Gold and silver stocks are highly levered to the price of the underlying metal. And spectacular gains can enter your investment account at a blistering pace.

Double, triple and even more than 10 times your money are all possible. And they can go down 50% just as quick.

- When silver or gold spot prices rise, you can bet that catalyst will lift many boats in the sector. Even those with gaping holes in the hull.

While those gains are realistic when the cycles turn in investors’ favor, paper profits can also evaporate in the blink of an eye.

Though junior gold and silver stocks get all the glory…

They’re also the ones that carry some of the highest risk in the stock market.

Let me explain some items that need to be on your resource stock cheat sheet…

Liquidity in Junior Gold Stocks

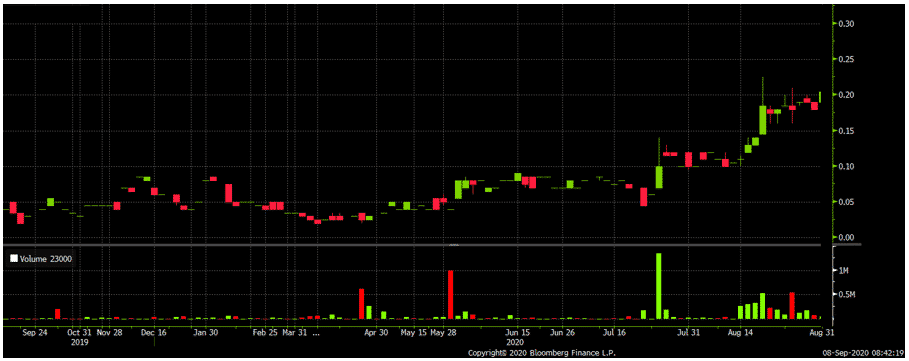

Junior gold stocks have one major issue that no one likes to talk about.

They lack liquidity.

Liquidity is the amount of dollar volume the junior company trades on a publicly listed company.

Most juniors trade less than $250,000 a day in volume. That’s peanuts for a publicly listed company.

On that type of volume, even a single moderately sized order of $100k or $200k would send the share price up 20% in a day.

Sure, they could offer the company a bought deal financing, but what happens if the fund wants to sell?

Good luck selling your large position into a stock that trades $100,000 worth of volume a day without hurting its share price.

Even if the bet pays off, how do you sell? The liquidity math just doesn’t work for most funds.

It’s just way too much risk.

Regardless, gold is up $400 over the past year and brokers and companies have been aggressively financing all year. There has been over $4 billion in equity financings this year.

Most of those shares that have been issued from the $4 billion in financings have been restricted.

This means that investors have not been allowed to sell. But those shares are now coming free trading.

So, a major question you should be asking yourself is “who is going to absorb those shares when they go free trading?”

Our in-house analysis is telling us something important…

- Although mining stock prices are rising, the total dollar amount of financings are not increasing at the same rate.

Let me explain what that means…

You can attribute this trend to 3 different factors:

- Prices are rising faster than the liquidity rise and financings are happening. That is not the case when compared to previous cycles.

- The bigger funds and the generalist funds have not yet gotten into the mining financings like they have in the past.

- Passive funds are focusing on ETFs rather than on equities.

Now, number 3 is where I believe the significant change is.

Passive management funds are primarily buying gold exposure ETFs rather than the mining ETFs and mining financings of the mid-tiers and juniors.

You’ll see in the chart below, fund flow into the GLD is +25 billion, versus a net outflow of over 2 billion in the mainstream gold miner ETFs.

Nor do they finance mine construction via debt instruments or streams.

The Katusa Playbook: The Boom, The Bust and The Echo

There’s more to a cycle than just Boom and Bust, or the Bull and the Bear

There is the Alligator.

And the Alligator is much older, wiser and has been on the planet for over 100 million years longer than either the bear or bull.

To be rich in the stock market, you must be able to survive many cycles and come out stronger and that is what the ‘Way of the Alligator’ is all about.

- There’s also a sideways market that always appears somewhere between the last Bust and the next Boom,

And it also occurs in microcycles between corrections…

It’s called the “Echo”, hence: Boom, Bust & Echo.

I created this concept over 6 years ago and will be the basis of my new book coming out soon.

This sideways market is an integral part of the process, with unique and definable features.

Understanding how the 3 cycles work can make the difference between succeeding in the markets and failing, like most others do.

I’ve tried to explain this concept to others in the investment business many times over the years. Often to deaf ears.

I got the distinct feeling that my words were just bouncing off and returning to me, like an echo.

And that’s how I first got the idea and how Boom, Bust & Echo came to be.

The Katusa Focus: Investing in Gold and Silver Stocks Like an Alligator

I’ve refined my approach over the years and while I will take the occasional “punt” on a junior resource stock.

But my main focus is to find assets that have

- Had a lot of money spent on the project advancing the asset (read: OPM-Other People’s Money)

- With incredible upside potential in lower risk jurisdictions in the previous cycle and left for dead.

How do I go about finding the best assets and management teams?

Let’s break it down with a recent project my team and I have done.

My goal is to identify single producing projects that are:

- Not owned by majors.

- Located in +SWAP line nations.

- Potential to produce at least 100,000 ounces per year

There are over 700 producing gold mines in the world.

After running the criteria through my database, I came up with a list of 89 potential mines.

I then eliminated the following:

- Low-grade projects.

- Projects with short mine lives (less than 8 years with no exploration potential to increase the mine life).

- High-cost mines (cash costs of more than $800 per ounce; general rule of thumb – if cash costs are $800, all-in sustaining costs are ~$1,200 per ounce).

From the remaining list, qualitative digging was performed on each project.

- Who would it be a good fit for?

- Does mining the deposit require a unique skill set which discourages many potential suitors?

- Are there any potential synergies with mines operating nearby?

- Is there some low-hanging fruit to be plucked which creates additional value for the buyer?

For the gambling trader, this simply isn’t exciting enough.

That group would rather place bets on super high risk plays in hopes of mansions, Ferraris and women who will take their gold and hang out on their leased boats.

And the management teams of those companies are more than happy to take your money. You can subscribe to most of the other newsletter writers for those stock pics.

The criteria I’ve outlined has helped me identify more winners than losers. And I’m able to place very large bets on the outcome. Because I know there will be liquidity and an exit point.

I mentioned earlier that there was $4 billion of shares of mining companies that were restricted that are now coming free trading that may hit the market. That usually means there will be significant selling pressure and lower share prices usually result.

- In my latest monthly issue, I identified 6 companies which may be punished – unnecessarily – by free trading paper hitting the market this fall.

Do yourself and your portfolio a favor…

And – most importantly – make SURE you know when all that financing paper is going free trading in companies you own.

Regards,

Marin