The Canadian Oil Patch is the most beaten-up and hated-on oil sector in the world.

Over the past few months, the Canadian oil sector has been more volatile than I can remember.

Between Trump tweets, pipeline debacles in Canada and OPEC production decisions… it’s been a treacherous time for oil and gas producers in Canada.

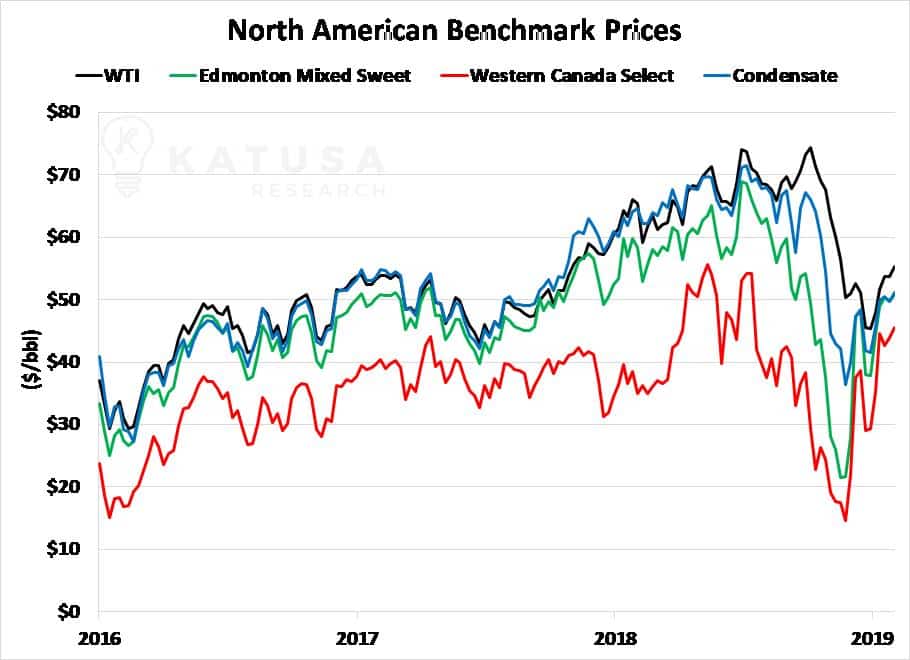

It took oil prices nearly two full years to recover from their January 2016 lows.

And in the span of less than two months, that recovery has been decimated. Especially with the United States benchmark crude oil price dropping below $50 per barrel.

In Canada, the producers gave up on profit as they were practically giving away their production, as prices fell to $20 per barrel.

Below is a chart which shows the price per barrel (USD) of North American crude benchmark oil prices.

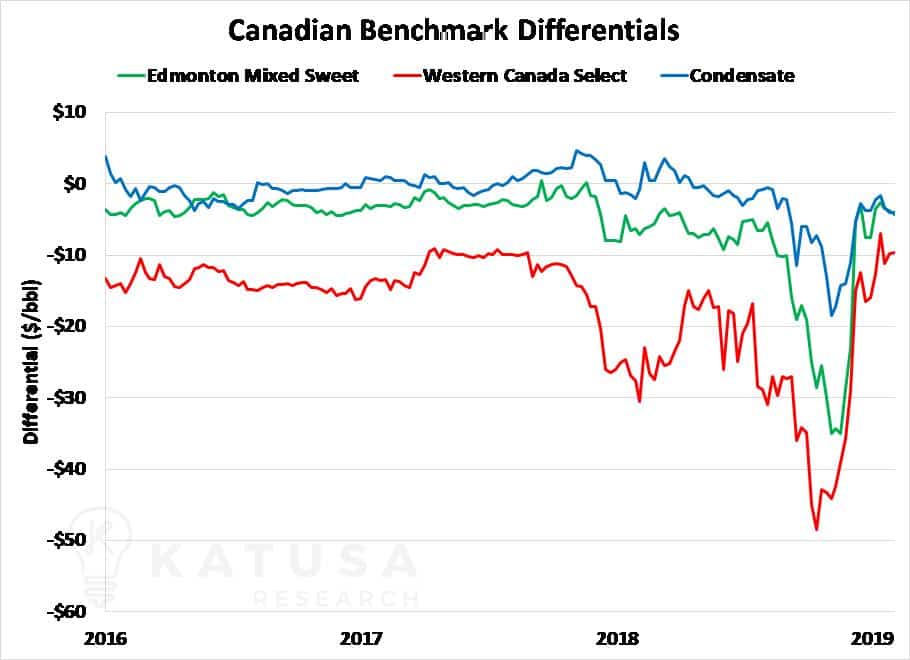

The Canadian oil patch worked through what is known as a “negative differential” for years.

