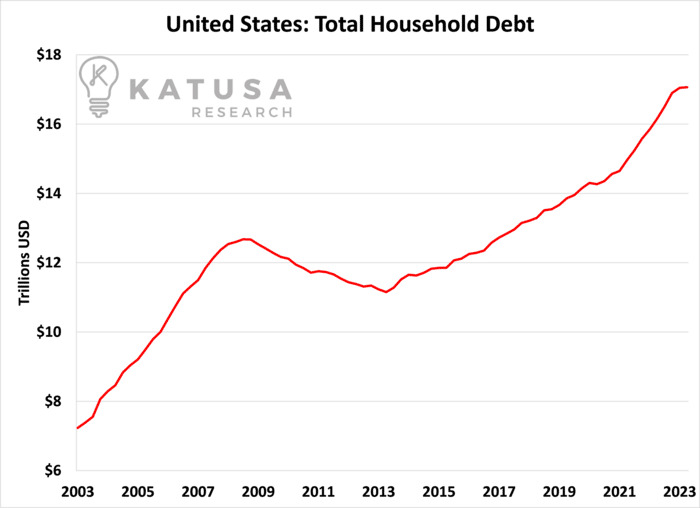

Main Street USA is feeling the pinch.Groceries, rent, travel, transportation…Every light in every home, every ringing cash register, every swipe of a credit card is a heartbeat in the living, breathing entity of our economy.The $17 trillion debt figure looms like a skyscraper, casting a long shadow over the streets. But there’s more to this skyline than meets the eye.When scaled against the US Gross Domestic Product, this towering debt transforms into a mere milestone on the path of economic evolution.In this week’s missive, we’ll do a deep dive into the real story behind these numbers.That despite the daunting height of debt, the GDP has soared even higher, reshaping our view of America’s financial health.Let’s get right into it, and it’s not pretty…

All American Dream: The Bet on Debt

American households currently hold roughly $17.3 trillion in household debt.It is a startling large figure. Housing debt accounts for $12.5 trillion, while non-housing-related debt accounts for the remaining $4.8 trillion.

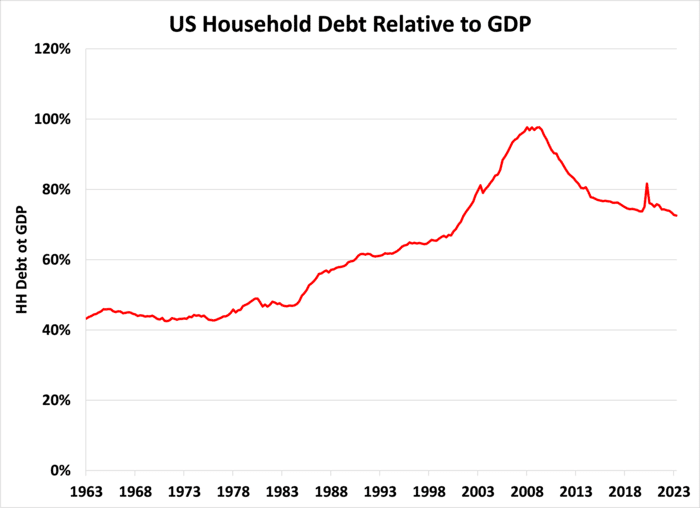

However, although household debt has grown, so has the economy, wages, prices for goods, think of this as the “income or earnings” side of the nation.Debt should be put into relative terms to paint a clearer picture of the situation.A common way to normalize household debt is against US Gross Domestic Product, over time mega trends are evident.

As you can see from the chart above, debt grew faster than GDP for decades, culminating during the Great Financial Crisis.However, since then, debt to GDP is not nearly as bad as it was during the GFC from 2007-2009 period.In absolute terms, household debt has gone up, but GDP has gone up faster over the past 15 years, which has led to a decline in the ratio.Now there is a lot of debate on the quality of GDP, but it’s a constant measure to be compared to…Remember, this is just one metric to demonstrate current debt levels relative to past levels.

GDP Growth and Credit Cards

Going deeper, GDP growth has outpaced household debt because of ultra-cheap borrowing rates.Trillions upon Trillions of dollars injected into the financial system have supported the economy, with consumers and corporations gorging on cheap debt.

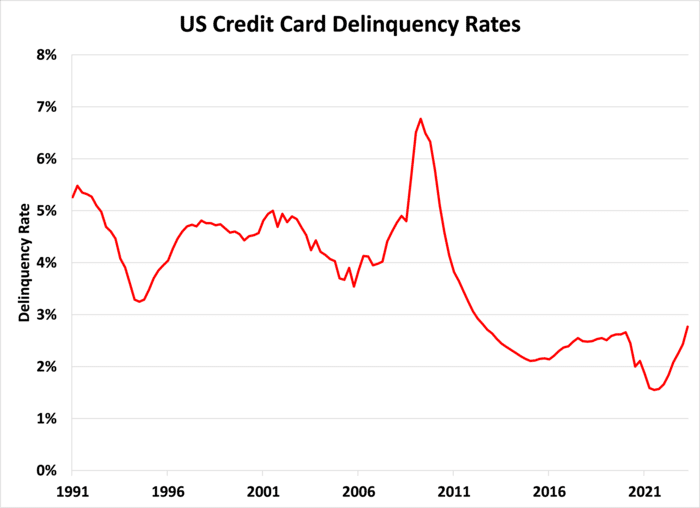

- Headlines may tell you that consumers are feeling the impact of higher rates, but we are nowhere near crisis levels of past recessions.

