The Evolving House of Saud

Ask any random sampling of Americans what the world’s largest oil company is and the likely answer is ExxonMobil. A few might vote for Shell or possibly BP.

As most of my readers will know, they’re all wrong because when most people think of oil companies they only think of the giant, publicly-owned multinationals.

But in terms of raw production, the state-owned oil companies dominate, and it isn’t even close. In 2015 Saudi Arabia’s Saudi Aramco was first, pumping 11.6 million bopd. ExxonMobil was tied for fourth with Russia’s Rosneft at 4.7 million.

On January 4, 2016, The Economist interviewed the Saudi King’s son, Deputy Crown Prince Mohammed Bin Salman al-Saud. The Deputy Crown Prince claimed that the Kingdom was months away from a Saudi Aramco IPO.

Huh?

Saudi Aramco was 100% nationalized in 1980 and the Saudi ruling family has maintained tight control over the company ever since. No wonder I had over a hundred emails from colleagues that day asking for my thoughts.

So here they are, for all to see.

For openers, a week after The Economist piece, the Wall Street Journal asked Saudi Aramco’s Chairman, Khalid al-Falih, about the potential for an IPO. The Chairman brushed off the notion, stating that the company wasn’t nearly as close as the Deputy Crown Prince had indicated. Khalid did affirm that the Kingdom had been contemplating a Saudi Aramco IPO on and off for many years, but by no means was there any definitive plan in place to float one.

When the Chairman of Saudi Aramco and the Deputy Crown Prince give conflicting takes on a potential IPO, it’s bound to leave people confused. Do you take the word of a previous President, CEO, and now Chairman of Saudi Aramco with 35+ years of experience in the petroleum industry. Or, do you take the word of an upstart, 29-year-old son of the King?

My readers know I call it the way I see it though it doesn’t mean I am always right. But, perhaps the Deputy Crown Prince’s comments referred only to the three IPOs Saudi Aramco has planned concerning the Joint Ventures with Total, Sinopec and Dow Chemical. Totally plausible, and these affect only refining, not production. So, it could have just been a case of The Economist misstating reality or twisting Mohammed’s words for their own reasons.

And what publicity it did generate.

But if we take the interview at face value, let’s dig a bit deeper (and I do want to point out, no mainstream media has reported the above JV IPO’s).

Saudi Politics 101:

There is a bigger issue with Saudi Arabia than the Saudi Aramco IPO. To understand the current inner strife in the Kingdom, we have to go back and analyze the history of both the country and the al-Saud family.

Though human habitation of the region extends back perhaps 20,000 years, what we now think of as Saudi Arabia didn’t emerge until 1932, when it was unified by King Ibn Saud. Ibn Saud, backed by clerics of the powerful Wahhabi Islamic sect, established the Ibn-Saud as the Kingdom’s ruler and he held power until his death in 1953. He left behind 100 children, 45 of them males. So what was to be the rule of accession in a region that had formerly consisted only of scattered tribes?

It was kind of fuzzy.

At the founding of the Kingdom, Ibn-Saud had declared his second son as the Crown Prince and next in line to the throne. However, he decreed that from then on the new King would be the deceased monarch’s younger brother rather than one of his own sons. This all but assured that succeeding Saudi rulers would be old men.

In accordance with King Ibn Saud’s wishes, his second son, Saud, was elevated from Crown Prince to the throne. King Saud – a man many history books depict as a reckless and unpopular leader. But his half-brother, Faisal bin Abdel-Aziz Al Saud, led a coup to overthrow the anointed King. Saud was deposed and Faisal assumed the throne in 1964. From then on the monarchy continued to be passed down to the youngest brothers of King Abdel-Aziz’s sons until 2015 and the ascension of King Salman bin Abdel-aziz al Saud.

