The mainstream media has no clue as to why the gold market is surging…

But I do.

Over the last few months, I’ve gotten multiple calls from high net-worth investors (HNWI) and funds in the Eastern markets – all wanting to buy large quantities of PHYSICAL GOLD.

I’m talking 8 figures in dollar amounts, per week, directly from mines.

While your average retail investor is hesitant to jump on the gold bull bandwagon, the tide is turning… by those with DEEP pockets.

|

**URGENT GOLD BRIEFING** Marin Katusa just recorded an emergency gold market update and will release it on Wednesday, April 24 at 9am PST. The multi-year Gold breakout is confirmed, and this is not a briefing you want to miss. |

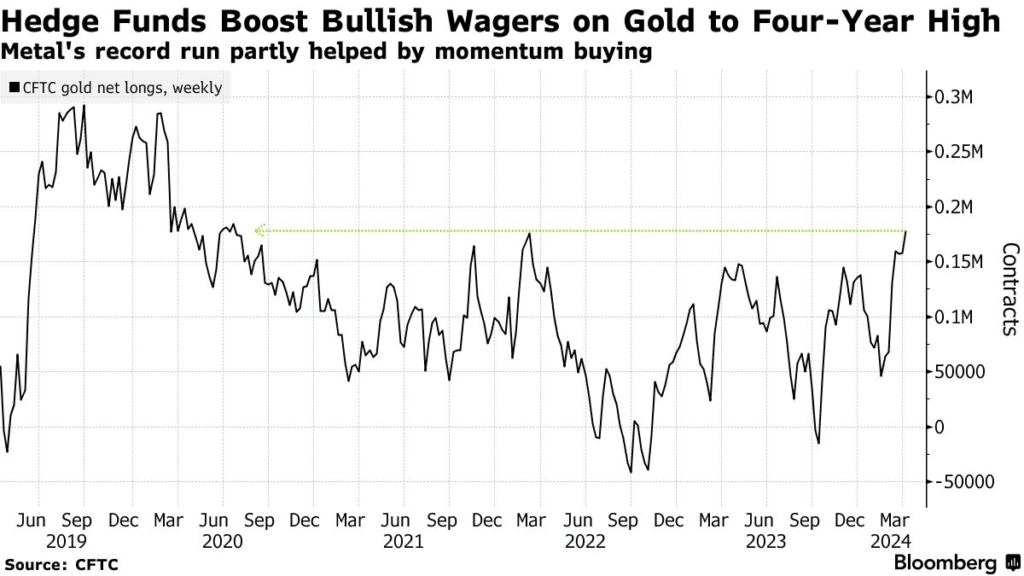

Hedge Fund Gold Appetite

Investment managers and hedge funds are really going all in on gold, pushing their positive bets to the highest level in four years.

In early April, hedge fund investments in U.S. gold futures and options went up by 13%, the highest since 2020.

Emerging markets and central banks are leading the charge, favouring physical gold over digital assets, signaling a massive shift.

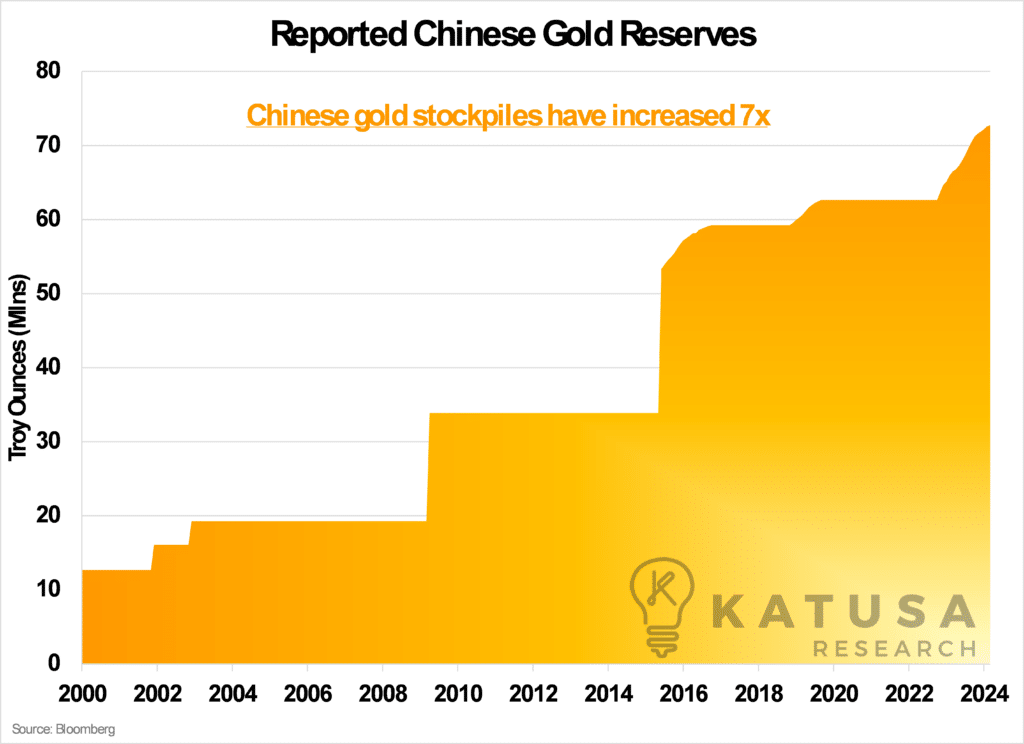

China has quietly accumulated large quantities of gold for 17 straight months – to the tune of 72.7 MILLION ounces (about 2,250 tonnes).