When times are really bad, consumers don’t make payments on their credit cards and used cars and give up on mortgages and so on.We saw this happen during the Financial Crisis in 2008. A good real-time indicator is delinquency rates on credit cards.As you can see in the chart below, in 2008 delinquency rates doubled, shooting up as high as nearly 7%. Today rates are still below average but have begun to spike and are approaching 3%.

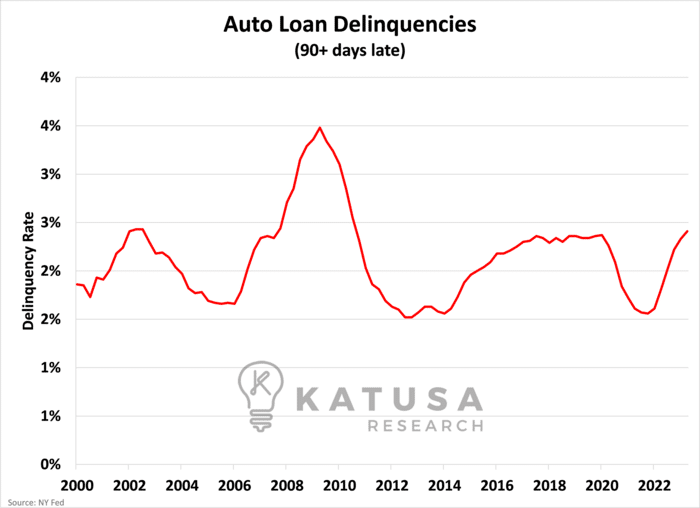

Auto loan delinquencies paint a similar picture. Auto loan delinquencies are rising, but not anywhere near crisis levels.

With the consumer in reasonable shape, the economy still reporting higher-than-expected GDP.So we feel the Federal Reserve is not under immense pressure to cut rates just yet.

Who’s Working and Who’s Not

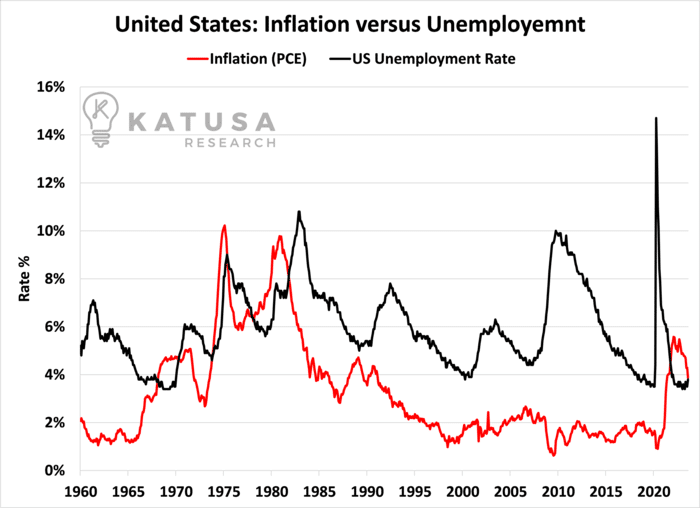

The two preferred gauges of economic health used by the Federal Reserve are PCE Inflation and the unemployment rate.As you can see in the chart below, unemployment has not spiked, and PCE inflation is heading lower, but is still near 4%.

All of this to me suggests that the Fed is not ready to cut rates yet, which in turn means borrowing costs for companies will remain elevated in the near future, at least 6-12 month time frame.This means there’s a fight for cash.If you have money, your benchmark right now is that you can earn over 5% in the USA and Canada, risk-free. (That is, unless you see the government defaulting).Any public stock or private company enticing you to buy a share or a thousand is now dealing with this struggle.It’s the cost of capital. Your capital. Company capital. Debt capital.All of the above.Right now, we’re not a crisis levels of debt when you factor GDP into the equation, but there is a crisis of liquidity emerging in the markets.It’s making your favorite stocks get cheaper and cheaper.

Following The Money is What I Love Doing…

We’re undertaking a massive project analyzing corporate treasuries, burn rates and available cash.We put many companies through the ringer to find out where they’re spending their money – and how wisely.

- Are they paying themselves first through excessive compensation to keep their lifestyles afloat?

- Are they juicing up their companies to look good on paper, vs growing shareholder value

- Are their dividends safe

- Are stock buybacks worthwhile

A lot of companies are value traps right now at current rates, and other companies are coming right into my alligator investor buy zone.We went into deep analysis on two companies high on my watchlist, picking everything apart in a stress test.And then we revealed two potential high-risk, high-reward takeout candidates.You can do this all yourself…Or you can make a few clicks and let us do the heavy lifting for you by joining Katusa’s Resource Opportunities.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.