This week in Katusa’s Investment Insights…

|

Get real-time alerts right away. Follow on X: @KatusaResearch and @MarinKatusa

When the war in Ukraine shut down pipelines and emptied storage tanks, Europe faced dark reality.

Russian gas deliveries collapsed. Industrial furnaces went cold. Energy ministers warned of rolling blackouts through winter.

Europe was exposed.

Then the ships arrived.

Tanker after tanker of American LNG docked at European terminals. Within months, the U.S. Gulf Coast became Europe’s lifeline.

The flow reshaped the entire regional market.

Whenever the crisis hits, whenever the lights flicker, whenever the system buckles, Europe turns to the same country it loves to criticize, “the evil Americans.”

America Became Europe’s Gas Station

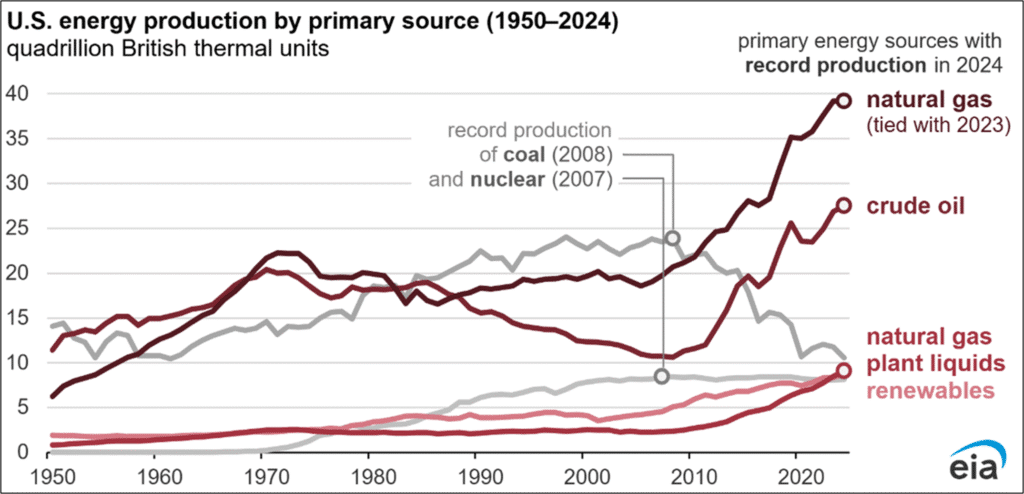

America produces more energy today than at any point in history.

Natural gas drives that dominance with 38% of total U.S. energy production in 2024. Gas has ruled domestic output since overtaking coal in 2011.

We built this massive supply machine for ourselves. Then Europe’s crisis changed everything.

When Russian pipelines went dark after Ukraine, European factories started shutting down. Storage facilities hit critical lows. Brussels warned citizens to prepare for blackouts.

Europe had spent decades lecturing America about energy policy. Now they needed American gas to survive winter.

The tankers started sailing east.

American Gas Flow Reshaped the Entire Regional Market

Within three years, the United States built itself into the core supply pillar for Europe’s energy system.

- Europe is the world’s largest LNG buyer in the first half of 2025, taking a quarter of global LNG imports.

- EU imported 53.3 million tonnes in the first half of 2025, the highest level ever recorded.

- More than half of that volume came from American exporters.

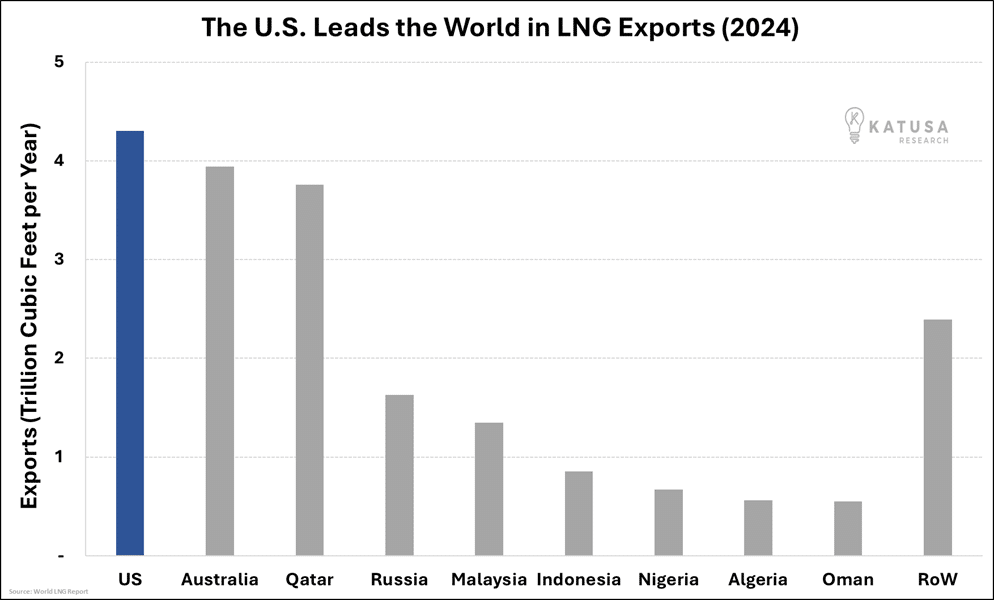

The United States ships roughly 4.31 trillion cubic feet (TCF) of LNG every year, which is 2.5 times the Russian LNG exports.

