In our most recent edition of Katusa’s Resource Opportunities…We went into detail showing some cash flow metrics most investors have never heard about.It breaks down complex data into simple chart points that are easy to follow.We then published the “Spread on Growth” which is the economic value created or destroyed by deploying capital.And it has some alarming conclusions.

- NOTE: If you’re not yet in the room with us, I encourage you to get in on the inside. We’re working on finalizing the details of a brand-new buying opportunity for subscribers – I call it “Big Game Hunting”.

But here’s what I can tell you for free…

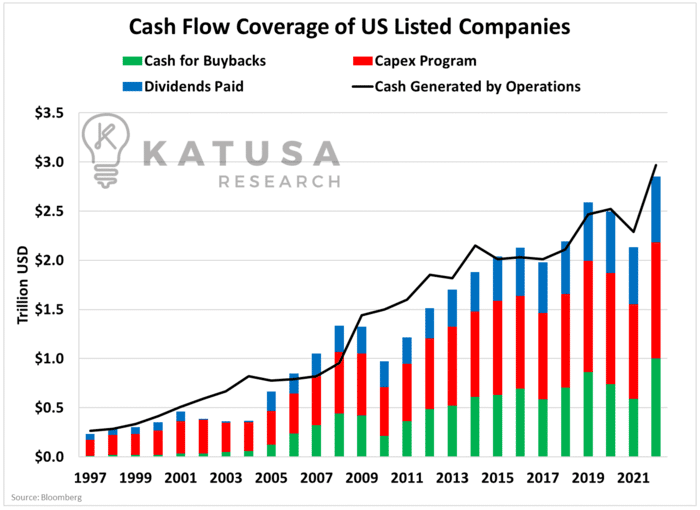

From our projections, it looks like US companies (on average) will be facing major headwinds for the next few years. This is because the cost of capital is going to outweigh the return on invested capital.This is already being shown in the BIG 7, where Google Cloud isn’t meeting its growth expectations, same for Amazon and Meta.It gets even worse for the companies whose cost of capital is much higher than the Big 7.Companies utilize their cash flows for 3 primary uses.

- Capital Expenditure Programs

- Share Buybacks

- Dividends

Share Buybacks 101

To reward loyal shareholders and signal confidence in its future, a company announces a massive stock buyback program.Suddenly, everyone’s talking about what this means.

- In the public markets, a stock buyback, also known as a share repurchase, is a corporate action where a company buys back its own shares from the marketplace.

- This process reduces the number of outstanding shares, increasing the ownership stake of remaining shareholders.

It’s often seen as a way for a company to invest in itself, reflecting its belief that its own stock is undervalued.Buybacks can positively impact the stock price, as they often lead to a higher earnings per share (EPS) ratio, making the company appear more profitable and attractive to investors.However, they can also signal a lack of profitable growth opportunities and lead to questions about long-term value creation.This financial maneuver plays a significant role in stock market dynamics, balancing corporate strategy with shareholder interests.As you can see in the chart below, share buybacks became an important tool in the corporate toolkit and is the fastest-growing segment of cash uses.

What’s important for investors to understand about the share buyback plan is that the company has control over when and how much stock to buyback – and at what prices.In some instances, a company may elect not to buy back its full allotment.

Cash Flow and Stock Dividends

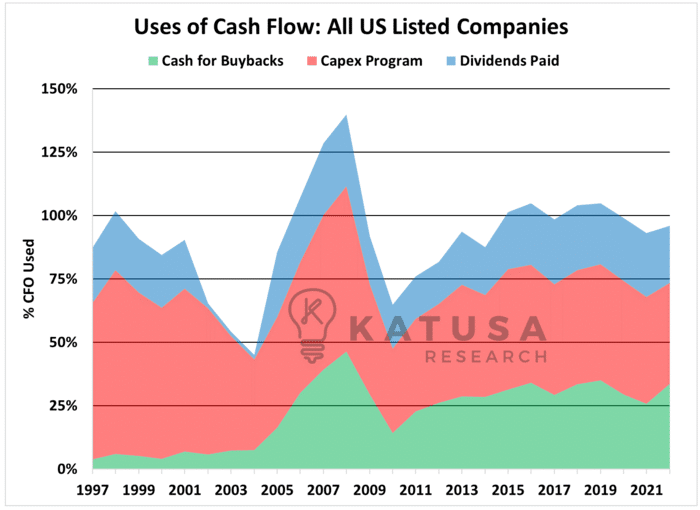

Let’s compare to a dividend policy which is approved by a board of directors and is fixed. It’s rare for a stock to sell off hard when it fails to buy back its full allotment of shares.On the other side, it is common for dividend-paying stocks to get crushed upon the announcement of dividend cuts or halts.The chart below shows the 3 uses of cash as a percentage of the cash flow generated by the business.

