Financial Activism in the Canadian Resource Sector

ac·tiv·ism: a doctrine or practice that emphasizes direct vigorous action, in support of or in opposition to one side of a controversial issue.

Since the global financial crisis, no subsector of the hedge fund industry has experienced as much growth as the activist funds. In 2013, the activist funds totalled less than $12 billion in cash. Today, they have access to in excess of $100 billion, a growth of over 700% in 3 years.

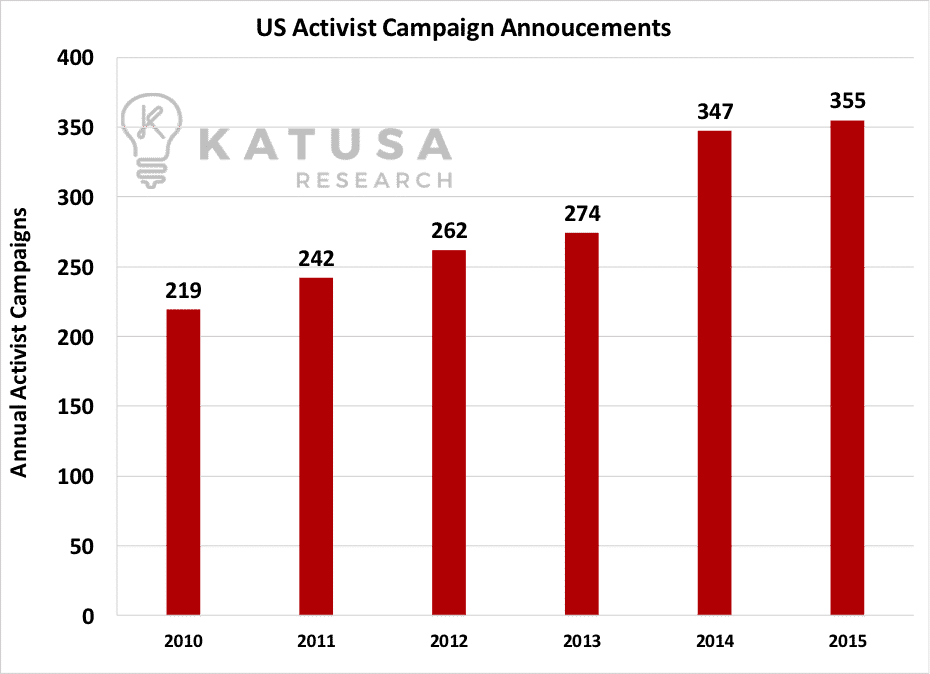

And the number of activist campaigns has risen significantly since the financial crisis of 2008.

The goal of an activist fund is to have a direct and immediate impact upon the target company. It sets its sights on board seats, in order to influence management decisions, leading to either a shakeup or a total breakup and sale of the company. The end game for all activist funds, including my own, is to generate returns above the market average.

With the US markets reaching frothy levels, many US activist funds ventured north of the border and entered the beaten-down, undervalued Canadian resource sector. It seemed like a good plan, as the valuations were attractive.

However, the success of the activist funds in the US markets has not been replicated in Canadian resource sector.

Moreover, financial activism in the Canadian public market resource sector has become a real cause for concern among all shareholders.

The collapse of commodity prices has had a negative effect not only on producers but also, ironically, on the activist funds that have tried to take advantage of the situation. Many have themselves become distressed and even insolvent—utterly destroying shareholder value along the way.

The reason: Most activist funds have very little specific resource operating experience. They convince themselves and their own investors that they themselves and the consultants they retain can create operating efficiencies that the existing management could not. More often than not, it’s a fool’s errand.

I like to contrast this with what I call positive activism, in which activist funds bring both intellectual and financial capital to the table, to forge a working relationship with the existing board and management and thereby improve shareholder value.

In this special report, I will present case studies that illustrate both outcomes. On the one hand, I’ll outline the issues that caused negative returns for the negative activist funds and the businesses they chose as hostile targets. On the other hand, I will also detail instances in which positive activism has worked, and explain why.

My hope is that what you find here will serve as a useful future guide for activist funds entering the Canadian publicly-listed resource sector.

Table of Contents

Ch. 1: Activism in the Canadian Mining Sector

Case Study I: Taseko & Raging River Capital

Ch. 2: Activism in the Canadian Energy Sector

Case Study I: Bellatrix Exploration & Orange Capital

Case Study II: Rock Energy & Front Four Capital

Case Study III: The Blackbird

Ch. 1: Activism in the Canadian Mining Sector

Case Study I: Destroying Value: Taseko & Raging River Capital

The copper landscape has drastically changed in the last five years following a 50% decline in the mineral’s price. Share prices of all the copper producers and developers have dropped like a rock.

The large fall in equity prices across the copper universe has attracted both positive and negative activist funds, and caused a good bit of confusion. In my opinion, it’s crucial for all shareholders of a company to cut through the fog, to understand what type of activist group is entering the company they own shares in.

My first case study comparison between the negative and positive activist funds conveniently involves the same management group. Both are happening simultaneously. While only time will tell which approach is the more profitable one, the empirical data so far support the positive activist approach.

Case Study I: Destroying Value – Taseko Mines Ltd. (TKO.TO) vs. Raging River Capital

Taseko Mines is Canada’s second largest copper producer; it also has a few development stage projects. Taseko is an HDI associated company, and its main assets were those which were brought to the company under the auspices of Hunter Dickinson Inc. (“HDI”). Today its board is in the majority independent of HDI, and is remains affiliated with HDI but fundamentally operates under its own management team in all respects, utilizing HDI services when convenient and cost effective.

Raging River Capital (RRC), which owns slightly above 5% of Taseko, was created by Henry Park, Mark Radzik and their team as an activist attempt to remove certain management and directors of Taseko who are related with the Hunter Dickenson group. Matthew Wood of Vertex One, which owns 3.92% of Taseko, has released a public statement in support of Raging River Capital’s initiatives.

Raging River’s focus was on building that 5% position in Taseko because that’s the level necessary to generate enough voting shares to requisition a shareholder meeting. Under Canadian law, ownership above 5% allows those shareholders to requisition a meeting, and management and the board must abide by their request.

I spoke to both Henry Park and Matthew Wood. They are intelligent and I enjoyed my conversations with both. However, neither has direct experience in the copper mining sector, and I do not believe the slate of directors proposed by Raging River Capital is in the best interest of the existing Taseko shareholders. Let me explain why.

As of the press release dated February 18, 2016, it was announced that RRC owns over US$10M in par value bonds. Mathew Wood of Vertex One shared with me on a phone conversation that Vertex One owns Taseko bonds also.

There becomes a clear conflict here for the shareholders as the bond holders are higher up the food chain than the equity shareholders. And both Raging River Capital and Vertex One have larger investments in debt than they do in equity, yet are trying to take control of the board of Taseko, where the shareholders vote, not the bond holders.

