Key takeaways:

- Amazon reported Q3 revenue guidance of $174‒$179.5 billion, beating Wall Street’s prior consensus.

- Earnings per share (EPS) for Q2 came in at $1.68—well above the $1.31 estimate—showing robust operational efficiency.

- Retail and AWS growth, plus global logistics investments, underline Amazon’s continued expansion and innovation.

- AMZN stock volume surged after earnings, with analysts pointing to ongoing upside potential for institutional and retail investors.

Amazon Delivers a Standout Quarter: Revenues and Growth Outpace Expectations

Amazon once again captured the spotlight following its latest quarterly earnings announcement, reporting clear strides across its business lines. For Q2 2025, Amazon posted revenue of $167.7 billion, which reflects a 13.3% year-over-year increase, easily outpacing analyst forecasts of $161.8 billion. EPS for the quarter hit $1.68, handily beating the Wall Street consensus of $1.31—a positive deviation of over 28%. The company’s own revenue guidance for Q3 lands between $174 billion and $179.5 billion, signaling confidence and momentum heading into the peak retail season.

Amazon Web Services (AWS) continues to drive growth, along with the core retail segment. The technology giant’s recurring investments in global logistics, automation, and artificial intelligence underline the operational strengths behind these figures. Amazon’s annual revenue now stands at $637.96 billion, while net income reached $59.25 billion over the past year, confirming its standing among the world’s most profitable and innovative companies.

Innovation and efficiency programs remain center stage for Amazon, including efforts in supply chain optimization and deeper integration across markets worldwide. This strategy is reflected in operating margins and the sustained acceleration of key business segments—from Prime services to third-party marketplaces and AWS’s expanding client roster.

Guidance Signals Optimism: What Investors Are Watching This Fall

Attention now turns to Amazon’s Q3 forecast, with management projecting revenue between $174 billion and $179.5 billion—exceeding analysts’ consensus of $172.8 billion. This bullish guidance not only supports expectations of a dynamic holiday season, but also demonstrates management’s strong conviction in the resiliency of its e-commerce and cloud segments.

Guidance for next year is also robust, with analyst projections showing anticipated earnings per share rising to $7.44 in 2026, up nearly 18% from current levels. The ongoing focus on logistics and cloud infrastructure modernization is seen as a pivotal lever for maintaining the company’s leadership in global commerce and technology.

The growth narrative isn’t limited to the U.S. Amazon continues to expand internationally, laying groundwork for further gains in Europe, Asia, and Latin America—areas that are expected to play a critical role in future earnings cycles.

Stock Volume Spikes: How Wall Street Is Reacting to AMZN’s Performance

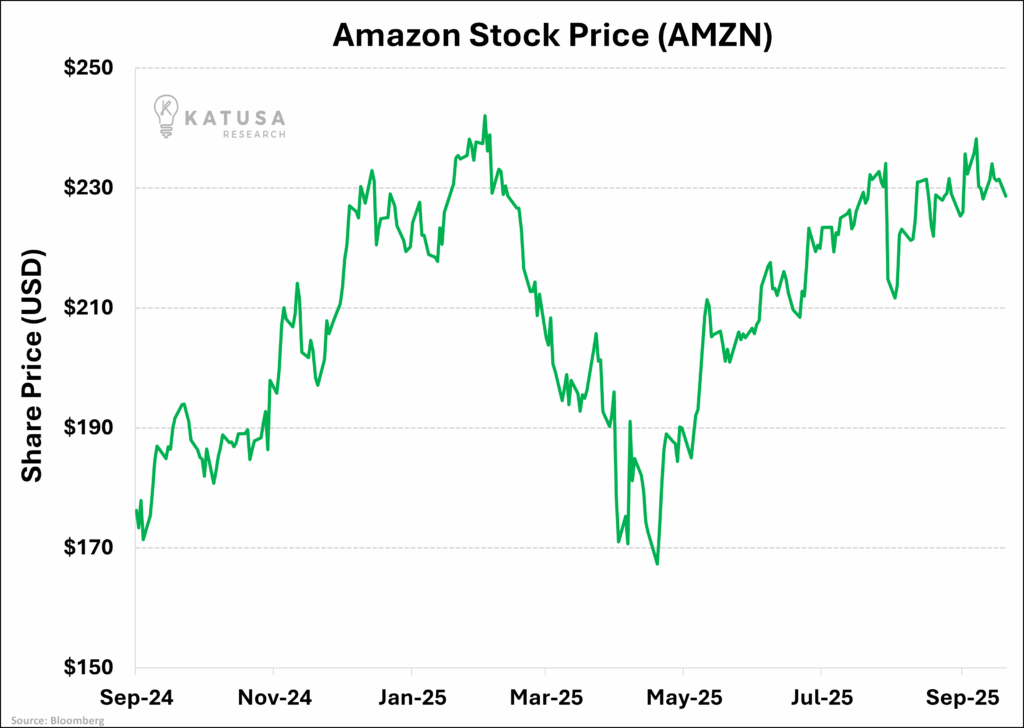

Following the Q2 earnings surprise and upbeat Q3 guidance, AMZN stock saw an immediate uptick in trading activity. Investors reacted strongly; trading volume jumped notably as both retail and institutional traders repositioned ahead of year-end. The stock price prior to earnings was $234.11 and, despite a subsequent minor dip, the market’s focus remains on Amazon’s longer-term earnings power and margin improvements.

The company’s current price-to-earnings ratio is around 35.29, while the forward ratio stands at 36.68. Analysts predict a 17.9% annual EPS growth for Amazon, indicating strong medium-term potential. Quarterly swings are common in big tech, but the recurring pattern of exceeding estimates and raising guidance reveals why investor sentiment remains solid.

Market strategists emphasize Amazon’s diversified business, robust cash flows, and innovative edge as foundational advantages, supporting ongoing interest from large funds and long-term holders. Those monitoring options and volatility have also noted increased derivatives activity, suggesting bets on continued price momentum in the coming quarters.

What’s Next for Amazon? Eyes on Expansion and Earnings Power

Looking ahead, Amazon is well-positioned to capitalize on key holiday shopping trends and the rise in global e-commerce demand. The company’s consistent reinvestment in technology and logistics, paired with a solid leadership team, continues to draw favorable reviews from both buy-side and sell-side analysts. For investors, AMZN offers a unique combination of stability, growth, and recurring innovation—a rare trifecta in today’s shifting market.

With both operational strength and forward-looking strategies, Amazon remains a core holding for global institutional investors and an attractive opportunity for retail portfolios. The next quarterly earnings report, scheduled for October 30, 2025, will be closely watched as a bellwether for broader retail and tech sector fundamentals.