China’s economic strategy involves diversifying away from the US dollar, which dominates global trade and commodity pricing.

Despite its rise as an economic power, China’s vast reserves are predominantly in US dollars, an exposure it aims to minimize.

To reduce this reliance, the People’s Bank of China is diversifying by increasing its gold holdings.

Since 2011, China has decreased its dollar reserves by a third, down to approximately $800 billion.

Meanwhile, China’s gold reserves have skyrocketed.

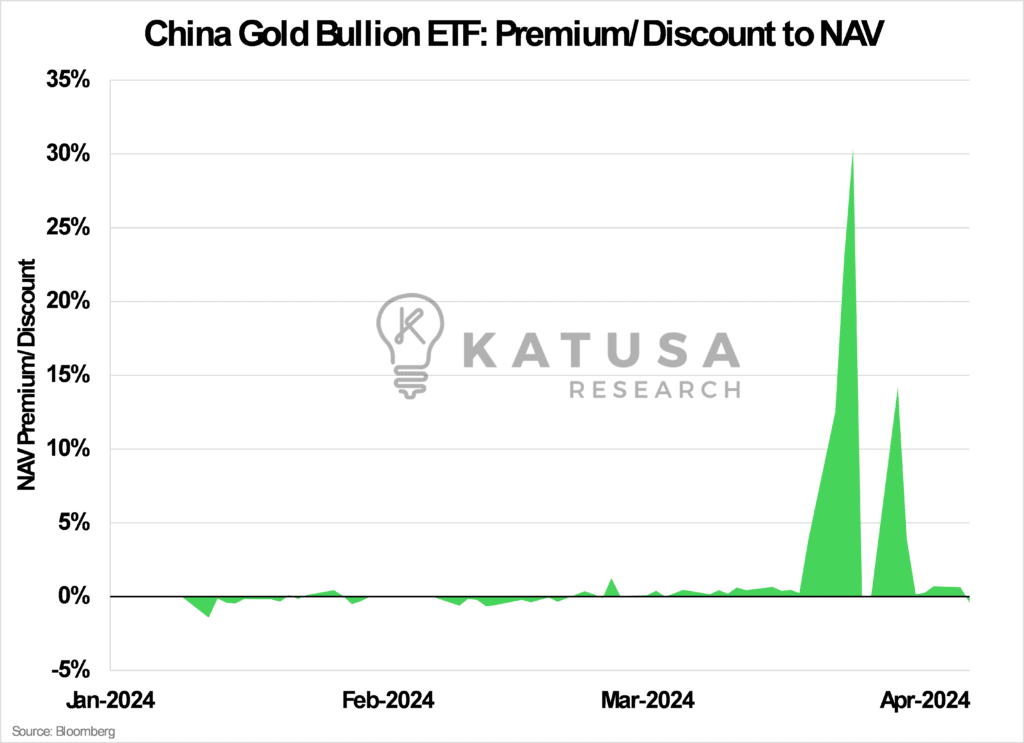

Even individual investors are buying up ETFs in China at an alarming rate.

- In fact, on April 8th, 2024, there was SO MUCH demand in the Chinese gold ETF that it pushed premiums to 30%, and regulators had to halt trading!

But that’s not all…

China’s Youth Revolution: Gen Z is Buying Up Gold BEADS

This next bit is stunning…

Young folks in China are all about gold beads these days. Using them as a cool way to stash their cash amidst shaky economic times.

These little nuggets are a big hit as a safe saving option, especially when other investment choices look a bit risky.

It’s not just about the money; gold beads are also a fashion statement among the younger crowd.

In fact, gold is so popular right now that sales are booming, making it a hot commodity in China.

And “gold beads” is one of the most searched items in that demographic on Weibo (the Chinese version of X). A whole new generation is waking up to gold in China.

So you have…

Major high net worth (HNW) investors and funds buying up physical gold from China…

The Chinese Central Bank accumulating mammoth amounts…

And a whole new generation – among the largest demographics in the world – waking up to a brand new investment thesis.

It’s All Leading to One Thing

I hope you’re ready to find out what can happen in a major gold breakout.

As of right now, gold stocks have not caught up to the physical demand — and that’s the next stage of the cycle.

You’re about to see how crazy precious metals stocks can go in a gold bull market, when even just a small amount of capital starts pouring.

That’s why I’m preparing an urgent gold market briefing on April 24th for you at 9am PST.

In my Gold Breakout Briefing, you’ll learn:

- Why Gold is rising in the East and setting in the West (for now)… and when they’ll rise together

- 8 flashing signals that show why gold is set to soar higher

- A HUGE secret of the gold market the mainstream financial media has no idea about (Hint: these are the gold stocks you must avoid buying at all costs)…

- The best gold stocks to begin accumulating right now

Regards,

Marin Katusa

Chairman, Katusa Research

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.