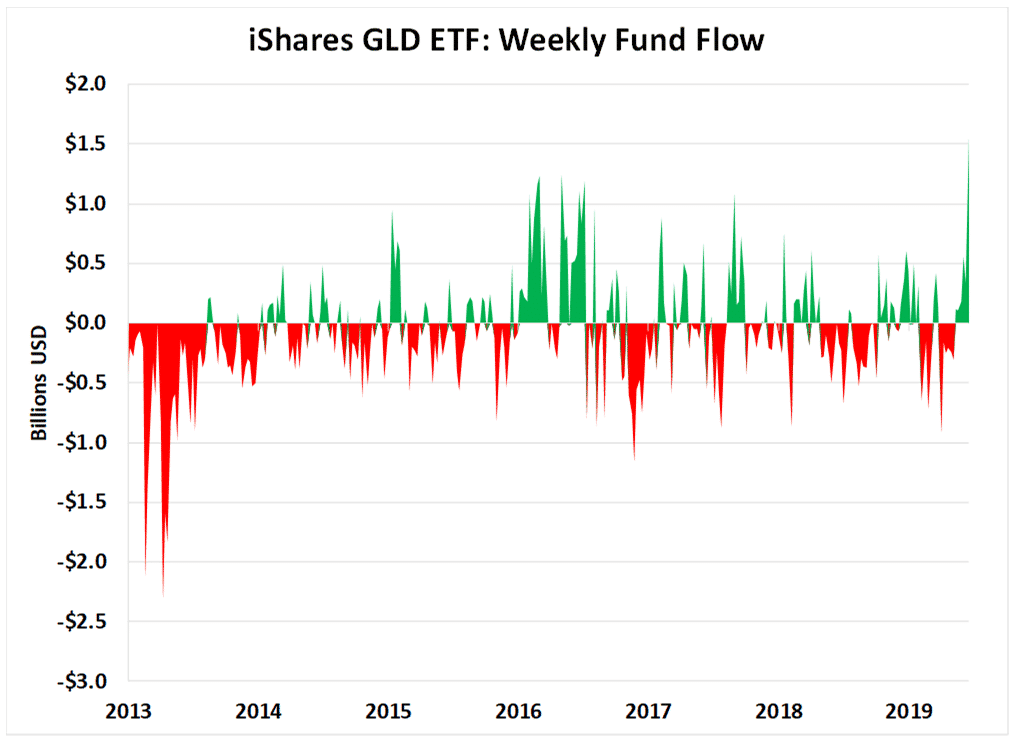

On Friday June 21st, the largest gold focused Exchange Traded Fund (GLD) saw over $1.5 billion flood into the ETF.

The inflow that day was over 10% higher than the 2nd largest ever inflow. That happened on July 11, 2008.

Last week, we witnessed the single largest inflow day ever in the ETF’s history, which was created just before the 2008 financial crisis.

And this will have massive implications for gold investors.

So pay attention…

Below is a chart which shows the weekly inflows and outflows of the GLD ETF since 2013.

