I’ll let you in on a market secret…

A few years ago, there was an entire generation of investors who placed their trust in precious metals stocks—and got decimated.

But the greatest toll it took wasn’t financial. It was the foundational trauma to their investing psyche.

The unfulfilled promises and brutal bear market they endured left a lasting scar. It’s not unlike childhood trauma, where the investors are unaware of its effect on their decision-making—and they couldn’t “fix” it even if they were.

So as gold starts to take off again, they’re running the opposite direction; freezing in fear; or fighting the investment thesis altogether.

“A gold breakout to all-time highs? That’ll never lead to anything good.”

“A gold breakout to all-time highs? Only a matter of time before it goes sideways and everyone loses money.”

No matter what data they see, or what they know to be true about gold, they won’t budge.

Here’s why. Profits were easy in 2020-2021—and Katusa Research subscribers were among the many who had several double – and triple-digit gains.

And they faithfully adhered to the rules and followed the wisdom passed down for centuries.

Then the gold market betrayed them.

When the storm hit—a bear market that ravaged portfolios and obliterated fortunes—precious metals investors’ faith was shattered. They were forsaken by the very asset that was supposed to be their safe haven.

And the severity of that negative experience severed the connection between ration and action.

So now, as gold reaches unprecedented heights, these once-bitten, forever-shy investors are staying on the sidelines.

Their anxiety of missing out is overpowered by permanent memory of the traumatic experience.

And it could cost them a fortune from missing out on the coming bull run in gold stocks.

|

URGENT GOLD BRIEFING COMING… Marin Katusa will be recording an emergency gold market update and will release it NEXT WEEK. The multi-year Gold breakout is confirmed, and this is not a briefing you want to miss. |

You might ask: How do we know that’s what’s happening?

We have front row seat data that others don’t have…

Katusa Research knows the number of research letters people subscribe to, as well as how they fluctuate based on what’s popular.

We see the sentiment levels in forums and are in contact with customer service teams. And we now how much money is raised every month in the private and public sectors.

- As a rule, subscriptions, financings, and raises all go to all-time highs when a market is at its peak.

But the current market is breaking that rule. Here’s firsthand information you won’t find on Bloomberg or in the Wall Street Journal…

We are nowhere near the levels earlier this decade in the previous commodities bull market.

Traumatized investors no longer see new highs in gold as a strong indicator that gold stocks are ready to run. Instead, they see it as another prelude to a painful letdown.

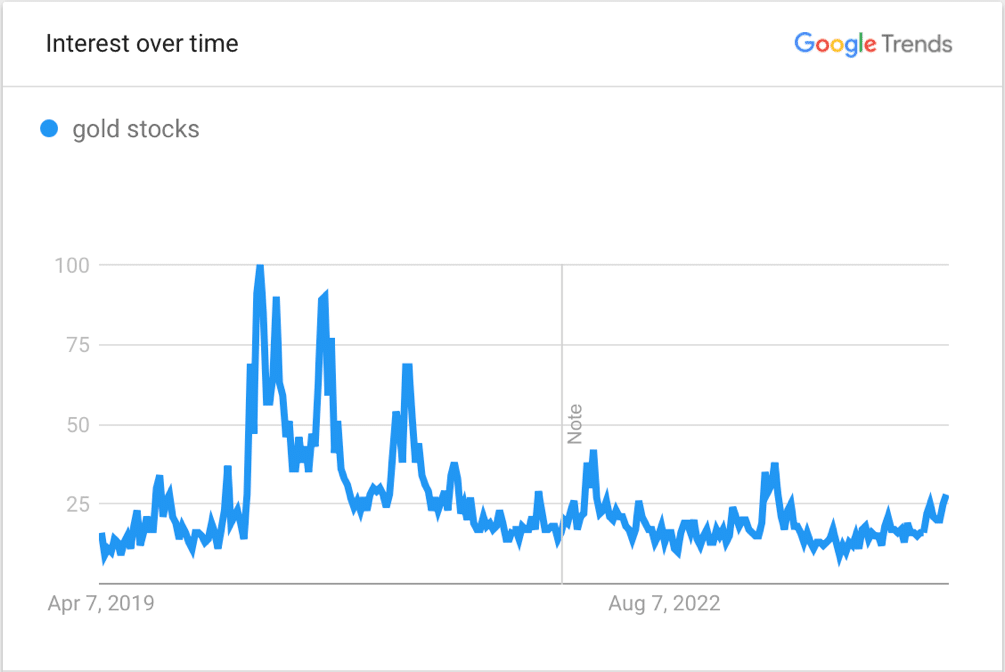

Here’s more evidence, from the granddaddy of data itself:

As you can see, gold stocks aren’t anywhere close to the interest levels they held in 2020-2021—the last bull market.

