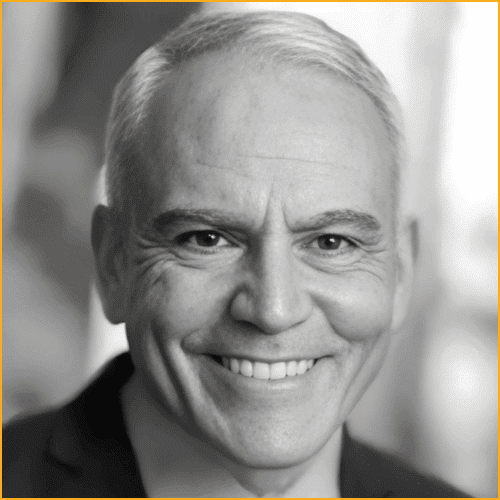

David Garofalo, a man who’s spent his entire career in the metals and mining sector including building mines from scratch for the biggest mining companies on the planet…

Had a light bulb moment.

Precious metal lending was already dry-as-a-bone pre-2020…

Now, higher interest rates have only made funding new gold mines even harder.

Staying in the ‘development and exploration’ space was a dangerous game to keep playing. And David knew it.

Cannibalization in the industry is already happening…

… Gold mining projects delayed

… Mega mergers (one he just completed)

… even miner bankruptcies…

David saw an opportunity to be in the ‘picks and shovels’ of the mining space.

While the largest gold royalty companies in the world - Franco-Nevada, Wheaton, Royal Gold, all focus on investing in developed, producing minds (aka ‘low risk’ investments)...

David Garofalo believes average investors can have a foot in both camps by:

- Investing in cash-flowing mining assets with future upside potential at no additional cost.

- Invest in up-and-coming projects that have the potential to be cash-flowing over the long-term.

Big royalty companies like Franco-Nevada, Wheaton, Royal Gold --- generally don’t want to make speculative bets. They’re established players who just want low-risk, cash-flowing mines up and running.

David believes you can do both.

And that’s why he launched Gold Royalty Corp. (NYSE: GROY) the IPO in 2021 on the NYSE… shortly after leading his record-breaking merger which was the largest ever gold merger globally at the time.

He didn’t wait around putting his vision to life.

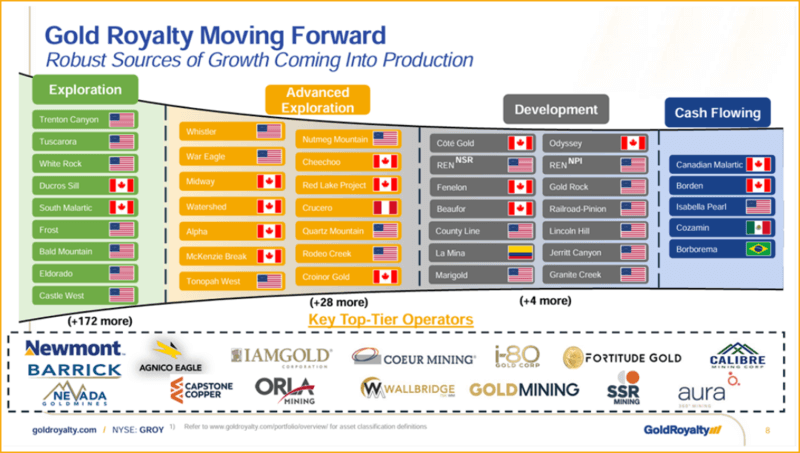

Within 48 months, Gold Royalty Corp. has acquired 240 (and counting) royalties since its inception…

These are just headlines at the back-half of 2023…

It’s been constant new acquisitions, and they have been working fast. And building Cash flow.

Gold Royalty has 240 royalties (and counting)...

The VanEck Junior Mining ETF (GDXJ) is 43% down from its peak.

Newmont Mining, who co-owns the largest US gold mine with Barrick, is off 56% from 2021 highs.