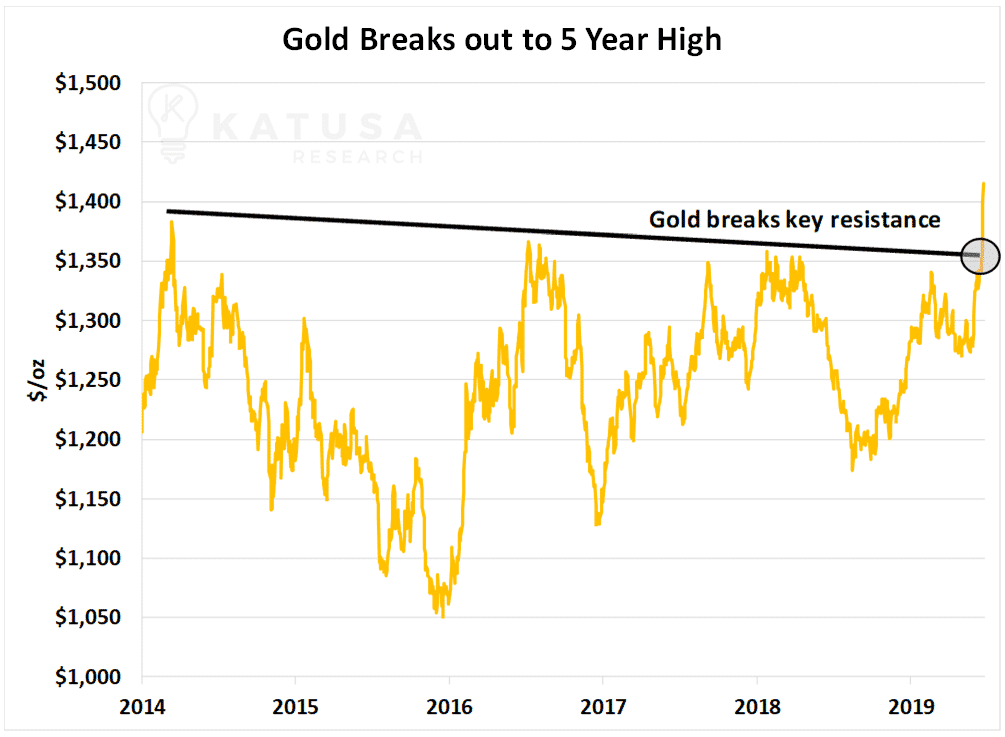

It’s no wonder that Gold is at a 5 year high and recently broke a 5 year resistance line…

Gold Rush – Follow the Fund$ Flow

A metric we follow very carefully is this:

- Which sectors are “passive” funds directing their capital into?

It’s been many years since the passive funds have paid attention to gold.

More importantly, the passive funds have just started their influx of capital into the gold sector.

And if you understand how the algorithms work (which us math nerds do), the algo’s and passive funds chase gains and liquidity.

The gold sector is tiny compared to other sectors like the financial sector or bio tech sector. Thus…

It doesn’t take a lot of new capital to send the share prices soaring.

Let me explain…

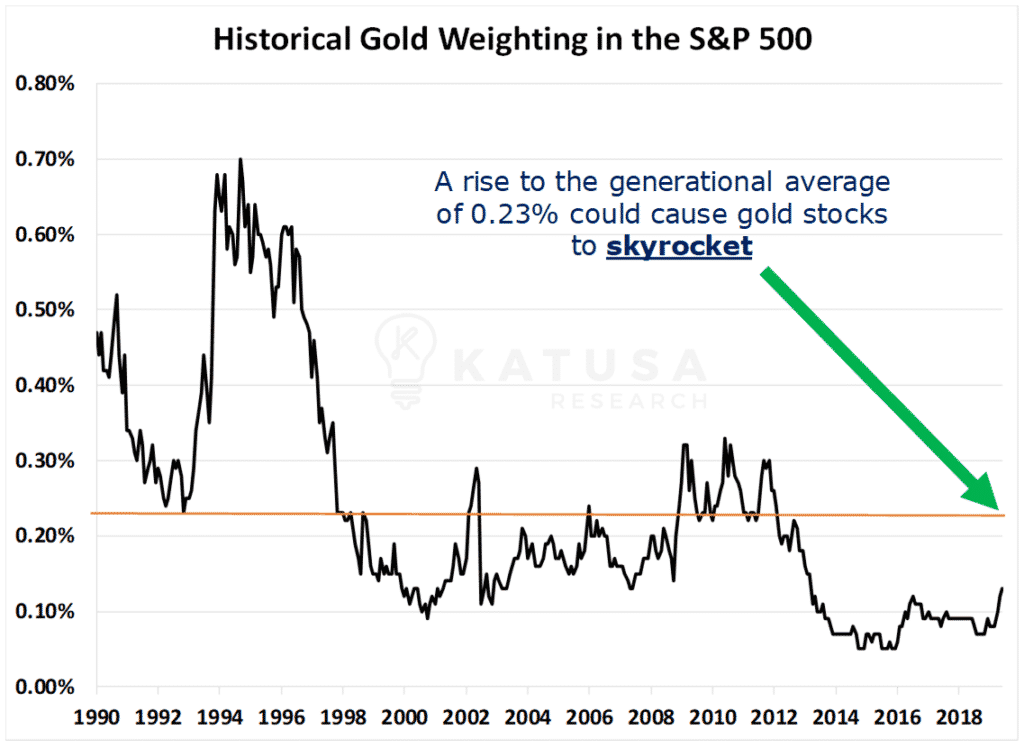

Below is a chart which shows the weighting of gold stocks in the S&P 500.

The reduction from 0.30% to 0.07% sent the gold market into the worst bear market in history.

But that’s what happens in ‘niche’ sectors.

Gold is a niche sector.

However…

Niche sectors are the easiest to get 10 baggers when new capital flows into the sector.

