Past, Present and Future of the Federal Reserve and the Bubble End Game

The US Federal Reserve as we know it today was created in 1913. Most people do not know that the current Fed is actually the third rendition of the ‘central bank’ of the US. The first two had 20 year mandates, and were legislated such that 20% of the bank was owned by the US federal government and the remaining 80% was owned by wealthy shareholders.

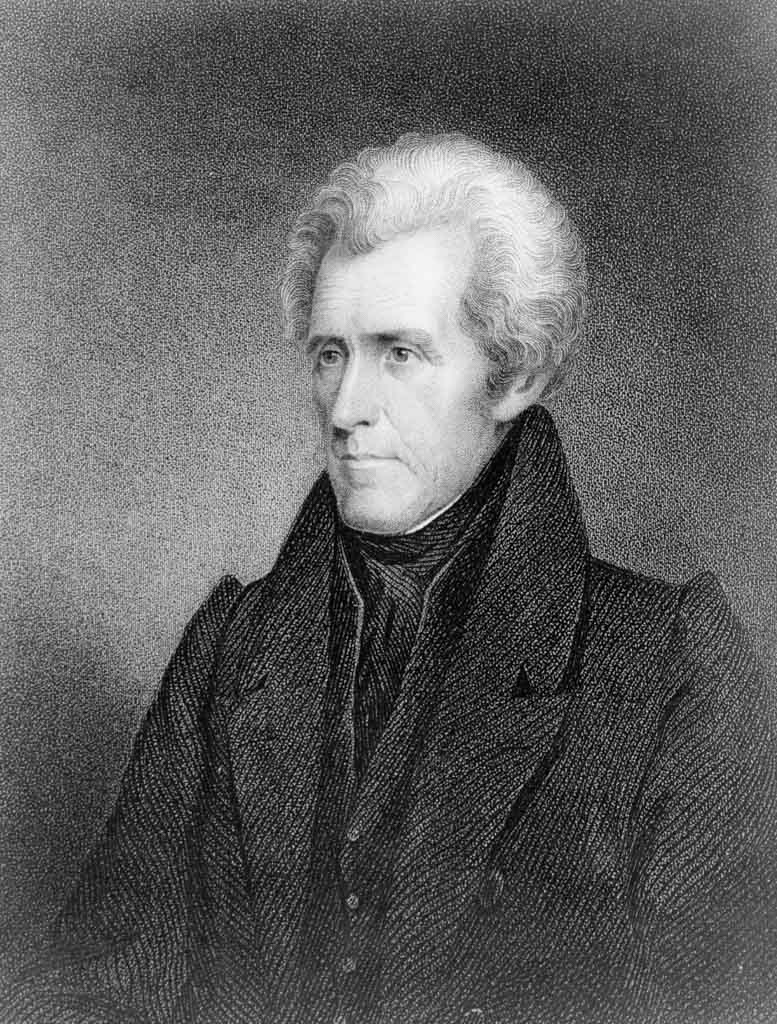

President Jackson (7th President of the US from 1829-1837) should get much credit to ending that history of the “rich” controlling the Fed when he used this as a key issue in his campaign for his second term as president. The system was terminated in 1836.

President Jackson’s second term ended in 1837, and he succeeded in preventing the Second Bank of the United States getting an extension to its mandate, a victory for Jackson.

Little changed over the next 24 years. Then the US Civil War changed everything.

To finance the Civil War, a system of national banks was created via the National Currency Act, which evolved into the National Banking Act a year later in 1864. A major problem at that time with the National bank currency was the fact that the value of the currency was based on US Treasury bonds.

That meant, that if the bond price declined, the national bank had to reduce the currency it had in circulation which had significant impacts to the economy. Not only did that mean it couldn’t make new loans, but it also meant that the bank would have to call in loans it already had out. This was a serious liquidity issue for the national currency. But the problems would only compound for the bank when this occurred, because when word got out that the bank was in a liquidity crunch and calling in the loans, people who had deposits in that bank would rush out and withdraw their deposits, only causing more issues.

