Here are the 3 key words: Amend, Extend & Pretend.

As we all know, every business is driven to seek profits.

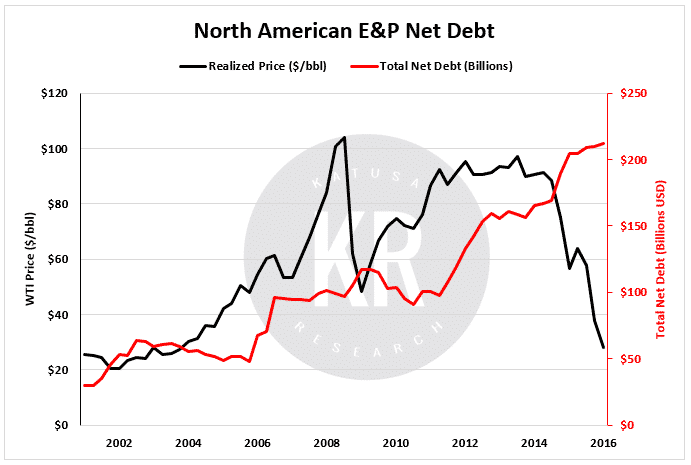

Not long ago, energy prices were high and an endless supply of cheap money chased the oil patch. Profitability looked easy. To no one’s shock, the explorers and producers (E&Ps) took full advantage. They borrowed and drilled, then borrowed and drilled some more. They went full tilt—and why not? According to some talking heads, oil was headed to $200 a barrel. The irrationally exuberant times were going to last forever, right?

Nope. They never do.

Now, with oil collapsing to $30/barrel, many producers are breaching their debt covenants. But do the investors, bankers or private funds want to exercise their right to foreclose on the property and take it over?

Not likely.

Solution: more debt of course!

It’s a touchy state of affairs. The ones lending the money are as much to blame as the producers for the current dilemma.

As the following chart reveals, even in the wake of lower prices oil companies have still been allowed to load ever more debt onto their books.

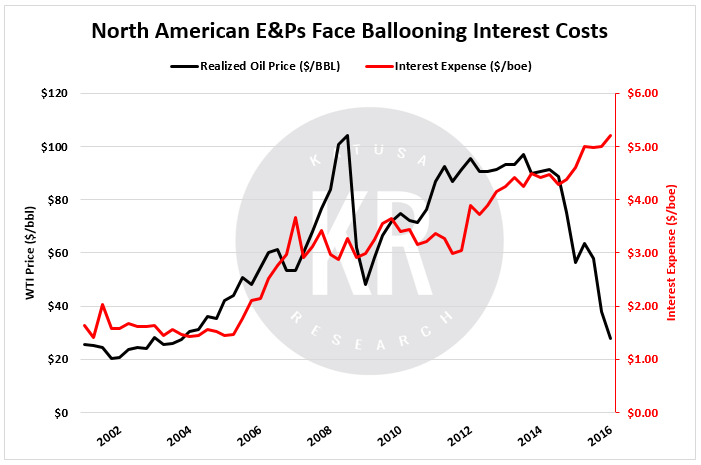

One could even make the case that the banks have turned into borderline predatory lenders. Since E&P-related debt is skyrocketing, interest payments must also be going up. That math might work just fine at $100 or maybe even $75 per barrel of oil.

But at $50 or lower, the mandatory interest payments become a crushing weight on the shoulders of the E&Ps.

At $30 oil, forgetaboutit!

Charted below is the 300% increase in interest payments per barrel since 2001. Yet, the E&Ps cannot rein in production because they have taken on more debt. On the contrary. Lower oil prices mean reduced revenues, which requires more oil production to cover the rising interest costs.

Which is bad news.

The harsh reality is that many E&Ps are facing a dreaded debt death spiral from which they’ll be unable to recover.

But all is not lost.

Part 1: Amend

Unlike in the housing crisis, where the banks could fall back on selling a foreclosed house, this is a far less viable option in the oil patch. Bankers are bankers, not petroleum engineers. They have no idea how to run a drill program.

Thus, the last thing in the world a lender wants is for the E&P to whom it lent money to go bankrupt. If the driller does go under, the bank is stuck with a mountain of debt and an operation it does not have the ability to run. It also likely can’t sell the operation except at a big loss. Without question, it is in the banks’ best interest to keep these companies alive.

As a result, the banks would much rather amend and alter the agreements they have with the oil producers. Or, in some cases, the only option may be to lend the E&Ps even more money, hoping to help them weather the storm.

Part 2: Extend

The easiest ways a bank can do this is four-fold:

- To relax the covenants on the current debt

- Make interest demands less stringent

- Lower collateral requirements

- Post a company’s reserves up against another loan

As illustrated below, the gap has never been wider between available credit and credit used. Companies will have to turn to their line of credit as the only way to keep production at current levels. As a result—with companies aiming to please both shareholders and bankers at the same time—the gap should close quickly over the coming four quarters.

In the Canadian oil patch, there are several prime examples of bankers loosening covenants to keep companies afloat.

