Editor’s note: In this week’s edition of Katusa’s Investment Insights, our new Special Situations analyst Mike Chang and Marin look at a very interesting area of the venture capital world – marijuana. It’s a multi-billion-dollar sector enjoying huge amounts of new capital flows. Of course, what is enjoying huge capital flows also offers huge opportunity for speculators.

In early 2014, a tiny Canadian company raised money from investors with a wild idea. It planned to be one of the world’s largest growers and sellers of legal marijuana.

These days, “weed stocks” are hugely popular with investors. However, this company formed way before the sector became popular… and before many places in North America actually legalized weed. It was a weed stock before weed stocks were cool.

My good friend and colleague, the brilliant business mind Pat DiCapo, invited me to a private meeting about the idea he had for this company. I really liked its business plan and the management seemed smart, so I became one of its early very large shareholders.

I still laugh about that back then, when, my devout Catholic Italian in-laws asked me what I was working on during a family get together (you know the kind I am talking about, 40 Italians around a big table all eating insane amounts of food) and my answer was, “Nonna, I am in the marijuana business. I am now a drug dealer, like in the movies.” The family’s collective reaction was priceless.

Their reaction was priceless.

Today, this once very small, very speculative company is one of the world’s largest growers and sellers of marijuana. It’s also one of the world’s hottest stocks. This company – now called Canopy Growth Corp. – commands a huge $8 billion market valuation… and its shares have appreciated more than 14-fold in the past two years.

I have to confess: Although I saw huge long-term potential in the marijuana industry, I didn’t hold my Canopy Growth shares for the whole run higher. I sold my shares after making almost a ten bagger. At the time, I wanted to direct the capital into some other very large opportunities and my wife and I were building our dream house. And, my Italian in-laws were happy that I got out of the “drug business.”

Looking back I had to do what I did. I left a firm where I was at for a decade, took the Vancouver branch as my own and had to personally guarantee their salaries and the offices expenses. Not to mention I had no revenue coming in, I also had to buy out one of my partners in a fund and at the time I was personally the lead order in the Northern Dynasty private placements during the restructuring of the board in late 2015. Not to mention my wife and I were building our dream house and our second child was on the way. It all worked out well as I locked in +1,000 gains on Northern Dynasty and my office has doubled in size since then. And my Italian in-laws are happy I am no longer in the “marijuana and drug business. Lol” However, I believe the marijuana industry has tremendous growth ahead of it. Since this area is very hot with the public, I believe it will offer tremendous speculative opportunities as well. Here’s how I see things in the weed industry right now…

America’s New Cash Crop

By now, you’ve surely heard the big picture case for investing in the marijuana industry. Laws related to marijuana consumption and production are being relaxed… with some U.S. states making recreational weed use legal. Now, the once-cooped up marijuana industry is poised for huge growth… much like the alcohol industry was after Prohibition ended in 1933.

This is a story that shady stock promoters, bankers, and brokers can use to get the public excited to invest in overvalued stocks and outright bad deals. However, there’s no denying that there is huge, legitimate growth ahead for weed.

