Corporate greed meets corporate greed as major money is moving in the carbon space.But that’s not a bad thing.If decarbonization becomes profitable, not only will corporations be chasing the benefits, but so will the brightest minds in the world.The world doesn’t need more lawyers and bankers.We need the bright minds of today to get into decarbonization, and more will follow if the financial gains are there.And things are moving fast…Startups focusing on climate technology, particularly those dealing with carbon and emissions solutions, secured a record-breaking $7.6 billion in venture capital investments during the third quarter of 2023.This amount surpasses the sector’s prior highest funding by $1.8 billion, countering the overall trend of reduced fundraising.Did we mention this is all happening while nature-based carbon prices in the voluntary market are at their lowest recorded level, ever?This week we are going to take a deep dive into Carbon Capture, one of the most important growth markets attracting major dollars.By the end of this, you will become smarter than 99.99% of other investors in this arena, including management teams of certain royalty carbon credit companies.

Breath In, Breathe Out

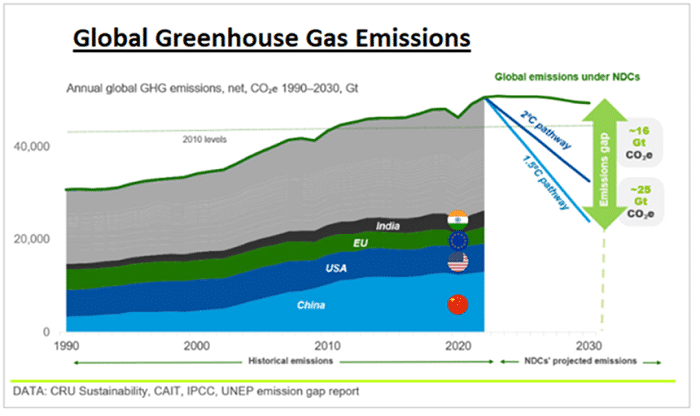

Carbon capture refers to capturing carbon dioxide either before or after it has been released into the atmosphere.To meet net-zero ambitions by 2050, it’s estimated that the US alone will need to invest over $150 billion, $80 billion of that dedicated to the “capture” of carbon dioxide.Now, put aside any bias you have or emotional trigger about the words “climate” or “global warming”…Greenhouse gas emissions are on the rise and there are few ways to reduce course at this point.Carbon capture is an integral part of the long-term solution to reduce greenhouse gas emissions.

- Swiss Re, one of the largest insurance companies in the world, cited that 18% of global GDP or $20+ trillion could be wiped out if we do not curb emissions.

Today we only have a few tools in our toolbox and capturing carbon at scale through technology is vital.

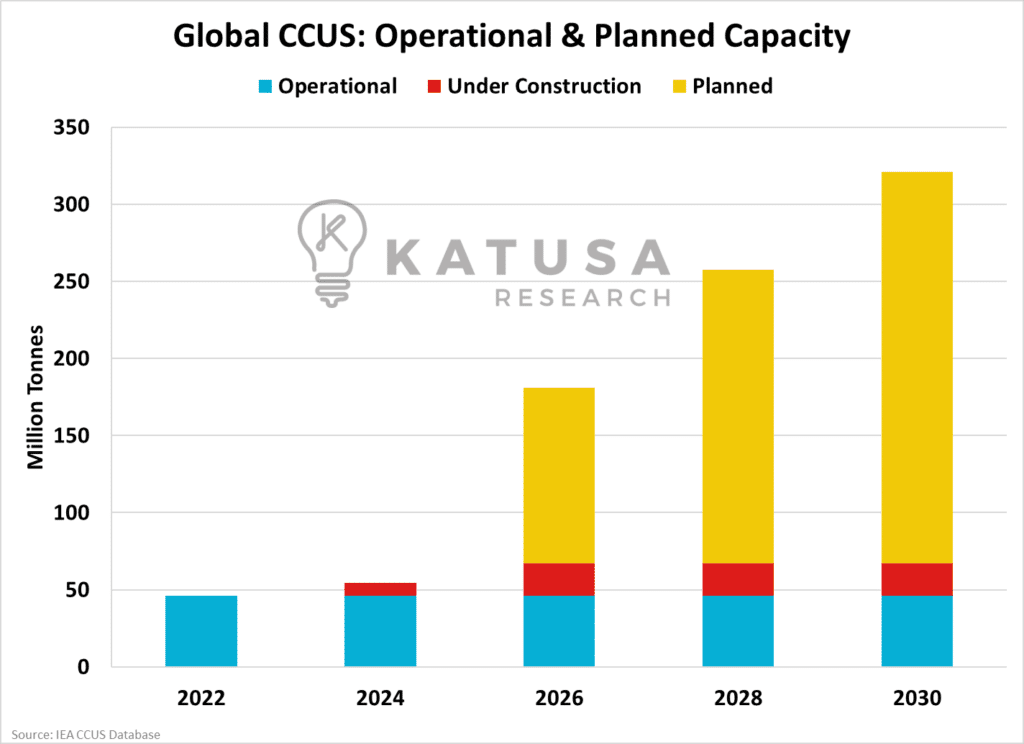

According to the International Energy Agency (IEA), there are 573 carbon capture projects worldwide that are in early development through to operational stages.The majority of these projects are “planned” meaning they are very early stage, likely requiring many permits and capital for build out. Below is a forecast for global CCUS projects.

