The data center industry used to be a relatively small, niche sector.

But in 2023, it was thrust into the limelight—and it’s been growing at an unprecedented pace ever since. The overall number and sheer magnitude of the data centers being built defies imagination.

Bill Vass, vice president of engineering at Amazon Web Services, said that the world is now adding a new data center every three days.

A data center’s capacity is typically measured in megawatts (MW) or gigawatts (GW): how much power its servers require to run.

- In just two years, the MW of data centers under construction has risen by 700%.

Imagine what would happen to real estate if, two years from now, the number of houses under construction rose 700%.

Odds are good that demand would drop and prices would plummet. But that’s just not happening for data centers.

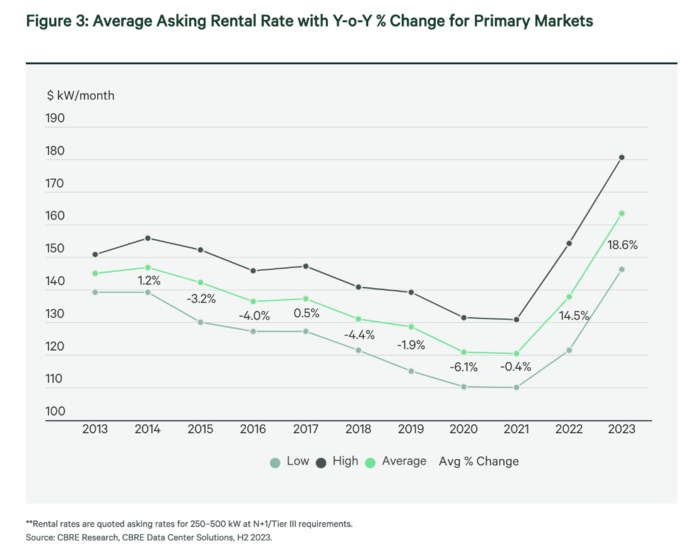

Even as construction spikes, lease prices are skyrocketing.

The average asking rate for data center leases increased by 15% from 2021-2022, then another 19% last year. In primary markets, prices are rising as much as 30% a year.

And 2024 is expected to see another year of double-digit growth in lease prices.

At the same time, data center demand continues to rise. U.S. companies leased 1 GW of data center capacity in 2021 . . . 2.3 GW in 2022 . . . and 3.8 GW in 2023.

In other words, this is the start of an exponential growth curve.

It couldn’t be better news for data center developers—or worse news for tech companies.

NO Vacancy

Data center demand is so high that as soon as a new project is announced, it’s taken. There’s no time for a tour; the lease has to be signed before shovels are even in the ground.

Historically, less than half of data centers have been preleased. Now, more than 80% are. Northern Virginia data centers have a vacancy rate of less than 1%.

Take it from the market experts:

“Every [data center] that gets built gets leased. There is no vacancy.”

– KLNB principal Ryan Goeller

– JLL Managing Director Andy Cvengros

Data centers simply cannot be built fast enough to meet demand.

So the prelease window is getting longer. Hyperscalers like Meta and Microsoft are now preleasing two to three years before a facility is finished—up from a one-year lead time in 2022.

And the picture is expected to get even uglier for tech companies.

– JLL Managing Director Andy Cvengros

But tech companies don’t need data centers in three to five years. They need them now.

It begs the question: If some of the most powerful companies in the world have been pouring hundreds of billions into the buildout . . . what’s the holdup?

The answer is something even Blackstone admittedly didn’t consider in its original investment thesis. It’s something that will severely handicap the growth of any data center company that does not find a solution.

And it has the potential to be a far greater investment than data centers themselves.

Got Power?

Re-read the end of Andy’s quote above. He knows something crucial: Data centers aren’t just storage units.

They’re storage units filled with massive numbers of computers—computers that suck massive amounts of power.

E. Cermak, the data center in downtown Chicago, hosts more than 100 MW of mission-critical power infrastructure.

It’s so big that it has surpassed O’Hare Airport as Commonwealth Edison’s single largest customer in Illinois—all housed in a single building.

- A single data center like E. Cermak can use as much power as 200,000 people.

Let that sink in. Hundreds of E. Cermaks are cropping up all across the U.S.

Consider the five-building campus recently pre-leased in Northern Virginia. Its 430 MW of servers would require an entire full-sized nuclear reactor to run.

- QTS estimates that completing its data center projects alone will require the same amount of electricity as five million homes.

But utilities, many of which have already been struggling to keep the lights on, don’t know where that surge in power availability is going to come from.

So they’ve begun implementing strict quotas on new data center construction.

Virginia’s utility, Dominion Energy, for example, has both delayed and flat-out rejected new construction due to its inability to meet power demand.

In Ireland, data centers are expected to consume 1/3 of its electricity by 2026.

And Ireland’s electricity system already emitted an alert last year that electricity supply was at risk of shortfall.

So EirGrid, Ireland’s power company, has placed a moratorium on new data center construction in Dublin through 2028.

Data center construction timelines have been extended by as much as six years due to power constraints.

Data centers won’t be Blackstone’s “best investment ever” if they can’t get any power.

Fortunately, their properties currently under development have already contracted for access to power.

But other data center developers have been less fortunate—and have been forced to identify alternative solutions, like building their own expensive power plants.

Without luck in that endeavor, they will be the proud owners of multibillion-dollar sheds.

Without a fix to the power dilemma, the data center industry will never catch up to demand.

But it’s going to get worse before it gets better.

Because the current race to catch up on the data center backlog is only prologue. It’s mostly just cloud providers catching up from the pandemic-era data boom.

There’s now a new, rising source of demand for data centers. It requires significantly more power than the ones currently being built.

How much more? It could use as much power as 100 million people—in the U.S. alone.

The data center market has and will continue to explode over the coming years. Get all of my latest ideas here.

Regards,

Marin

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.