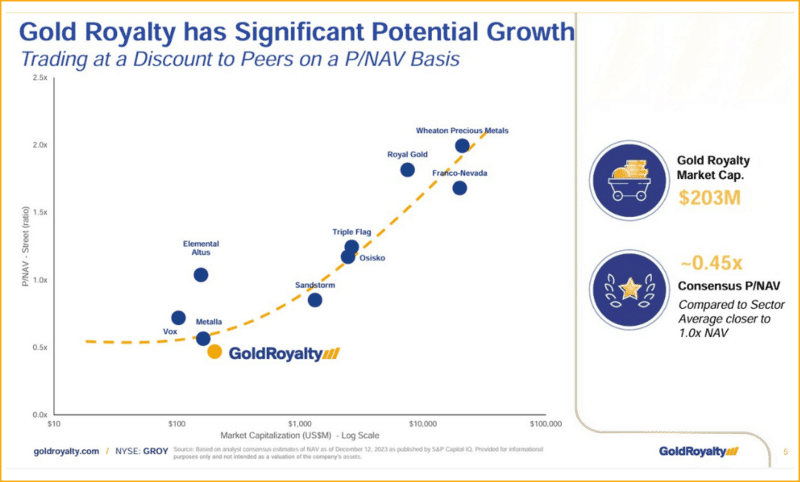

Gold Royalty Corp saw this as an opportunity to continue to add to its large portfolio. And the company is cheap on an analyst consensus NAV basis…

SKIN IN THE GAME:

Gold Royalty Insiders own 19% of all outstanding shares.

Franco-Nevada insiders only own 0.74%...

Wheaton Precious Metals, only 0.14%.

Meanwhile, the insiders of Gold Royalty Corp own 19%.

David says, “Our long-term goal is to be one of 2-3 mid-tier gold royalty companies.”

Nine small gold royalty companies were bought up… and Gold Royalty acquired three of them.

As GROY acquires more… it increases its potential revenue base.

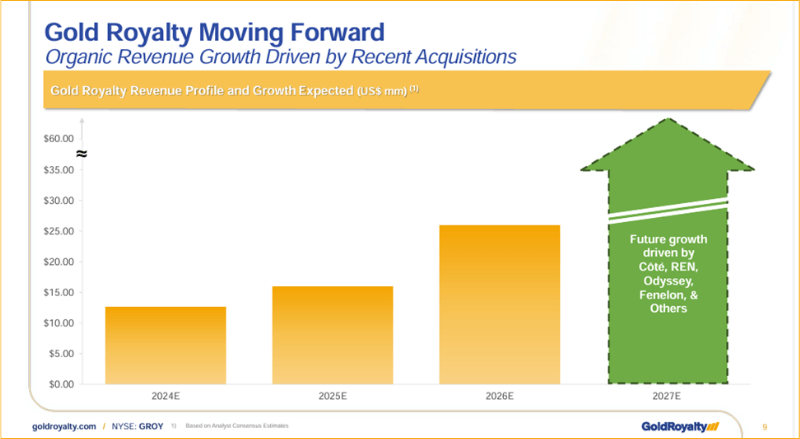

Based on operator mine plans, Gold Royalty has projected strong organic growth potential in the next several years.

The following are analyst consensus estimates for future revenue based on existing projects and mine disclosures.

As more of their 240 royalties start producing… more revenue will come.

More royalties = more diversity for shareholders.

As additional projects in its portfolio ramp production, cash flows should increase as well.

Currently 19 out of GROY’s 246 royalties will be in the development stage, meaning that these projects will all have a good chance of becoming producing mines.

