Don’t let a dead cat bounce fool you…What we’re seeing now is the prelude to carnage.Never have the markets had such a shock where economies and critical supply chains have all stretched to critical mass.Every new day seems to bring increased panic and downside.

Maximum loads are tested daily – at airports, hospitals, and grocery stores. “Back to normal” post-pandemic is proving a challenge.

Add inflation that a whole generation has never experienced to that – and you have major failure points.

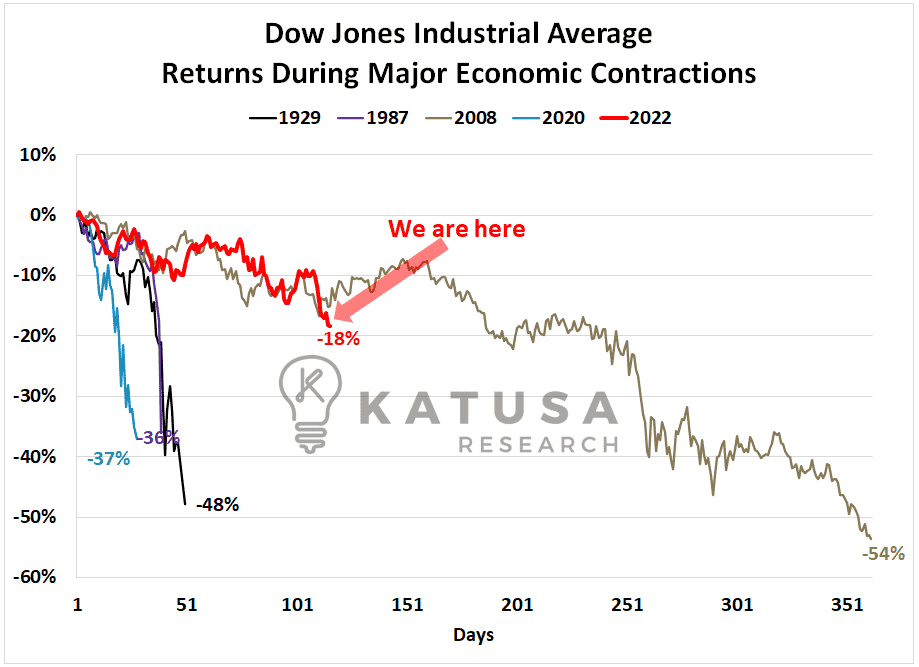

Market Meltdown

On a comparative basis to this market melt, only the 2008 crash compares.

The charts look eerily similar, and a meltdown seems imminent…

Investor sentiment is cratering and market confidence indicators have tanked.

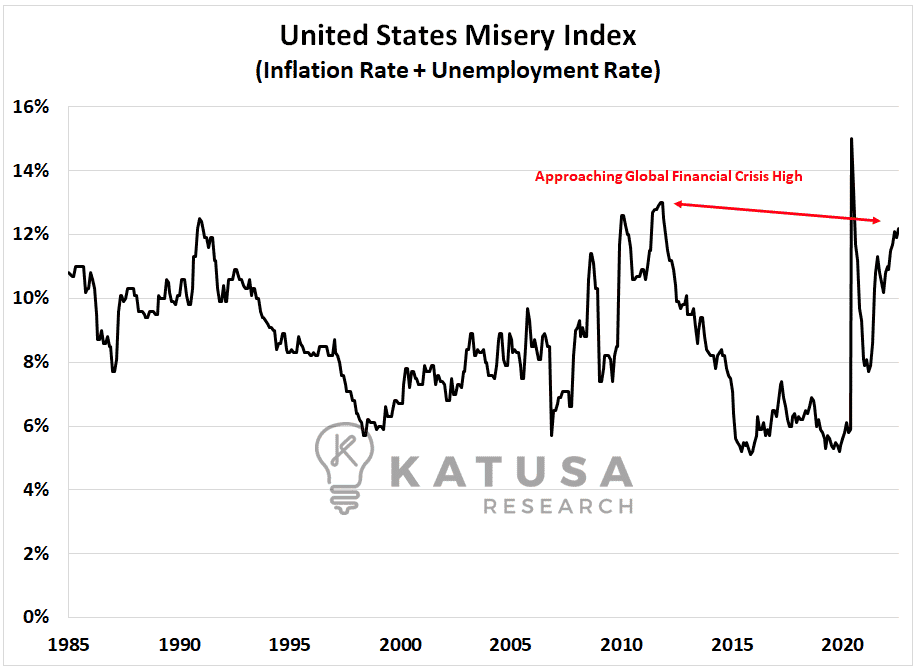

The “Misery Index” is an index created using the monthly inflation rate plus the unemployment rate. It’s another indicator one can use for the sentiment.

