Within seven years, EV production will come to a screeching halt.

Carmakers will switch gears back to gas-powered cars, net-zero goals will get thrown to the wayside, and emissions will rise precipitously.

This flies in the face of current predictions, but it’s an unavoidable reality.

Let me explain…

Analysts have consistently underestimated the growing demand for EVs, (including us here at Katusa Research!).

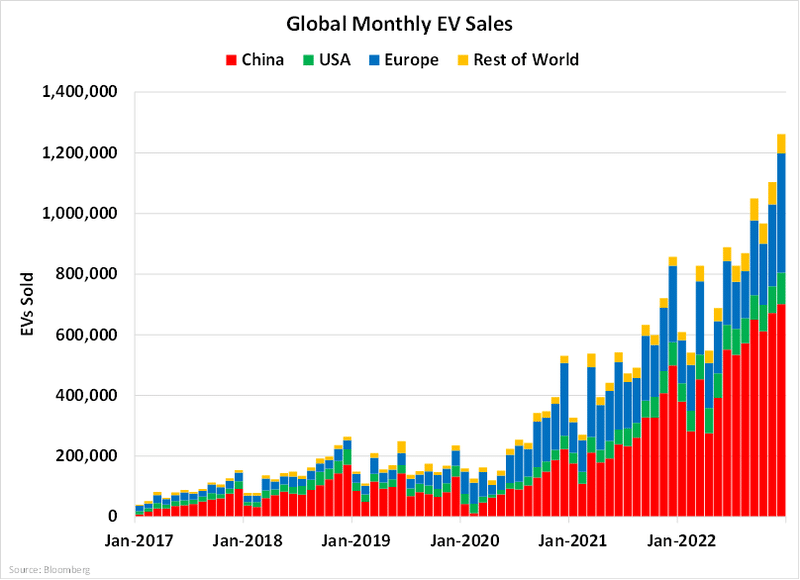

Bloomberg, a firm bullish on EVs, predicted in 2007 that 3.5 million EVs would be sold in 2022.

By 2019, they realized their projections were off by over 40%, so they revised their outlook to 5 million EVs sold in 2022.

The actual figure? 10 million.

- In fact, more EVs were sold in 2022 than from the beginning of human civilization through 2020… combined.

Much of the EV growth over the past few years has come from China. 60 percent of 2022 EV sales were in China.

Growth in the country was due primarily to EV subsidies, which ended at the end of 2022.

But just as China is slowing down, the United States is putting the pedal to the metal with a full gamut of subsidies, tax credits, government investment, and regulations.

EV sales in the U.S. have already shot up 400% since 2019 and it’s only the beginning.

- The United States plans for 50 percent of car sales to be EVs by 2030.

That requires a 10x in EV sales in just seven years.

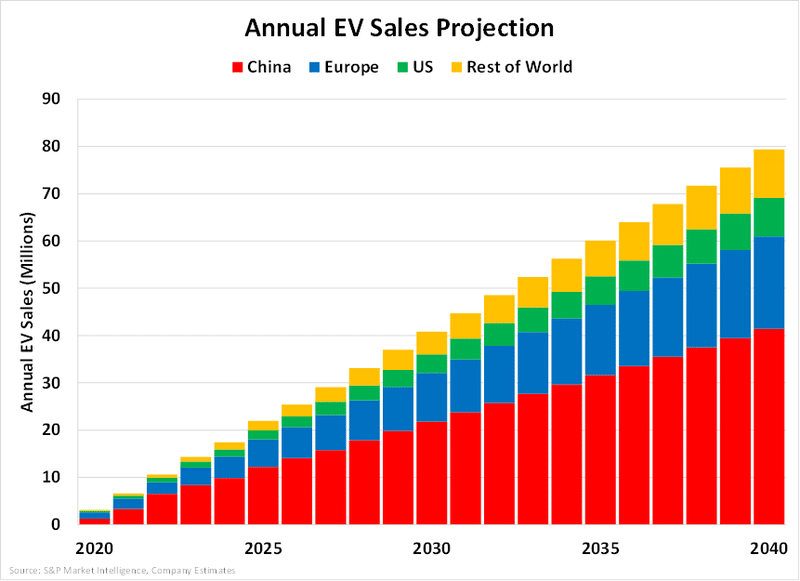

The growth is global: Bloomberg now projects that by 2040, more than 56 million EVs will be sold worldwide.

The hockey-stick EV growth is all due to two unstoppable forces bearing down on the industry.

The Gas-less Carriage Goes Global

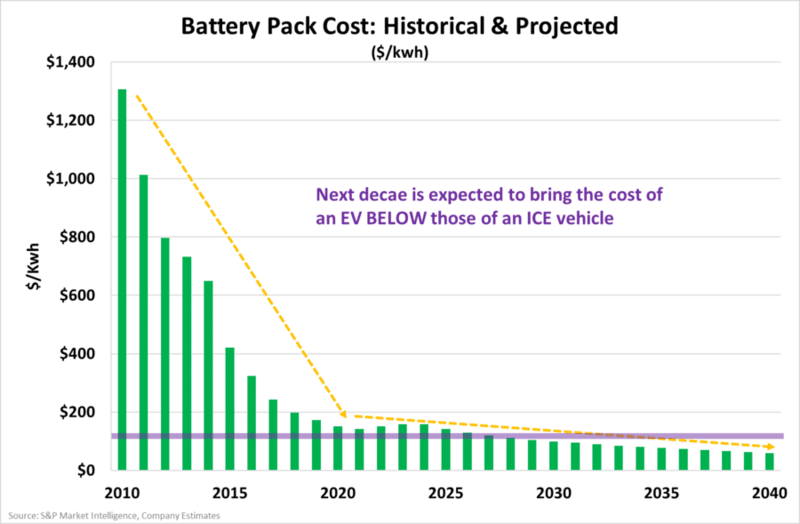

The first is “Wright’s Law,” which predicts that every time global battery capacity doubles, the price will decline by 18 percent.