All this led to more financial panics. The worst of these panics up to the time was the October 1907 financial panic. Most people know that, as legend goes, JP Morgan saved the day by having all the key bankers come to his home after the panic had shut down Wall Street.

What many people don’t know is that one of the major catalysts that led to the October panic actually started in February 1907, because of the world’s largest oil company at the time, Rockefeller’s Standard Oil Company.

Standard Oil had a severe financial problem it did not anticipate. What caused its crisis? A good guess would be that the price of oil dropped significantly.

But that wasn’t the reason.

The oil price was quite stable during those years. It was because of a decision by President Roosevelt in 1906.

Roosevelt had decided to push through Congress the Hepburn Bill, which would deliver two serious blows to Rockefeller and Standard Oil. But what President Roosevelt didn’t consider were the unintended consequences that would happen to the other 43 trusts he would break up.

The main premise of the Hepburn Bill was to reform rate evaluation, ban excessive rebates designed to thwart competitors and bring in federal government supervision of all interstate commerce.

The cash crunch hit Standard Oil very hard, and their crisis in February 1907 had a significantly negative effect on the stock market during that time. The stock market sold off. Then as more companies experienced the struggles which Standard Oil barely survived, but didn’t have the wherewithal of Standard Oil, more companies started to collapse.

From left to right: J.P. Morgan, George Wharton Pepper, Teddy Roosevelt, and Flavel Sweeten Luther in 1918 with Trinity College president, Luther (Record photo morgue)

The tipping point came in October, when the US economy (and the global economy as a whole) was slowing. Then two major corporations failed:

Westinghouse Electric Company and Knickerbocker Trust. And when news got out that the president of Knickerbocker Trust committed suicide the siren announcing the 1907 Panic went off.

Massive bank runs, on a scale never seen before, occurred all across America at the same time. Stock market prices plummeted, deposits were being pulled as fast as the tellers could process them, and the US Treasury had no choice but to pump millions of dollars into undercapitalized small banks across the US hoping to save them. The domino effect was in full motion.

JP Morgan to the rescue.

The leading financial experts and bankers all get together at JP Morgan’s house where he was able to convince the strong institutions to bail out the weak ones.

At the same time, another major crisis erupted when the very large brokerage firm called Moore and Schley nearly collapsed, and would have if it wasn’t able to get access to $5 million in stock in the Tennessee Coal and Iron Company it held to pay back its investors.

President Roosevelt again looked to JP Morgan for help.

Morgan orchestrated a brilliant takeover of Tennessee Coal and Iron, such that his US Steel would buy the company. However, in return, Roosevelt blessed the deal by granting JP Morgan an exemption from the Hepburn Bill and the Sherman Anti-Trust Act, moves which would eventually make Morgan the most powerful man in America.

The emergency measures worked for the time being, but both the Democrats and Republicans believed significant reforms to the American banking system were required to prevent another major panic such as the one experienced in the Panic of 1907.

What is the most dramatic item that was to be changed? I see the key issue at the time to be the inelasticity of the currency. A custodian of the currency that was responsive to the needs of the economy, and independent of party politics, was desired by both political parties.

With significant input from the bankers from J.P Morgan, First National Bank, National City Bank of New York and Kuhn, Loeb &Co, the Owen-Glass Federal Reserve Act was passed, and what we know today as the Federal Reserve was created.

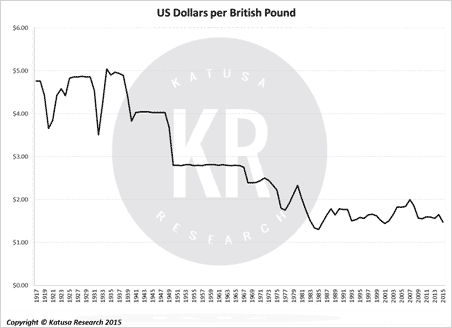

So, how has the Fed done? Depends who you ask. For example, look at the USD vs the British Pound. From the Brits’ perspective, the Fed has done a much better than job then their own Bank of England has done on the British pound.

