“Hit the bid.”

“There isn’t one!”

These words are all too familiar to anyone that invests (or speculates) money in speculative high risk junior companies.

And this is especially true for anyone that puts money to work in companies listed on the Toronto Venture Exchange (TSX-V).

This exchange is home to the serial start-up entrepreneurs looking to get their next big resource, tech, or cannabis company off the ground.

One difficulty with early stage companies is that they are not well known out of the gates. These are the companies you hear about in an internet chat room, from your brother-in-law, or from your barber.

It’s the hot tip of a company that will shoot to the moon once it gets a permit, approval, or a grant. Or even if it hits a drill hole or puts the dog collar supply chain on the blockchain.

A second issue comes when that particular market sector cools down significantly. The momentum and interest evaporates, and the buyers along with it.

When the buyers run out, there is no ‘bid’ in the stock price. There’s only a lineup of sellers on the ‘ask’.

When a stock trades very little or no volume, the stock becomes ‘illiquid’. An illiquid stock can trap a shareholder for days, months, or even years before you can sell your position.

This is a new phenomenon for the many blockchain, crypto, and marijuana investors new to the TSX-V.

Welcome to the TSX-V. Where your dreams are shattered and your worst nightmare is the reality most of the time.

Long time resource speculators have gone through a few cycles of boom and bust on the TSX-V.

Whether its uranium, gold, rare-earths, blockchain or cannabis related companies, the pain is the same.

And on a side note…

After every major bubble bursts, expect more regulation that go to the exchange and regulators. (Read: higher costs for companies to stay listed).

But there is one constant regardless of the sector: only the best will survive.

Junior Stocks Can Become Illiquid Fast

Seasoned gold, silver, and uranium investors are no strangers to illiquid companies and markets.

Once the company or sector falls out of favor, or didn’t have any favor to begin with, the stock chart will look choppy like this…

Charts that look like this can provide fast 10-50% returns for shareholders that are able to sell into volume quickly. But there could be a line of orders waiting to do so. And this is what you deal with when a stock is illiquid. You can see that the blue line doesn’t connect because the stock did not trade on those days. There was simply zero volume.

With any rush of buyers, a stock can rise significantly.

With any rush of sellers, a stock can drop drastically.

And the latest sectors experiencing a liquidity drop are the cannabis, crypto and blockchain companies.

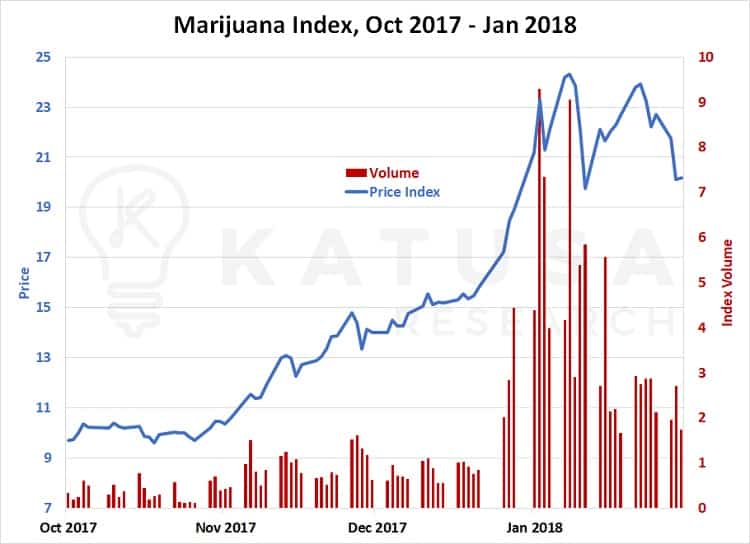

You can see from the chart below that the marijuana company index surged in late 2017 through to early 2018. And those stocks had solid trading activity (the volume).

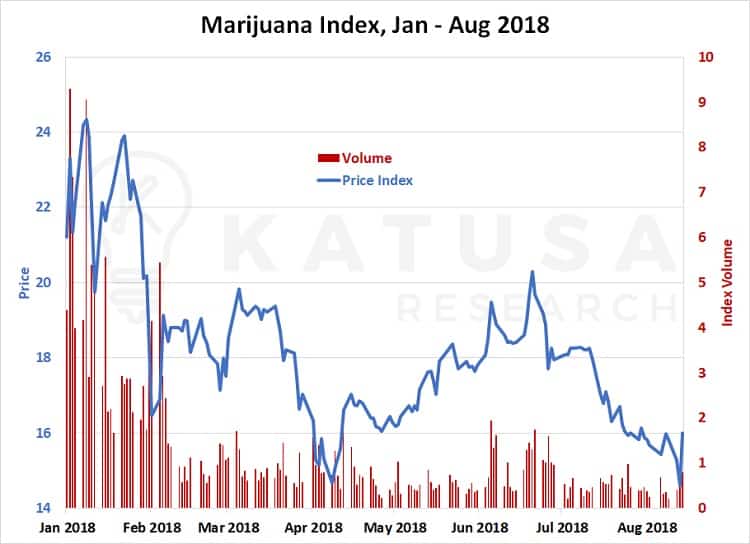

As the first half of 2018 wrapped up, those same companies saw a big drop in trading volume. With that drop in volume has come a drop in price…