I will get into more detail on this later, but first let’s take a closer look on the overall situation.

On January 13, 2016, Raging River Capital LP (RRC) requisitioned a shareholder meeting of Taseko Mines. RRC had publicly stated they own 5.1% of Taseko at a cost base of $0.43 per share. The fund received shares from two major shareholders, according to my conversation with Henry Park. It purchased 3% of its position from Geologic Resource Partners, managed by Taseko director George Ireland at the time, and the remaining 2.1% of its position from SailingStone Capital.

SailingStone Capital is a sub agent advisor of the larger mutual fund, RS Investment Management, which holds an additional 10.4% in Taseko.

That is the reason so many American mutual funds distance themselves from activist initiatives.

“should Raging River’s independent nominees be elected to Taseko’s board of directors, Vertex One would be supportive of Raging River’s plan to focus Taseko’s business strategy, evaluate the relationship with Hunter Dickinson and address Taseko’s balance sheet.

“Strong corporate governance, accountability and alignment with shareholder interests have always been important to Vertex One. As such, Vertex One supports the replacement of incumbent directors Ronald Thiessen, Russell Hallbauer and Robert Dickinson with Raging River’s independent nominees Paul Blythe, Randy Davenport, Henry Park and Mark Radzik.”

There are 6 key statements to break down in Vertex One’s statement, and we will address each of them in turn:

- Raging River Capital’s plan to focus on Taseko’s business strategy

- Evaluate the relationship with Hunter Dickinson

- Address Taseko’s balance sheet

- Strong corporate governance

- Accountability

- Alignment with shareholder interests have always been important to Vertex One: But no mention of the Taseko bonds in either Vertex One or Raging River Capitals press releases.

But first, let’s get a visual breakdown of when Vertex One bought Taseko stock.

Vertex One Asset Management is located in Vancouver, and I’ve been on site visits with their key executives. I’ve always liked and respected the Vertex One group, but on this one, they are wrong. Let me explain why.

Raging River Capital’s focus on Taseko’s business strategy

The information that follows regarding Raging River Capital represents my understanding from my conversation with Henry Park.

Raging River Capital has raised between $4.5 to 5 million, and invested about $3.5 million buying Taseko stock in order to bring RRC to the 5.1% ownership level. The remaining $1-1.5 million was raised to defray the costs of its attempt to execute on its initiatives. I asked Henry if he bought any bonds and he said no. So perhaps they bought the bonds after my conversation. Clearly the amount he mentioned that Raging River raised was for Taseko Equity, and they bought over twice as much in bonds as they did in stock.

In Raging River Capital (RRC) Henry Park invested $1M, Paul Blythe invested $750,000, and Randy Davenport invested $250,000 according to Henry. I wasn’t told who the other shareholders were.

Jonathan Lee, who used to work for George Ireland’s Geologic Resource Partners Fund LLC is now in some way associated with Raging River Capital.

George Ireland has been on Taseko’s board since July 7th, 2014, and on February 25, 2016 George Ireland resigned as a director of Taseko.

Per my conversation with Henry Park, Geologic Resource Partners (George Ireland’s fund) sold 5.9 million shares of Taseko stock to Raging River Capital while George Ireland was a director of Taskeo. This represented 50% of George Ireland’s Geologic Resource Partners holding in Taseko.

Henry also mentioned his major dissatisfaction with Taseko buying out Curis, which was another Hunter Dickinson affiliated company. He said he really didn’t like the Curis deal.

But I pointed out to Henry that none of the independent board members of Taseko, including George Ireland—all of whom voted unanimously in favor of Taseko buying Curis—were targets of his proposed changes. Raging River Capital’s original stance would have had more pull with me if they went after the independent directors who were directly responsible for voting for the Curis deal.

Henry stated to me that George Ireland wasn’t on the board at the time. I had to correct Henry and point out to Henry that George Ireland was in fact on the board, and that the approval of the Curis transaction on the Taseko Board was unanimous. I pulled up the exact dates during our conversation, and confirmed that information.

Raging River Capital wants to remove Russ Hallbauer (President & CEO of Taseko), Ron Thiessen (Chairman of the Board and Director) and Robert Dickinson (Director), and replace those three with four of its own nominees: Paul Blythe, Randy Davenport, Henry Park and Mark Radzik.

It’s significant that Raging River wanted to remove three directors but add four, because there was a direct link between RRC and George Ireland, yet there is no mention of this linkage.

If RRC succeeded before George Ireland resigned from the board, that would have brought 5 of the 9 board seats under its Raging River’s influence, giving the company board control for less than 6% of the outstanding shares of the company.

But with George Ireland resigning from the board, at most, if RRC is successful will have four board seats under its influence, and the board of Taseko will be at a stalemate. This is assuming Taseko will appoint a director to replace George Ireland. However, Taseko announced that it is adding two board seats, so it appears to me that even if Raging River is successful in getting its 4 nominees on the board, it will not have enough influence on the board to control the board.

However this is where the bond investment becomes interesting.

If RRC undertakes initiatives, which denigrate equity values but enhance bond values, then there is a definite conflict. Given they’ve likely bought the bonds at 50-60% of face value this could easily increase in value with a few steps such as asset sales. I believe that under the terms of the bond indentures any proceeds of asset sales may have to be paid to bond holders first at full face value; a 100% return on investment. Not a bad return on investment.

One must give all due credit to Henry Park and the crew at RRC for attempting to seize control of Canada’s second largest copper producer for a mere $3.5 million in equity investment.

Raging River Capital needed SailingStone’s vote, and from my conversations with Henry Park, what I gathered, they believed they would have SailingStone’s vote.

On Friday February 25th after market hours, SailingStone filed a 13D form stating that they will vote for Taseko management and not with Raging River Capital. This is definitely bad news for Raging River.

I earlier stated that SailingStone owns 10.44% of Taseko.

I believe SailingStone made the correct decision.

I’ll get to Raging River’s nominees in a moment, but first, here are the current board members RRC proposes to replace: Russ Hallbauer, Ron Thiessen and Robert Dickinson.

During the Taseko takeover of Curis Resources; Hallbauer, Thiessen and Dickinson were all on the Taseko board, and all three are considered related parties with both companies by virtue of their positions in Hunter Dickinson Inc. The three did not vote on the issue for either Taseko or Curis, as there was a clear conflict of interest. That was the kind of situation where the independent directors on any board must be relied upon. And those independents on the Taseko board unanimously voted in favour of taking over Curis. Among them, remember, was George Ireland. I will restate here for emphasis that Jonathan Lee, who is working with Henry Park of Raging River Capital used to work for George Ireland. Whether they want to admit it or not, on my phone conversation with henry Park, he did state that George Ireland knew of Raging River’s intention, as he sold a lot of his funds stock to Raging River.