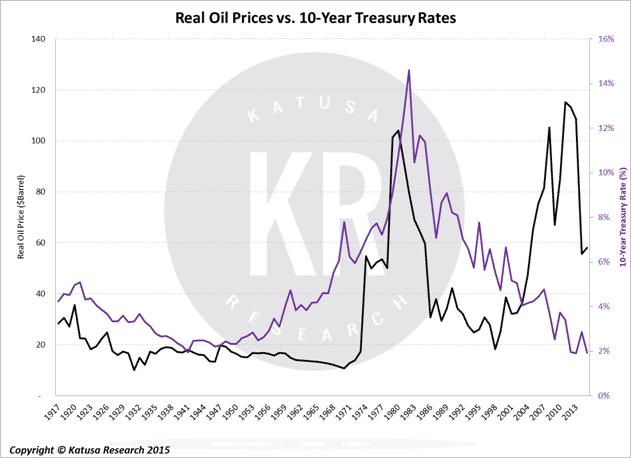

Let’s now look at The USD thru the oil lens.

Well, that was easy. One can see that it was much better to own a tangible item like oil rather than the USD the last 100 years.

The Present Central Bank Dilemma

We are in uncharted territory.

This is the first time in the history of the Federal Reserve that the Central Bank is buying bonds and that we have had essentially zero interest rates for six years. The Fed is doing everything in its power to fight deflation, which is the greatest enemy of a central banker.

Why is Deflation worse than Inflation for a Central banker?

This answer is actually quite simple.

With inflation, the banker can inflate his debt away. However, with deflation, that debt becomes even more cumbersome, and harder to pay. Thus, interest rates held at near zero for so long.

Considering that the drastic measures taken currently by the central bankers are greater than at any time in the past, one must ask why? Are the current economic conditions present in the US the worst the US has experienced over the last 100 years? Or do the central bankers know something we don’t?

The U.S. Federal Reserve Perspective

In late 2014, I spoke at a conference also attended by Alan Greenspan. In the speakers lounge room, we exchange pleasantries, and he is quite the witty old man. I reminded Alan of our first encounter in 2007 when we had lunch and of our conversation at that time, which was about gold.

Back then, I asked Mr. Greenspan what he believed was the appropriate asset allocation between USD and gold, and his answer was, “That is a difficult question”.

Fast-forward 7 years, and now Mr. Greenspan believes gold is going a lot higher. That is an interesting answer for the former Federal Reserve Chairman.

Greenspan, Ben Bernanke and now Janet Yellen have done whatever they can to stimulate the economy. One can argue that if the Fed didn’t have near zero interest rates and didn’t buy the bonds (which has never been done before in the history of the Central Bank) to increase the risks on the Federal Reserve balance sheets, the US economy would have struggled much more the past few years than it has already.

This is probably true.

Pushing out the Risk Curve

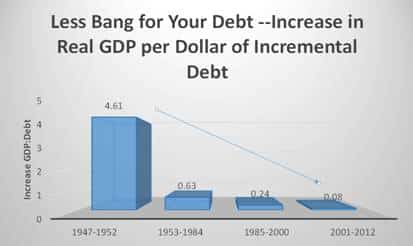

Eventually a bubble caused by the low rates and unintended consequence of pushing out the risk curve will pop. A bubble popping is clearly, at least in my mind, a deflationary event. But, it’s common sense that with interest rates so low for so long, the marginal benefits one gets greatly diminishes. For example, consider what’s happened since the end of World War II, as shown in this chart.

One only needs to look at the current state of the debt load in the US oil shale sector to see the risks investors have taken onto their balance sheets.

