What can luxury watches and fine wine auctions tell us about the economy?The luxury market is coming back to the mean.Covid Cash that was injected by most Western governments helped the luxury watch market reach astronomic highs.This was a classic unintended consequence of government planning.You didn’t have to look far to see articles like this…

Watch prices from Rolex and Audemars Piguet, staples of flashy investment bankers cashing in on successful IPO’s, went through the roof on the resale market.

- A typical AP Royal Oak went up from $24k in 2019 all the way to $83k in March 2022.

- While an in-demand Rolex Submariner Hulk climbed from $13k in 2019 to $34k in April 2022.

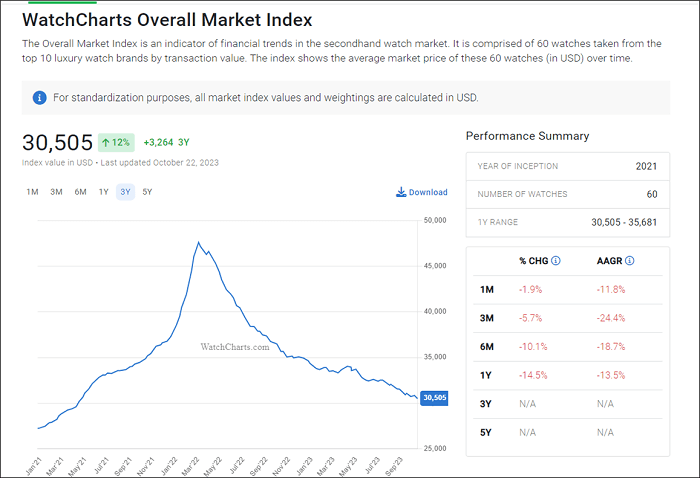

Things changed quickly when the Fed spiked interest rates at the fastest rate in modern history. The Overall Market Index according to WatchCharts is down 36% from its peak – back to May 2021 levels.And no signs of slowing down to newer lows.

Since those early 2022 highs:

- A basket of Rolex’s are down 31%…

- A basket of AP’s are down 33%…

- And even top vintage wines are down (looking at auctions)…

We’ll find out shortly how popular the secondary markets are for luxury excess items, once the world’s “most sought-after scotch whiskey” sells at auction. And at what price.However, the price correction might show that the investment bankers are trading in their timepieces for some even sexier 10-year treasuries…

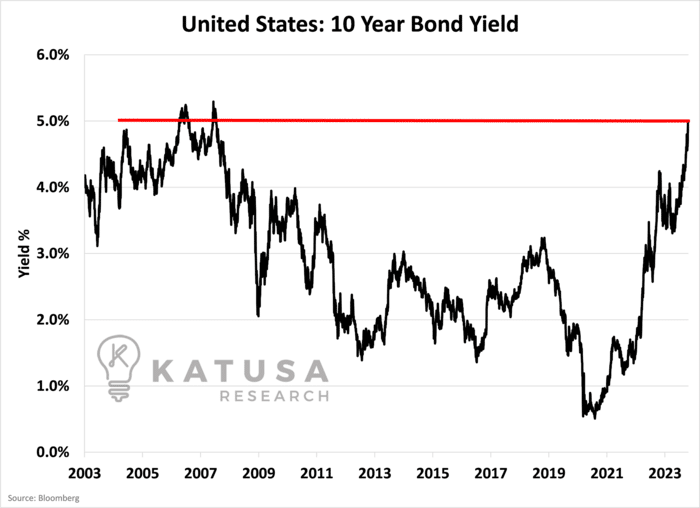

The Name’s Bond, Government Bond: US 10-Year Yields Pop Above 5%

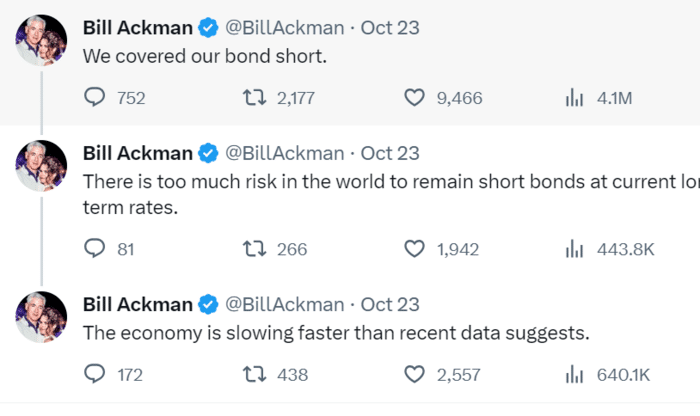

Monday of this week, at the market open, long term bond yields shot up to over 5% for the first time since summer 2007.The spike prompted a tweet by hedge fund managers Bill Ackman and Bill Gross to declare that they are covering their short bond positions.