Which raises an interesting question: If, as Henry said, the takeover of Curis Resources was such a bad deal, then why is Raging River not looking to remove any of the independent directors who voted unanimously in favour of it? Specifically, like George Ireland before he resigned. Also, I will get to George Ireland resigning later.

It certainly looks as though he was the key to RRC’s activist plan, and that went awry after George Ireland’s resignation and with SailingStone deciding to vote with Taseko management. With George not on the board, Raging River would not be able to assume control, even if it’s successful in seating its own four appointees at the table.

Before I continue, just let me add this disclaimer: I have no involvement in Taseko whatsoever. I am not a shareholder in the company, nor do I own any of their debt. Neither I nor anyone in my office who works for me is employed or compensated by Taseko. I have been asked by many investors what my thoughts on the situation was as I have experience on both financing mining companies and on operations. This report is an answer to all those who want to know my thoughts. I am voicing an independent opinion for all the existing shareholders of Taseko, as someone who understands the complexities of operating a BC copper porphyry mine. If there are any errors in my assessment, please send me a note at subscribers@katusaresearch.com and I will do my best to correct my assessment. This analysis is based on the best information I could find from my discussions with Matt Wood and Henry Park and all public documents.

I am a neutral third party in that sense. But that doesn’t mean I’m disinterested. This industry is my life. So what I would also like to do is provide a voice for the thousands of Canadians working across our country’s operating mines. Everybody is aware of the harsh realities within the current commodity complex.

Over 70,000 high-paying oil jobs were lost over the last 18 months in Alberta. The women and men working at the mines understand this. They are trying their best to do what they can, and what is asked of them, to help improve production and reduce costs, without putting any workers at risk.

But there was a significant piece of information missing from both Vertex One and Raging River Capitals announcements that bothered me: The stellar safety record of Taseko at their Gibraltar Mine. It should have been discussed.

The top priority of all management teams of operating mines is the safety of the men and women who work the mines. The operating mines in Canada have the top safety record in the whole world. That is something we Canadians should be proud of and continue to improve upon, and be a global leader on. As there is nothing more important than the safety of our people at all operations.

And finally, I want to make it very clear that what my comments below I discussed with Henry Park, as I did about George Ireland being on the board and approving the Curis transaction.

The Requisition:

Raging River’s first target has been the ongoing relationship between Taseko and Hunter Dickinson Inc. (HDI). The fund alleges that HDI board and executive members of Taseko are unfairly influencing Taseko operations. They further claim that the services fees received by HDI from Taseko have improperly siphoned $25 million from the company in the last 4 years. They also maintain that HDI’s 2.6% position in Taseko is not large enough for them to have such influence over the company. In the case of HDI related or affiliated companies it’s the principals like Hallbauer Thiessen and Dickinson (there are 3 others Snyman, Cousens and Copeland) who own the shares in their personal capacity.

I believe there is misrepresentation regarding HDI’s role in Taseko. Taseko is not managed by HDI. The reality is that HDI is a service provider. This service agreement can be scrutinized by the independent board which is made up of non HDI individuals, such as George Ireland while he was on the board. If the “service agreement” between HDI and Taseko is not at fair market prices, it is the responsibility of the independent board to revaluate such an agreement.

Let me break down the numbers and differentiate between ‘number spinning’ and ‘factual numbers’.

Raging River has planned to target three existing board members. All of them—Robert Dickinson and Ronald Thiessen and Russ Hallbauer—also work for HDI. Hallbauer is also Taseko’s President and CEO.

Before joining Hunter Dickinson, Russ Hallbauer was one of the top mining executives at Teck Resources (Canada’s largest miner) and was the Chairman of the JV committee on both Highland Valley and Antimina. At the time, Highland Valley was a JV between Teck and BHP, and today it is owned by Teck and is Canada’s largest operating copper mine. After coming to Taseko, Hallbauer and his team more than doubled the production at Gibraltar, Taseko’s producing copper mine in BC. Russ’s specialty is open pit, low-grade BC porphyries. That’s exactly what Gibraltar is, a porphyry averaging about 0.28% Cu grade. Because BC copper porphyries are low grade and bulk tonnage operations, they are difficult to manage. They require an experienced, very specific skill set. Which is what Russ and his team have.

And do not underestimate Ron Thiessen’s financial ability and his foresight and Bob Dickinson’s geological ability (recall, Bob Dickinson is in the Canadian Hall of Fame of Mining). This is probably a good time to remind my readers that Ron Thiessen and Bob Dickinson were the driving force of Taseko’s acquisition of the Gibraltar mine.

Boliden Mines which controlled Gibraltar through their takeover of Westmin Mines in 1996, shut down mining operations at Gibraltar at the end of 1998. Ron Thiessen had been negotiating with Boliden through the better part of 1998, on a transaction to acquire the Gibraltar mine as opposed to a shut down and reclamation. During the early part of 1999 Ron Thiessen on behalf of Taseko finalized the transaction which saw Taseko buy Gibraltar on July 19, 1999. But it wasn’t how much Taseko paid for the project that was impressive, it was how much Boliden Paid Taseko to take the mine.

Boliden had a $17 million environmental bond in good standing with the BC government. Boliden transferred the full $17 million bond to Taseko, and then sold all the Gibraltar asset to Taseko for $1. Yes, you read that right as in one dollar.

In addition to the Bond transfer, Ron was able to convince Boliden to invest $17 million cash in a 0% Coupon, with an out of the money Convertible Debenture (initial conversion was over 100% premium to the then Taseko share price, with annual fixed percentage escalation). At the time of the transaction, copper was trading at $0.62 per pound, and Gibraltar was showing only 4 years of reserves if copper was priced at $0.85.

Bob Dickinson was adamant the resource was much larger than Boliden thought it was and Ron Thiessen structured a deal which essentially created Taseko into what it was today; 85,000 tpd open pit operation producing 145 million pounds of Cu in concentrates and a reserve life of +25 years.

For $1, Taseko shareholders received one of the best copper projects in Canada. Ron was also able to restructure the $17 million bond with the government into a Reclamation Trust, and so these funds were actually then turned over to Taseko’s treasury. In addition when the mine was restarted in 2004, Ron and HDI structured a very unique Royalty for $16 million to Taseko, zero share dilution to the company and the royalty payments were funded from tax saving from Taseko’s historical tax pools. Ron Thiessen is an accountant whose whole career has been working within the mining sector. Without Ron Thiessen and Bob Dickinson, there would be no Gibraltar today in Taseko.

This was one of the greatest deals ever structured in the mining industry. The only other one I know of that was similar was the one Jim O’Rourke structured with Newmont in the 1990’s to take over the Princeton mine.