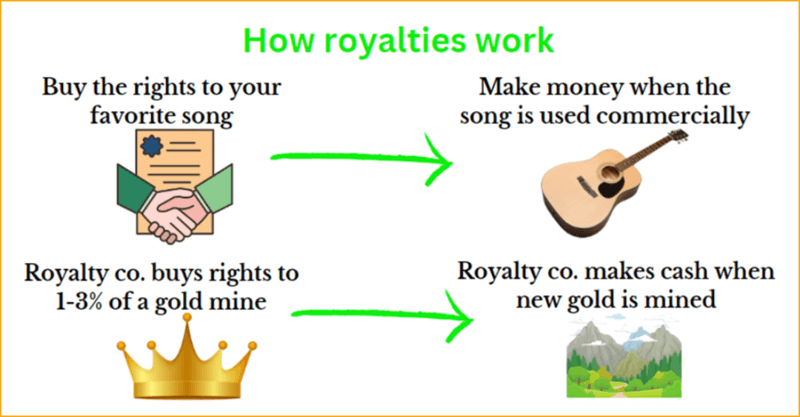

A gold royalty company vs. buying shares in the actual gold mines?

Think of a royalty company like if you bought the rights to a song.

As few radio stations spin the record, you’re not receiving much in royalties from owning the rights to the song.

With a gold royalty…

The company invests in a mine to help finance the development or expansion of an operation with the objective of producing gold.

In return, if the project produces, the royalty company generally receives cash distributions in perpetuity based on the mine’s output.

Think of it like a dividend on a mine except the royalty is based on sales/production.

Gold Royalty invests in a mining project…

Gold Royalty now owns the rights to a certain percentage of the revenue or profits.

Here’s why you need royalty Companies

Miners have a few options when they need to finance their digs:

- Debt

- Raise capital from stock sales (whether public or private)

- Sell Royalties or Streams

Gold Royalty CEO David Garofalo worked for Agnico Eagle for years… orchestrated mergers and acquisitions in the mining space…

Plus, 33 years of experience building and operating a mine from scratch - from staking to pulling resources out of the ground.

The costs are enormous to build mines. The risks are enormous and many.

As rising interest rates tightened money, exploration miners can’t find the cash they need to keep their projects alive.

That’s where a gold royalty company like Gold Royalty steps in.

A company like Gold Royalty or Franco-Nevada invests money not for equity or as a loan…

But to receive future cash based on profit or revenue generally in perpetuity, based on the gold production.

That way mining executives don’t give up their equity… nor are over a barrel paying a sky-high interest rate on a loan.

Gold Royalty wants a project to succeed as they get paid more.

There’s less pressure on the junior mining to cut corners… and their interests align with the royalty company.

It gets leverage on a growing mine with relatively less exposure to inflation of costs. All royalties are owned outright. No more capital is required in holding a royalty generally.

Royalty companies can keep their expenses generally constant, but their revenue increases.

Gold Royalty has 8 full time equivalent employees at this time of writing in Dec 2023.

“We’re as busy as we’ve ever been on the corporate development front,” says David.

Gold Royalty reviews multiple projects every month. Most, they turn down.

That doesn’t include their royalties on three key mines in development.

These three are what I believe are strong assets including the largest gold mine in the US and one of the top gold mines in Canada.

