The Coronavirus originated in China and is now a global outbreak.

It’s gotten so bad that entire cities in China have been shut down. Cities of 10 million people, normally hustling and bustling are eerily silent. Even Foxconn, the maker of Apple iPhones closed their factories for several days.

China is an economic powerhouse.

The country produces and consumes an enormous quantity of goods and services. Did you know that today, China accounts for 17% of global Gross Domestic Product (GDP)?

Make no mistake, the impact of the Coronavirus is far reaching. The virus will have an impact on a lot more than just the Chinese economy.

Many forget that China produces an enormous quantity of rough goods and materials. They aren’t just consumers.

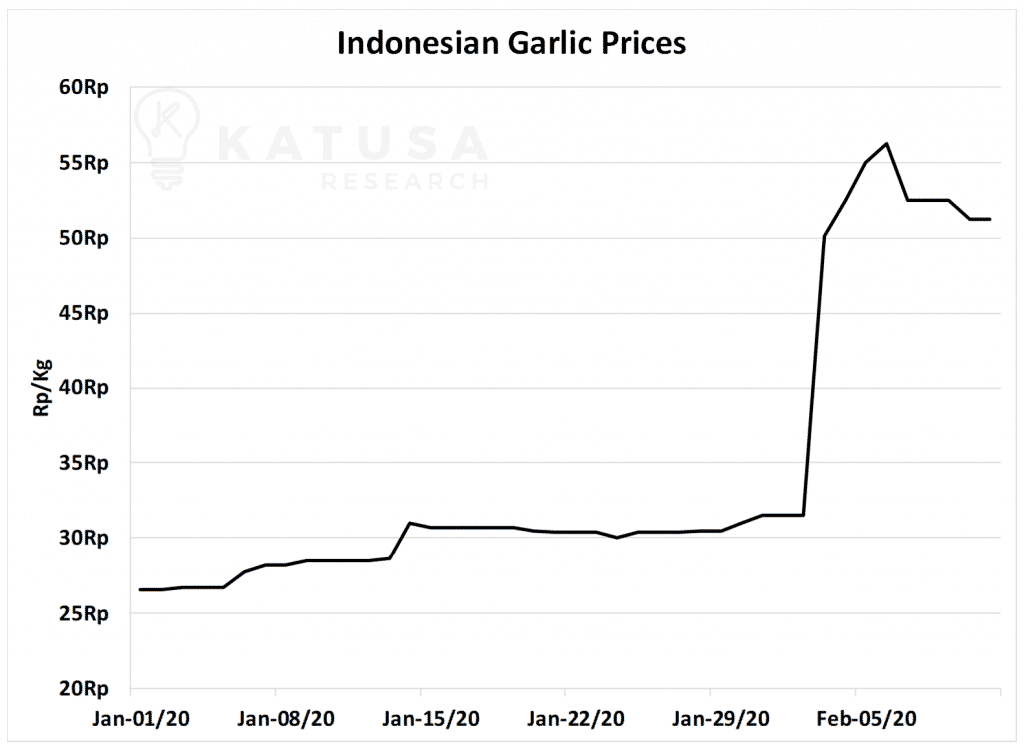

For example, the price of Garlic in Indonesia has skyrocketed, up over 50% in the span of a week.

Coronavirus Impact on Commodities

Coronavirus is already having ramifications for many commodities.

For example, let’s look at the oil market.

