Eleven Chinese missiles landed in Taiwan’s waters this past week.Including 1 directly over Taipei, all while Chinese military exercises were conducted in six zones surrounding Taiwan.The recent Chinese power demonstration is the largest cross-strait exercise in decades.It is the most recent act of Chinese aggression in an ever-escalating tinder box of conflict.

- Domestically, there are power struggles going on within China which are only ratcheting up the tension for the CCP even further.

It’s no secret that for the past few decades, China enjoyed world-leading economic growth.However, double-digit economic growth can only go on for so long. A natural cooling of the economy is not unexpected or considered unhealthy.

Growth Cracks

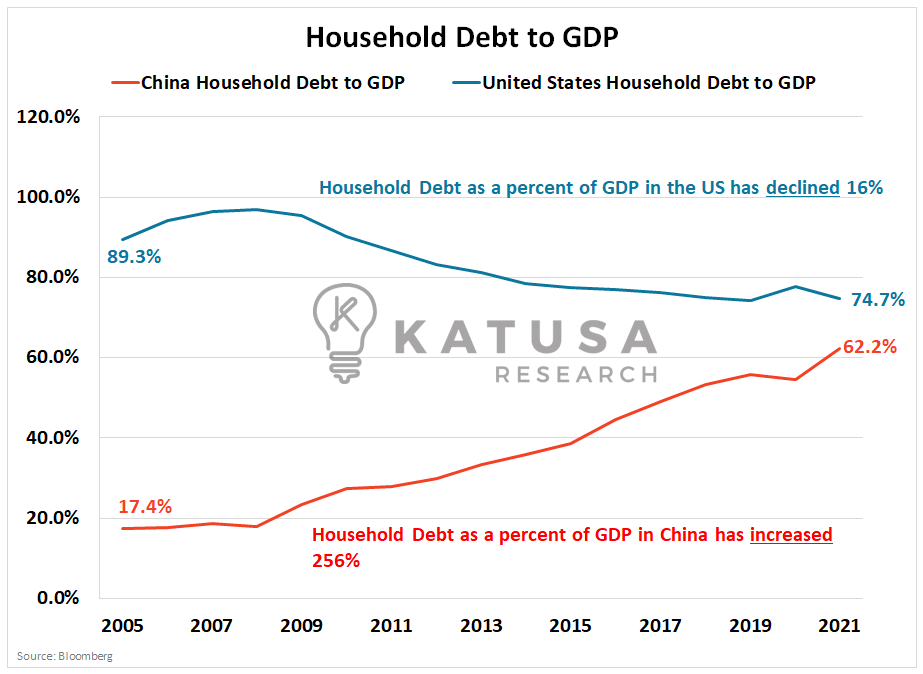

Much of this economic growth has been supported by massive amounts of corporate and household debt.And it looks like the chickens are coming home to roost.Below is a chart that compares household debt to GDP for China and the United States.

- You will see that Chinese household debt relative to GDP has increased 256% since 2005.

For comparison, the United States has seen household debt to GDP decline by 16%.

China and Income

Let’s drill down further…

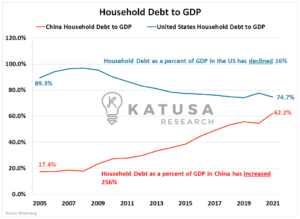

- In China, you can see that disposable income levels relative to debt have soared 5x since 2006.

This indicates that Chinese incomes have not risen nearly as fast as the debt they have taken on.

Chinese Mortgages and Housing

Much of the debt taken on by households in China, the US, and elsewhere is mortgage-related.Because it is usually the largest purchase an individual will make in their life.Fueled by low-interest rates, rising equity prices, and strong economic growth citizens around the world have been loading up on the real estate.And China is no exception.Recently, however, for many Chinese citizens, these projects have not come to fruition.Hundreds of Chinese citizens have taken to state-run social channels like WeChat to voice their displeasure.

- This has led to a “mortgage boycott”, where many Chinese home buyers are refusing to pay their mortgages.

The Leverage Dynasty

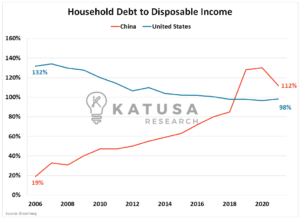

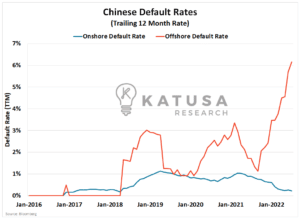

It’s no secret that many major Chinese real estate firms like China Evergrande are overleveraged. When the times were good, they spent frivolously and expanded recklessly – Evergrande even bought their own soccer team.When crackdowns on lending began to occur in 2020 these developers had to slow down or halt construction completely. All while the buyers had to keep paying their mortgages.Now, these homebuyers are refusing to pay their mortgage payments on construction projects which are sitting idle.This triggering effect of crackdowns and failed projects is leading to a surge in Chinese defaults.Below is a chart that shows Chinese defaults. Onshore and offshore defaults are converted to US Dollars and shown in billions of dollars.As you see below, the amount of defaults are touching all-time highs…

Now Let’s Look at Chinese Default Rates…

Looking through a different lens, you can analyze the data through default rates.You can see that issuers, especially offshore bonds are seeing default rates soar to multi-year highs.

- In the last 12 months, 27 issuers that hadn’t been in debt trouble in the past, have defaulted.

This is an ugly trend that the Chinese government cannot be happy about.

The “Too Big to Fail” Card

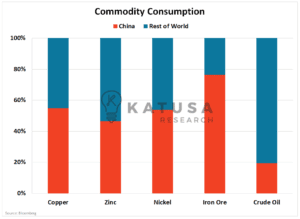

There are a dozen issuers facing debt payments over the next 30 days, which could make the default rate climb even higher.I suspect that the CCP will continue to allow mid-sized “not too big to fail” type companies to fail.And this sends a strong message for the rest of the group to get their houses in order.But when push comes to shove, the CCP will likely step in and support the largest of the loans and the “too big to fail” tycoons whose political ties are in line with the establishment. China’s central bank is looking to issue $30 billion worth of low-interest loans to commercial banks. These banks will then be allowed to leverage the $30 billion up $148 billion in liquidity for the property sector. Is this enough you may ask? Well, Evergrande alone has $300 billion in development liabilities…Make no mistake, the CCP does not want China to become a declining superpower, it will do everything in its power to make sure that doesn’t happen.What does this mean for the rest of the world?A lot, especially for commodities investors.China has long been a major buyer of commodities such as copper, zinc, iron ore, and crude oil.Here’s a chart that shows just how important China is to the global commodity markets.

In today’s world investors need to be acutely aware of macroeconomic changes.

China’s developments should not be taken lightly…

Just like how most market participants took a few months to understand how Covid was impacting China, so too, could be the case here.I recently outlined in my latest issue to subscribers how I am managing and looking to capitalize on Chinese risk.

- I outlined a full playbook and analysis of the number one company I am targeting over the next few months.

If you want to give yourself an edge and find out which sectors and ALL the companies I’m putting my own money into…It’s all detailed every month in my premium research service, Katusa’s Resource Opportunities.Regards,Marin