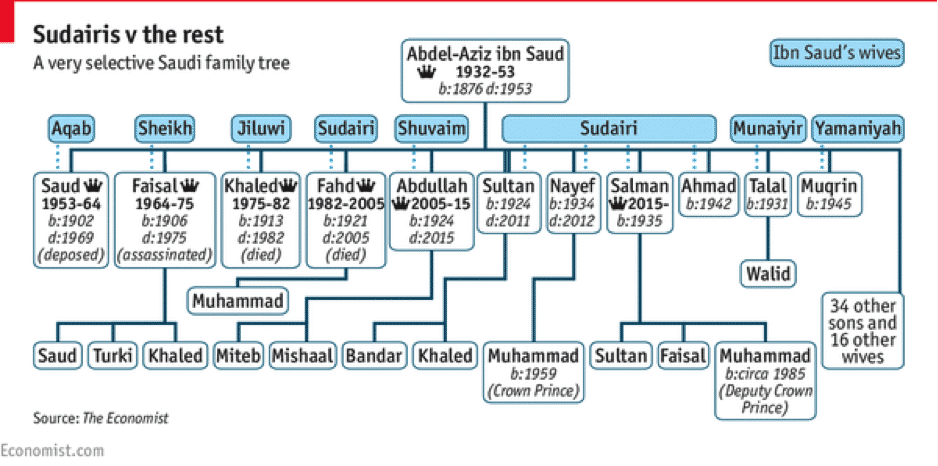

To give you an idea of the complexity of the vast Saud family, here’s just a small slice of it:

Muqrin, son of Abdel-Aziz and brother of Salman, was the rightful new Crown Prince and next in line to the throne. But Salman awarded the Crown Prince title to his own young son: the same Mohammed Bin Salman al-Saud who spoke with The Economist.

What makes this problem of immediate concern is that the newly-minted King Salman is 80 years old and seems to have some health issues. He is rumored to have already been diagnosed with dementia. One can see how this creates an atmosphere of ongoing tension. Leaving young Crown Prince Mohammed Bin Salman as next in line and setting up the real possibility of a nasty tussle for the throne.

It is difficult for us to imagine a 29 year old ruling the largest Kingdom in the Middle East, and so it could be for the people within the Kingdom.

Arab culture awards respect and seeks advice from the elders and rarely the other way around. As Salman’s health deteriorates, a youth vs. age struggle could develop and a 1964-style coup could be in the air. Which has ramifications. The political fragility within the Kingdom may be a significant threat to the internal stability of Saudi Arabia, the Middle East, and the Saudis’ allies as the country enters treacherous ground going forward.

I cover all of this in much greater depth in my New York Times Bestseller, The Colder War. See the chapter entitled, ‘The Shaky House of Saud’.

Why would an IPO be so difficult?

Saudi Aramco has the world’s largest oil reserves, 20 times those of Exxon (XOM). But how to value the company for an IPO?

Some analysts have suggested that Saudi Aramco is worth $10 Trillion. This using the metric of comparing its production and reserves to ExxonMobil. But directly comparing a secretive, state run oil company like Saudi Aramco to a public company like Exxon is a bit of a stretch. Let’s look into the facts.

The Facts are:

Exxon produces over 60% fewer barrels of oil per day than Saudi Aramco, yet Exxon still manages to pull in $15 billion more in yearly revenue than Saudi Aramco’s $378 billion (2014 figures, including only revenue generated by operating activities).

Considering that Exxon’s and Saudi Aramco’s downstream capacities are fairly similar, one can assume that Saudi Aramco is diverting payments to the Kingdom before posting its earnings.

Additionally, analysts need to take into account that Saudi Aramco is less diversified. Thus, it is subject to geopolitical risks that are being played out in the Middle East as we speak. All these risks and financial burdens to Saudi Aramco’s operations warrant a discount to its valuation. Nevertheless, comparing Saudi Aramco to other partially public national oil companies (NOCs) gives the company a value as high as $2 trillion. Still a big ticket item, but you can see how tricky this process would be.

This question must be asked: Where would they list their stock?

Given the Deputy Crown Prince’s proposal to float 5% of the company in an IPO, it would be hard to imagine those shares trading on the Saudi Arabian Tadawul stock exchange. Even this small fragment of Aramco would yield a market cap equal to a quarter of the entire national exchange.

Further difficulties arise over the question of transparency once Saudi Aramco became some form of public company. If its shares were listed in the US, the company would need to disclose payments made to the Kingdom through various subsidiaries, have its reserves re-assessed by an outside entity, and face shareholder dissatisfaction with the use of oil as an economic weapon at the cost of profits.

A Saudi Aramco IPO would likely be all about Capturing Refining Market Share

Saudi Aramco’s Chairman has said that the company could list parts of their upstream and downstream business, or a small chunk of their upstream business, or most of their downstream segment. Basically, Khalil al-Falih made the potential IPO as vague as possible.