But Ron Thiessen knew to make Gibraltar a massive success for Taseko shareholders he needed an operator with the right skill set and testicular fortitude to get the job done.

Ron Thiessen will tell you himself that the biggest achievement by far for Taseko was when he and Bob Dickinson were able to convince Russ Hallbauer to leave Teck where he was a senior VP, and come and take the helm of Taseko (a relative high risk junior at the time) to build an operating and development team to rebuild Gibraltar into the mine it is today. Russ put together one of the best open pit-low grade mine development and operating teams certainly in Canada if not North America.

Like every operating management team, Russ Hallbauer and his colleagues have attempted to implement various cost-cutting measures without sacrificing the future mine production plan. To think that a new group can come in, and with the help of a few armchair analysts, make improvements to operations and reduce copper production costs is a farfetched dream to say the least.

Above you see the guys who have been instrumental in building Taseko into Canada’s second largest copper producer. So who does RRC propose to replace them with? Here’s the list:

That’s three new directors with no direct low grade BC copper porphyry mining experience. As should be evident, this plan lacks logic, and is bad for shareholder value. It’s hard to look at it and not think that RRC is chasing short-term solutions to a much larger, industry-wide problem that stretches a ways into the future: low metals prices.

The Would be CEO

Now, under Raging River’s proposal, Paul Blythe (currently not operating any mines and I was told was retired) would take control as CEO and assist in mine operations at Gibraltar, based on his experience in selling Quadra FNX Mining to the Polish conglomerate, KGHM, for $2.8 billion. Paul is a metallurgist, not a mine operator. Proposing that a metallurgist who hasn’t been involved in a BC operation or mine in over 20 years has the hands on understanding of the specific issues at hand and the ability to make mine operations more efficient and enhance shareholder value is a stretch.

Let’s take a look at some of the specific mine operations of Paul Blythe’s track record that are not mentioned on his CV.

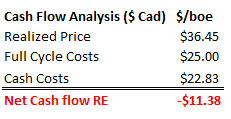

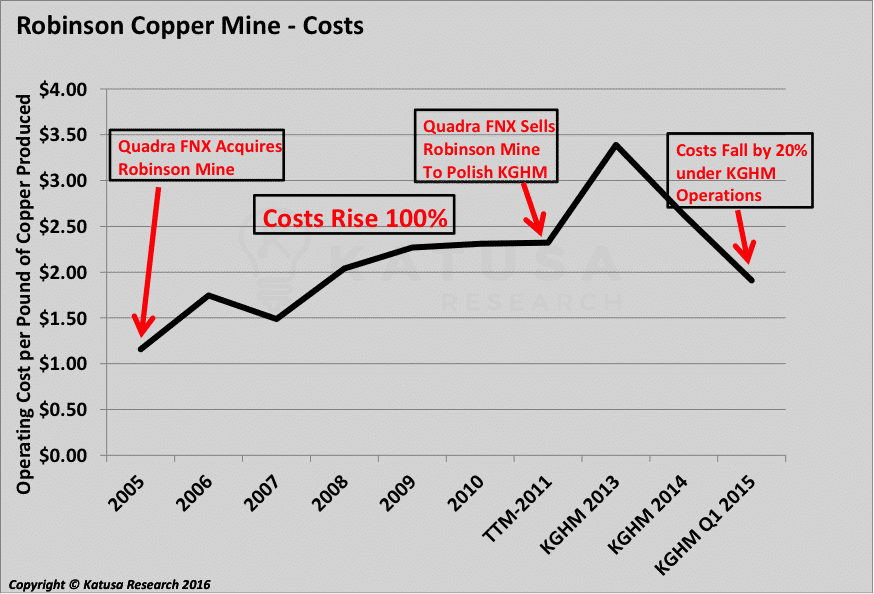

Let’s look into Quadra’s Operational performance on their flagship copper mine in Nevada, the Robinson Mine which had struggled to perform to expectations. It was expected that copper production at Robinson would exceed 105 million pounds in 2011, but that was revised as Quadra FNX again after missing their targets. Mining is not easy, but I state this to show that on the sale of Quadra-FNX was a success for their shareholder, it has not been a success for their acquirer.

Once acquired by Polish mining giant KGHM, the mine operations did improve, but never reached the original targets Paul Blythe and his team stated.

KGHM was able to create operational efficiencies within the mine to bring costs down 20%. This was after Quadra had inflated costs by 100%.

Focusing in on Quadra’s flagship Robinson mine leaves me to ask more questions about Paul Blythe’s operational ability. So, I dug a bit further to look into the performance of two mines, Carlota in Arizona, USA and Franke mine in Chile.

Let’s start with Carlota. This was a complete disaster, producing nowhere near what was expected, and this was because of development/operational issues. Carlota production was based on the solvent-extraction/ electro-winning (SX/EW) method. The ore is usually loaded into large haulage trucks and subsequently transported to the heap leach pad for conveyor stacking in fifteen foot (5 meter) lifts. Mining failed and reclamation of the mine started within five years of operations.

I believe the mine failed because of operational errors with the dumps. The Carlota mine experienced what is known as “frozen dumps” where the solvent solutions needed to mobilize the copper minerals failed to penetrate the heaps due to over compaction of the heaps/dumps. This was attributable to the mine developer deciding to build the dumps entirely with truck haulage instead of using conveyor stacking. This was occurring under Paul Blythe’s watch.

Another failure in my mind was the Franke mine. When I brought this up to Henry, we disagreed on this topic, but the fact is the Franke mine was a very high acid consumer. Franke was also an SX/EW heap leach project, but the amount of acid the ore consumed per unit of copper produced has made the project uneconomic from a recovery of investment standpoint. The Franke Porject was acquired by Quadra when it took over Centanario in 2009, even then it was known as a very high acid consumer.

The Franke mine has never lived up to its original projections or subsequent projections by the Quadra team. In my estimation however it has lived up to its original nomenclature; Franke is short for the Frankenstien as it was originally known as the Frankenstein Project. Looks like the acid consumption was never under control.

In any event these are the only 2 mines to my knowledge that were actually developed by Paul Blythe or at least under his management (he was CEO), and neither have worked financially; returned their capital and a return on capital.

Paul Blythe and the team at Quadra FNX did capitalize on the window in 2010 and sold their company to the polish copper giant KGHM for over $2 billion.

Paul Blythe and his team deserve credit for returning significant gains on the share price on the sale of Quadra-FNX.

The purchase has not worked out well for KGHM.

It was announced on Monday, Feb 22nd, 2016 that KGHM is being audited by the Polish government’s treasury. Essentially the Polish treasury is carrying out the audit of the acquisition of the Sierra Gorda copper-moly project it acquired from Quadra-FNX.

The Polish ministry is “critically evaluating” the Sierra Gorda acquisition and other overseas purchases undertaken by entities owned by the Polish state.