With yields at generational highs, cashed-up companies and investors are making the easy decision of taking the guaranteed 5% with cash in the bank.So why is this important to you?As we wrote previously, it’s the new cost of capital and continues to rise higher. This is free, no-risk money so when an investment opportunity crosses my desk, I ask immediately:

- Why is this better than me making 5.15% (annualized) for doing NOTHING?

If your favourite stock or private company isn’t planning for higher rates for longer, they’re going to have a rude awakening.

The Fight for your Money: The Cost of Your Capital

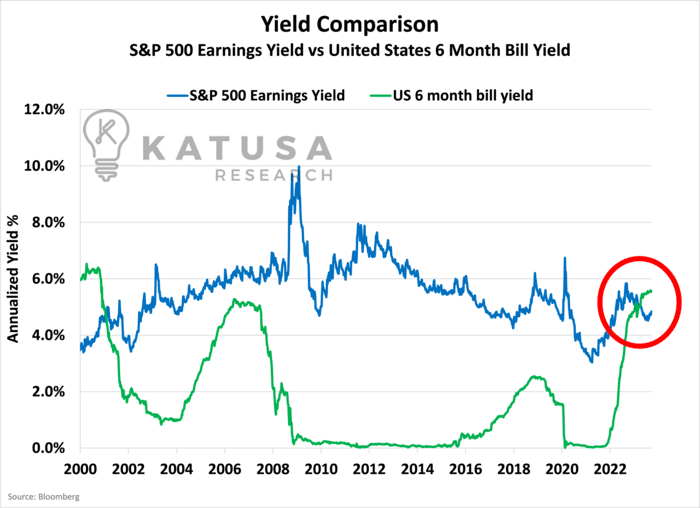

Speaking of rates, not since Nokia smartphones dominated the portable device market have we seen 6-month T-Bills yield the same (or more!) than the current S&P 500 earnings yield…

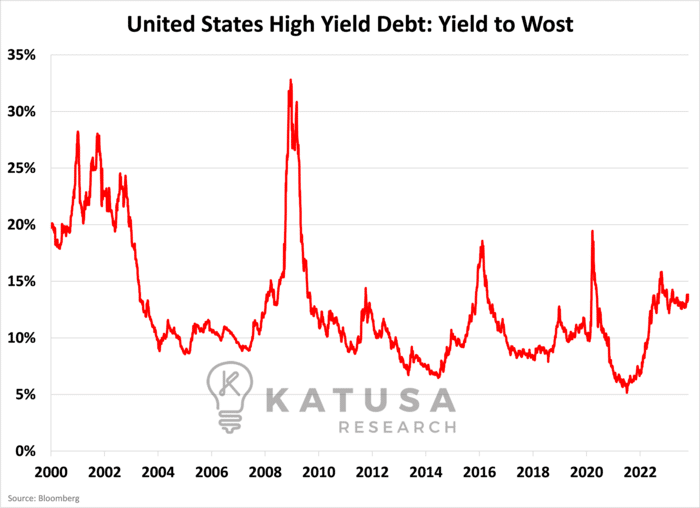

In a rising yield/cost of capital type of market, value traps are plentiful.It bears repeating… DO NOT BLINDLY CHASE YIELD.Know what you’re buying, and what the company is doing. Companies are just now starting to see the impact of a rising rate environment.Not to mention, CEOs of many small companies have never seen interest rates this high or run a company in this type of capital-constrained environment.They’re used to the ultra-cheap ultra-loose financial heroine of the past decade.Those days are long gone.Interestingly, the debt markets are not fully pricing in all the risk at this point, risk is elevated but not near ultra-crisis levels.Below is a chart which shows the yield on High Yield C-rated debt in the United States.You can see the cyclicality of the debt in times of crisis; notably in the tech bubble in 2001 and then again in 2008-2009 during the financial crisis.