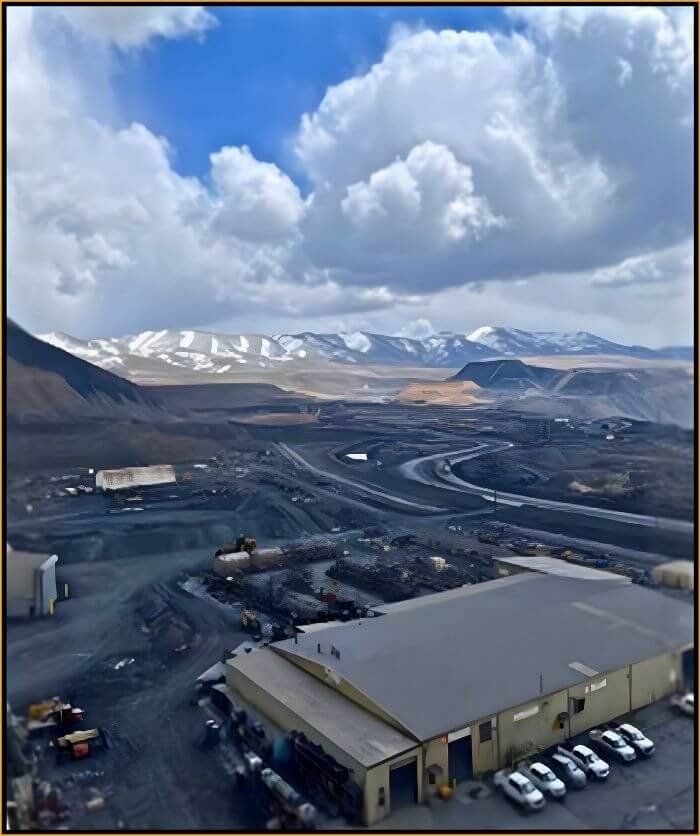

The REN Project is built along the Carlin Trend in Nevada. The Carlin Trend has produced an incredible 70 million ounces of gold ($140 billion in value at Jan 2024 gold prices).[1]

It’s estimated that project has the potential of 3 to 5 million minable ounces (as stated by Barrick in presentations—Barrick is the world’s 2nd largest gold producer), with further potential exploration upside beyond that.[2]

The project is owned in a joint-venture with Barrick Gold and Newmont Mining… two of the biggest players in the world.

Gold Royalty owns a royalty on the REN Project which is being operated by the two largest gold producers in the world, Newmont and Barrick. These two companies spend a fortune finding the right sites to dig and this mine was one that passed their diligence to build.

Ren Project is still in development and any potential extraction is years off. Gold Royalty obtained a royalty on this project by buying out a junior royalty company in 2021.

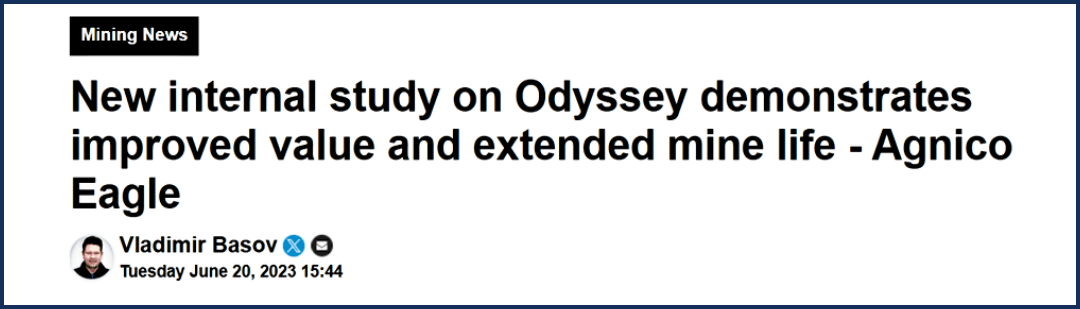

One of the top-rated Canadian gold mines - The Odyssey Project

One of Canada’s largest operating gold mine projects, Agnico Eagle (Gold Royalty’s CEO was a former executive of Agnico) owns the mine, and Gold Royalty owns a royalty on portions of the mine.

Gold Royalty acquired a royalty on this mine in November 2021.

The current mine plan as outlined by Agnico Eagle in June 2023 for Odyssey indicates annual production of 545,400 ounces per gold [3] until 2042.

Gold Royalty has a royalty on a portion of the mine area.

What gets really exciting is that only half of the underlying resource are currently incorporated into this mine plan, and only 1/3 of the plant capacity is being used… the potential to enhance production or extend the mine life is immense.