KGHM now will have to write down the purchased assets. The production has not been able to meet production nor cost guidance, and with the decrease in commodity prices, KGHM announced that it will write down the carrying value of the assets in its upcoming financial results.

But, in the resource sector it is a team, not just one man that creates a success,

In my opinion, Raging River would have a much stronger argument if William “Bill” Myckatyn agreed to join Paul Blythe in this battle. William “Bill” Myckatyn was co-founder and CEO of Quadra FNX along with Paul Blythe.

Mr. Myckatyn is a professional engineer (P.Eng.) with 35 years of technical and management experience in mine financing, development and operations. After Quadra’s purchase of the

Robinson mine from BHP for $14 million, the company re-started the mine in 2005. Mr. Myckatyn had the operational expertise to produce 126 million pounds of copper and 81,000 ounces of gold from the Robinson mine at the end of 2005. Before Quadra, Mr. Myckatyn worked at the Huckleberry open-pit copper mine in BC. He was also the mine manager and CEO of Gibraltar Mines (1991-1997), whose flagship project belongs to Taseko as of 1998. Mr. Myckatyn would have been a better candidate to pick a fight with Taseko, but the two together would have been a much better argument.

Has anyone thought, “Geez, why isn’t Bill joining his former partner in this activist battle?”. Not a single media journalist or interviewer has asked this question, so I am going to.

Maybe it’s because he knows RRC can’t do it?

Maybe he doesn’t have the fight in him?

Maybe he is happy being retired from mining and would rather not take on a full time job at this stage of his life.

Maybe he knows the existing Taseko team led by Russ Hallbauer are the best operators for the job.

I don’t know, as I haven’t asked Bill myself. But I do find it interesting that he isn’t involved.

Ok, now what about those HDI service fees that RRC complains are unreasonable?

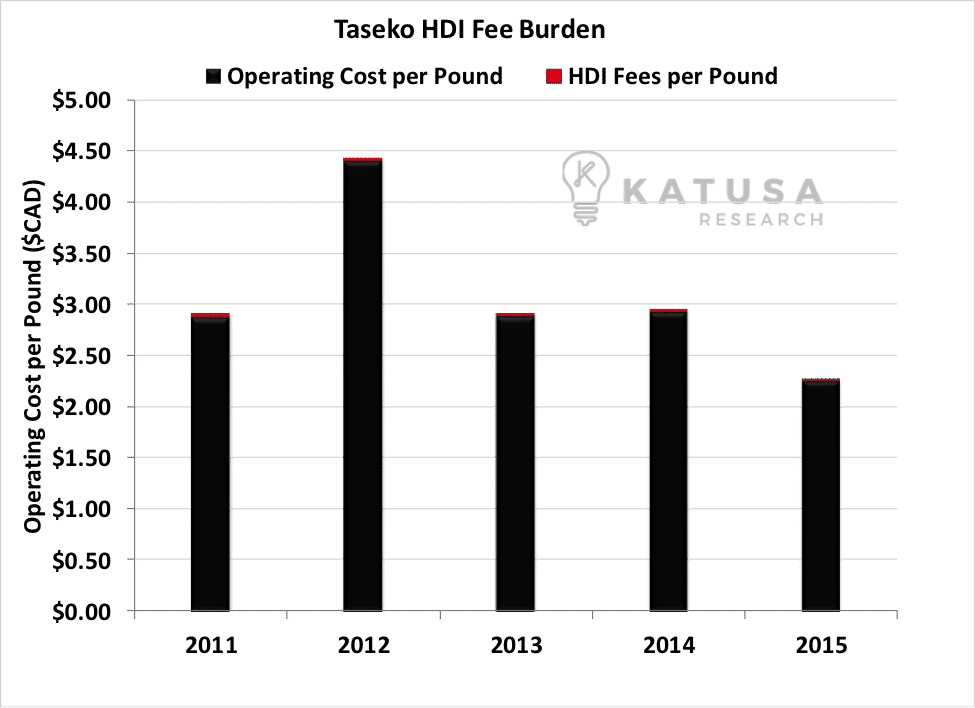

HDI and Taseko fees since 2011:

Did you need your magnifying glass to spot the small sliver of costs per pound attributed to HDI fees? It must also be mentioned that these service costs also cover G&A costs from within Taseko.

The HDI and Taseko G&A fees amount to $0.014 ($CAD 0.02) per pound of copper produced by Taseko.

If you eliminated HDI services, TKO will have to get these services elsewhere, and I think that would result in higher costs to Taseko shareholders, not lower—as these services are not easily outsourced.

Many of the fees are passed through such as rent insurance employee benefits. Also, costs overall will go up for TKO as they will not get the economies of scale by being affiliated with HDI and in some instances they will have to bring on full time staff to do jobs they currently outsource to HDI.

This is actually at or below the peer group comparable, something both Vertex One and Raging River Capital did not mention in their public releases.

It’s a great catchy media tagline to say you can reduce costs by doing this and that, but one must really develop an overall perspective on what that means.

The above bar graph explains it well. Also as I understand it, many of these HDI costs are simply pass through costs or services, like rent, taxes, insurance, employee benefits on which no mark ups exist; Taseko is simply taking advantage of scale in conjunction with HDI to reduce their overhead costs. HDI is one of the most successful exploration and development groups in the Canadian resource sector and Taseko has access to their core competencies at costs which are more than competitive to other consultants and advisors.

Again, the Audit Committee of Taseko must review these related party (HDI) costs each year and approved them (see the notes to Taseko Financial Statement), and only independent directors sit on the Audit Committee which has included George Ireland before he resigned.

Also the HDI services agreement is pretty innocuous, and can be found in Taseko’s SEDAR filings; there are no guarantees or commitments, it’s a one way agreement; if Taseko wants to use a service they ask for it. HDI does not have a lock up agreement, force or push any services or costs on Taseko.

Raging River Capital promises that they can cut an additional $8 million in costs from corporate overhead and spending on projects in Arizona and Northeast BC, thereby saving the company another $0.03 per pound of copper produced. But, can they deliver; where is their plan? Russ and his team are on site. They have proven they know how to develop, build and operate a mine. Why should we believe that someone from the outside would have a better understanding of where the possibility for cost reductions would be, rather than the ones who lives and breathe the day to day operations?

If the plan is to cut out the HDI service costs, one must know that Taseko will have to obtain and pay for those services elsewhere.

So, when I phoned Russ Hallbauer for a comment on this, he told me that his team has been reducing costs without sacrificing employee safety and without hindering any production efficiencies. Russ states that Taseko has reduced costs by $40 million, 500% more than what Raging River Capital intends on doing.

Mining Economics – British Columbia, Canada

Russell Hallbauer has succeeded at operating one of the best run open-pit copper deposits in BC. He will join the likes of his father, Bob Hallbauer, his partner Bob Dickinson, and friend Jim O’Rourke in the Canadian Hall of Fame mining sector.