A negative differential is a fancy way of saying that American benchmark oil (WTI) sells for a premium to the Canadian benchmark (known as Edmonton Mixed Sweet).

On a specific gravity and sulphur basis, the two crudes are reasonably similar.

Yet Canada’s oil sells for a huge discount.

The green line in the chart below shows the differential between Canadian benchmark crude oil and WTI for the last three years. It’s substantial.

Why Does Canadian Oil Trade at a Huge Discount?

Canadian oil sells for a big discount for a few simple reasons.

First, Canada produces more oil than it can efficiently refine through its domestic crude oil refineries. In Canada there is less than 2 million barrels per day of refining capacity. For comparison, the United States has over 18 million barrels per day of refining capacity.

Secondly, Canada does not have the pipeline capacity to export crude oil to the United States. Never mind export capacity to the west coast— it’s not happening for many years.

The supply glut could be solved easily if there was enough pipeline capacity to ship the crude to the United States refineries and to the coast to be shipped to Asia. But there is not.

The end result is a large supply glut and a substantial discount in price for Canadian crude oil.

This past fall, Canadian light crude differentials were approaching $40 per barrel.

This means that if American crude oil was selling for $60 per barrel, the light oil in Canada (Edmonton Sweet) was selling for $20 per barrel.

Those with a sharp eye will notice the differentials have narrowed considerably over the last few months. They have gone back to levels not seen in several years.

The reason for this was government intervention.

Recently, The Alberta provincial government has stepped in and ordered a production cut of 325,000 barrels per day. That’s very un-free market of the Canadian Province.

Or one can say very OPEC-ish of Canada.

The government also said they’d buy rail cars to help move crude south to American refineries—how dumb. It’s a band-aid solution instead of a long term, safer solution. Did you expect anything better from the Canadian government?

Normally, government intervention in oil production is only used as a tool by nations that operate State Owned Enterprises (SOE) and OPEC.

It’s one thing to tell government workers to cut production. It’s another to tell a public company with thousands of shareholders that they have to cut production.

That said, something needed to happen. And it was easier to lash out on the shareholders than to hurt the uneducated, unscientific based protestor’s feelings.

Hey, the protestors are working for someone’s agenda—it just isn’t for the best interest of Canadians.

The federal government has been useless at pushing through the Trans Mountain Expansion Pipeline. With that pipeline tied up for the foreseeable future waiting for a National Energy Board decision, there’s little visibility into things improving.

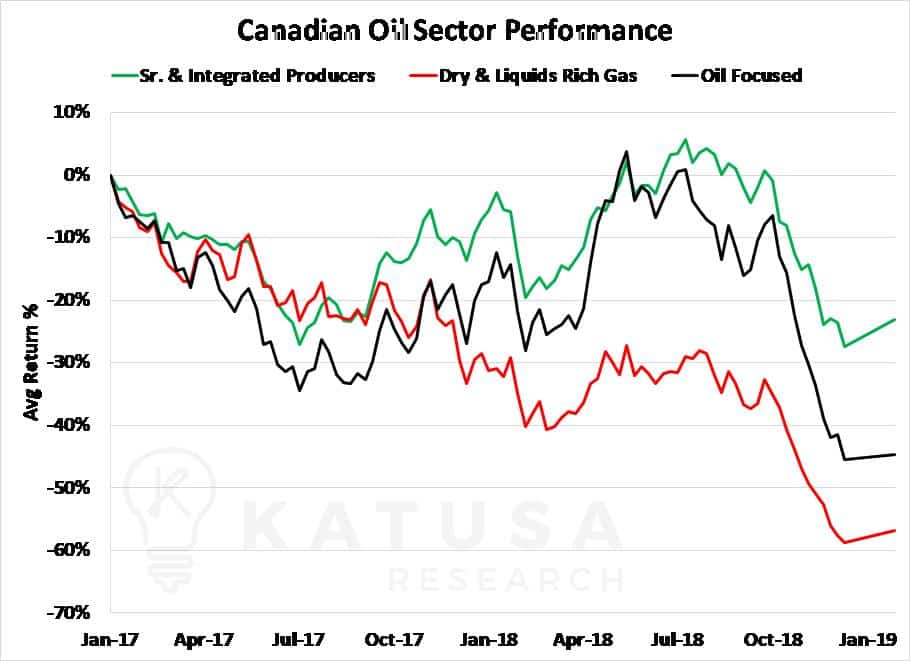

And that has a massive effect on the confidence in the stock price of Canadian oil companies. Below is a chart which shows the two-year performance of Canadian oil and gas producers.