During uncertain times…

High grading the portfolio is my favourite approach

Why take the risk of a speculative junior with no liquidity when I can get a comparable return in a large cap?Or better yet, for the first time in over a decade, wait and get paid over 5% (annualized) until it’s Alligator Time.We’ve just done an in-depth analysis on one of my favourite energy stocks.It’s the type of monster company that’s difficult to disrupt and will pay me to own it for years to come.But we’ve uncovered a very important technical item that not a single analyst (that we are aware of) has mentioned in any institutional report.We aren’t smarter, but we do have considerable skin in the game, so we are willing to look where others may have not.

- In this month’s edition of my premium newsletter – Katusa’s Resource Opportunities – we will publish those details.

And we suspect it will be a topic discussed in a few months in institutional research reports.We love being first.

Interest in Gold is Picking Up

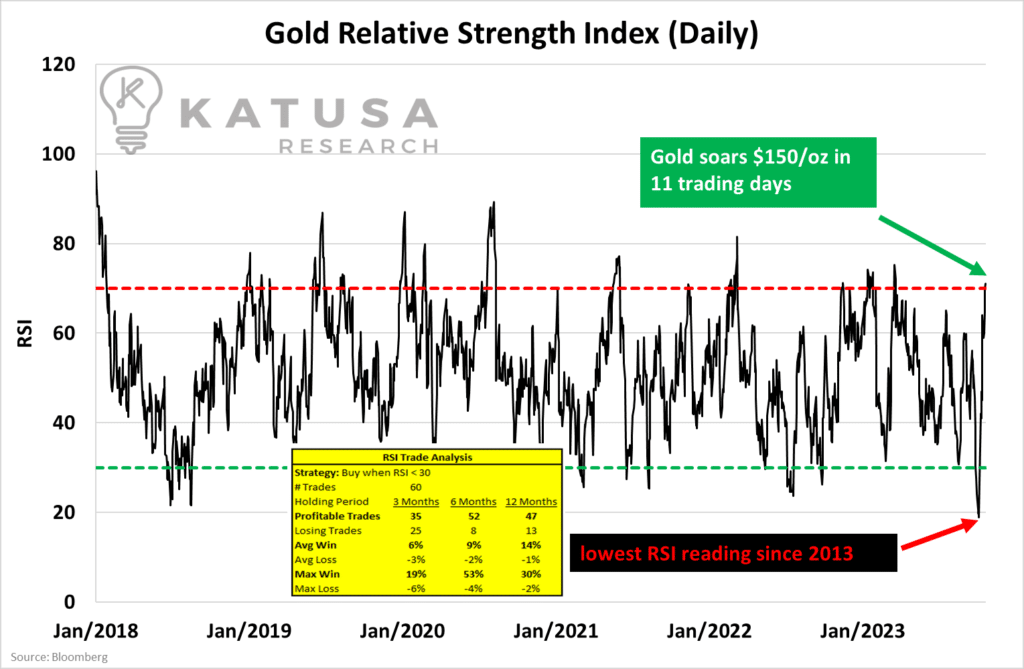

A few weeks ago, even though gold was well above $1800, the sentiment in the gold sector was absolutely horrible.

- In fact, spot gold was the most oversold it’s been in TEN YEARS.

Things changed fast, when less than a fortnight later, gold ripped $150/oz and entered overbought territory.

Gold is responding to uncertainty on the geopolitical chess board and could just as easily spike to new highs, or correct lower.My team and I are prepared for both scenarios and I continue to monitor the entire gold and silver market, looking for alligator-type opportunities in the public markets.Some companies continue to wither lower and lower, as the liquidity factor continues to dry up. Investors are preparing for what could be a unique tax loss season.Corporates are also waiting to see what assets shakeout from the Newmont/Newcrest merger.That’s the main reason the market hasn’t seen any mojo in the gold M&A sector.Since Feb 2022, we have been warning of a rise in cost of capital and have largely stayed on the sidelines.The alligator opportunity is coming much closer…And we get right into these options in this month’s Katusa’s Resource Opportunities KRO.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.