Two Americans sat in a plush office on the 27th floor of a tower in Hong Kong.

Their eyes were fixated on the live action coming across their TV screens.

Across the street, a horse race was thundering to a dramatic finish. But seated in their plush office chairs, Bill Benter and Paul Coladonato were only interested in the lines displayed on three computer monitors.

Those lines showed every bet they had made on the race.

The citizens of Hong Kong bet more on horse racing than anyone else on Earth.

And that particular race, on November 6, 2001, was a historic one. Rollovers from six previous races in which no one had won the jackpot had resulted in a larger pot than ever before.

More than 1 million people placed bets.

For 16 years, two of those bettors had fastidiously studied every factor that could affect a horse race: from the temperature on race day to what the horse ate for breakfast to wind speed. They surrounded themselves with people who were experts in their field – developers, journalists, analysts, and other bettors.

Together, they had carefully crafted a horse racing betting algorithm based on about two dozen factors.

Now, they were all-in on the race of a lifetime.

“We hit it.”

The instant the race ended, the computer-executed a program that determined which bets had won. 35 bets had perfectly called the finishers in two of the three races, yielding a sizable cash return.

And one bet had called the top three finishers in all three races, netting the two men the grand prize: $16 million.

They would never claim the winnings. After all, in the past decade, they had netted over $1 billion exploiting the Hong Kong horse race betting market, simply by making calculated and educated guesses.

Over the past month, I went deep into my data and analysis bunker to do the same.

I leaned on my experience, my Rolodex and my analysts. Together, we set up shop to make educated guesses on who will buy whom in the resource space.

One of the exercises we did was to breakdown the ownership stakes of major resource companies.

Who do the Gold Majors Currently own Shares In?

It’s common for large gold companies to buy pieces of smaller producers or developers before buying the whole company.

Buying a small stake in a company acts as a blocker, dissuading other suitors.

In the next few tables, you’ll see a summary of which smaller gold companies the majors are investing in. And then I’ll provide my raw take.

Goldcorp:

Can David Garofalo even buy out another junior?

Under his watch, Goldcorp has been quite active investing in the junior exploration sector as seen in the table above. In addition to the list above, Goldcorp bought out both Exeter ($247 Million) and Kaminak ($520 Million) under Garofalo’s leadership.

Garofalo thus far has failed to move Goldcorp’s needle. His next move will definitely need to move Goldcorp’s needle and buying a non-producer doesn’t move it. I do not see Goldcorp buying 100 percent of any company on the list above any time soon. The company is on the hunt for a project that will move the needle for shareholders.

There have been many rumours floating around that Goldcorp is looking at making a move at Detour.

If I was David Garofalo, I would go after Clive Johnson’s B2 Gold (BTO:TSX).

A company like B2 Gold would move the needle for Goldcorp and the assets fit into Goldcorp’s strengths.

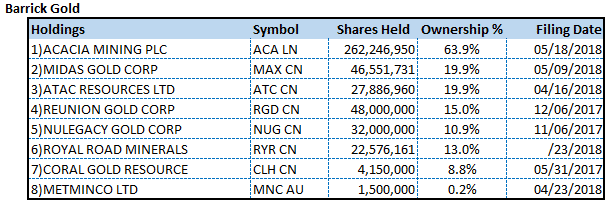

Barrick Gold (ABX:TSX)

An obvious takeout candidate for Barrick is Midas Gold (MAX:TSX-V). But that won’t happen until Midas’s permit is close to being issued. Midas CEO Stephen Quin and his team have a winner on their hands. I believe Midas will be bought out late 2019 or early 2020 by Barrick.

Open Disclosure: I have been a major shareholder of Midas twice in the last 8 years. I am no longer a shareholder.

Barrick has their hands full until the merger with Randgold is integrated. Until then, I don’t see any juniors being bought by the new Barrick.

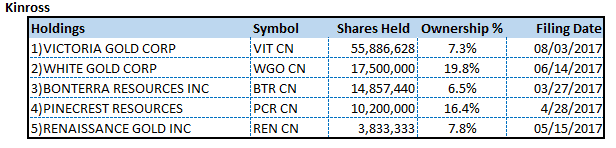

Kinross Gold (K:TSX)

There are a lot of rumours that Victoria Gold (VIT:TSX-V) is close to being bought out.

Kinross is still feeling the effects of the failed Red Back Mining $7 Billion dollar takeout. Again, B2 Gold would be a great addition to Kinross but I just don’t think Kinross can afford B2. That is unless B2 CEO Clive Johnson is willing to run the new Kinross. Now there is an interesting scoop for you.

Newmont Mining (NEM)

There was a strong rumour floating around that Newmont would be buying out Continental Gold (CNL:TSX). With the horrific and tragic issues that have occurred to the employees of Continental in Colombia, I don’t see Newmont making the move. I just don’t see Newmont buying out 100 percent of Continental as Colombia is not its strength.

On the other hand, the struggling TMAC (TMAC:TSX) is an interesting candidate. I can see an Australian underground miner making a deal with Newmont for their shares in TMAC and making a move for 100% of the company.