Let me just add a few more words about Russ’ botched BNN interview. First off, he shouldn’t have done the interview, as I am assuming the lawyers didn’t want him to say much of anything. Russ was in remote Vancouver studio and the interviewer was in Toronto all happening live. I’ve sat in the same CTV studios countless of times. And I am not making excuses for Russ but it’s an awkward process as you are in a dark room, with an ear piece, which might I add is tough to hear through and told to talk to the camera. I’ve done intense media training before the launch of my New York Times Bestseller ‘The Colder War’, and I don’t expect a mining executive to shine on camera, no more than I expect an NHL hockey player to have an eloquent and thought provoking post-game interview.

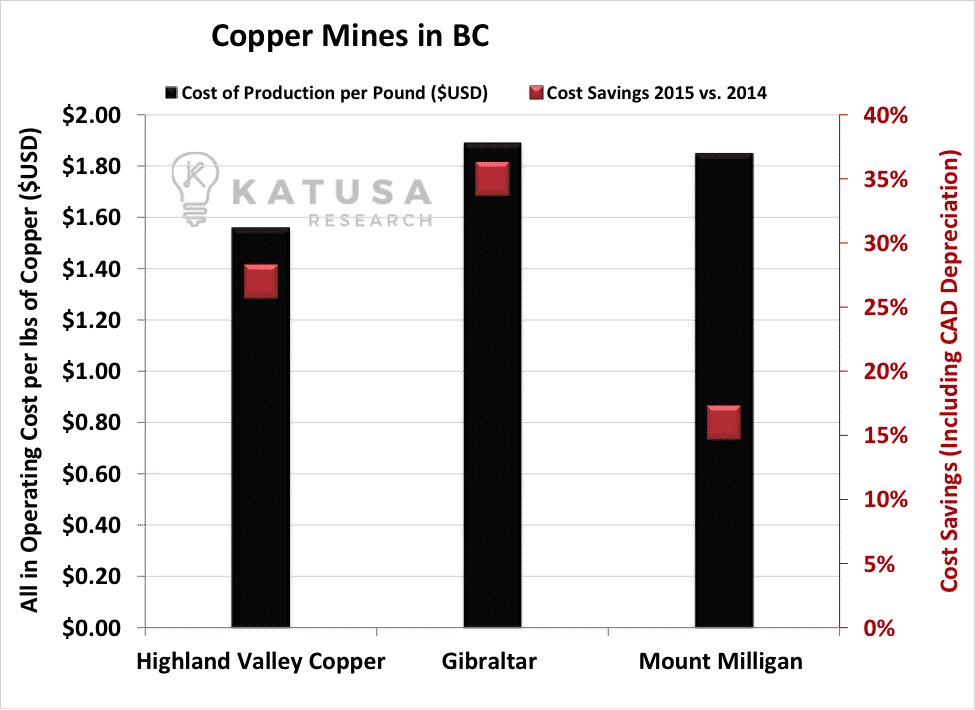

Under Mr. Hallbauer, the Gibraltar mine has become one of the lowest cost major copper producers in BC and has seen cost reductions of 35%. Because of low moly prices, the moly circuit at Gibraltar is not operating. But if Moly prices do come back (which one day they will) that will result in additional cash flow.

Mr. Hallbauer has been a part of the operational oversight of two of the largest mines in BC. As noted earlier, he was the Chairman of joint venture committee for the largest copper mine in Canada: the Highland Valley copper mine in 2002. He is now shouldering the responsibility of keeping the Gibraltar mine one of the most efficient and cost-effective in a depressed copper market.

It would be very difficult to explain to the employees and operation managers at Gibraltar that a mining veteran, Russell Hallbauer, who has built the company into what it is today, is leaving the company to make way for a retired metallurgist, Paul Blythe, whose last hands on site visit was in the 80’s. Mining is a tough business, and these miners have worked under Mr. Hallbauer for over a decade; loyalty and respect is a very hard bond to break, especially when the threat comes from an opportunistic corporate raider.

Like operational managers at the Gibraltar mine, Canadian resource investors value a commitment to success and creation of sustainable value. In this depressed market a quick board shake-up is not going to add to sustainable value. Taseko’s commitment to being one of the lowest-cost producers of copper in BC—and having the experience to battle through a tough market—has built a reservoir of goodwill that probably won’t be realized until the market turns for the better after being held back for four years.

Chapter 2: Activism in the Canadian Energy Sector

The Canadian oil sector, like its shale peers to the south, underwent monumental growth from 2010 to 2014. In similar fashion to its US counterparts, share prices and cash flows have since cratered. Creating new value for shareholders from existing assets has become a common theme in the energy sector, primarily used as a tool to generate cash without dilution. Activists have flocked to the Canadian energy sector, but with limited success. There’s even a term for it: “spreadsheet activism,” meaning deal flow in the sector that looks good on paper, but in reality will never work.

Case Study I: Bellatrix Exploration & Orange Capital

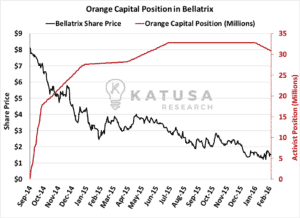

Bellatrix Exploration is a mid-tier gas producer that underwent a siege of continuous buying from activist group Orange Capital, run by Daniel Lewis. Orange Cap’s investment thesis for Bellatrix involved increasing shareholder value without diluting the existing shareholders, and Lewis’s plan to achieve this was to capture board seats, push for debt issuance rather than equity, and unlock additional value through midstream asset sales.

While Orange Capital were confident in their ability to turn a profit in an oil and gas company, no founding partner of Orange Capital had the necessary expertise to run an operating Canadian oil and gas company. The majority of their intellectual capital came from Lewis’s time spent in special situations and distressed debt at Citigroup. Their shortcomings were further illustrated by Orange Capital’s 13-F filings at the time, which were mainly composed of REITs and investments within the technology space.

The demise of Orange Capital’s activist stake in Bellatrix stemmed from a basic misunderstanding of the Canadian gas markets—including the value of NGLs in the Canadian gas stream and their impact upon BXE cash flows—and the vital importance of vertical integration within the Canadian natural gas sector.

Failure to understand Canadian Gas

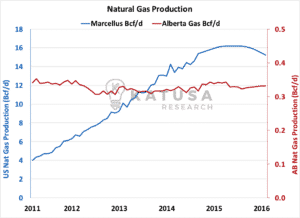

The Canadian natural gas industry is not like its US peers. It simply cannot compete with the Marcellus and Utica shales when it comes to gross production or new productivity per well. Production is not even a growing industry, due to transportation issues and the poor economics associated with LNG exports from Canada. At well under 1Bcf per day, Alberta’s natural gas output is dwarfed by the likes of the Marcellus (15.2 Bcf/d).

