This week, there are 4 major developments in nuclear power you need to know:

- The U.S. House clears the “NO RUSSIA” uranium act to the Senate,

- Miss America is putting the crowd on nuclear power,

- Microsoft and major tech darlings are going full nuclear throttle,

- Uranium prices are at 15-year highs

Uncle Sam Pushes the Red Button: NO RUSSIA

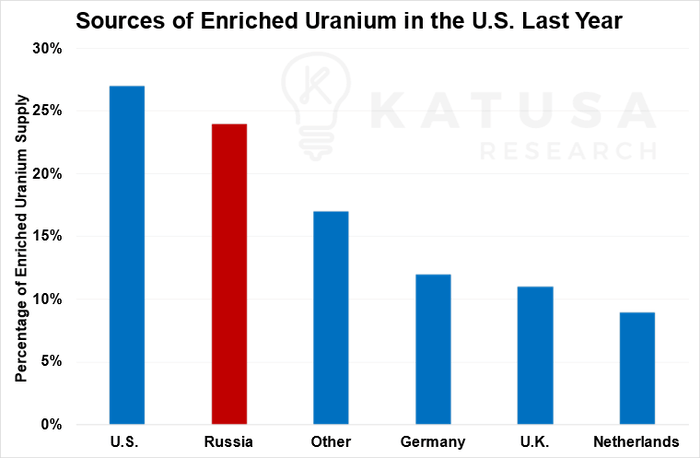

In a major move this week, the U.S. House of Representatives passed bill H.R. 7403 (117th), the National Opportunity to Restore Uranium Supply Services In America Act (NO RUSSIA Act) of 2022. Also approved was a separate but related piece of legislation, bill H.R. 1042 (118th), the Prohibiting Russian Uranium Imports Act.Combined, these two bills are a clear response to reduce Russian influence in the U.S. uranium market and both enjoy widespread bipartisan support.

- The bills, now awaiting Senate approval, ban the importation of low-enriched uranium (the kind used in nuclear reactors) from Russia.

- While also calling for the Secretary of Energy to establish a Nuclear Fuel Security Program.

This program aims to revitalize the U.S. uranium industry, vital for fueling 93 nuclear reactors and military nuclear needs.With these reactors require nearly 50 million pounds of uranium yearly, a steady, secure supply is crucial.

Russia is the U.S.’s top foreign enriched uranium supplier and third in uranium oxide. Reshoring production and enrichment demands a significant investment.But wait, there’s more…

Miss America Goes Nuclear

Grace Stanke, Miss America 2023, is using her newfound fame to push for one specific form of zero-carbon energy.And for good reason: after studying as a nuclear engineer, Grace is especially qualified to teach people the truth about the world’s safest zero-carbon energy source: nuclear energy.

Most importantly, she wants to squash the widely accepted view that nuclear power is dangerous and expensive.In fact, in a recent interview, she explained that nuclear energy already plays a large role in the lives of many Americans, whether they know it or not…

“From curing my dad’s cancer twice, to powering 20% of America, to helping with agriculture which is so important in my home state of Wisconsin… it really does feel like nuclear does it all.”

Why is that, you ask?

The AI Energy Challenge: A Computing Power Explosion

AI development has seen an unprecedented surge in computing power requirements.

- Since 2010, the energy needed to train AI systems has been doubling every six months – a dramatic acceleration from the previous two-decade norm.

This surge signifies a looming challenge: AI’s future advancements hinge on massive energy availability.The world’s most advanced supercomputers, like the 1.1 exaflop Frontier and the upcoming 5 exaflop AI Research SuperCluster by Meta, illustrate this trend.These machines, essential for AI progress, consume power equivalent to tens of thousands of homes.Intel’s “Zetta Initiative” aims even higher, planning a zettascale computer by 2027…

- Such a machine would require the energy output of 21 nuclear power plants with current technology.

It’s only a matter of time before large funds investing in the AI revolution figure out that a supply chain of clean baseload power is the key to guarantee the AI Revolution.Microsoft will be one of many, but expect the smart funds looking to clip their share of the profits by locking down a piece of the power supply.

The Nuclear Solution: Small, Efficient Reactors

Addressing this energy challenge, Gates, Thiel, and Altman are focusing on Small Modular Reactors.

Enter the Radioactive Elephant in the Room

In 2015, I gave the keynote at the World Nuclear Fuel Market (WNFM) in Paris where the utilities meet the producers to cut deals.My talk spoke about the cost of enrichment, how prices would go lower, and why Kazakhstan held the power to truly benefit if they planned accordingly.When Kazatomprom (the largest producer of uranium globally) went public in 2018, the investor PowerPoint presentation featured data and charts credited to Katusa Research.Kazatomprom executives got the point loud and clear.And now they’ve positioned themselves to become the OPEC of uranium.

- Kazatomprom quietly partnered with the nation’s Sovereign Wealth Fund to build a Strategic Uranium Reserve (A SUR Thing) that now has plans to purchase $500 million dollars of physical uranium.

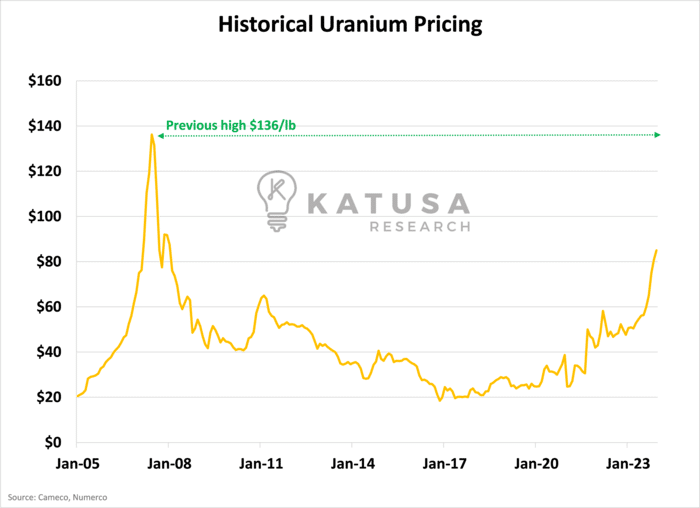

Think about the advantage this Strategic Uranium Reserve will have compared to the other market players looking to purchase uranium, due to their close association with Kazatomprom which produces 43% of the world’s supply.It’s an incredible leg up for one to be tightly aligned with such a powerful force in the physical uranium market.For context, last year, Kazakhstan alone produced 46.8 million pounds of uranium. At today’s price of $85 dollars per pound, that’s $4 billion in a single year.Purchases by Kazakhstan’s Strategic Uranium Reserve will make the price of uranium that utilities outside of the country must pay go radioactive – in other words, a lot higher.In a similar move, Chinese state-owned energy company China National Nuclear Corporation signed a massive deal with Canadian uranium company Cameco earlier this year in an attempt to get as much uranium as they can get their hands on.There are even rumors floating around that Cameco may actually be short in their committed contracts and will be required to enter the spot market to purchase physical uranium to meet their contracted obligations.To make things even more interesting, there’s also hearsay that Kazakh ISR production is coming in lower than expected. The uranium is all still there, but the cost of production will increase and deliveries will be later than scheduled.Expect actual physical delivery of uranium in both the spot and long-term markets to be delayed.The uranium spot price just soared to a 15-year high of $86 per pound this past week and is showing no signs of slowing down:

- RELATED: You can view the latest uranium prices here.

Click here to learn more about my premium newsletter, Katusa’s Resource Opportunities, where I detail what companies I’m buying, holding and looking to get into.Before you see it on the front-page news headlines.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.