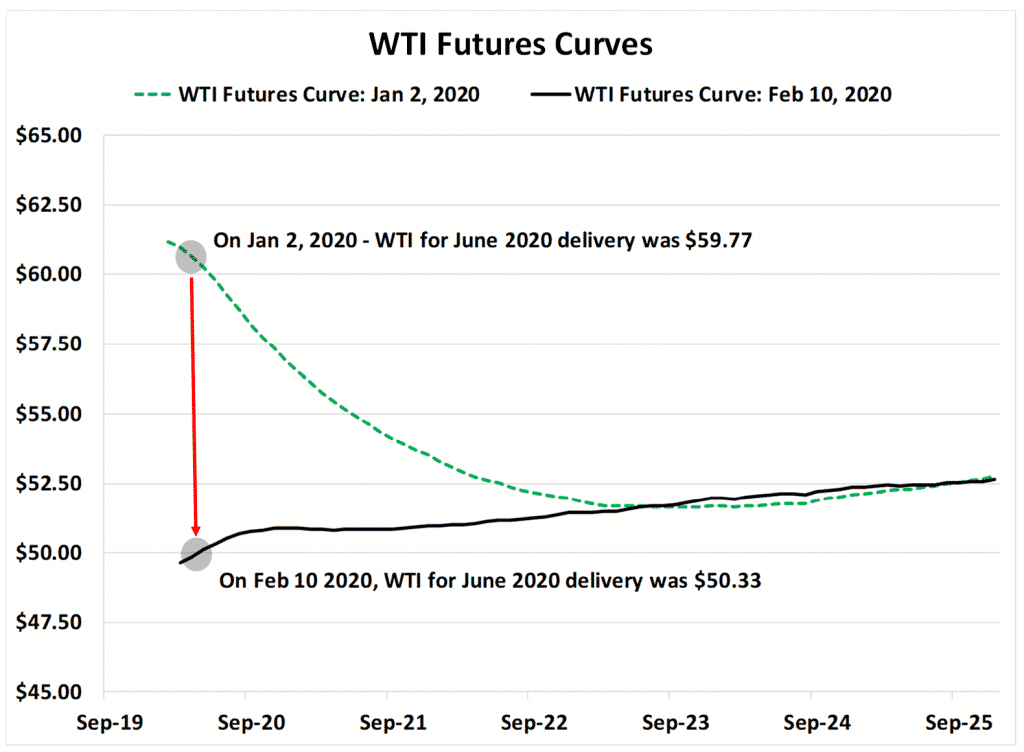

The oil market has done a complete reversal in the span of 40 days. Below is a chart which shows the 180-degree change in rhetoric for the WTI futures market. You’ll see on January 2, 2020, WTI crude oil for June 2020 delivery was selling for nearly $60 per barrel. That same barrel of oil is now selling for $50 dollars. This represents nearly a 16% decline in prices.

Even with a healthy China, the global oil market was already teetering on the brink of oversupply. China consumes 13 million barrels of oil every day. Due to the Coronavirus, Chinese oil consumption has plummeted by 20%. This means 2.6 million barrels a day of crude oil need to find a new home. Without China’s massive demand, there will most certainly be a glut of oil for the first quarter of 2020.

I believe the oil market is just one example of the many commodity markets to be affected. Copper, iron ore and coal are surely to face major headwinds here in the interim.

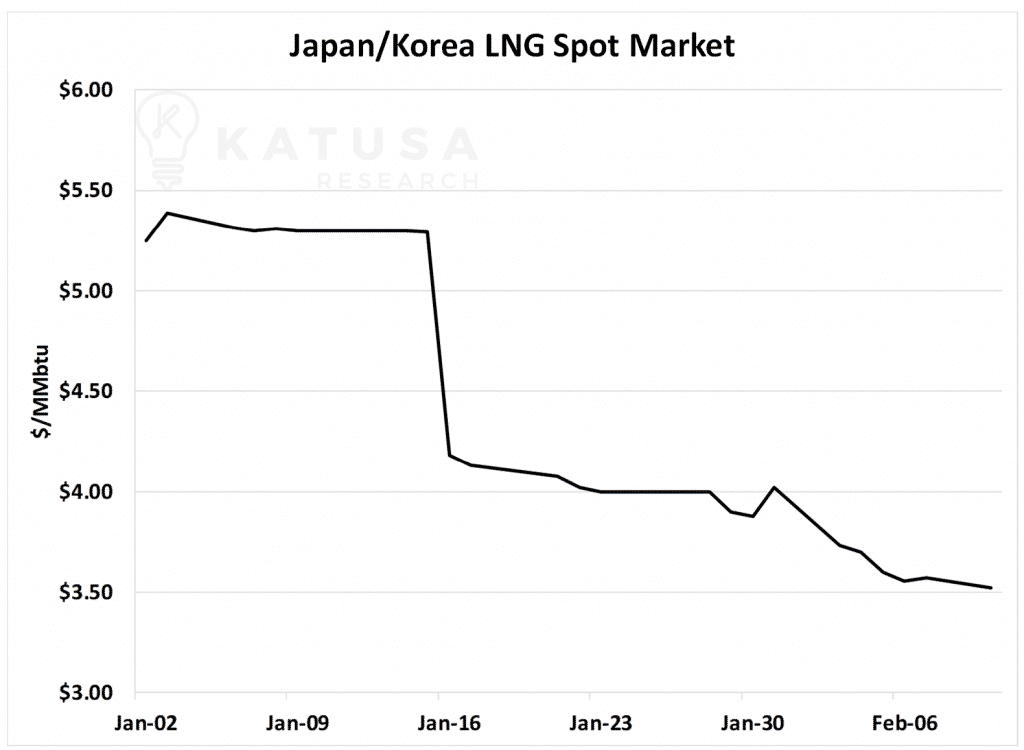

Liquified Natural Gas (LNG) has been decimated. LNG prices are down 33% ytd. Below is a chart showing the year to date price for Liquified Natural Gas.

Opportunity for Crisis Investing

As a professional investor and fund manager, I use situations like these to my advantage. Deep dive due diligence, and the best resource industry contacts give me and my subscribers a massive leg up on the rest of the market. We have a war chest of cash and are thoroughly prepared to use this outbreak to our advantage. In my upcoming March report, I am outlining my crisis game plan to all my subscribers.

I believe there is a massive opportunity ahead.

Regards,

Marin

P.S. If you’re not yet a subscriber, consider becoming one right here and get ahead of the crowd for the coming boom in commodities. I’m about to go big on three new positions.