The Internal Zones at Odyssey represent the nearest term upside, this was recently highlighted and upgraded by analysts:

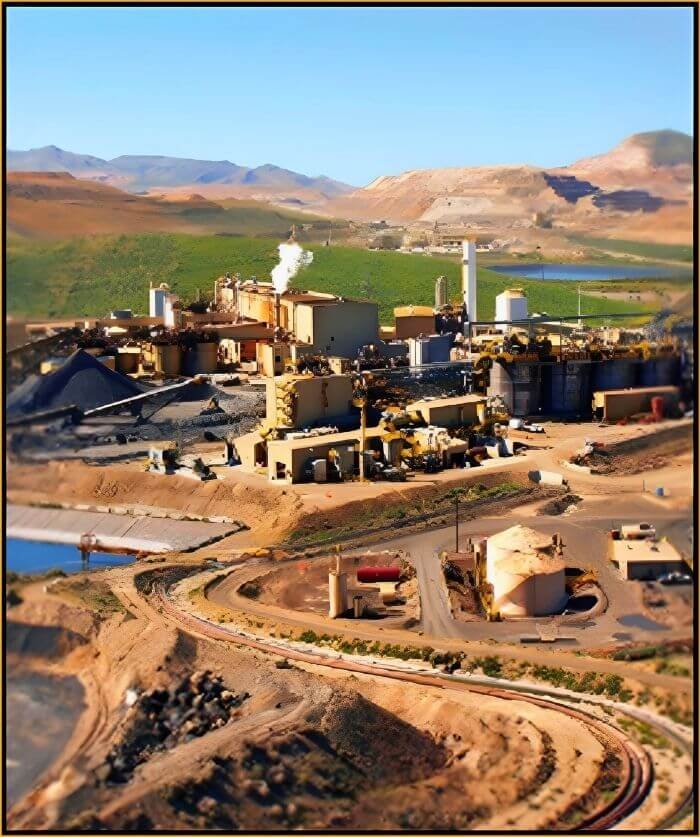

*Going LIVE 2024* Tier 1 Canadian asset --- The Cote Project

Once production ramps up in 2024, IAMGOLD, the owner of the Cote gold mine, expects Cote to be one of the largest gold mines in Canada.

According to IAMGOLD’s January 2024 presentation, initial gold production is expected in early 2024.

In years 1 through 6 of commercial production, IAMGOLD expects gold production to be 495,000 ounces per year.

That’s $990 million in revenue at today’s gold prices.[4]

Gold Royalty, which owns a royalty on Cote, should see a positive impact on revenue in 2024, which is when IAMGOLD expects this mine to start producing.

Potential Revenue and CASH FLOW from existing assets… without having to make another acquisition

It’s an incredible business David and his team at Gold Royalty have built.

GROY’s long-term blueprint is not to rest on their successes, but to acquire more royalties…

Of course, that’s not a guarantee that they continue on their rapid rate of growth

The Gold Royalty team has over 400 years of collective experience in the junior mining and precious metals arena.

Meanwhile, CEO David Garofalo is plugged in with the top executives of every major gold and royalty company out there…

“I know everyone in this space. It’s a small industry especially once you’re in it for 30 years,” David claims.

When a small cap mining company first starts digging, they buy up the land or claim a stake for the rights of the gold in the ground.

They spend 8-9 figures of cold hard cash to acquire and start digging.

This is another spot where royalties are much less risky…

Gold Royalty then approaches neighboring plots of land and acquires stakes from the landowner for a small sum. Sometimes, less than $50,000. (compare that to tens of millions the junior miner spends).

Then…

As the junior miner expands, there is the opportunity that their deposit ends up running into the land Gold Royalty just bought a stake in.

For the junior miner to continue, they must buy the land to pull the gold out.

Gold Royalty instead offers to let them have their stake, but the miner must pay Gold Royalty a perpetual royalty for every ounce of yellow metal they pull out.

The miner doesn’t have to shell out a gigantic sum for the land…

Gold Royalty doesn’t have to do their own digging and can simply sit back and get its royalty.

It’s a perfect match.

