| Marin’s Note: We are going to do something different with today’s missive. Today we will allow long time reader and esteemed colleague of ours (who wishes to remain anonymous), Era “the Nature Boy of Finance” Flair, our platform to make his comments. They are well thought out and his angle is worthy of consideration. |

Dear Marin,

Congrats on your book-making #1 on the Wall Street Journal. It’s a fantastic read.

I wanted to share with you my thoughts on MMT, which you nailed in your chapter.

But I feel you “held back” in your analysis.

You did a great job explaining economist jargon into common sense; but I think we are a lot closer to MMT than you state, and the outcome will be much worse than you anticipate.

Maybe it’s because you are rich and happy, you don’t see the world through the lens of the Nature Boy of Finance.

There’s a virus sweeping across the United States…

It’s infecting politicians at the highest levels, completely changing how people think about the new legislation.

It suggests that the federal government can spend as much money as it wants.

Spending will enable the government to grow the economy to its full capacity… get rid of unemployment… eliminate all student loans…

Governmental policy decisions no longer need to be bound by considerations of the national debt.

So, it can create multi-trillion-dollar programs like free universal healthcare. Free college tuition.

And huge green energy programs.

Infrastructure budgets, no problem. It’s the ultimate solution.

That magical solution is called: “Modern Monetary Theory.”

It’s the definition of a misnomer:

- It’s not modern. It stems from chartalism, an economic school of thought from the early 1900s.

- It’s not monetary. It takes place almost entirely through fiscal policymaking (more on that in a moment).

- It’s not a theory. It’s been tried dozens of times over hundreds of years… Venezuela, Zimbabwe, Yugoslavia, Hungary, Greece, Germany… and it ended very poorly every time.

All told, it’s more Archaic Fiscal Failure than anything.

But this time it will be different, right?

Yet politicians from both sides of the aisle, and economists at the highest levels, are buying in.

And they’re doing so without knowing what it is.

Not even the people running the show could describe MMT to you.

“I have not seen a carefully worked out description of MMT.”

– Jerome Powell, Chairman of the Federal Reserve

Even people who claim to know what MMT is; don’t even agree on the basic tenets.

MMT is gaining ground fast. And it’ll have profound long-term effects on the global economy.

You must know what MMT is and how it’s going to affect you. Otherwise, investing in the future will be little more than a crapshoot.

Marin as you recently published in your #1 Bestseller on both WSJ and Amazon (in the main overall category of all books in both fiction and nonfiction, not some obscure niche category), ‘The Rise of America’, you broke down in great detail, in real talk, not economist jargon what MMT really is. I don’t hesitate to recommend the book so my friends can educate themselves.

Here’s a basic description of the theory…

| Because the United States borrows in U.S. dollars, it can always print more of those dollars to cover its debt. Under MMT, defaulting is impossible.

Therefore, the government can run long-term budget deficits, racking up ever-more debt, without any negative long-term effects. |

Put simply, from a politicians perspective:

- The status of the USD means that deficits (and debt) are not relevant to policymaking by the United States government.

It’s a complete economic paradigm shift like we haven’t seen in forty years.

Marin: There Ain’t No Such Thing As a Free Lunch…

To understand the future of MMT, let’s take a step back.

You were a teacher in a past life, and as you’ll recall from high school economics that there are two primary ways to control the U.S. economy:

- Monetary policy: The Federal Reserve controls the level of money and credit in the economy by borrowing from and lending to other banks.

- Fiscal policy: Congress controls the level of money in the economy through taxation and spending.

Generally speaking, the job of keeping inflation in check and managing economic growth belongs to the Fed.

In times of crisis, the Fed’s first tool is interest rates. Lowering rates to zero can quickly juice the economy by providing ultra-cheap credit.

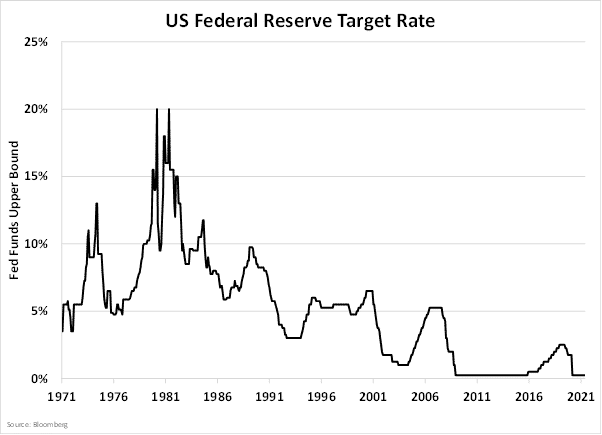

As you can see, interest rates have been in steady decline for close to 40 years.

Globalization, technological progress, and capital deepening amongst nations swallowed up most inflationary conditions.

Bouts of economic decline were met with increased rate cutting, while times of prosperity never saw the previous cycle’s high-rate watermark.

In the 2007-2008 global financial crisis, the Fed’s testicular fortitude was tested.

In the initial wave of the crisis, the Fed cut rates to near zero. But it wasn’t enough.

So, what did the Fed do when it was backed into a corner?

It created a shiny new “tool”.

This “tool” was called “Quantitative Easing”, or QE for short.

QE is a fancy term that refers to the Fed Reserve buying up government bonds in the open market to release cash into the economy.

