Long-time readers and subscribers know I like to keep a sharp eye on one very important indicator.

This indicator has the “pay attention to me” alarm bells that include both its psychological and analytical merits.

In mathematics, the inflection point is where the curve goes from concave down to concave up (also goes vice-versa).

The uranium market has just reached its inflection point and is moving up.

Let me explain why.

First off, fortunes can be made and lost at inflection points.

The inflection point represents the change in the balance of power between buyers and sellers in a given market. By recognizing an inflection point early, you can position yourself before the stampede of unsophisticated generalist investors.

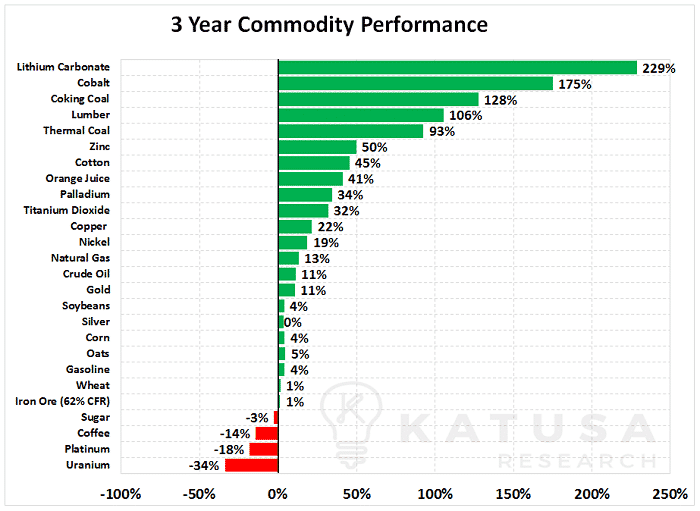

Uranium has been one of the most hated investment classes for the past few years, and for good reason. Surplus inventories caused uranium prices to crash 35% over the past 3 years. This kind of bad news made uranium good for the last place in the Katusa Commodity Monitor as shown below.

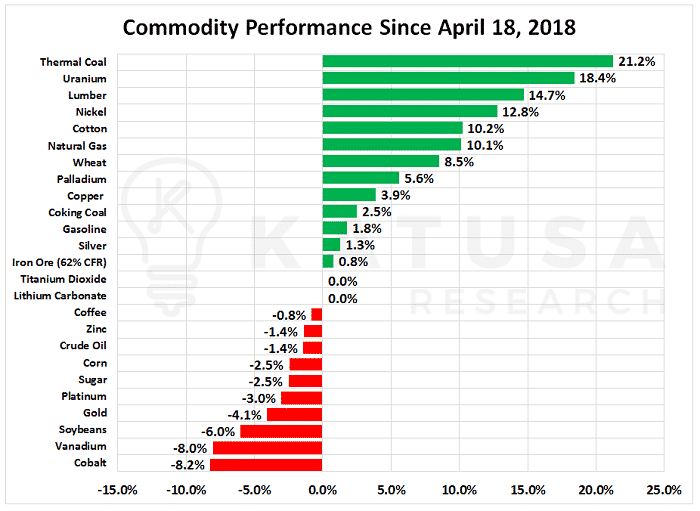

Since mid-April, uranium has picked up significant momentum and is up 18%. A chart showing the metal’s recent performance over the past 2 months is below (yes, uranium is a metal).

I find it interesting that uranium focused companies are still playing catch up to the commodity price. Over the same two-month period, uranium companies are up on average less than 10%. Below is a chart which shows the performance of physical uranium against the Katusa Uranium Index, which is a basket of uranium focused companies at development and production stages.

Is Uranium Back En Vogue?

Earlier this week, The World Nuclear Fuel Market (WNFM) Annual Meeting just finished. It’s one of the most important uranium conferences in the world and every major utility and uranium producer is there. I was invited to give the keynote address at the WNFM in Paris in 2015.

One of the big talking points of this year’s conference was the spot market.

In less than two weeks, the spot price for uranium moved from $22 a pound up to $23.50 per pound. That’s a rise of 6.8%. This may not sound like a lot, but it certainly is when you understand the context of the rise in price.

What drove the price increase?

A single buyer came in and bought 600,000 pounds of uranium (which represents less than $14 million worth of buying). This purchaser bought less than 0.5% of annual demand and pushed the price up almost 7%.

That’s a big deal. Here’s why…

The average nuclear reactor consumes about 375,500 pounds of uranium every year. Think about what would happen if a utility company like Exelon in the United States tried to lock in a year’s worth of production for its 23 nuclear reactors. The price of uranium would go through the roof.

It’s not surprising the market is tightening. The world’s largest producer is Kazakhstan’s state-owned producer, KazAtomProm. It makes up 40% of global primary uranium production.

KazAtomProm has just agreed to a deal with a Special Purpose Vehicle (SPV) where the latter will buy up to 25% of their annual uranium production. The concept is to sell uranium to the holding company (i.e. the SPV) which removes any overhang from the spot market the Kazakh uranium production would normally have. We believe the SPV that struck a deal with KazAtomProm will have much more demand than the market expects. So that large purchase could be the tip of the iceberg – the inflection point if you will.

If you think about it, the deal with KazAtomProm is a self-fulling prophecy, meaning the spot price of uranium will go up.

Why?

The world’s largest uranium producer does not want to go into the spot market to buy uranium and risk having the “traders” mess with the bid/ask spreads. With this deal, KazAtomProm is taking 25% of their annual production offline (which is 10% of global production). This means that specific allocation of produced uranium is not available for sale in the spot market.

This move caused two things to happen:

One, it caught the utilities off guard.

And two, it’s freaking them out.