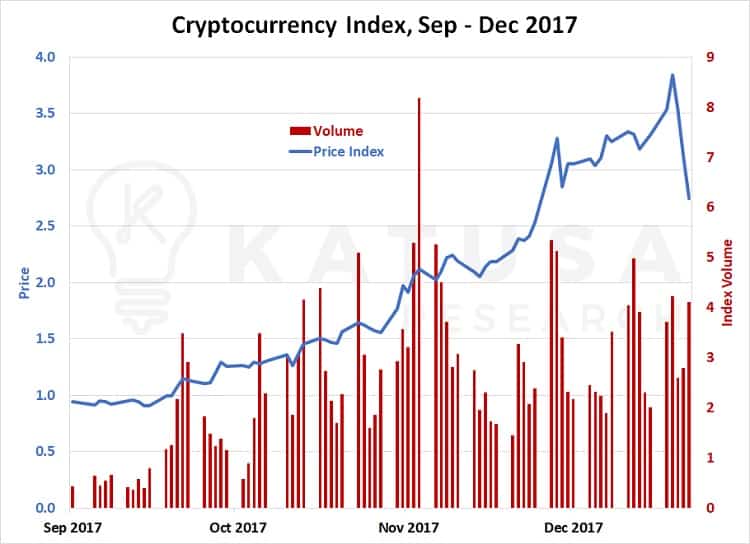

Things were no different for crypto companies.

In 2017, they pulled in over CAD$300 million in financings on the Canadian markets alone.

These companies delivered massive returns to early investors that bought in the market and to those that had their hold periods expire early enough. (The hold period is the length of time that you can’t sell shares into the market when you participated in a private placement).

In the chart below, you can see the Katusa Crypto Stock index went bananas at the end of 2017. And the trading volume was through the roof.

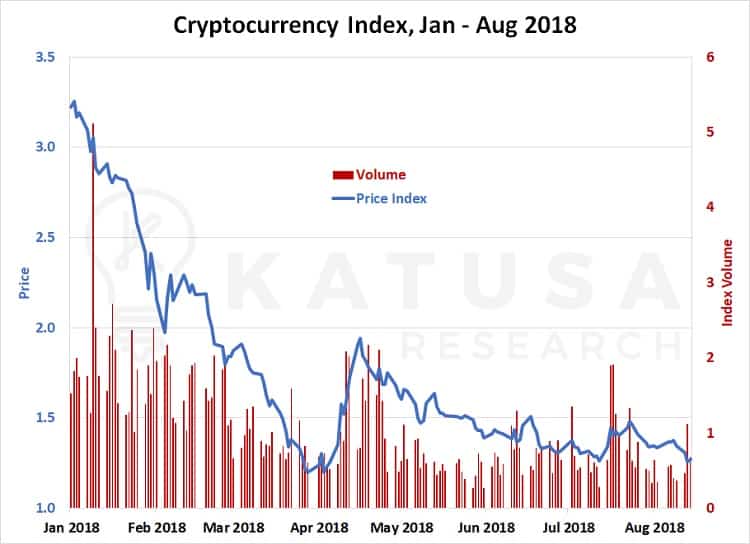

The first few months of 2018 saw a major dip in both price and trading volume…

What you’re seeing in the above charts is the exiting flow of capital.

A tsunami of capital flowed into the cannabis and crypto sectors in 2017. And in 2018, the capital is exiting stage right.

It is very important to watch capital flow in these markets because it’s true that a rising tide lifts all boats. But after the capital leaves, only the strong companies will stay afloat.

Thus far in 2018, funding for crypto and marijuana ventures has dropped significantly. The management teams behind the scenes say that funding has all but evaporated.

The big mutual and hedge funds I talked to that were raising hundreds of millions of dollars and injecting them into any such companies in fall 2017 have dried up. Managers were fired. And those exact funds are now experiencing major redemptions by investors.

Therefore, expect more pain ahead. There is no more capital being allocated to the fly-by-nighters.

Gone are the days of easy money where a no-name company could switch its name to “Bill’s Blockchain” and raise $10 million in 24 hours.

And those funds are underwater. By quite a bit.

Now that those exact major funds are experiencing fund redemptions – you don’t want to be left holding the bag with shares of companies that don’t have revenue or any future.

With Little Liquidity – Why Invest in Juniors?

Juniors have a lot less analyst coverage than large caps.

A $200 billion giant could have over 30 different professional analysts covering the stock. They will analyze the company inside and out. Their research will be read by the world’s largest investment managers.

It’s not uncommon for a junior to have ZERO professional analysts covering it. The management at some juniors can go a whole year without fielding a call from a professional analyst.

To me this is a great, great thing.

The lack of widely disseminated information about juniors allows us to get a big “information edge” in this market.

It means we can find pricing inefficiencies and uncovered opportunities that can explode higher very quick. The junior market isn’t swarming with professionals looking under every rock. That is if you know how to analyze this information.

You can think of it like this: would you rather take your child on an Easter egg hunt with 100 other kids or with 5 other kids, of which 3 don’t walk yet and 1 doesn’t want to leave his mother’s side?

Your child will find a lot more eggs competing against those 5 kids.

And the prize will be a lot bigger.

If you know what to look for, who to follow and when to buy, your portfolio will also benefit from the TSX-Venture discount in a bear market. Granted, 98% of the companies are worthless and run by useless management.

But the 2% can make you very, very rich.

Regards,

Marin

P.S. The way of the Alligator is the exact style of investing during the current market conditions. I cannot emphasize this strategy enough. There are two companies we have published on, both dividend players that are well run, well financed and I plan on investing millions of dollars personally in both—when my target price gets hit.

I published this report many months ago, and I believe we are within a couple of months before my “Way of the Alligator” proves out to be a big winner and gets us cheap stock on both companies. To learn the ticker symbols of these companies, consider becoming a subscriber to my premier research service, Katusa’s Resource Opportunities by clicking here.