Part 3: Pretend

Yes, pretend. Bankers do this all the time. So do management teams. And we all know investors do too. Amend and Extend on the balance sheet, and pretend everything will work out OK. But we all know it can’t work out well for everyone. Let’s look at some real time examples.

Income Trust to Income Bust: the Penn West Story

It was once a $20 stock, now struggling to stay above $1. Penn West’s bankers have relaxed their grip on the debt restrictions, allowing the amount of senior debt to increase by 60% relative to EBITDA. All the while permitting total debt to EBITDA to increase by 20%.

Lighstream to Darkstream Story:

Lightstream was once a $20 stock and a Western Canadian Sedimentary Basin prized operator. It now fetches under 40 cents a share. Lightsteam only has one covenant, which is a standard debt to EBITDA covenant and the bankers have relaxed it considerably for them for 2016.

Amend, Extend and Pretend at its finest: Denbury Resources

Some of the best wizards in the sector are the bankers who are propping up Denbury Resources. Like the majority of E&Ps, Denbury has a credit facility as well as several note issuances. Times are so tough at Denbury, that its bankers have suspended all covenants for 2016 and 2017 except for a Senior Debt to EBITDA covenant. The only debt that is considered senior during this time period is Denbury’s credit facility.

This is a cute bit of financial engineering. It means that Denbury can run up its credit facility debt, sell new notes in the public marketplace and use the proceeds to pay back the credit facility. End result, no new senior debt and lots more debt that is hidden under the mattress for later.

Oil Service Companies are Just as Affected

Trican Well Services was a once-prominent oil and gas services company in the Western Canadian Sedimentary Basin. The company recently also joined the growing line at the bank’s amendments desk. Its creditors have allowed Trican to waive all its covenants for at least half a year.

What about Mining?

Here you will also see Amend, Extend and Pretend.

And the Bankers will come up with all sorts of justifications for the extensions.

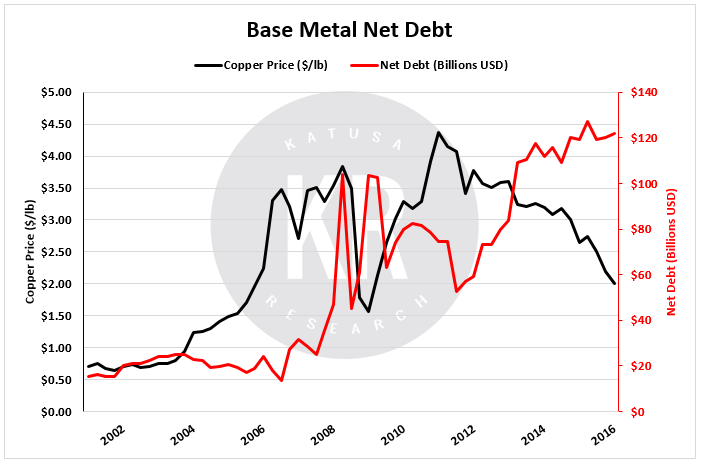

Let’s start with the base metal miners, which have seen cratering prices throughout 2015 and into 2016.

Interest Coverage Ratio:

Base metals have been hit hard as Chinese imports have slowed significantly. As with oil, it’s a demand issue.

Consequently, there is significant supply available on the open market and that has suppressed metal prices. But just like in the oil patch, metal companies have interest obligations that need to be kept.

Below is a plot of the interest coverage ratio for the global base metals group. The interest coverage ratio is exactly as it sounds, i.e. the number of times over a company can cover its interest payment. The higher the better.

It’s not a pretty graph.

Since 2011, companies have gone from a 17.5X ability to cover interest to near zero. Negative interest coverage ratios, seldom seen outside of deep recessions, loom on the horizon.

For example on the junior mining front, Aureus Mining has joined the amend, extend and pretend list. So much so that they do not even have to pay any portion of their first interest payment. A new interest and debt payment plan will be decided upon the review of a new mine plan. Concurrently they have also hired a financial advisor to assist them with “strategic alternatives.” This is banker talk for selling all or part of their interest in the mine to free up cash. This would most likely be used to pay back creditors.

Even some of the biggest names in the base metals sector cannot pull off a “head in the sand” maneuver. Freeport McMoran (FCX), one the world’s largest copper producers had to go to its bankers for credit assistance. Below is a snippet from the new deal.

The bankers have thereby agreed to raise the covenant threshold by nearly 25% for the first part of 2016. I expect this to be extended for all of 2016 and into 2017 as base metal prices are now lower than they were in December, when this amendment was drawn up.

As I write this missive, oil has broken $30 and times are unbelievably tough for the commodities sector. I fully believe that things cannot turn around until the debt unravels. Nobody wants the debt to unravel—hence all the fancy financial manoeuvrings detailed above—but it’s essential for the bottoming process.

And the debt defaults will happen even after the Amend, Extend and Pretend phase of the markets.

Because of all I have mentioned above, there are great opportunities for investments that are emerging. I intend to take full advantage of them, but one must understand the balance sheet. Fortune Favors the Bold, but Mr. Market Pays the Wise…

Marin Katusa