In 2023, Gold Royalty has generated numerous royalties in this manner.

In total, they’ve garnered over 60 royalties just from this strategy.

All are still in early exploration and development phases… but if any produce (and this can’t be assured), Gold Royalty would receive passive income from a stake they acquired for relatively low cost.

It’s a genius strategy.

Why go through all this trouble?

They drum up their own deals to get the fattest returns. Some of the deals come from the connections in the industry.

In August 2023, Gold Royalty acquired the rights to the Cozamin mine in Zacatecas, Mexico.

This is a full-fledged, already-up-and-running gold mine.

John Griffith, the Chief Development Officer at Gold Royalty, who was head of Bank of America’s Metal & Mining Investment Banking arm for 14 years.

John knows most of the executives at these large companies as they’ve likely sat across each other to hammer out a financing and understands the corporate funding needs of the gold companies.

Not only do they have a team with all the connections and financing ability…

They have a strong technical team.

The Gold Royalty Corp ‘Secret Sauce’

is an open secret

And highly technical:

- Everything is ground up from the geological level. That means re-building the block model (i.e. the mine plan) from scratch. It’s validating the reserves and resources on the property as if no one’s been there before.

- Gold Royalty has a strong technical team on both the management and advisory side… with a VP of Project Evaluations that’s an experienced mining engineer.

- Team builds a cash flow model off their due diligence and NOT the figures provided from the potential seller.

- Any subject matter not on staff is hired on an independent contract basis out of Gold Royalty’s pocket. Whether it's metallurgical or geological engineers or scientists.

- Then, a ‘zero-risk’ rate of return is built factoring in technical risks, geological risk, capital intensity. Gold Royalty then builds in a risk premium on top of their calculated ‘risk-free’ return so investors are protected if proforma numbers come up short.

- This is all on top of doing deep dives on the actual management team who owns the asset. “Are they good operators? What’s their track record? Do they have references?” Red flags here alone can make or break a deal.

Here’s the kicker…

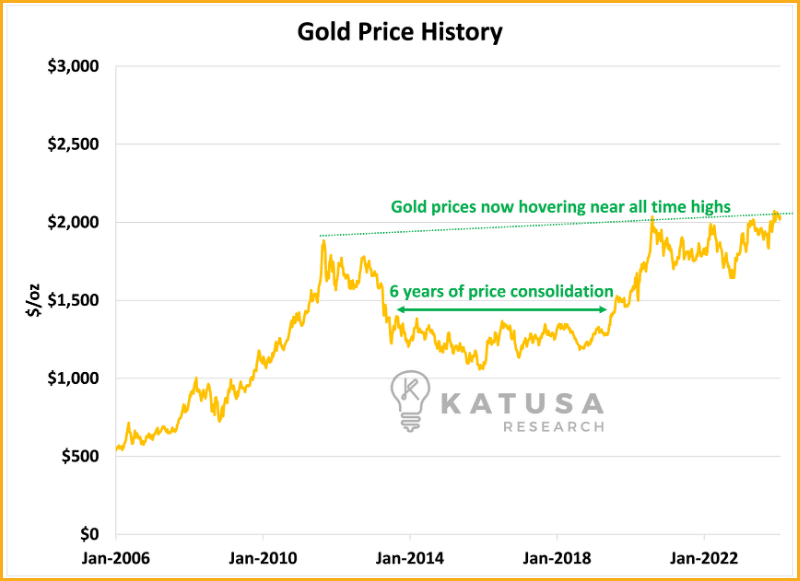

Gold hit all-time highs in December 2023…

And I think there’s a chance it could stay above $2000/oz for a long time

Unlike currency…

Gold can’t be printed. Gold is finite.

The amount of gold ounces pulled out of the earth in its entire history would only fit inside an Olympic-sized swimming pool.

Only about 2% of supply is added per year. That’s a slow trek.

Worse…

Due to gold prices slacking over the past decade post 2012…

Investment in the gold space is down. Way down.