There really has been nowhere to hide…

Now I could provide a dozen more metrics our team has run that show a pattern of increasingly undervalued companies.

You might think it must mean that there’s a whole bunch of great oil and gas companies to load up on, right?

Wrong.

For long-term investors, the Canadian oil sector as a whole is stuck in what I call a “value trap.”

Until oil prices rise significantly or the Canadian Dollar collapses further to the U.S. Dollar. Pipelines won’t be coming to the rescue anytime soon.

A value trap refers to a situation in which a company’s share price has been hammered so that it appears to be cheap – just like in the Canadian oil patch.

But what many unsophisticated investors miss is why the stock is cheap.

Until that reason is eliminated or solved, anyone who invests capital into the company is stuck in a languishing stock. Hence the term “trap”.

If the Canadian government had its act together…

And had gotten a pipeline decision finalized, construction going…

And all looked promising…

I’d be more inclined to say we have broken free from the “trap.”

However, that’s not the case in the Canadian oil patch. We’ve yet to see if Canadian producers will cut production. Nor have we seen the rail cars purchased. And the pipeline situation is still a mess.

Where are the Crazy “Bargains” in the Canadian Oil Sector?

If you could buy a $15,000 Rolex for $5,000 would you?

How much is it actually worth and to who?

The answer is exactly how much someone else is willing to pay for it. And right now, investors are not willing to pay much for Canadian oil stocks.

We have been watching the situation very, very close. We are familiar with many of the operations and teams in the land of maple syrup.

One situation we’re monitoring closely is multibillion dollar market cap companies falling out of favor. They’re falling safes that have yet to hit the floor.

Back in in the July 2017 KRO, I made a bold prediction about the U.S. and Canadian oil patch. Albeit a bit early…

Seven Generations Energy (VII.TO, US ticker SVRGF) is the premier condensate producer in Canada. Condensate is a heavy hydrocarbon chain which is part of the natural gas molecule. These condensates are worth as much or sometimes more than the equivalent amount of oil.

Seven Generations Energy has an enormous acreage position and produced over 150,000 barrels of oil equivalent last quarter. The company completed an initial public offering in the fall of 2014 and has since traded as low as CAD$12 per share and as high as CAD$33 per share.

Right now, shares of Seven Generations are trading at 1-year lows and can be had for CAD$22 per share. I believe the share price hasn’t bottomed out yet. Condensates are priced based off the oil price. In a weak oil market, the market for condensates will be weak…

I will wait on the sidelines as I think the shares will break under CAD$17 per share and then drift lower with time.

Not too long after, Seven Generations stock drifted lower with no end in sight.

But even in the “Value Trap” there is the “Value Trap Bounce”.

A handful of stocks in the Canadian oil sector are looking very ripe for the picking right now.

These are stocks that have potential for quick 50-100% gains in under 2 months. And long term, if oil turns around, these former market darlings could gain 2x or even 5x long term.

But which companies can withstand the “echo” markets?

The echo is the long, drawn out, sideways trading period where only the strong companies survive and thrive.

This is where analytics comes in.

Our research team has looked at all the key metric for companies in the Canadian oil patch.

We then ran them through the ringer using…

- A bearish case, $45 per barrel WTI

- Current prices, $47 per barrel

- A bullish case, $55 per barrel

We wanted to see if the dividends were safe and what the cash flows of the companies were.

And we did just that for our subscribers in our recent issue of Katusa’s Resource Opportunities.

Note: Companies and results are blurred out of respect for our paid subscribers

Out of these 14 companies, there was a few standouts.

And there was one in particular that was head and shoulders above the crowd. It was steadfast enough for a full blown recommendation.

And one that I’m very comfortable having in my portfolio.

Regards,

Marin

P.S. This particular oil company is a producer that’s been in business for over a decade and run by one of the most reputable people in the business. It pays a healthy dividend and has incredible cash flow. To learn the ticker symbol of this company and the price I’m buying at – click here to become a subscriber to Katusa’s Resource Opportunities.