U.S. LNG Exports Jumped at a Speed No Exporter Matched

In August 2025, the U.S. shipped 451 billion cubic feet (BCF) of liquefied natural gas (LNG), up 24.1% from a year earlier.

That pace turned the Gulf Coast into the world’s busiest LNG corridor.

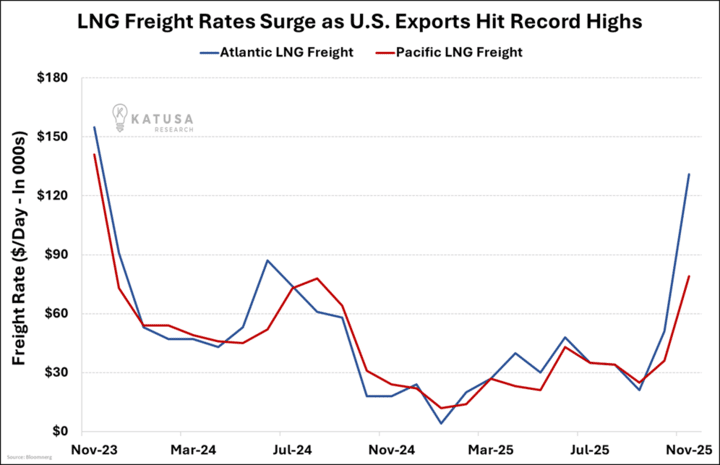

- Atlantic LNG freight rates climbed to $131,000 per day, the highest level in two years. It now costs 1.65 times the Pacific route.

That gap in the chart shows the gravity of the situation. Europe became the center of global LNG demand.

Tankers keep heading to Rotterdam, Dunkirk, Zeebrugge, Bilbao, and other European ports because Europe’s grid depends on U.S. cargoes. Vessels stay tight, rates stay high, and the Atlantic basin absorbs the bulk of the fleet.

Freight only behaves like this when the system runs close to capacity. And a system running close to capacity usually signals a structural shift.

The Great American Gas Flip

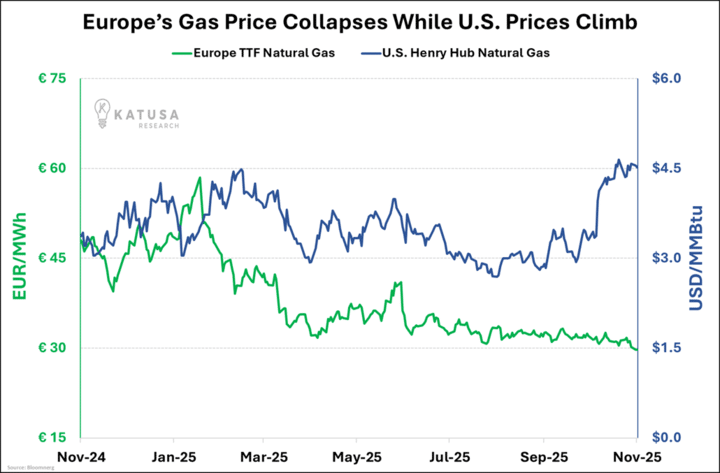

Europe’s key natural gas benchmark (TTF) dipped below €30 per megawatt-hour, a level below the €45–€50 seen in late 2024 due to ample supplies.

Meanwhile, U.S. Henry Hub prices (the main domestic benchmark) rose 1.3x from ten months prior.

For the first time in history, American ships more gas overseas than its own citizens use. The numbers prove it:

- U.S. households burned 3.05 trillion cubic feet in early 2024

- LNG export plants consumed 2.57 trillion cubic feet, up 20% from last year

Seasonal behavior pushes that gap wider.

Export plants run harder in the back half of the year because buyers in Europe and Asia rebuild inventories ahead of winter.

Household demand moves in the opposite direction and drops by roughly a quarter as temperatures warm.

Put those pieces together and the direction of the market becomes obvious…

Export volumes will move ahead of residential demand for the first time, and the internal order of the U.S. gas system will shift with it.

The strain shows up most clearly in household bills.

- Henry Hub averaged $3.60 so far this year.

- Power generators paid around $4.24.

- Industrial users paid $5.07.

- Commercial buyers paid $11.30.

- American Families paid $17.63 per thousand cubic feet.

Read that again, households pay almost FIVE TIMES Henry Hub…

And three to four times the rate paid by the biggest industrial customers.

Yes, delivery costs and utility infrastructure add some premium. But the real driver is simple: More gas leaves the country every month. Less stays home and prices adjust accordingly.

Europe gets wholesale American energy. American families got the bill.

Regards,

Marin Katusa

P.S. We’re keeping a close eye on big oil and gas plays and MUCH MORE…

In the upcoming December issue of Katusa’s Resource Opportunities, we reveal one company that’s moved over 200% and caught the attention of one of the most profitable companies in the world. Learn the name and how to become a subscriber here.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.