That is what the opportunity is in the gold sector.

As you’ll see in the chart, the weighting has recently spiked back above 0.10%.

The 30 year weighting average is 0.234%

If the gold weighting doubles from here…

Which would still be less than the 30 year average…

The gold sector will be one of the hottest markets in the world.

And we will see multiple ten baggers in short order.

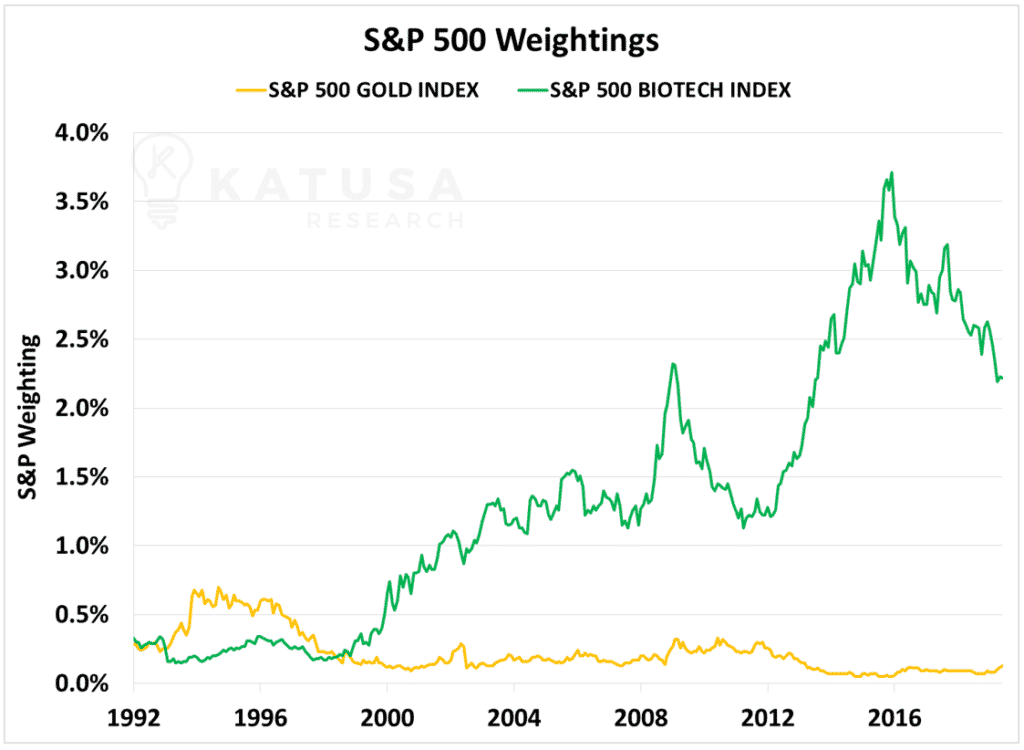

Let’s compare the gold sector to another high risk, venture capital market like biotech.

Below is a chart which shows the weighting of gold stocks in the S&P 500 compared to the bio tech sector since 1992.

Since the late 90’s, biotech has received far more capital than the gold sector.

If even a slice of the passive funds rotate into gold, look out.

The great thing about the niche sectors is it takes a long time for the passive, generalist fund manager to rotate their capital into gold stocks. A savvy investor can get in front of the herd and make a killing.

How You Can Make Money in This Cycle

History shows that resource stocks move in cycles. Especially gold stocks.

And the proof is in the data.

Winning is what I love to do. Especially when I kick my friends’ asses.