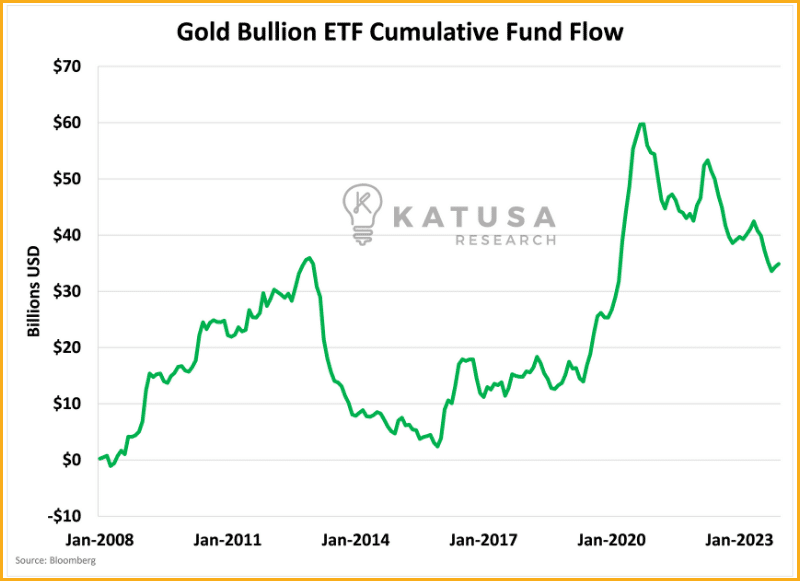

The chart below shows the price action through a different lens: ETF Fund Flow. Which is shown as the difference between net creations and redemptions within gold bullion ETFs such as GLD and IAU.

Looking at this trend overtime, it shows the major waves that gold buyers go through.

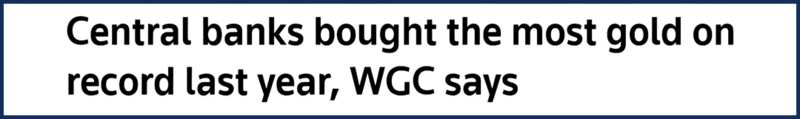

Now, pair the central bank gold buying activity with ETF flows and now recognize that reserves in the ground are down 40% due to lack of investment. Because, again, mining is expensive.

As capital tightens due to higher interest rates…

Junior miners get even less funding for their projects from the Banks of Americas of the world.

Hence, why Gold Royalty has been able to acquire royalties at a record pace in just three years.

However, David believes rates will eventually get cut, which could increase inflation once again.

High inflation = higher gold prices. But it also means the mining companies will need more money, which means more potential for Gold Royalty Corp (GROY on NYSE).

Inflation was at 40-year highs in 2023. The Central Bank jacked rates to the moon in the 80s and tamed inflation.

However, this time around, debt is 3.5X higher than the 70s.

Every $1 of $7 goes to debt payments alone. If the Central Bank today (after the fastest interest rate hikes in history) tries to raise rates again, it could bankrupt the US.

They can’t.

The dollar’s lost 90% of its spending power since the decoupling from the gold standard.

That’s not changing anytime soon.

Meanwhile, central banks across the globe are gobbling up gold at a record pace.

In 2022, central banks bought $70B in gold… the most since 1950.

China, Poland, India, Russia… all have boosted their gold reserves in the past five years.

Supply can’t keep up.

More gold is needed… meaning, higher prices so more mines can profitably get back to work finding the yellow metal.

Still…

Gold Royalty isn’t banking on gold going up to succeed. It’s a tipping point for the company. Higher gold would be great for the company.

In fact, even if the gold drops, the company will do well based on the production forecasts of their operators. Talk about a win-win strategy.

David’s thesis for Gold Royalty is that there needs to be more mid-tier royalty companies out there.

That means royalty companies willing to speculate on new mines… but also hold a steady portfolio of revenue-producing mines.

