After seeing it first-hand 20 years ago for the first time…

I was blown away by the results of one particular investment tactic.

It was my first real insight into how well-connected investors really gain wealth.

As I found out nearly 20 years ago – and have repeated many hundreds of times since then – there is, in fact, a secret advantage to it.

I’m going to share with you today one of my favorite ways to invest:

Equity Financings and Private Placements.

It’s a little-known investment that’s usually off-limits to regular investors.

Even though they’re publicly issued, these investments are essentially “invitation-only” and fill up fast.

I was hooked since the first time I found out about it in the early 2000s…

You’ll almost never hear private placements discussed on CNBC. And you’ll never see their ticker symbol pop up on YahooFinance, MorningStar, or anywhere else.

They’re completely off the radar of people that even pay close attention to the markets.

And I should know.

I’ve been featured on Forbes, Yahoo!, CNN, Bloomberg, and many other outlets, because I’ve been a leading financier in the resource industry for nearly 20 years.

Not once have I ever seen private placements mentioned.

I’ve never even been asked about them in any of the interviews I’ve done.

- It’s why many people tend to think they’re only available to “insiders” or wealthy investors.

But as I’ll show you – it’s actually easy to tap into them…

…once you know how.

It’s a way to amplify your wealth and profit in these situations…

And when it hits, it can really change your life for the better.

Here’s one recent example…

Just under 10 months ago, we sent an alert to our subscribers about a private placement opportunity in a secret ESG commodity sector…

That I was going to be the lead order of. (Like my new financing project – which I will announce on Monday, Feb 7th)…

In that ESG financing, we got shares…

As well as “2 for 1 shares” with the upside kicker. We call this the “Katusa Warrant.”

Within 6 months of the financing, the company went public in the summer of 2021.

Shares of that CAD$0.75 private placement went public and attracted a lot of attention.

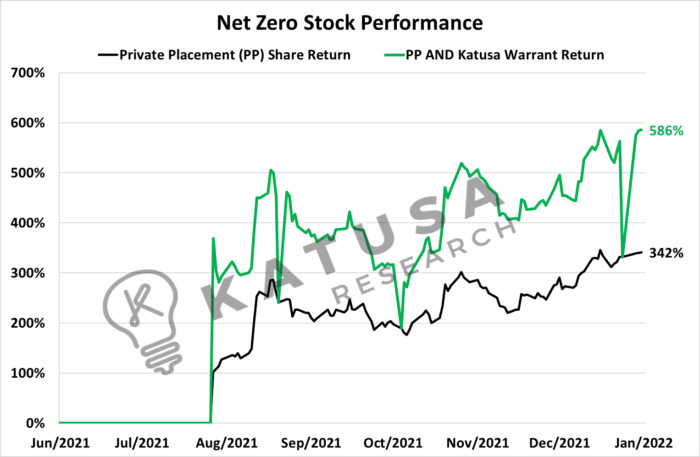

The share price rose to $3.30 for a return of 342%.

But you got an ADDITIONAL share in the private placement with the upside warrant kicker – what we call the Katusa Warrant…

This boosted your total return (shares + warrants) to 586%.

That’s nearly a 6-bagger and all your shares were listed and free-trading.

Let’s see how that looks on the chart. You can see how the upside kicker amplifies the return when the stock moves up…

And I believe it’s just getting started…

The company will be listed on a major U.S. exchange by mid-2022 and that should attract a lot of new buyers…

As the sector starts to accelerate further and grow multiples higher than its total current market size.

This is how you REALLY make money in the markets… and why private placement financings can be so lucrative.

Tomorrow, I will go into detail on warrants…

Specifically, the Katusa Warrant – one of the most powerful upside kickers in the world.

It’s a way to amplify and supercharge your wealth and profit in these private placement financings and deals.

Regards,

Marin Katusa

Chairman, Katusa Research

P.S. Private placements and warrants are one of the true insider secrets of the financial world.

They offer the opportunity to make 10, 20, even 50 times your money in a single stock. A private placement can turn a modest investment of $25,000 into half a million dollars.

If this style of investing is new to you – or you’ve never had the chance to participate in a private placement – click here and download my free report, Katusa’s Quick Guide to Private Placements.

And make sure to keep an eye on your inbox tomorrow.