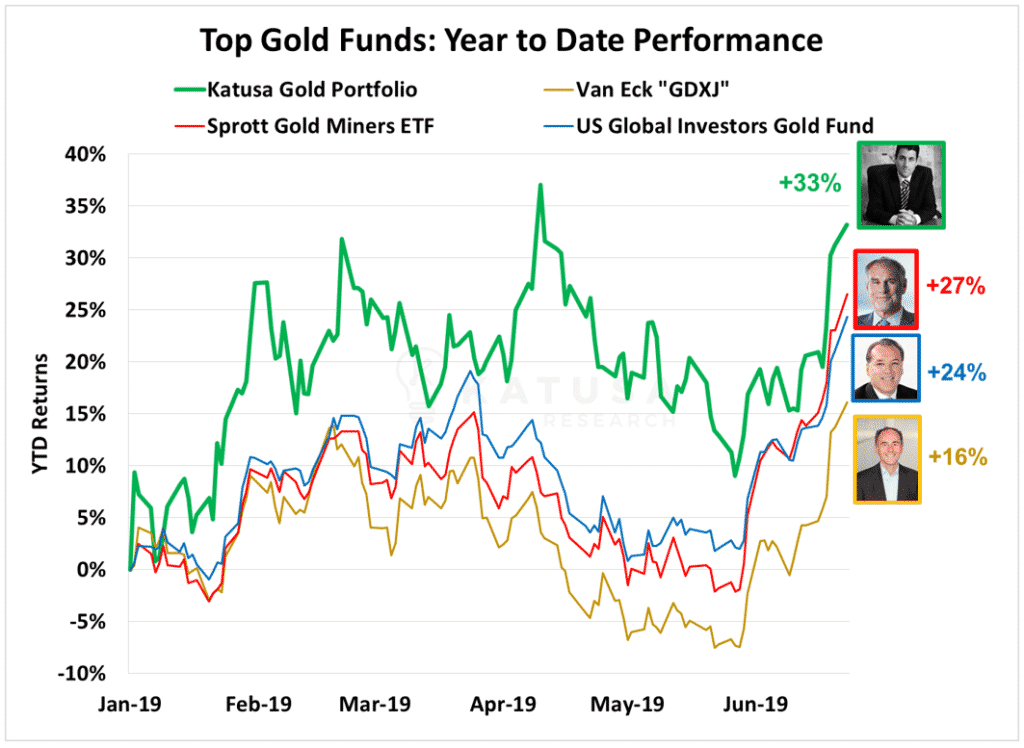

Below is a chart which shows the performance of major gold funds and the Katusa’s Resource Opportunities portfolio.

I’ve compared apples to apples. My investments in our portfolio (and my subscribers’) versus my competitors bets.

A big difference between me and many of the funds in the market—I bet big with my own money – they bet big with your money.

Skin in the game is how I roll.

Rumble Time: Katusa vs Rick Rule vs Frank Holmes vs VanEck

So what are the results?

We’ve outperformed all the major funds by a wide margin.

Note: This doesn’t even include our recent option play (which generated a near 200% gain in a little over a month). Nor our warrant exposure we get with our deals in the Katusa’s Resource Opportunities portfolio.

If I included the profits from the option trades and warrants, our margin of victory would be even higher.

But, being conservative, they are already top in the industry. See for yourself in the chart below…

Look, I’m not picking on Rick Rule and Frank Holmes because they lost to me (again). And all three of us have significantly outperformed Van Eck.

Both Rick and Frank are friends. I’m showing the facts.

And I have no problem putting our portfolio up against the best in the business.

I want everyone to see our analysis and our reports. We already have some of the top fund managers and family offices as subscribers.

Winning Is Fun… but Making Money Is Even More Fun

There’s a reason why gold bugs go nuts…

There’s no rush quite like a gold rush.

And throughout the last fifty years there have been many major (and some minor) gold rushes were the gold stocks went absolutely ballistic.

Many investors remember the rally during 2009-11 where incredible gains were made in gold stocks.

The last time gold stocks lifted off brought incredible gains.

For example, back in 2008 I started accumulated shares in Ryan Gold.

I met the management team on a site tour in the Yukon Territory, where the average winter temperature is -22 degrees.

Our plane was frozen, so I helped de-ice and push the plane to the airstrip so we could make the tour. Fast forward to the gold bull market of 2010-2011 and the stock jumped from around 15 cents to over $2.

A 1,450% profit.

I have many ten baggers under my belt. It’s why even my competitors have me manage their own money, rather than their own analysts.

I work incredibly hard to build my network and assess the data to get into the best gold deals.

For example, Katusa Research was the first to publish on an unknown junior copper/gold explorer in late 2018.

In under 2 months, on a mega successful drill hole, the stock gave subscribers and me a 270% gain… in a sideways market.

Another gold pick in our portfolio, what I call “the next 1 million ounce producer” is up over 25% in less than 2 months.

But my favorite gold stock is just getting into its groove and will blow away the market with its results.

My portfolio is available for all subscribers to see when you subscribe to my premium research newsletter, Katusa’s Resource Opportunities. If you’ve been on the fence or you want to invest in the same stocks I’m putting my own money into (and at the same terms and price), then you’ll want to take action.

There’s no doubt my subscribers and I are fully prepared to ring profits when the golden time comes in.

Regards,

Marin