But it’s not just in the oil sector. This is true for the tech, bio-tech and other sectors that make up the US market. For example, today 80% of US IPO’s are unprofitable when they list and go public. Last time this was the case: 1999. We know how that party ended. In fact, this has only happened twice in the last 100 years.

Poker with the Federal Reserve

I’ve played poker with professionals, guys who think they’re professional, and very smart, very good players who play just for fun. I have a pretty solid track record playing poker, and my old friend Doug Casey has been trying for years to get me to come to Vegas for the World Series of Poker tournament.

Personally, I don’t find it fun playing poker with strangers. I’m what you call a social poker player. I love playing with people I know, such as Doug and other industry professionals in the resource sector, because we have more than just our passion for poker in common.

In fact, one of my favorite poker tournaments of all time was a pretty large tournament that Doug Casey and I played in, held by Stansberry & Associates. Porter, who is the charismatic front man of S&A, really made it clear that his goal was to beat me.

In fact, he wanted it so bad, that in a multi-table tournament, with an open bar all night, Porter choose to sit beside me as he wanted to knock me out of the tournament.

Well, on one of the first hands of the tournament, Porter and I were betting big.

Knowing Porter is smart, I knew he wasn’t bluffing. But I looked at what cards were on the table, and looked at the outs, meaning how many combinations I could have to make the best possible hand on the table. I determined that there was one better hand than mine possible, and waiting for the river, I had multiple outs so I went for it.

Porter and I were all in.

I won the hand, and Porter was the first knocked out of the tournament. After about 4 hours, and multiple drinks, Frank Curzio and Jeff Clark both showed strong, but it was Doug Casey and I who were the final two at the table.

There was a few thousand dollars on the table, and it being now past 2 a.m., and me travelling from Europe the day earlier, I had been up for over 24 hours and made Doug Casey a proposal I thought was very fair.

“Doug, I have twice as many chips as you. It’s late and we are both tired. Let’s make a deal and call it a night. We will split the pot 50-50.”

To my dismay, Doug said “no.” I was shocked. I thought perhaps the old man had lost his marbles and was out of touch with reality. No?

Next hand, Doug caught me, and now the chips were about equal. I lost focus, my bad.

Anyways, I got my focus back quickly, and within a couple of hands, I took the pot. I placed first, Doug doubled his money, placing second.

But not once did either of us bluff. When the stakes are high, it’s a fool’s game to bluff. Which leads me to ask:

Is the Federal Reserve Bluffing?

It sure seems like the attitude at the Fed right now can be described by the line,

“The situation is critical, but it’s not serious”.

Will Janet Yellen do nothing and leave rates as they are? Will she raise them, so she has some gunpowder to fight deflation down the road by cutting rates? Can she even raise the rates?

What outs does Janet Yellen actually have? The US Federal Reserve has 4 outs right now:

- Interest rates go lower

- Interest rates stay the same

- US actually follows the fate of Germany and the interest rate goes negative

- Interest rates rise

Either way you look at the cards Janet Yellen is playing with, her hand is weak.

The first two outs would show that the economy is slowing and eventually the pushing of the risk curve will implode somewhere and a bubble will pop…deflationary event. QE4 sound familiar?

Long term, this is very bad for US pensions as there are millions who would be in big trouble. Why? With such low interest rates, how would the pension funds be able to earn enough money to meet the payments for all the retirees depending on the system?

I don’t see US rates going negative in the near term. But I have learned long ago to never say never. If the rates went negative in the US, expect the bubble of all bubble in equities and real-estate in the US markets, as the investor will have no place to store his cash safely.

If Janet Yellen were to raise interest rates, the US bubble would pop much quicker than most expect, and major deflation would bring the US economy much hardship.

Even with its negatives, the most likely outcome is Janet Yellen does nothing, and leaves rates as they are. Why?