Furthermore, Dominion North/South sells for $1.40/mcf, whereas Alberta’s AECO trades for $1.45, and going lower in my opinion. The ability to breakeven at $1.45 or lower shows how far ahead of Canada the Americans are. The Marcellus and Utica formations are a nightmare for Canadian natural gas producers.

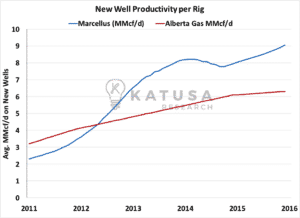

In addition, the lack of competitiveness in Canada relative to the United States is evident when well outputs are compared across each basin. The productivity per new well has peaked in the Alberta formations, whereas in the US producers are continually squeezing extra gas out of the shales.

Hidden costs, not hidden value

An activist’s worst-case scenario should always include the ability to fall back onto a cheap valuation, thus limiting downside risk for the fund in question. Multi-stack formations are a quality way to achieve this. Value is unlocked when each layer of the shale play is delineated, increasing the company’s proven reserve base. This is exemplified across well-known formations such as the Permian, and in the Canadian WCSB where Bellatrix is located. Ideally, the fallback for the E&P activist would involve being able to unlock value through formations that have not been aggressively drilled, and which the market has heavily discounted.

The exact opposite is true in the case of Bellatrix. Non-core operations are completely uneconomic; there is $0 in value add for the Duvernay acreage. At a development cost of $11 million, new wells can’t be drilled profitably. In fact, they would still be only borderline at $80+ per barrel oil during that time frame—but with time and enough experience and data, will decrease.

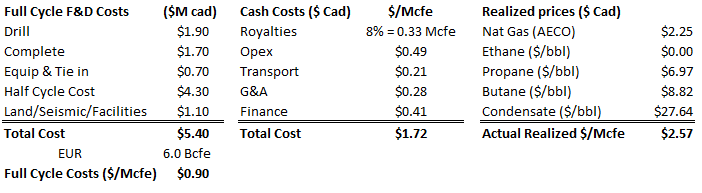

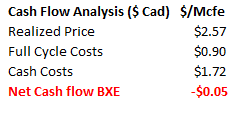

Further due diligence reveals that the situation is actually worse, because even Bellatrix’s core acreage is uneconomic at current prices. For every Mcfe that comes out of the wellhead, Bellatrix loses $0.05.

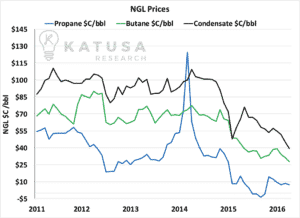

The pricing environment of NGLs in Canada were frothy and most failed to read the fine print on Bellatrix’s investor presentation, which vastly overstates the present NGL pricing environment:

The NGL market in Canada continues to be oversupplied and has succumbed to the same pricing pressure as oil and gas. The big catalyst for the Canadian NGL market was the Oil Sands’ heavy reliance upon condensate as a diluent. However, as a result of poor bitumen prices and high capex, demand for condensate is now minimal. Lighter NGLs such as ethane are not even removed from the gas stream at fractionation facilities as the cost to remove them is higher than the market price—a phenomenon known as “ethane rejection.”

Value destruction, not addition

Spinning off midstream assets has become a common tactic used by E&Ps to create cash without dilution or debt issuance. Pioneer Resources best exemplifies this value unlock, selling their EFS midstream assets for $1.3 billion. Similarly, there were individuals that believed Bellatrix’s midstream assets would be better sold off or spun into a new company, rather than retained within BXE.

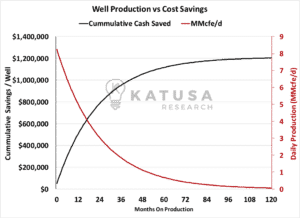

Bellatrix has invested $300 million into infrastructure assets, which in the first quarter of operation lowered transport and opex costs by 14% compared to the previous sequential quarter. The company’s deep-cut natural gas processing facility vertically integrates Bellatrix and allows it to bypass 3rd party midstream operators. If BXE sold these assets to a 3rd party, the cost reductions would be erased.

On a per well basis, this 14% or $.20/Mcfe translates to a PV of $1 million in cost savings over the lifetime of the well.

Additionally, third-party revenue for the midstream infrastructure business brings in approximately C$12 million per annum. If Bellatrix had substantial excess capacity that it utilized to process 3rd party gas then a SpinCo would be a viable option. However, as evidenced by their $12 million in annual 3rd party processing revenue, this is not worth the effort.

So an outright sale has to be off the table.

Spreadsheet Activism—What Not to Do

Orange Capital investment in Bellatrix did not work out. Lewis and his management team tried to enter a market which had its main commodity price slaughtered.

Orange Capital has recently closed their fund and according to Bloomberg’s insider ownership, they still own 30,000,000 shares of BXE. Furthermore, as a testament to their lack of success Daniel Lewis has resigned from the Bellatrix board.

Case Study II: Rock Energy & Front Four Capital

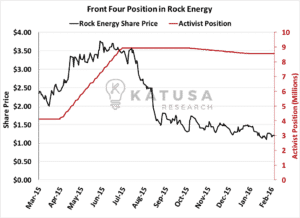

Rock Energy is a Canadian heavy oil producer, in which Connecticut-based Front Four Capital has acquired an 18% stake. Hedge fund manager Zac George is taking an activist approach to the Canadian energy sector, which he should know extremely well given that his father was the founder of a $45 billion market cap major integrated producer, Suncor.

George prides himself on being a value investor along with an activist approach. His 18% stake in Rock Energy has provided Front Four the opportunity to attain three board seats as a step toward facilitating an outright sale. So far so good.

This is not new territory for Front Four. It attempted a similar activist-style shakeup at Renegade Petroleum in August 2013. With a brash sense of urgency, Front Four rejected the two offered board seats in the face of Renegade management, which began a saga of PR madness for both sides. The end result for Front Four was a loss at the special voters meeting to elect a new board. But, fortunately for George and his fund, Renegade sold itself without the activist’s assistance, netting Front Four a 40% gain.

Rock Energy to this day has not been acquired and in these difficult sector conditions Front Four Capital may be the only one who still sees value in a small heavy oil producer. Front Four has missed the market window to sell Rock Energy and experience the gains as they did with Renegade Petroleum. The economics of the Canadian heavy oil market has changed drastically and the pipeline issues surrounding heavy oil have resulted in a significant decrease in the Rock Energy share price.

Lastly, the elephant in the room is Rock’s credit facility. It is well over 80% drawn. Further constricting funds, the Alberta Trust Bank rescinded their offer for a second credit line of $75 million.