FULL DISCLOSURE WARNING:

Nothing is guaranteed at all.

And every investment has ultra-high risk, especially in gold markets.

This is not a promise of any gains or returns from Gold Royalty stock. (NYSE: GROY).

Moreso, if you’re looking for exposure to the gold space without putting all your eggs in the basket of one junior miner…

Consider looking at Gold Royalty Corp…

As always, you should review all their public disclosures, including their Annual Information Form, to learn more about the company and understand its assets and business.

This can all be found under its profile at www.sedarplus.ca or www.sec.gov.

The firm is led by top mining executives with over 400 years of collective experience:

The Executive Team includes:

David Garofalo

Andrew Gubbels

Alastair Still

John Griffith

The Advisory Board includes:

Amir Adnani

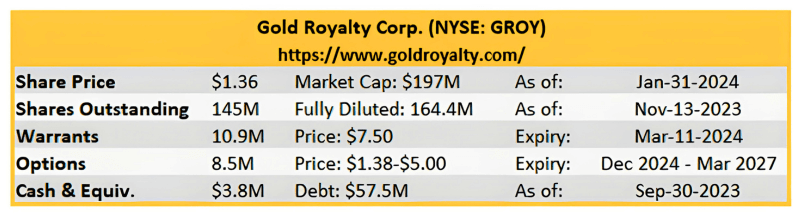

Shares are currently less than $2. The company is listed on the NYSE.

More acquisitions are possible in 2024 and beyond as miners turn to financing opportunities outside of traditional banks.

If you’re looking for exposure to many projects, including the largest gold mine in the US, consider owning shares in Gold Royalty Corp. today.

- Katusa Research Special Situations Team

References:

[1] Based on cumulative historical production per Barrick multiplied by current spot commodity prices of $2,000/ounce.

[2] Per NGM Analyst Visit Presentation, September 2022. page 27 https://s25.q4cdn.com/322814910/files/doc_presentations/2022/09/NGM_Analyst_Site_Visit_2022.pdf

[3] Per Technical Report titled “NI 43-101 Technical Report, Canadian Malartic Mine, Québec, Canada” with an effective date of Dec. 31, 2020 prepared by Mine Canadian Malartic.

[4] Per Technical Report titled “Technical Report on the Côté Gold Project, Ontario, Canada Report for NI 43-101” with an effective date of June 30, 2022 prepared by SLR Consulting, IAMGOLD, and Wood Canada.

DISCLOSURES/DISCLAIMER

IMPORTANT DISCLAIMER: Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction. Please do not rely on the information presented by Katusa Research as personal investment advice. If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor. The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

Gold Royalty Corp. has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED: In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research has received cash compensation from Gold Royalty Corp. in the amount of $250,000 in Nov 2023 and second payment of $250,000 in Dec 2023 and is thus extremely biased. Members of Katusa Research also own shares in Gold Royalty Corp.

It is crucial that you conduct your own research prior to investing. This includes reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures.

The information contained in our profiles is based on data provided by the company, extracted from SEDAR and SEC filings, company websites, and other publicly available sources.

HIGH RISK: The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE: By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS: Certain of the information contained herein and in the Company’s disclosures referenced herein constitutes “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”), which involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements respecting the Company’s strategies, expectations regarding gold markets, expectations regarding the operations and results of the operators of the projects underlying the Company’s interests and expectations regarding future production and revenues from the Company’s royalties. Forward-looking statements are based upon certain assumptions and other important factors, including assumptions relating to commodities prices and the business of the Company. Forward-looking statements are subject to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed or implied by such forward-looking statements, including those set forth in the Company’s Annual Report on Form 20-F and its other publicly filed documents under its profiles at www.sedarplus.ca and www.sec.gov. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

Readers should review Gold Royalty’s public disclosures at www.sedarplus.ca and www.sec.gov for important information regarding it and its assets.