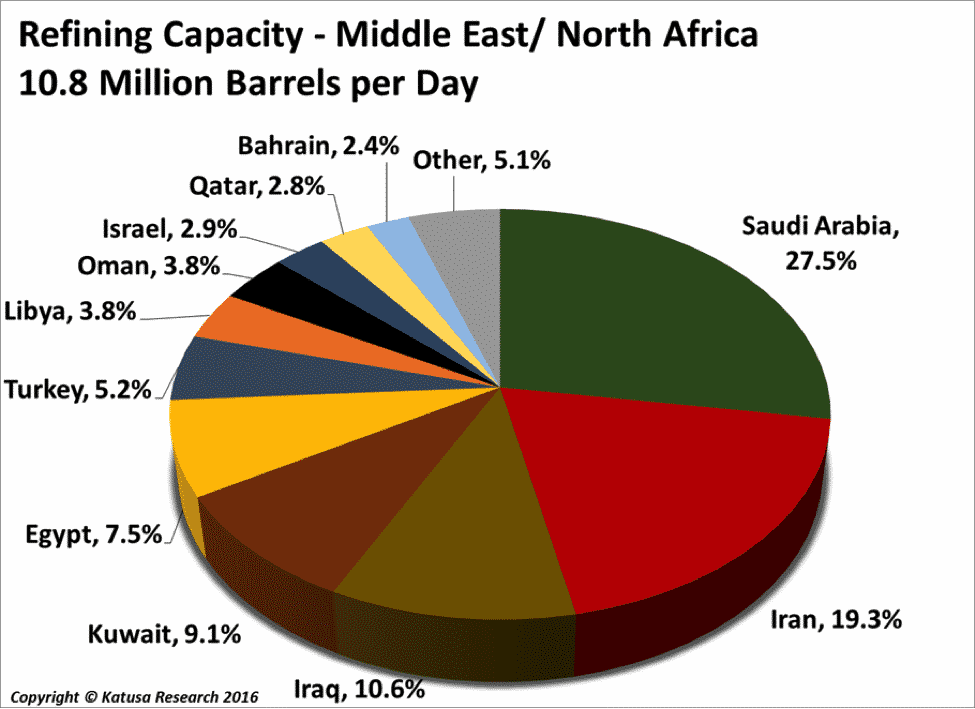

The most likely outcome of a Saudi Aramco IPO would involve a smaller segment of the company’s business that continues to remain highly profitable in today’s market: its refinery business. Saudi Arabia has the largest share of refining capacity in the Middle East & North Africa.

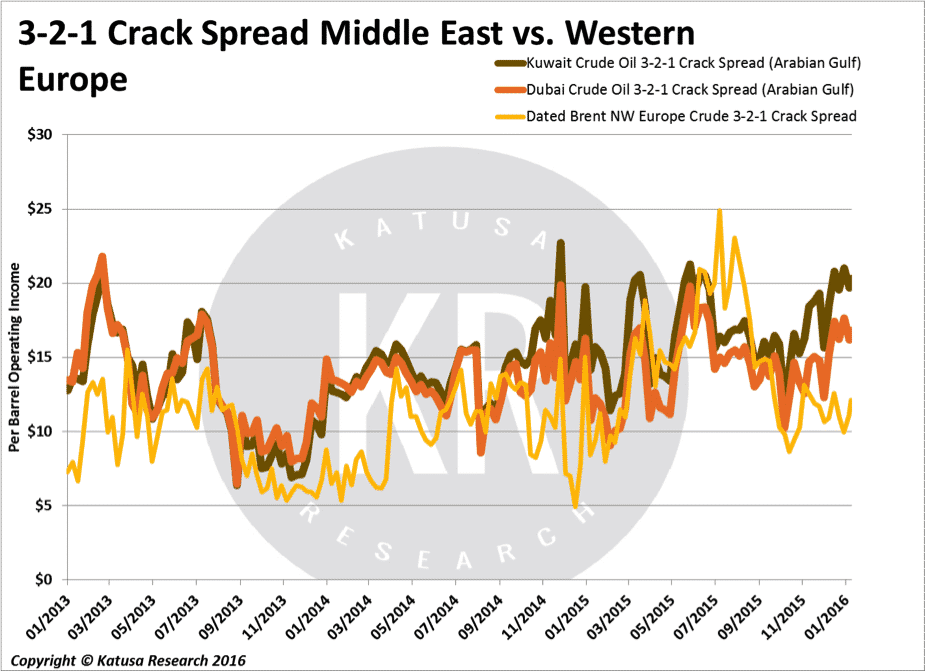

The company’s downstream business is still highly profitable as it takes on cheap regional crudes and sells petroleum products at global prices. Saudi Aramco’s refineries can make double the operating profit of US and Western European refineries.

