On a late Saturday night, when I was 12, I came across a movie called A Fistful of Dollars.Never seeing a spaghetti western before, I was immediately drawn to Clint Eastwood’s character, “The Man with No Name.”Still to this day, he is one of my favorite characters ever.Growing up in the lower-income, blue-collar neighborhoods of East Vancouver with a name like Marin, you attract unwanted attention by the herd.Much like the character in the famous Johnny Cash song, Boy Named Sue; who gets ridiculed for his name and more. And he fights back.The Man with No Name was the coolest person I had ever seen on T.V. and he didn’t even have a name. So, I thought to myself: Why couldn’t his name be Marin?It was the first time in my life that I realized that you can make yourself into whoever you want to be. It might be a long, tough road. But, it’s possible.And trust me when I say, it’s been a long and tough road to get to where I am. And if I can do it, so can you if you are prepared to make the sacrifices required to execute the plan.Clint Eastwood’s character, The Man with No Name, rarely talks. So, when he does, you lean in close to listen to his raspy lean voice.One specific line of his stuck with me… and has since I was 12:

“When a man’s got money in his pocket, he begins to appreciate peace.”

You and I are alligators.My long-time readers know what I am talking about.We are value speculators and investors.

- We look for significantly discounted companies in the world’s most speculative, cyclical sectors: resources and commodities.

I’ve discussed position sizing and the importance of keeping cash on the sidelines. And will continue to reveal my alligator strategy and blueprint.Sadly, we have not seen the worst of the resource market.

Recession Proof Your Portfolio

Earlier this year, I wrote to my KRO subscribers about how I believed we would enter a recession.And as a result…The U.S. Dollar would strengthen, commodities would decrease in price (including gold), and the share prices of the resource stocks would sell off.

- We are now entering tax loss season and I believe you and I need to prepare that the worst of the resource bear market is yet to come.

In this market environment, I appreciate the peace that comes from knowing I have money waiting for the right deal.When it’s time, I’ll pounce on great opportunities in the resource sector.And if it comes, we want to adhere to the 6 P’s…

Proper Preparation Prevents Piss Poor Performance

Many of you have likely heard of the saying “when there’s blood in the streets, you buy”.It is easy to get caught up in the day-to-day hype of the markets, especially these days when it is pretty ugly out there.

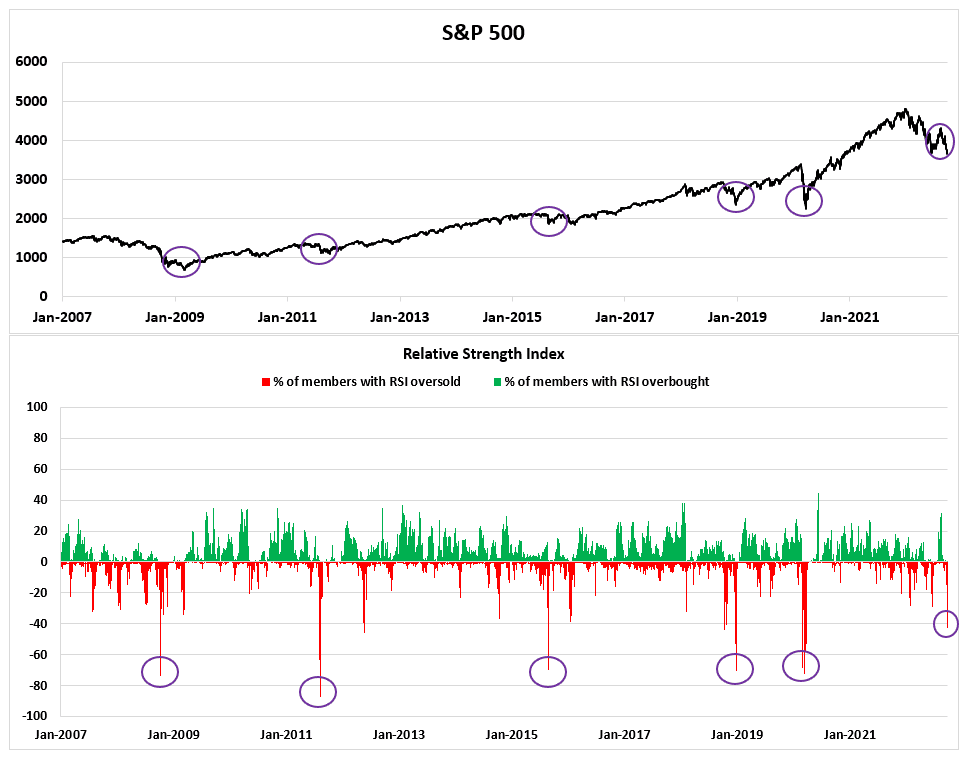

- As you can see in the chart below, based on the Relative Strength Index for S&P 500 companies, we’re nowhere near “capitulation levels”.

It’s only one indicator in my toolbox, but since 2007 it has been a reliable metric.

When it’s time, I’ll pounce on great opportunities in the resource sector.

Let Me Explain Why This Is So Very Important Right Now…

Over the past two decades, I have watched as management teams have frantically pitched their company’s potential to large fund managers.They hoped those fund managers would fund their dreams.Unfortunately, most of these investment bankers and fund managers owned very little – if any – stock in their own accounts and funds.Picture that. They had no skin in the game.So, guess what happened?The funds underperformed. And more than three-quarters of them have lost over 65%. Or shut down entirely.Many of the big accounts that were lead orders to many junior explorers and mid-tier producers have walked away and are under a lot of pressure for their apparent lackluster performance and high fund redemptions.

- That means the traditional big buyers of stocks have been the biggest sellers in a market with very little buying volume.

This is exactly when an alligator buys – when Institutional Funds are forced to sell.That’s why there’s a massive opportunity for us right now as investors looking to buy the highly cyclical resource stocks.

We Are The Buyers With No Name

It’s me. It’s you.It’s how the alligator wins.I have nothing against the investment bankers and money managers personally—it’s just the ones that have no skin in the game that I avoid.The ones who have no skin in the game are the ones who take the largest take the largest fees from managing other people’s money, regardless of performance.And frankly, they are not one of us, as our interests are not aligned.They will never be The Man with No Name.They are part of the establishment.

- Suits who look down at the retail crowd.

- Suits that look down at Marin Katusa and what he stands for.

- Suits that fear what the retail crowd can do if they know of the broken financial system structure. The one they have for far too long manipulated and exploited on the backs of the retail crowd.

They remind me of another quote from A Fistful of Dollars when The Man with No Name says:

“Sometimes the dead can be more useful than the living.”

The players with no skin in the game are essentially dead in the resource sector.The few that are left are still experiencing redemptions. Redemptions are when shareholders of their funds or accounts want their money back.And when redemption happens, they are forced to sell shares of companies they own to give the fund shareholders their money back regardless of the share price.It’s time for those with no skin in the game to become useful to us.

We Have a Fistful of Dollars

We are going to be alligators, waiting for our prey to come to us…

- Buying up opportunities at valuations that make analysts blush, and corporate management teams cry.

So where am I looking to park a lot of my cash in the near future until the debt bombs start exploding?You can learn more about Katusa’s Resource Opportunities right here.And if you didn’t take profits and raise cash many months ago, what have you been reading and doing?Fortune favors the bold. And the bold moves.Regards,Marin