Imagine running a business where every year your costs climb, but the reward for all that work keeps shrinking.

That’s the reality for Bitcoin miners in 2025.

Mining Bitcoin isn’t a magic process. It’s math on steroids where rows of machines race to solve cryptographic puzzles.

The first to solve one gets paid in new bitcoins, a kind of digital prize.

Every four years, Bitcoin cuts mining rewards in half. It’s called “halving”, designed to create scarcity like gold.

Except gold doesn’t halve your paycheck while your costs double.

- The numbers are brutal: In 2020, miners earned 6.25 bitcoins per block.

- After 2024’s halving, they earn just 3.125.

Meanwhile, energy prices climbed 40% and mining difficulty hit all-time highs, pushing break-even costs to $90,000–$100,000 per Bitcoin.

Same electricity bill. Same equipment costs. Half the revenue.

That squeeze isn’t new, it’s by design.

Bitcoin’s halvings force economic resets, clearing inefficiency and setting up the next phase.

At today’s prices, the best operators squeeze single-digit profits. The rest pivot to AI hosting or shut down. This consolidation phase is washing out weak players.

As supply growth slows and inefficient miners exit, price must eventually rise to rebalance incentives.

The numbers tell the story…

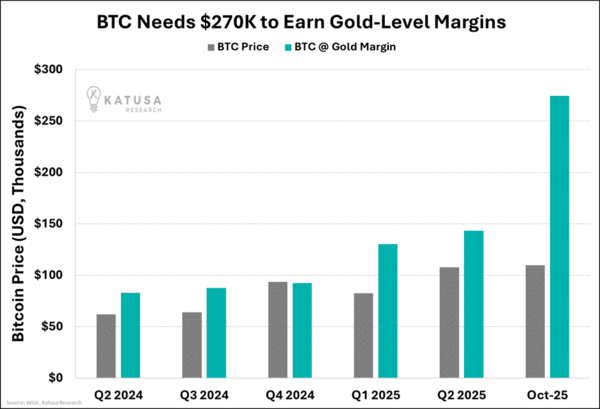

Bitcoin Needs $270,000 to Match Gold Mining Profits

Based on today’s data and our calculations…

Bitcoin would need to trade near $270,000 just to match the margins gold miners enjoy right now at $4,000 gold.

Think about that number for a moment. It’s not a price target. It’s a reality check.

It says that at current costs and current technology, Bitcoin mining has fundamentally unequal economics compared to gold mining.

One can scale margins smoothly. The other hits halving walls every four years.

Both chase scarcity, but they get there in different ways. Gold grows steady; Bitcoin grows through stress.

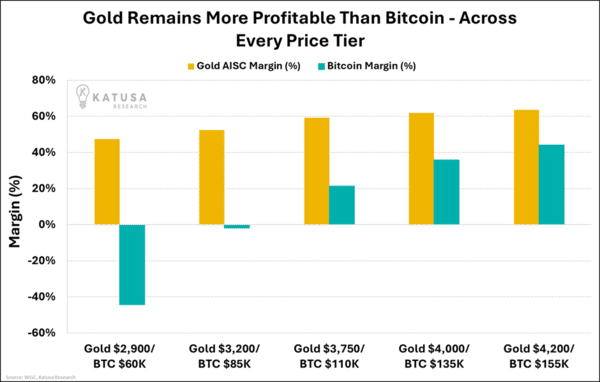

Monster vs Minion Margins

When gold trades at $2,900, miners earn healthy margins around 47%.

Push that to $4,200, and margins stretch past 64%.

Gold’s rally has comfortably outpaced the steady creep in costs.

Bitcoin tells a rougher story. At $60,000, miners lose money, roughly -44% (negative) margins.

Even if Bitcoin rockets to $155,000, profits rise to only 44%.

To put things into perspective and compare apples to apples:

- Bitcoin would need to trade near $270,000 per bitcoin just to match the average margins current gold producers enjoy right now at $4,000 spot gold.

Every halving cuts rewards. Every hardware cycle raises costs. The “digital gold” (Bitcoin) lags the margins of the real thing.

The Power Problem Bitcoin Can’t Solve

Beyond the halving math, Bitcoin’s margin squeeze runs deeper.