The growth in advanced development projects makes sense, as lawmakers around the world have pledged big subsidies to these types of projects.The lead time to build a carbon capture facility varies greatly from a few years up to a decade and I think the IEA is overly optimistic in their forecast.Government subsidies play a crucial role but so does debt and equity financing, which has gotten tremendously more expensive, raising big slugs of capital is not easy right now and I think this will push out the timelines considerably.

- Total CO2 capture in operation today is approximately 46 million tonnes, with 250+ million tonnes in the development pipeline.

It would be considered a political failure if total CO2 capture didn’t scale into the billions of tonnes per year over the coming decades.

Immediate Opportunity: Power and Heavy Emitting Industries

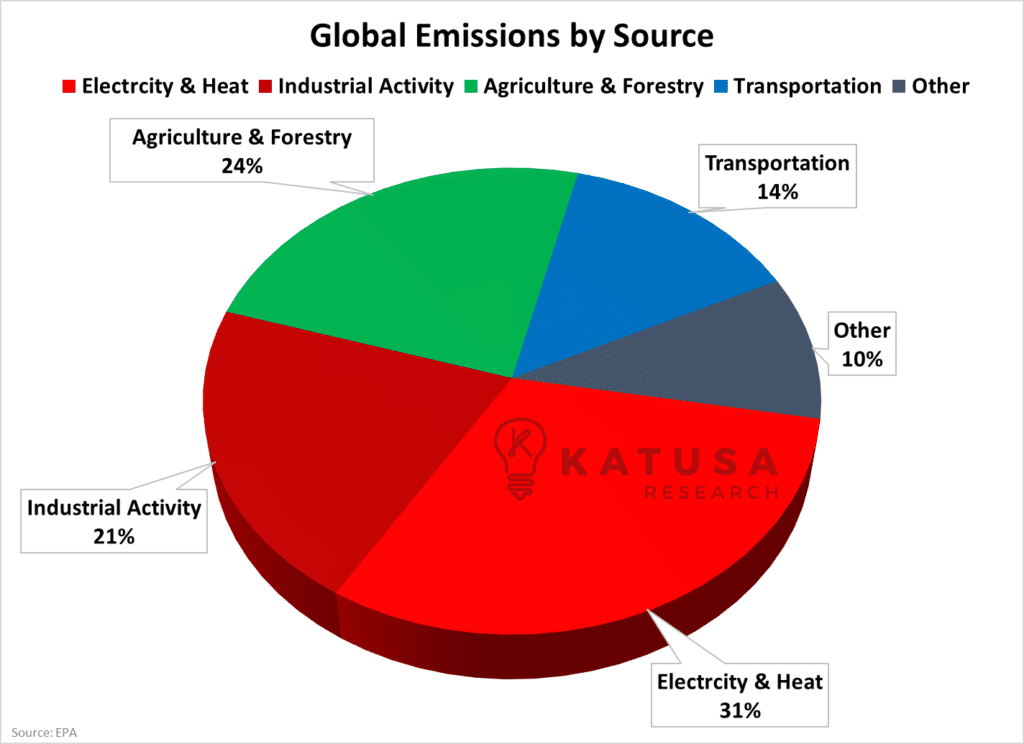

Electricity and industries like cement, steel, and petrochemicals account for over 50% of global emissions.This is an enormous market for carbon capture to be deployed at scale.

Coal-fired power generation presents a particular challenge but is a massive opportunity.

- The global coal fleet accounted for almost one-third of global CO2 emissions in 2019,

- And 60% of the fleet could still be operating in 2050.

Other than retiring the plant early, Carbon Capture and Storage is the only alternative to maintain the electric grid while mitigating emissions.Retrofitting CO2 capture equipment can enable the continued operation of existing plants, as well as associated infrastructure and supply chains – but with significantly reduced emissions.Carbon Capture and Storage is also the only solution to address CO2 emissions from natural gas processing.This is important given the continued reliance on low-cost natural gas across the global energy system.