Over the past three decades, battery prices have followed Wright’s Law with precision, declining by nearly 90% in the last decade as production has accelerated:

In 1992, a Tesla like battery would’ve set you back a jaw-dropping $450,000. Today, that same battery costs a mere $10,000. And by 2025, thanks to skyrocketing production, it’s expected to drop below $7,500.

Tesla CEO Elon Musk nails it when he says, “EV demand is a function of affordability, not desire. Even small changes in the price have a big effect on demand.”

Plummeting battery prices have allowed Tesla to slash costs across its lineup.

It’s a virtuous cycle: lower battery prices fuel higher EV demand, which in turn drives battery prices even lower.

Enter the game-changing “Minority Rules Law.”

This principle states that once 10% of a population embraces something, the majority will follow suit—practically overnight. In late 2022, EV sales reached that crucial tipping point, with 10% of all new vehicles sold worldwide being electric.

Hold onto your hats, we’re living through a rare, history-making moment.

The rapid global adoption of EVs is unfolding before our eyes, outpacing even the most bullish predictions. In fact, the growth from 2021 to 2022 alone surpassed the total number of EVs sold in 2020.

The future is electric, and it’s charging full speed ahead.

There’s only one problem, according to the IEA: “Electric car sales continue to break records, but mineral supply constraints are looming.”

And that’s why EVs are already at severe risk of being phased out, just as they’re getting started.

Car Manufacturers Sound the Lithium Alarm

You see, lithium required to meet all this demand just isn’t on the market.

Tesla plans to make 20,000,000 cars a year by 2030.

That will require lithium equivalent to more than 225 billion iPhone batteries—more than twice as much as the entire lithium industry today.

We’ll need 78 new mines by 2035 to accommodate total demand.

But few mines are under development, and existing mines are not scaling up lithium production.

Also, lithium mines take 10+ years to bring online. So if the mine is not already under development, it’s too late.

This is why massive shortfalls are already being predicted.

Under the best-case scenario, the lithium shortage in three years will be as much as the entire demand was in 2022.

To avoid the impending crisis, EV manufacturers are taking matters into their own hands. In a rare move, they’re getting involved in lithium mining itself.

What’s unfolding is an escalating, no-holds-barred brawl for lithium supply.

Consider Volvo, which is talking with the biggest mining companies in the world about buying a stake in their operations. Not for a profit, but just to have access to lithium.

Volkswagen’s CEO, Scott Keogh, echoes this sentiment: “We are not going to become a mining company. But certainly, we will get significantly closer.”

Or Ford, which pre-purchased 33% of the lithium output of a new mine in Nevada last year.

A few months after that, GM invested $650 million in a lithium mine—also in Nevada.

GM Director of Purchasing Tanya Skilton predicts that the industry will be divided into winners and losers: Companies with minerals for “electrified dreams” will succeed.

The rest are toast.

The Canary in the Lithium Mine

In short order, lithium has transformed from “unknown mineral” to “a matter of survival” for automakers.

Even the CEO of Mercedes-Benz predicts a coming lithium squeeze—and says that’s why Mercedes is buying future output from lithium miners to help suppliers raise financing.

Mercedes has even begun a nearly unprecedented step among carmakers: working on building its own processing facilities.

Unprecedented, of course, except for Tesla.

Two years ago, Elon Musk announced that Tesla planned to mine lithium on 10,000 prime acres in Nevada.

Industry observers thought it was a gambit: Musk was just trying to put pressure on the industry to step up production. Only Tesla is actually following through.

Dozens of new, hugely profitable buyers competing to buy lithium mines is going to make the mines much more valuable.

But it’s not just that. You see, the prospect of future competition for lithium has caused the price to skyrocket.

Lithium prices shot up from $6,800 in 2020 to $78,000 in 2022 before settling at the current ~$41,000 per tonne.

Which means ready-to-produce lithium mines have become far more valuable—all before a single ounce has come out of the ground.

Car manufacturers wouldn’t be getting into the lithium mining business if they thought the price was going down any time soon—or that lithium would be available when they need it.

And it’s in part because they realize that cars aren’t the only demand for lithium.

- You see, Tesla has a non-car division that will eventually be bigger than Tesla Motors: Tesla Energy.

Forget about EVs for a moment.

The batteries Tesla Energy is building—and the lithium they require—seal lithium’s fate as the white gold of the 21st century.

Lithium mines as some of the hottest properties on the face of the planet.

It doesn’t matter now how quickly supply is ramped up now; it cannot be fast enough through current production and refinement.

And EVs are not the only thing increasing lithium demand…

Because this isn’t just about cars. It’s about the literal future of power.

Renewables will require utility-scale batteries, each of which require an order of magnitude more lithium than EVs.

The future of energy in any form requires lithium. It has just become the most powerful metal in the world.

But America has just one, major, problem…

I’ll tell you how important it is in the next missive.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.