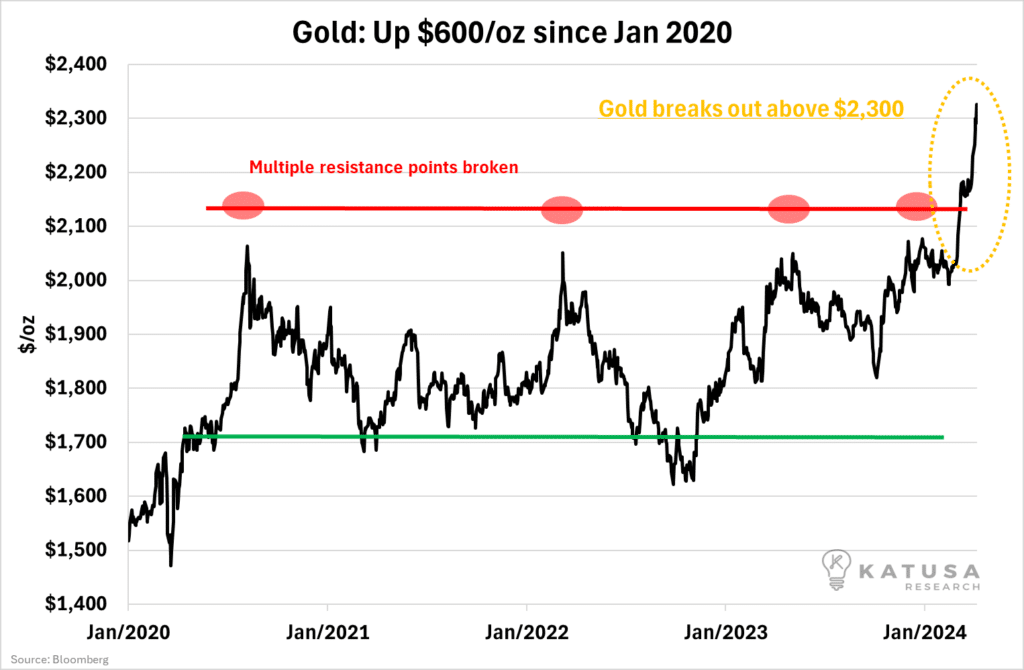

Meanwhile gold itself has broken through – decisively – through its mid-2020 high.

But gold (and silver) stocks have yet to turn around—which means the runway this time is long.

Gold stocks could report record-high earnings in the next few quarters. And it could send stock prices soaring.

As one of our lead analysts was researching a stock pick recently, he turned to me and said:

“This company prints money at $2,100 gold. At $2,300 it’s bananas. And if it goes higher… well, that would break my model.”

And that’s a company that our subscribers saw published at the tail end of the last bear market in gold stocks when gold started moving higher.

It’s risen 895% since early 2020.

Yet many investors will miss out on opportunities like these, all because of their past negative experiences.

Left unchecked, that trauma can lead to even more severe consequences.

Because here’s the reality…

Your Wallet Keeps the Score

Avoiding the market because of the past will keep investors from experiencing profit in the present.

Now, as the market buzzes with excitement over gold’s surge, these investors face a difficult problem. And fixing it is not just a matter of willpower.

Because this group of investors isn’t merely cautious. They have a deep-seated fear—a psychological barrier formed from the memory of past trauma.

Fortunately, therapy also happens to show the way out of this deep-rooted trauma and anxiety. And it happens to be the same alligator investing formula I’ve used for two decades, to get to where I am now.

In a clinical setting, it’s called “exposure therapy.” To practice exposure therapy, a patient repeatedly:

- engages with the “threat”

- in small ways

- and in a safe environment.

Here’s what that looks like in investing.

Buy into a position using tranches.

Take a very small position at first. Then another. Then another.

Never put all of your allocated capital in immediately. If the stock takes off after your first tranche, score! If it drops further (and no one can time it perfectly—I’m notoriously early on the buy… and on the sell) you have another buying opportunity.

Put a max of 5% of your portfolio into any one position.

This helps avoid a catastrophic loss, just like some investors experienced with gold stocks. It doesn’t matter how much other people are convinced the position is a home run. Only put in 100% if you’re willing to lose.

Take a Katusa Free Ride.

If you get a quick 50% or 100% return, take your initial capital off the table following the Katusa Free Ride formula. That will create the safest position for you to be in if there’s a market crash.

Is this gold market for real?

Only time will tell. But all signs point to a massive, multiyear breakout that has yet to catch the attention of many investors.

This is a contrarian investor’s dream.

And once again, by the time everyone is talking about gold stocks, we’ll be selling our profitable positions.

That’s how you will win long-term.

Regards,

Marin Katusa

Chairman, Katusa Research

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.