I’ve said it in the past and I will say it again, the Pebble project which is owned by Northern Dynasty (NDM:TSX) is a natural fit for Newmont. I know all the political/social issues with Pebble, but that doesn’t change the fact it is a world class asset that’s not owned by a major mining company.

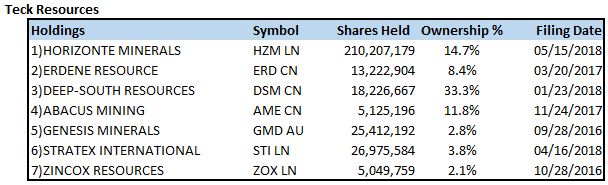

Teck Resources (TECK)

Now that Teck’s completed the build out of Fort Hills with Suncor, (Teck CEO) Don Lindsay can no focus once again on moving the needle.

I don’t see Teck buying out 100 percent of any of the names above.

However, I could see Teck buying out a chunk or all of Nexa (NEXA:TSX). A wealthy family trust owns about ½ of Nexa and the trust will be sellers of the Nexa stock.

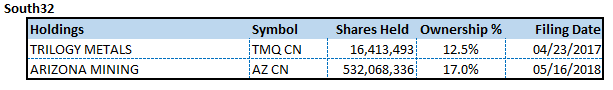

South32 (S32:ASX)

Trilogy (TMQ:TSX) is a very interesting and promising company, and we spent a lot of time looking at this one.

That said, South32 needs to make Arizona Mining (who it acquired in August 2018) a success before they buy out Trilogy.

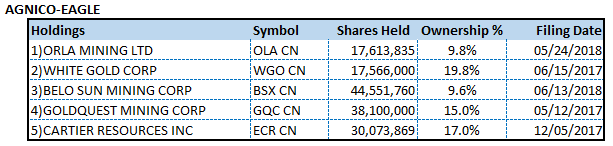

Agnico-Eagle (AEM or AEM:TSX)

I’m convinced Agnico will make a big move. Management are aggressive and have the balance sheet and ability to move quickly.

I wouldn’t be surprised if Agnico and Yamana are talking about doing a joint bid on Detour, which I wrote about before.

Australian Gold Producers may be the most active group consolidating the Canadian listed developers and producers. Note: We have been working on a complete list for our paid subscribers.

Gold Winners and Losers

The gold sector has not had a world class (+5M ounces), sexy gold discovery in a number of years.

The market is desperate for a real substantial gold discovery. Over the past couple of months there have been some notables, but nothing earth shattering.

With so many companies flush with cash, where is the money going?

Below is a chart which shows gold sector exploration budgets compared to annual gold discoveries over 2 million ounces. The red bars show gold discoveries since 1990 (in millions of ounces). The blue bars represent the global gold sector annual exploration budget. As you can see from the chart, the gold sector is spending significant money on exploration – but has little to show for it in the last couple years.

For the past 5 years, roughly $4 billion has been spent on exploration per year. In that same time period, there have only been 10 discoveries, with a total of 59 million ounces discovered.

This may sound like a lot. However, in 2017, the gold sector produced 107 million ounces. So, five years’ worth of exploration – 59 million in discovered ounces – represents only half a year’s worth of production.

Looking at the chart, what can we conclude?

Well, some may think the geologists today are not like the geos of the good old days, even with the new gadgets.

Others will say the low-hanging fruit (gold) has all been found, and it is harder and more expensive to find new gold. Or maybe there are many exploration teams in the sector that should not be allowed to flip burgers at McDonald’s, let alone run an exploration company.

Theories aside, in the non-AK-47 nations, gold is getting a lot harder and more expensive to find.

So with limited new discoveries, I believe the most efficient way to build a gold company is through the acquisition of development stage or underperforming producing assets.

I have invested millions behind this concept directly into only a handful of precious metals companies.

And I have a target of watchlist companies that I will pull the trigger on when tax loss season brings their share prices into my alligator hunting field of view.

Spill the Beans Marin – My #1 and #2 Favorite Gold Stock

There are two gold companies that I kept off the lists above on purposes. I have invested over $10M into my two top gold stocks, and have just purchased another $1.5 million dollars’ worth in the last 15 days.

The larger of the two recently announced a piece of news that put its valuation based on Enterprise Value to Ounce Produced at a market cap 200% higher than it currently trades at.

In 3 to 5 years, subscribers and I will look back at this company and say to ourselves “Wow, that stock was cheap in 2018”.

It is without a doubt my highest conviction gold stock.

The second, much smaller and less known will be bought out by an Australian producer looking to increase their gold production pipeline.

And there’s nothing like using the current gold price weakness to buy positions in your favorite, most undervalued gold companies.

Regards,

Marin

P.S. To learn the name of my two top core gold stock positions, consider becoming a member of my premium research service, Katusa’s Resource Opportunities. For a brief window, you have the opportunity to buy this stock at the same prices as market makers, top brokers and investment bankers.