- If the ratio is above 100% it means that companies had cash outlays greater than cash inflows in that year.

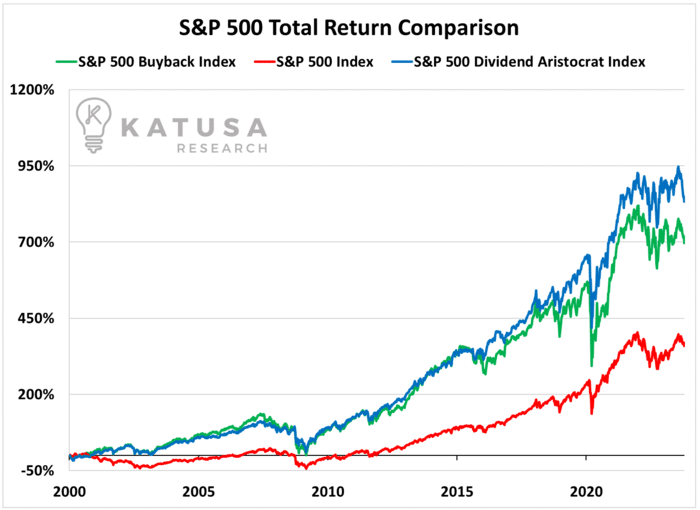

Over the past 2 decades, where investors were starved for yield most of the time, share buybacks and dividend payments represented lucrative inflows for investors.Below is a comparison of the S&P 500 versus the top 100 S&P 500 buyback companies and the S&P 500 dividend aristocrat index. These are all compared on a total return basis.

The results speak for themselves…

- Companies that increased shareholder returns via buybacks or dividend payments greatly outperformed the S&P 500.

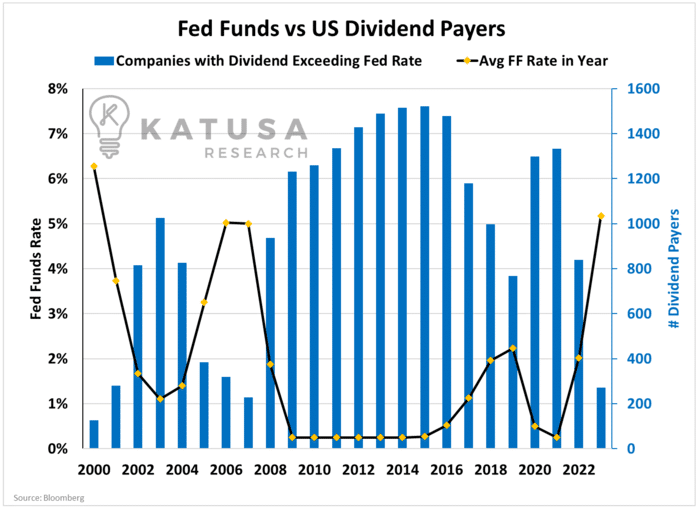

Today there are only a handful of companies in the United States that have a dividend yield greater than the 5.5% Fed Funds rate.Given the rocky market conditions and the fact that the majority of dividend-paying companies are currently paying less than the Fed rate of 5.5%…Means that, in most cases, we are taking significant equity price risk and not being compensated for it appropriately.Below is a chart that shows the number of companies with dividend yields exceeding the Fed Funds rate since 2000.

We track these companies in our database…And now that the pretend in the old playbook ‘Amend, Extend and Pretend’ is over, we expect many of these companies will not be able to continue the distribution payments.It will result in cuts to the dividend which could lead to significant equity share price decreases in 2024.Key TakeawaysI suspect that the cost of capital due to the interest rates will remain elevated for longer than most investors desire.This will put a strain on corporate profits along with capital raising and capital deployment. In turn, this will negatively impact company growth rates.This is not a situation that will be solved next week or next month, or maybe even next year.

- It’s paramount that Alligator Investors remain steadfast in our vision to buy great companies, with great assets, in safe jurisdictions at quality prices.

In the next issue of Katusa’s Resource Opportunities, we’re going BIG GAME HUNTING.There is a very interesting project…Hitting all the right numbers and grades…Getting all the right attention…And after nearly 12 months, the price is right for me to pick up shares.Click here to learn how to become a member of Katusa’s Resources Opportunities.Ensuring that you get the alert when I hit “send”.Regards,Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.