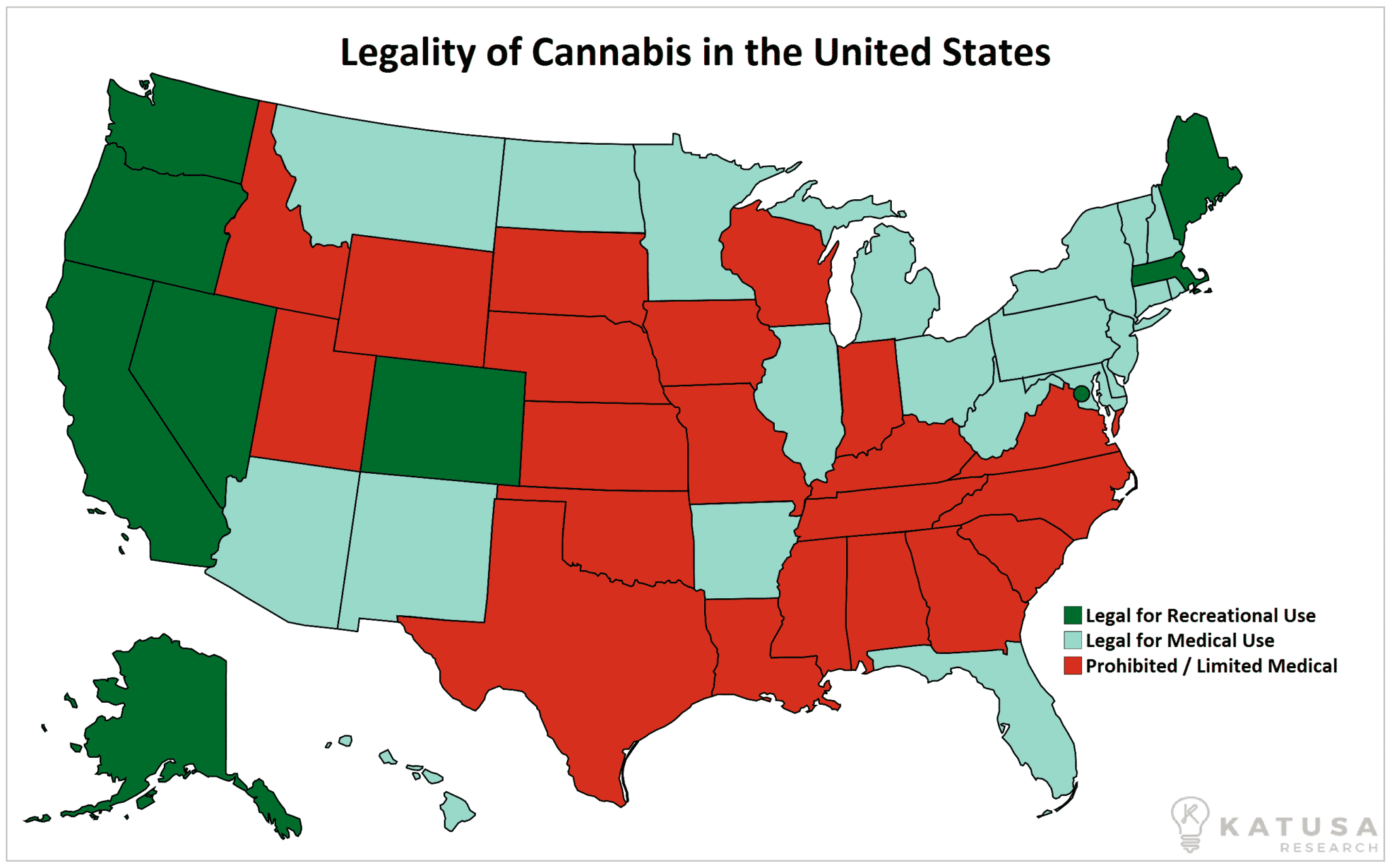

Here’s the breakdown of which U.S. states have legalized weed and which are in the process of it. In the dark green states, weed is legal for medical and recreational use. In the light green states, weed is legal for just medical use. In the red states, weed is prohibited or allowed for limited medical use.

Like it or hate it, marijuana’s popularity is undeniable.

According to a survey conducted jointly by Yahoo News and Marist University in the United States last year, 22% of adults – some 55 million people – reported the use of marijuana at least once in the past 12 months. Of that set, over 60% or people (about 35 million adults) reported using marijuana on at least a monthly basis.

This puts marijuana on the same standing as tobacco as far as usage goes – the CDC estimated that there were 36.5 million cigarette smokers in the U.S. population in 2015.

Marijuana users are often vilified as poisoning their minds. Compare this with tobacco, which is in contrast considered “cool” and glorified in movies.

And while I wouldn’t be caught dead doing either, the argument can also be made that marijuana actually has less harmful long-term effects than nicotine does. And then there’s marijuana’s legitimate medical applications as a pain reliever.

Taking that into consideration, it should make sense that 8 of the 50 states plus the District of Columbia have already fully legalized marijuana for recreational use, while another 22 permit its use for medical purposes. In the remaining states, cannabinoid products remain outright illegal in a small number, while the rest allow low-THC content medical extracts.

With all that said, it should come as no surprise that the weed industry has enjoyed huge growth over the last few years. Though overshadowed by Bitcoin’s explosive performance in recent times, marijuana has generated significant investor interest, becoming a $6.6 billion dollar industry in 2016. Of this amount, 71% belonged to the medical marijuana market, though this figure has likely already greatly changed since then as four of the eight states with legalized recreational-use marijuana had not yet implemented their new regulation as of 2016.

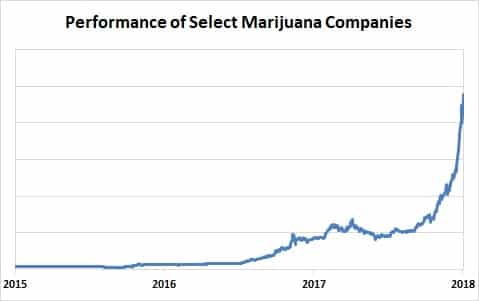

Below is a chart that shows the price performance of a custom weed stock index my team and I have created. As you can see, these stocks have soared.

There are still many positive catalysts for future growth in the marijuana market.

Between the numerous U.S. states that will be looking to legalize in the coming months like Vermont and New Jersey, and full legalization of marijuana coming to Canada at the federal level later this summer, there is still plenty of room for smart investors and entrepreneurs to make some green from green.