Run USD Run

Even though the USD has increased in value relative to other currencies, another way of looking at this situation is that the USD has been revaluing itself, while all the other currencies are staying within relative range of one another.

So, if the USD revalues and strengthens in the near term relative to its peer group, the Yuan will have to eventually unpeg itself from the USD, as China is currently pricing itself out of the global trade. Eventually this will lead to further revaluation for the USD—unless of course, the emerging markets get the stimulus they need in the near term from either the new BRICs bank, US QE4, China’s own QE policy or any combination of the above to attract the capital to keep their economies going.

Mirage in the Markets

In the last two years, US corporations issued over 50% more debt than in 2006 and 2007. Remember, in a deflation, debt is bad.

But, it’s the quality of that debt that is really alarming. In 2006 and 2007, only 28% of the $700 Billion in US corporate debt was B-rated or lower. In 2013 and 2014, 71% of the $1.1 Trillion in US corporate debt is B-rated or lower.

If this isn’t a wakeup call, I don’t know what is.

US Corporate Balance Sheet

Another alarm should be sounded by the US corporate balance sheet as a whole. If we were to put all the US public corporations into a holdco.—let’s call it USA Inc. for simplicity—in 2014, USA Inc. would have earnings of $1.1 Trillion. Cash flow would be about $2.5 Trillion. $1.7 Trillion would be spent on business and equipment and $700 Billion paid out in dividends, for a total of $2.4 Trillion in costs. Yet USA Inc. debt increased by $600 Billion last year.

Almost all of the $2.5 Trillion in operating cash flow was spent on dividends, business and equipment, and USA Inc. debt increased by $600 Billion last year (let’s not forget about $1.4 Trillion in depreciation).

So, the $560 Billion USA Inc. spent in share buybacks, was mostly financed by debt.

This is ugly.

Even though the debt increased significantly on the books and the book value of USA Inc. had no growth, everyone was happy, because the share price of USA Inc. kept rising.

But of course, we know that the fundamentals will eventually matter, and the smart money is starting to take their chips and go home. When the music stops, there will be some tragic losses in this one.

The Federal Reserve and the Oil Patch

If the Fed doesn’t raise interest rates, which I expect it won’t, oil production will continue in the US oil patch and the debt will implode many of the leveraged high cost producers in the next 24 months. It may take a lot longer than we all want or expect it to, because of the low interest rate in the current market. But in the end mathematics doesn’t lie.

Because of the Federal Reserve’s loose standards the US oil patch has been lent money from investors chasing yield. It’s going to be horrible for many of those oil investors.

Corporate America has benefited from the loose money also, and I don’t think its fate will be any different.

Eventually one of the bubbles will pop, which will have a ripple effect and lead to unintended consequences. Remember, a bubble popping is a deflationary event.

How to Protect Yourself

Stick to sound, long term, proven investing techniques. Stay unleveraged and avoid debt. Debt is a killer in a deflation. Debt is ok during inflation, but awful during deflation. The Fed is doing everything it can to fight deflation. Because other countries are devaluing their currencies, the most likely outcome, or the most probable hand Janet Yellen will play, will be doing nothing. Right now, the Fed doesn’t have to pony up an ante. Frankly, it’s the best hand the Federal Reserve has to play.

Zero interest rates cannot last forever, so be sound. Because of the lack of discipline, pushing out the risk curve will cause some companies, even in the zero interest rate environment, to default and implode. There will be more than one. It could be a foreign bank that defaults or a major oil company that sets off the domino impact of implosion like in 1907.

A key item to watch out for is the yield curve, because if it goes negative, and/or oil drops below USD$40/bbl for more than a quarter, watch out below. This will confirm the advent of a deflation that could rival the Great Depression.

Deflations historically have not been solved solely by inflation. It’s a misconception that the cure to the virus called deflation is a dose of medicinal inflation. Not true. Historically (and ominously), a major war has been mixed with inflation in the vaccine to counter deflation.