A commodity supercycle is on the horizon.

It has legendary investors and MAJOR market players buying gold and gold stocks, staking their bets in a BIG way.

Stanley Druckenmiller is a renowned investor and hedge fund manager, known for his long tenure as the lead portfolio manager for George Soros’ Quantum Fund.

That’s where he executed the famous trade that “broke the Bank of England” in 1992.

Druckenmiller’s investment style emphasizes long-term capital preservation and strategic bets on macroeconomic trends.

And now, according to his 13-F filings…

- Stanley Druckenmiller bought 1.76m shares of Barrick Gold and 474k shares of Newmont Mining.

Then there’s Ray Dalio, founder of Bridgewater Associates…

He created the “risk parity” strategy, which aligns portfolio risks with economic conditions, propelling Bridgewater to become one of the world’s largest hedge funds.

And now…

Major Investors are Making their Bets With or Without You

These are some of the smartest brains in the markets, making big plays into gold.

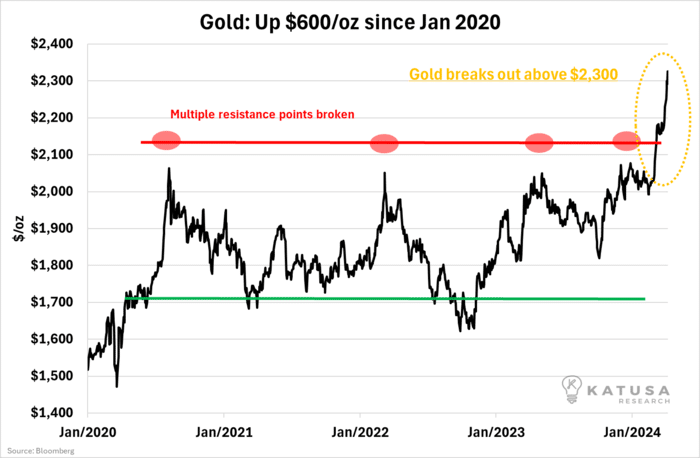

And the recent breather in gold is the best thing that could happen to recharge for further springboard moves.

It could happen in the next few months, or even in the next few weeks.

But wait, there’s more…

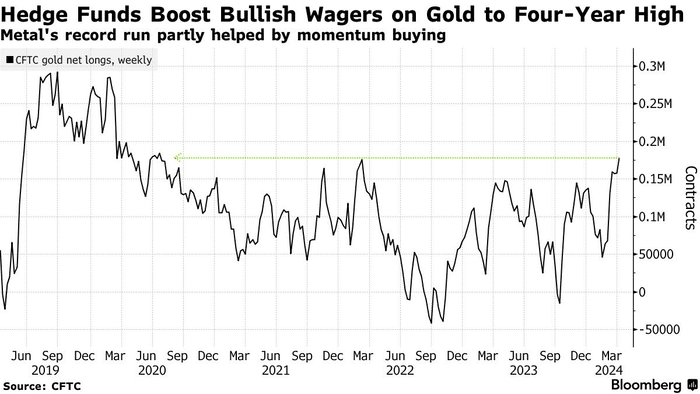

Hedge funds are adding to their gold exposure too…

I’m personally burning the midnight oil looking for the best gold stocks for 50-500% gains – or more.

You’ll want to be prepared if a “roaring 20s” stock mania comes — especially in gold because the move is now decisive.

When the gold price rises just $50-100 per ounce… in a single day…

The right gold stocks can soar to blistering heights, offering you gains that could eclipse the most speculative tech investment.

I’ve shown my subscribers opportunities to make huge gains in gold stocks over the years. And we’ve profiled a gold stock that’s risen over 50% from just a few months ago.

But one of my best (and favorite) winners was Kirkland Lake.

- Back in 2015—the middle of the last gold bear market—I recommended Kirkland Lake at $3 a share.

The company eventually went to over $60 per share for over 20X gains and was bought out by the world’s 3rd largest gold producer, Agnico Eagle.

The price action is pointing to a truly unprecedented gold bull market.

It’s the type of High-Risk / High-Reward setup that I absolutely love.

Regards,

Marin Katusa

Chairman, Katusa Research

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.