Failure to understand the WCS marketplace

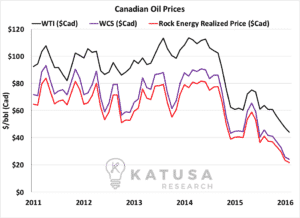

All Canadian oil trades at a discount to its southern benchmark—West Texas Intermediate (WTI)—for a couple of reasons.

First, there is the quality difference in API between Canadian oil and WTI.

API, or American Petroleum Institute gravity, is a measure of how heavy or light a petroleum liquid is compared to water. Specifically, the heavy crude which Rock produces has an API of 14o, compared to the WTI API of 39.6o and the standard Western Canadian Select (WCS) benchmark of 19o-22o. Second, there is a lack of infrastructure and pipeline capacity.

This combination of lower quality and lack of takeaway capacity forces Canadian companies to take a discount to WTI in order to remain competitive. That includes Rock Energy’s crude, along with the benchmark WCS.

If it wasn’t for the weak Canadian currency relative to the US dollar, many of the heavy oil producers would have gone bust last year.

Heavy oil is a big boy’s game, because margins are smaller on a per well basis; quantity rather than quality has to make up the difference. The only successful heavy oil producers in the Canadian energy sector are multi-billion dollar operations with massive running room and infrastructure.

No hidden value to unlock

Rock Energy is a relatively young company with no midstream assets that can be unwound into a new investment vehicle to create value for shareholders at current oil prices. Without midstream to fall back on, Rock and Front Four must find a way to unlock value using their existing acreage. This could be attained through exploration drilling on their heavy and light oil properties. But in the current depressed market, exploration drilling is rare.

It’s only minimally carried out by mid-tier and major E&Ps who can afford to spend money on exploration. Obtaining the funds for this activity will either result in significant dilution or have to come via a debt financing as Rock’s credit facility is nearly 100% drawn and all cash generated from operations will have to go towards existing production. Either route will decrease existing shareholder value.

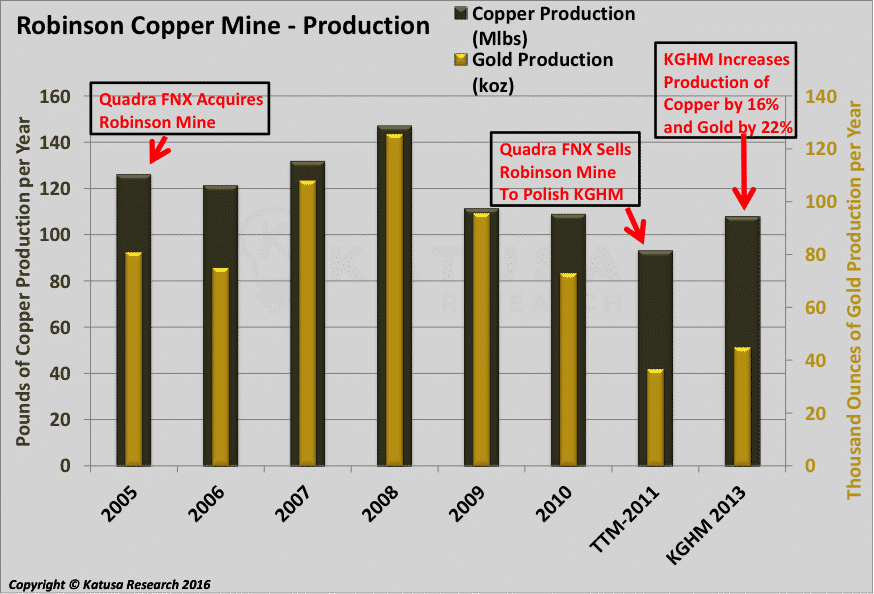

On a half cycle basis, their heavy oil assets will not generate positive free cash flow at current prices, which means no new value can be unlocked in the current environment.

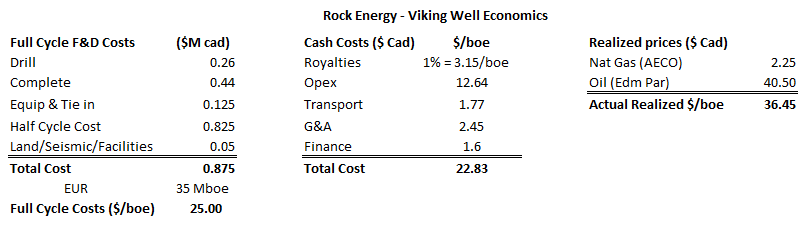

Rock’s Viking assets are the best chance for prolonging its survival under current conditions. However, breakeven point is $40-45 on a full cycle basis. Using current prices below, their wells do not come close to covering full cycle costs. This is a major reason why the Alberta Trust Bank rescinded their credit facility offering.

Front Four’s current cost basis is approximately $2.95, which bodes poorly for a profitable sale in our low price energy environment. Furthermore, with minimal room on their credit facility, Rock has limited ability to create any new shareholder value. As a result, Rock—like the majority of unhedged small producers—is entirely at the mercy of market conditions. And that’s not good.

Positive Activism in the Canadian Oil patch: Blackbird Energy BBI.VN

Back in 2013, I became a major shareholder of Garth Braun’s Blackbird Energy (BBI.VN). My geologists spent considerable amount of time going through the information. After many meetings, Garth Braun and I were on the same page so I decided to become a cornerstone investor.

I shared my vision with Garth.

I didn’t like Blackbird’s Big Stone asset, and wasn’t particularly excited about the Montario project which was supposed to be a “Rock Energy Look alike”.

But I was very excited about the potential of Blackbird’s Montney play.

I wanted Garth to sell the Bigstone asset and focus on making the flagship project the liquid rich Elmworth in the Montney.

Not only did Garth sell the Bigstone for more than I expected, he did everything he said he would.

The investment was +400% gain, and one I am looking to re-establish a large position when the opportunity arises.

Blackbird Energy’s last well is a testament to incorporating innovation and the best technology to reduce costs and increase production.

Blackbird announced a 1,768 boe/d well (36% liquids; with 94bbl/mmcf) last week, and the well results basically doubled all analyst expectations. This is what a world class well looks like in Canada.

The company has no debt (rare for any Canadian oil company in today’s environment), and has built a dominant land position in the Montney with 75 net sections of land. To survive a low priced oil market, management teams will have to innovate to deliver results. Blackbird Energy Inc. has made significant advancements in validating their dominant land position by using state of the art technology.

Blackbird was able to deliver world class results by executing on a 70 stage energized frac using 20,000 m3 of CO2 and water while using 2,200 tonnes of proppant. This is what a world-class frac looks like. That is exactly what the oil companies in both Canada and the US will have to do to survive this horrible oil market…. Bring innovation and exceed expectations.

– Marin Katusa