Some projections call for the marijuana industry to quadruple in the next decade, and there will be lots of opportunities along the way.

The challenge is finding the right vehicle…

A Market as High as Its Consumers

Much like its similarly much-hyped sibling Bitcoin, the marijuana sector has enjoyed tremendous publicity in the stock market. Valuations are through the roof, and even though the outlook for the sector on the whole is very positive, an overpriced stock is an overpriced stock.

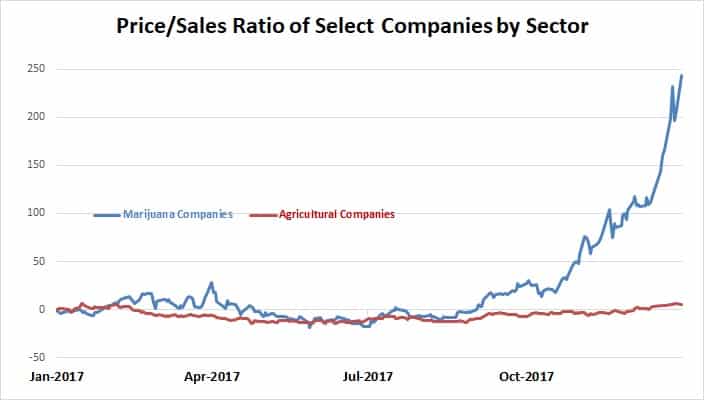

We look at the Price/Sales Ratio here since all of the marijuana companies are still pursuing aggressive growth and hence have minimal earnings. As you can see, compared to a sample peer group selected from the agricultural sector, the ratios for marijuana companies have gone out of whack.

This is similar to the situation with Bitcoin and cryptocurrency companies, though I wouldn’t use the word “mania” to describe the marijuana market like I would the Bitcoin market, given that marijuana companies produce tangible products that are very much in demand.

That said, patience and skepticism is called for.

Now Or Never?

The weed sector is just past the stealth phase of a bull market where the fastest triple-digit gains are made. The wall of worry, where rogue regulation and black swans could make investors think twice about the sector, is next.

That said, the global weed market is valued at around $7.7 billion, with a projected increase to $22 billion by 2020.

You can see in the chart below that sales steadily increased as legislation began to become a bit looser, and now that marijuana is legal in a handful of states, profits are about to skyrocket.

Source: Forbes

Despite it’s nearly 60% compound annual growth rate, that doesn’t mean there aren’t significant fluctuations in the market that can dramatically impact your bottom line.

Remember, any investment should be considered very carefully and with marijuana stocks, it’s often best to take a long-term approach.

Where’s Marin Putting His Money?

With weed stocks soaring, it can be very tempting to buy anything at any price right now…. And hope the sector’s momentum drives up the value of your shares. However, it’s important to remember that at the end of the day, a company’s fundamentals will be what shines through after momentum capital finds another target.

I don’t chase trends and price action. That’s not my style.

Be careful of buying bunk. Yes, bunk is a marijuana term. I’ve never smoked weed. But growing up on the east side of town, you pick up the street lingo quickly. Bunk was a term for shit weed.

Be careful of the bunk publicly traded marijuana companies, and guess what—most of what is listed and free trading is all bunk.

Though there are a number of companies in the marijuana space that do have their game plan down and are executing well (such as Canopy), many of these same companies are also trading well above their intrinsic value. That’s not to say they won’t go higher, but my caution indicators are flashing.

If this sector stages a meaningful correction that wrings a lot of optimism from the sector, I’ll be looking to invest in the best companies with the best management teams at the best prices.

The marijuana sector is just one of many that will be under the watchful eye of the new Special Situations team that I’ve created as an added bonus to select issues of Katusa’s Resource Opportunities.

We’ll be leaving no stoners unturned in our search to bring you the best deals available in the markets.

I’m not diverting from resources. I’ve built my net worth by investing in the right management teams, at the right stage and at the right time in this lucrative sector. There is no rush quite like a gold rush (although Bitcoin is sure coming close).

I work for my subscribers. So, if you’re interested in what we are doing with our Special Situations work, please drop me a line at katusa@katusaresearch.com with the words “Special Situations” included in the subject line… and let me know what you think. And I promise one thing, you won’t get any bunk at Katusa Research.

Regards,

Marin

P.S. On January 21st and 22nd, Katusa Research is co-producing the 2018 Vancouver Resource Investment Conference with Cambridge House. This year’s event will be a who’s who of industry titans joining me on the stage, including Frank Giustra, Rick Rule, Doug Casey, Frank Holmes, Jim Rickards, Frank Curzio and Teeka Tiwari. It is a chance for novice and seasoned investors alike to join over 7,000 others in search of the best investment opportunities in the junior markets. For complimentary tickets, please click here.