“Highs” are a sign of increased misery caused by high inflation and/or high unemployment…in other words when the indicator is high, that signals trouble.

And the indicator is approaching levels last seen at the peak of the pandemic and the depths of the Global Financial Crisis…

This means that novice investors have all but thrown in the towel.

But we haven’t even seen widespread capitulation… YET.

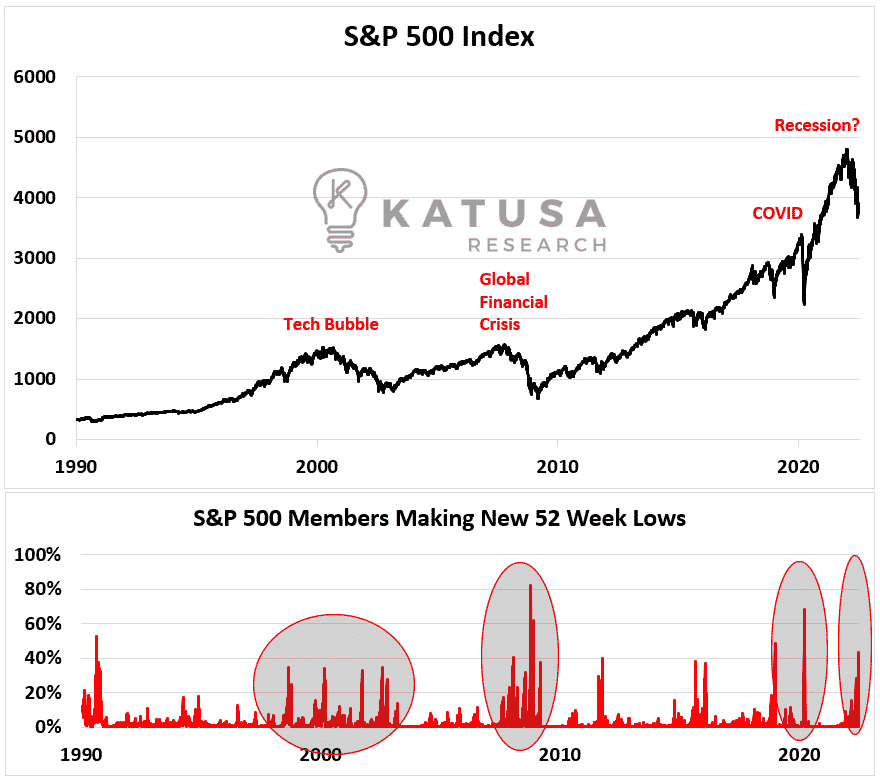

Over the past weeks, stocks have been declining rapidly…

The percentage of S&P 500 members hitting new 52 weeks lows peaked at 43% in June.

These are eerily like previous major declines such as the Tech Bubble bursting in 2000 and the Global Financial Crisis of 2008.