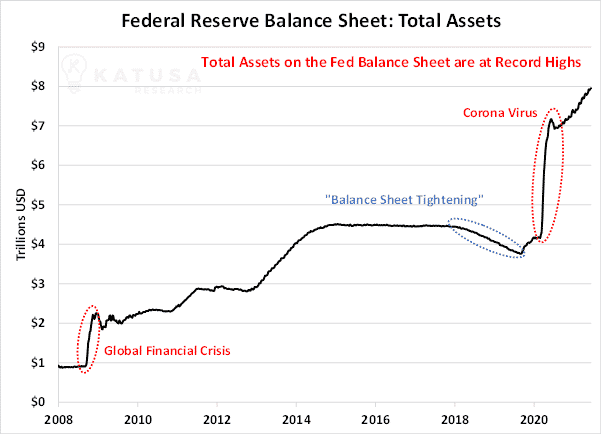

From September to November 2008, the Federal Reserve printed money and bought $1.3 trillion worth of assets in the open market.

As you can see from the graph below, it kept buying… and buying…

Between 2008 and 2014 the Federal Reserve’s balance sheet grew by $3.5 trillion.

With more dollars, asset prices naturally inflated…

As the American economy began to strengthen, finally in late 2016 the Fed began to increase interest rates and in 2018 began to unwind its asset purchases. All told the Fed unwound nearly a trillion dollars of the debt it had acquired.

It should come as no surprise that the combination of rising interest rates and balance sheet sales led to periods of increased volatility.

So in 2019, the Fed resumed the buying program. It’s never stopped since.

The spike in the chart above is COVID—when the Fed picked up another $4 trillion in assets with printed money.

And they’re continuing to sweep up assets, just to keep the floor from dropping out of the market.

The problem with QE is that it gets less and less effective as more dollars are printed. A phenomenon known as diminishing marginal returns.

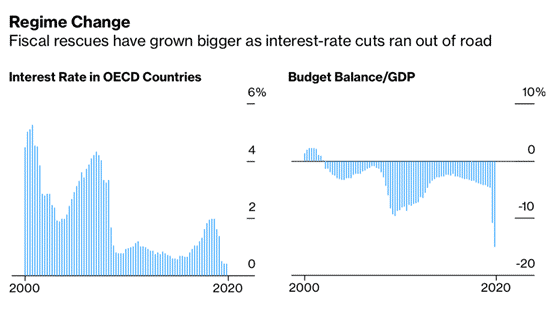

So, the Fed knew that they needed to get more creative. Bill Dudley, a Princeton scholar and head of the NY Fed for a decade, said:

Any more interest rate dropping, or quantitative easing, would just be pushing on a string.

All of which sets the stage for MMT.

The Rise of Fiscal Unilateralism (F.U.)

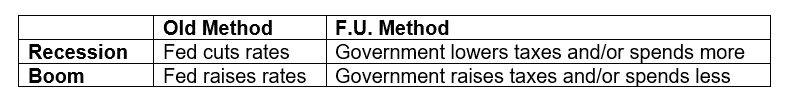

We’re seeing a historic handoff of power. Monetary policy as a means of economic management is completely giving way to fiscal policy.

- Congress is assuming comprehensive control of the business cycle and the U.S. economy.

That’s the core of MMT.

And it’s inevitable.

- Marin’s Note: Granted, the current situation is FMC, which I explain in great detail in my book. But MMT is coming.

Here’s what it looks like when compared to what’s been the case for the past forty years:

Here’s why F.U. policy (government spending, taxation, and wage and price controls) seems like a much more effective way of controlling the economy…

It’s fast. Think about how quickly you received—and spent—your stimulus check. Meanwhile Fed actions take months or years to have an effect.

It’s cheap. As long as the Fed keeps interest rates low, Congress can borrow at rock-bottom rates.

Or—more importantly—the Fed can print money, and through a convoluted mechanism, fund any bills passed by Congress for “free.”

It’s targeted. Congress can choose specific areas of the economy based on who needs the most help.

It can create massive bills for infrastructure, or send cash directly to people and businesses, instead of the money just going to big banks.

Of course, all of that spending means huge, record-breaking deficits.

Marin back.

OK—that was interesting. I don’t entirely agree, but that’s what makes a market.

But what you should be asking—is:

How Do You Protect Your Portfolio?

Whether you see the world as I do or as the Nature Boy, you need to focus on rule #1: Don’t Lose Money.

And Rule 2: Don’t forget about Rule #1.

Rule 3: Make Money.

So, what is Marin Katusa doing?

I’m increasing my exposure to tactical growth opportunities along with exposure to gold and specific commodities.

For example, opportunities that capitalize on the flood of money pouring into the ESG sector.

- Did you know that renewable energy is now the cheapest and most cost-efficient form of electricity generation?

- Or that Carbon Credits are becoming one of the most sought after investment of major smart money

Fortune favors the bold but smiles upon the prepared.

If you want to take the next step consider becoming a subscriber to my premium research service – Katusa’s Resource Opportunities.

Every month you’ll see how I’m positioning my portfolio for the coming Rise of America and all the windfalls I see coming in specific sectors.

I hope you’ll join me. It’s going to be an incredible adventure.

Regards,

Marin