Capturing the Man of Steel… and Cement

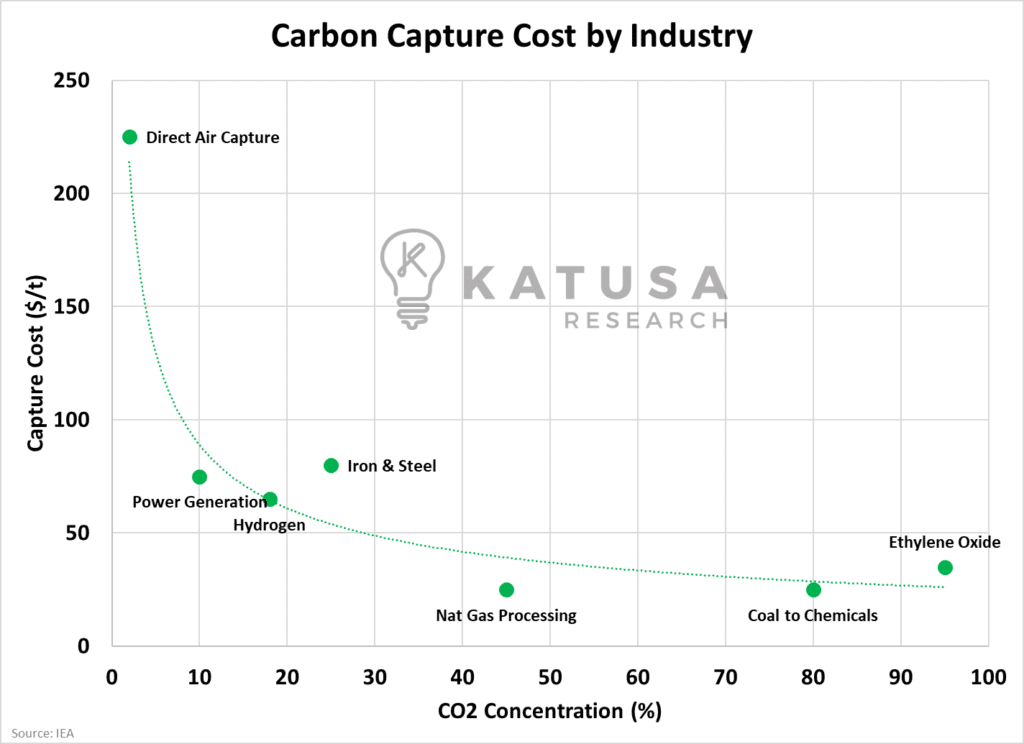

Steel, cement, and petrochemicals are industries that stand to benefit greatly from CCS activity.These are emissions-intensive industries.The challenge with those industries is that they are all very price-sensitive and may elect to wait until technology improves rather than diving in today.To incentivize these businesses to jump in, the government could play a support role in the transition.Typically, from a cost perspective, “capture” represents roughly 50% of the total capex of a CCU or CCS project.

- The most advanced and widely adopted capture technologies are chemical absorption and physical separation.

Below you’ll see a cost curve for carbon capture for various industries.As you will see, the more concentrated the CO2, the lower the cost of carbon capture.This makes sense as the air has a very low concentration of CO2 relative to power generation.

- This indicates that it takes enormous amounts of energy to capture 1 tonne of CO2 in the air versus 1 tonne of CO2 from a natural gas power generation facility.

There have been some major moves and money exchanged in this arena…

- According to PitchBook, over the last 2 years, there have been 1000+ deals in the carbon capture space, which have raised a total of $28 billion.

Well-known industry titans have begun to enter the space, a few of their deals are below.

- ExxonMobil just acquired Denbury Resources, an oil and gas producer with an extensive CO2 pipeline network, for about $5 billion. Denbury’s current infrastructure, including 1,300 miles of pipelines and ten onshore carbon sequestration sites, positions Exxon as the owner of the largest operating carbon pipeline network in the US. This move aligns with the growing carbon market trend and allows Exxon to take advantage of tax credits available through legislation like President Biden’s Inflation Reduction Act.

- Brookfield Renewable Partners alongside the Brookfield Energy Transition Fund will invest $1.3 billion into a handful of early-stage carbon capture and storage opportunities.

- L.A.-based carbon capture startup Avnos signed strategic investment deals worth over $80 million with big oil companies, Shell and ConocoPhillips, and JetBlue to ramp up commercialization of its novel Hybrid Direct Air Capture (HDAC) technology.

When the largest, most well-connected, and cashed-up companies in the world are making MAJOR moves like this…You might want to take notice. I do.These are smart people investing billions into a specific sector, early.Subscribers to Katusa’s Resource Opportunities are well ahead of most investors on the learning curve in the carbon markets.If you want to read about opportunities and specific ways to invest in one of the fastest growth markets on the planet…Click here to learn more about my premium research.It’s better to be early, than a minute late.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.