(Note: The 3-2-1 crack spread depicted in the following chart is the operating profit per barrel generated by refining 3 barrels of oil into 2 barrels of gasoline and 1 barrel of distillates. Distillates are a category that represents jet fuels, kerosene, LPGs, diesel, and fuel oil. The 3-2-1 spread is a solid indicator of how much a refiner will make in operating profit.

I use Kuwait and Dubai vs. Brent because they are representative of operating profits realized in the Middle East. There is no Saudi Crack Spread published, but the Kuwait and Dubai spreads give us a good idea based on their proximity to Saudi Aramco’s refineries.)

Although analysts are kept in the dark as to the exact profitability numbers, we can calculate comparable US refiners with 1.8-3 million barrels of refining capacity per day to get a range on the profitability. With those as a guide, we can estimate a $80-$100 billion value for Saudi Aramco’s downstream segment.

Yet, even in just this segment, a Saudi Aramco downstream IPO would not be easy.

That’s because only 1 million barrels per day of refining capacity is owned and operating by Saudi Aramco in Saudi Arabia.

Most of the company’s other capacity is in joint venture with companies like Total, Exxon, Sinopec, and Dow Chemical. This throws a wrench into any immediate IPO. Simply put, Saudi Aramco will have to consult its joint venture partners as to how to structure the appropriate listing.

Additionally, as I noted earlier, Saudi Aramco already has IPO plans for three of its joint venture projects with Total, Sinopec, and Dow Chemical. That leaves roughly 2.6 million barrels per day of refining capacity available to structure a downstream IPO, which would fall in line with some of the largest refiners listed in the US.

Saudi Aramco would be able to use their downstream listing as a way of consolidating refining capacity within the company. With assets in the US, Japan, China, and South Korea, look for Saudi Aramco to use its share price as an alternative source of funding to scoop up refineries in Asia.

Katusa’s Take

Here are my takeaways from the IPO controversy.

- First off, the Saudis are far from broke. With $640 billion in foreign reserves and untapped debt markets, they’re not even in rough shape. If they do float an IPO it is not because they need money to balance the budget.

- Second, The Economist may have misinterpreted Deputy Crown Prince Mohammed Bin Salman al-Saud’s words. He could have been talking about the three IPO plans Saudi Aramco has in place with their Joint Ventures with Total, Sinopec and Dow Chemical.

- Third, the Crown Prince might have been speaking out of turn and has since been reprimanded by his elders. I doubt it.

Most likely, there is an IPO on the way.

If so, I believe it’s all about refining market share. Make no mistake, Saudi Aramco is fully prepared for low oil prices for the next few years—as I’ve said for the last two years now. The Saudis are advised by smart people, and I’m willing to bet that they have recognized the possibility of increasing their revenue and political leverage by attracting large foreign funds. All this while ensuring that the foreigners stay on board with the Saudi agenda, while the Saudi’s increase refining market share.

Finally, take a look again at the pie chart above.

Who has the #2 refining capacity in the Middle East? Iran, the bitter Shi’ite Islamic enemy of Sunni Saudi Arabia. With the lifting of the sanctions on Iran, these two are going to be jousting even more intensely to become the dominant influence in the region far into the future. They are in a battle (perhaps to the death) for political leverage, and market share for refining and oil sales are a primary weapon.

From this perspective, it’s actually quite brilliant for the Saudis to consider IPO’ing a small percentage of their downstream sector assets. All to align the biggest funds in the world with their own best interests. That would only enhance their presence on the world stage.

I’ve read much about the Deputy Crown Prince Mohammed Bin Salman al-Saud being only 29 years of age and not ready for his role. But perhaps the talking heads have it totally wrong – perhaps youth will win out. Many outsiders are underestimating a powerful force for a new agenda and domestic and foreign policy out of Saudi Arabia.

Personally, I think we are going to hear a lot more about and from the Deputy Crown Prince Mohammed Bin Salman al-Saud in the years to come.

It’s all about market share.

Marin Katusa

P.S. For those of you in the Vancouver, BC area on January 24th and 25th, I will be co-producing the 2016 Vancouver Resource Investment Conference. It is the world’s largest investment conference dedicated to resources. There will be no shortage of investment thought leaders and wealth influencers to rub shoulders with and get their insights. You especially won’t want to miss me asking Frank Holmes, Doug Casey and Ron Thiessen to answer tough questions about the markets today.

You can sign up for the VRIC for free at this link – click here