Power eats over 70% of a miner’s costs. Of course, gold producers hedge fuel or lock in long-term deals.

But Bitcoin miners can’t. They run nonstop, and many are on spot energy prices, which fluctuate and have been increasing month after month this past year.

So, when power spikes, profits vanish.

Then comes the hardware treadmill. Every new ASIC model makes the last one a paperweight. To stay in the race, miners must keep buying, burning, and upgrading. The machinery that ruled in 2023 is dead weight by 2025.

It’s now a grind, not a gold rush anymore.

The business looks less like a tech breakthrough and more like a capital-heavy industry learning how to adapt.

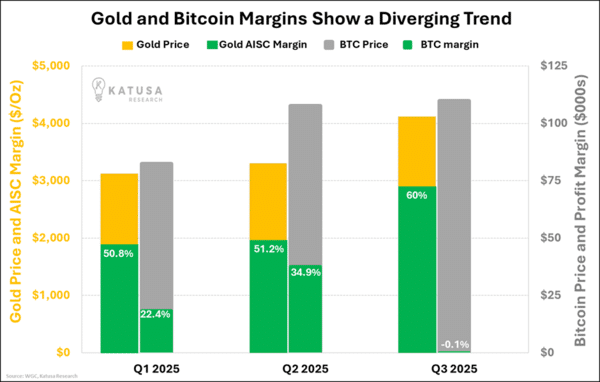

The Gap Is Widening, Not Closing

And that gap you saw earlier in the chart? It’s not closing. It’s getting wider every quarter…

Gold keeps climbing the profitability ladder while Bitcoin tightens through its reset phase.

- In Q1 2025, gold miners earned about 51% margins, compared to Bitcoin’s 22%.

- By Q3, gold margins hit 60%, and Bitcoin’s collapsed to break-even.

But don’t take this as a sign of failure. It’s the market doing what it always does, pushing capital toward what’s profitable today. Bitcoin is consolidating while gold is cashing in.

The biggest move now is that bitcoin miners are transforming mining campuses into AI and high-performance computing (HPC) data centers.

The Great Mining Pivot

Smart money moves like water. It doesn’t resist pressure, it finds a new path.

The biggest Bitcoin miners are converting operations to AI data centers.

- Core Scientific sold to CoreWeave for their infrastructure, not their Bitcoin.

- Bitfarms hired Wall Street advisors to find AI tenants.

- Northern Data already switched, higher revenue, predictable contracts, and no halving risk.

But here’s the connection everyone’s missing we brought up last week…

The profits from AI and stablecoins aren’t staying in crypto. They’re flowing into physical commodities.

Tether made $13 billion from their stablecoin operations last year. Their first major investment? They bought 10.5% of Gold Royalty Corp, a physical gold streaming company.

Not Bitcoin miners. Not crypto infrastructure. Actual gold in the ground.

- The pivot makes perfect sense. AI companies need 460 TWh of power by 2030 which is four times current levels.

Bitcoin miners own the exact infrastructure AI needs: massive power capacity, industrial cooling, and remote locations where nobody complains about noise.

When your margin tightens, you don’t quit, you evolve.

That’s what’s happening now.

Bottom Line

Bitcoin mining sits in a tough spot right now, but it’s part of the natural reset that clears inefficiency before the next rally.

Gold, on the other hand, is thriving. Margins are fat, and costs are steady.

The smart Bitcoin miners aren’t fighting this reality, they’re pivoting to AI.

The smartest crypto companies aren’t fighting it either, they’re buying gold.

The market hasn’t priced this divergence yet.

- Gold miners trade at historic discounts while Bitcoin miners still carry tech multiples.

That gap won’t last through Q1 2026.

When the world’s most sophisticated operators abandon digital mining for physical assets, the message is clear: the current runs toward what’s real.

Gold’s cashing in while Bitcoin catches its breath.

One is minting profits, the other is resetting for the next big charge.

Regards,

Marin Katusa

P.S. In November’s just-released Katusa’s Resource Opportunities, I reveal gold companies set to benefit from this pivot. The convergence of digital capital and physical commodities is just beginning.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.