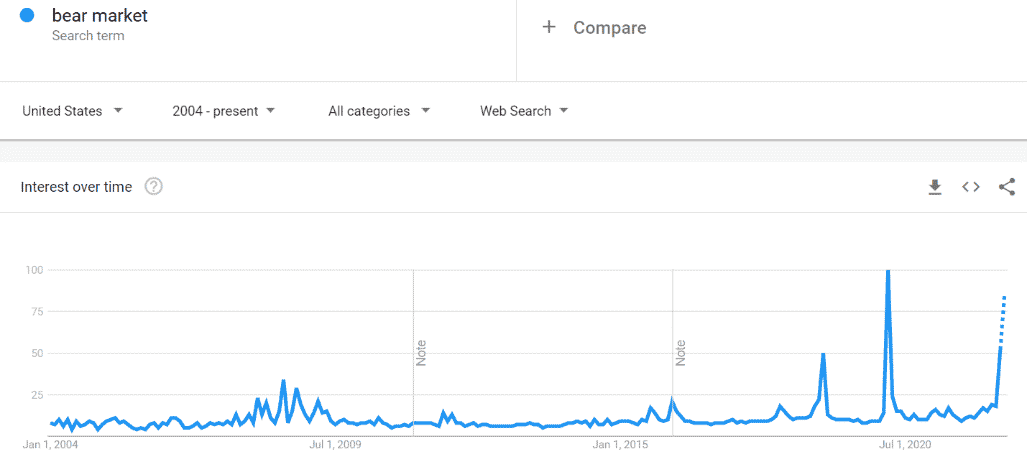

And the Ultimate Gauge of Sentiment…

Google search and news outlets are writing negative and “bear market” articles near the record 2020 levels.

This is Going to be Painful

And difficult to digest.

The worst is not yet over, and we are coming to the critical moments…

You can feel it everywhere.

It’s easy to talk about being a contrarian but now that it’s time to step up to the plate – many investors are paralyzed.

Wall Street analysts, major banks, and investment bankers are downgrading stocks faster than at any time since 2008.

I know of many funds that are on the edge of insolvency. I should know – they call me to buy their shares off them.

The phone calls I’m getting tell me we’re not yet at the Critical Market Moment.

That’s the time when shit hits the fan. True capitulation.

The response around the globe to the economy, supply chains, businesses, and workers is unprecedented.

Deflation, Not Inflation

Take your cue from the commodity markets.

- Copper sank 6.5% last week and is down 19.3% from the early-March high. It has collapsed to a 2-year low.

- Aluminum? Try -36%.

- Nickel? How about -47%

- The CRB metals index is down 16.5% from the highs.

- The food price index has slumped 9% — wheat has tumbled 19% from the highs!

- Now oil prices have joined the fray, with WTI down nearly 12% from the highs to $103 per barrel;

- Energy stocks, which lead the oil price, are now suddenly in an official bear market (-20.7%).

- Lumber is down 60.3% and steel rebar is down 25%! And everyone still has inflation on the brain!

BEWARE of What’s Coming…

This is true Alligator Investing…

Waiting in the wings, cashed-up, for opportunities that come around once in a decade. Or once in a generation.

But putting money in the wrong place, or for the wrong time period – and you will lose.

The truth is that investing in these times is very difficult.

And I’ve now seen a few crashes in my career – and navigated my portfolio through the storm.

I want you to know that the whole team at Katusa Research is burning the midnight oil.

We’ve prepared to act when the real crisis hits.

For example…

Back when the Fed cut rates on Sunday, March 15th, 2020…

I messaged my top analyst that we had to get to work immediately that day. Things would start to unravel quickly.

Later that night I sent a very important alert to my subscribers detailing what

I see this happening to the major commodity sectors.

If you were in the room with me, you could’ve made some quick and swift scores.

If you were on the sidelines, it was too late.

You had to be in the room with me when the Critical Market Moment happened.

Since that alert, there have been many major market changes.

As a member of Katusa’s Investment Insights, I want you to be aware of what’s happening right now… and what could happen next.

I am publishing a special emergency briefing:Tuesday July 12th at 9am PST.

In the morning I will send you a private link where you can view this presentation.

I’m going to go over everything you need to know in this market meltdown:

- An examination of past major US recessions big winners/losers

- How inflation and rising interest rates can affect your portfolio

- Which sectors are going broke and which sectors are attracting mind-boggling capital (even if a recession hits)

- Which group of stocks to focus on for a potential slingshot move upwards in a recovery

- The asset class I’m most bullish on and why you should be too

- The name and ticker of one of my biggest holdings… just for watching

In short: If you’re like most people, you might be sitting on the sidelines right now… or worried that a market crash could wipe out your earnings…

And you’re right.

But when this crisis hits, the market will present vast opportunities for investors that are ready.

Regards,

Marin Katusa