Over the past 7 years, the uranium buyers have become complacent, and for good reason. There was a lot more uranium available than demand, hence the 35% drop over the last 3 years.

If we are at the inflection point, rather than a dead cat bounce, we will need to see more uranium buying coming into the market.

I believe we will see just that. Not just from newly built reactors, but by SPVs. (Remember, SPVs = Special Purpose Vehicles).

One benefit of being a public figure in the resource sector is that I get pitched a lot of deals. Interestingly enough, I have come across quite a few SPVs looking for funding to get into the uranium sector.

These SPVs aren’t run by the old guard of the resource sector. These SPVs are backed by some of the largest titans from Wall Street and the tech sector in Silicon Valley.

Yes, you read that correctly. There is interest in the uranium sector from Silicon Valley venture capitalists. Uranium is about to go prime time.

These SPVs have the ability to make deals to buy large quantities of uranium, finance companies looking to produce, and develop and explore for uranium.

I am told by bankers that the SPV that cut the deal with KazAtomProm will have no problem raising their desired amount of capital.

And I believe it.

So, what does this all mean for the uranium sector?

There will be less uranium available on the spot market because of the deal to remove 10% of the global uranium supply by the Kazakhs.

Prudent investors need to think about the relevance of such a move. For example, imagine if all of Russia or Saudi Arabia’s oil production went offline and wasn’t available for sale in the spot market. We all agree the price of oil would surge. That is exactly what just happened in the uranium market.

Numerous SPVs are being created to take advantage of the historic lows in uranium and the associated companies.

All companies with uranium in their name have bounced off their lows. Rising tides lift all boats. But only the strong ships can navigate the choppy waters ahead.

After all inflection points, the good, the bad, and the ugly all rise and catch a bid. Just like in all cycles, a lot of money will be wasted on bad projects run by bad management teams. Please do your diligence and don’t get caught on the wrong side of these projects and companies.

You want to focus on companies with solid management teams that have skin in the game. These are the proven warriors and survivors who have remained in the uranium sector through the long bear market. Also, avoid any uranium projects in AK47 nations.

Trump is Pro-Nuclear

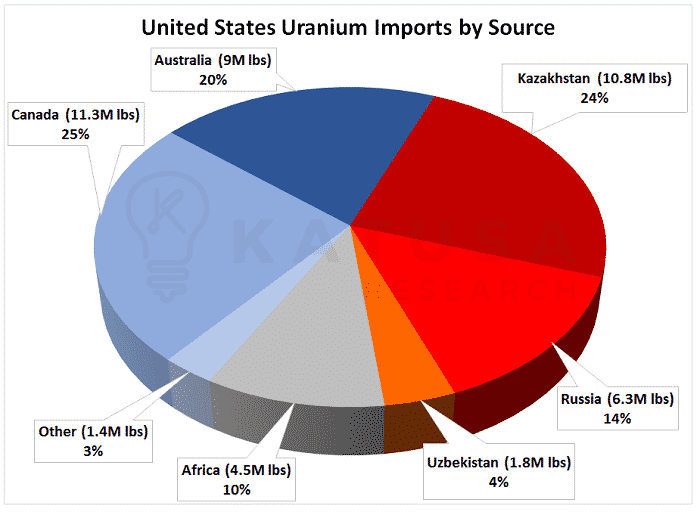

For better or worse, the U.S. President has made national security and trade deficits as the focal point of his presidency. It is ironic that, to date, he hasn’t made a step towards securing the U.S. electricity market. Nuclear power makes up 20% of United States energy generation. Yet the United States imports 89% of its uranium from outside sources. Below is a chart which shows United States imports by source.

You’ll see the Former Soviet Union supplies 42% of American uranium imports. If I were an American President hell-bent on national security, this is not what I would consider an ideal situation for the preservation of the baseload power grid.

The simple solution is one that Trump has used quite often lately. Put a tariff on imported uranium equal to the price of uranium so that the U.S. domestic producers will produce enough to meet domestic demand.

In the 1960’s, domestic U.S. production was touching 38 million pounds and met all domestic requirements. That was achieved with conventional uranium mining and before ISR (In Situ Recovery – a modern method of uranium extraction) was invented and implemented. ISR is significantly quicker to build and much cheaper to produce than conventional mining methods.

But could domestic U.S. uranium production meet domestic demand today?

The short answer is, not right away. And that is a big opportunity for those facilities that are permitted and ready for production. My calculations show that at a uranium price of $80/pound, it would take the U.S. 15 years to ramp production up to meet domestic uranium demand. And this is subject to all projects getting permitted—which is a big if.

In Trump speak, he would create “Great American Jobs for Great American People”. He would secure the American energy grid from “the bad guys” and he would decrease the trade deficit. It’s a public relations win-win-win for Trump and his supporters.

Is this a blip, or the beginning of a new bull market? Time will tell, but I believe we just crossed an inflection point.

I have traveled to every major exploration and development uranium operation in the world. I know all the real players in the industry, and truth be told, there aren’t that many you need to pay attention to. Perhaps that’s one benefit of a long bear market – only the true diehards and most viable of projects remain.

Right now, I am positioning myself and my subscribers into what I believe are the best speculations in the uranium sector. And even better, I’m working on one speculation that has never had a research report published on it – ever.

Do your portfolio a favor and read my research reports and benefit from my hard work and 15 years of direct experience in the sector.

Regards,

Marin Katusa

P.S. I’ve toured many major uranium facilities and early-stage projects. Katusa Research subscribers get the benefit of seeing these projects first hand with my world-class film crew. No other research service brings subscribers to the frontlines of a company’s assets that includes exclusive interviews with company executives. To see the private tour of the world’s largest uranium mill and to find out my two cornerstone uranium investments, consider becoming a subscriber to Katusa’s Resource Opportunities.