Dear Reader,

When the ‘Oracle of Omaha’ offers investment advice, it’s time to pay attention.

Buffett mentioned that Canada looks appealing, which means there is value for his potential investments.

So let’s put our Berkshire hat on…

The Buffet Indicator is the ratio of the total value of the stock market, relative to GDP.

This indicator can be applied to any country. Below is an example.

The Buffett Indicator posits that the stock market’s value should align with the country’s GDP. However, take note that the US stock market (the numerator) is forward-looking, reflecting future earnings.

In contrast, GDP (the denominator) is backward-looking, measuring past economic performance.

This makes the comparison somewhat mismatched, like apples to oranges.

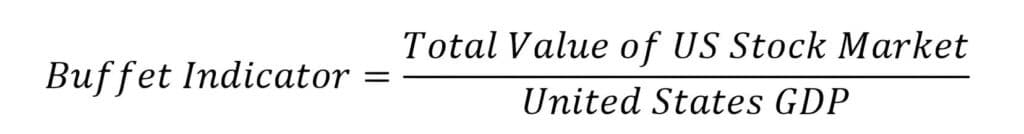

That said, let’s put Warren’s indicator to work, since 1970.

What we can infer from this chart is that the value of the US stock market has grown in value faster than US GDP.

This emphasizes the point that the stock market is more forward looking today than it was previously.

It is betting on growth well in advance of GDP growth.

An interesting tidbit of information came out of his mouth at the recent AGM in Omaha.

“We do not feel uncomfortable in any shape or form putting our money into Canada. In fact, we are actually looking at one thing right now.”

“There are things we actually can do fairly well that Canada could benefit from Berkshire’s participation.”

OK so let’s dissect this, the oracle has given us a big hint.

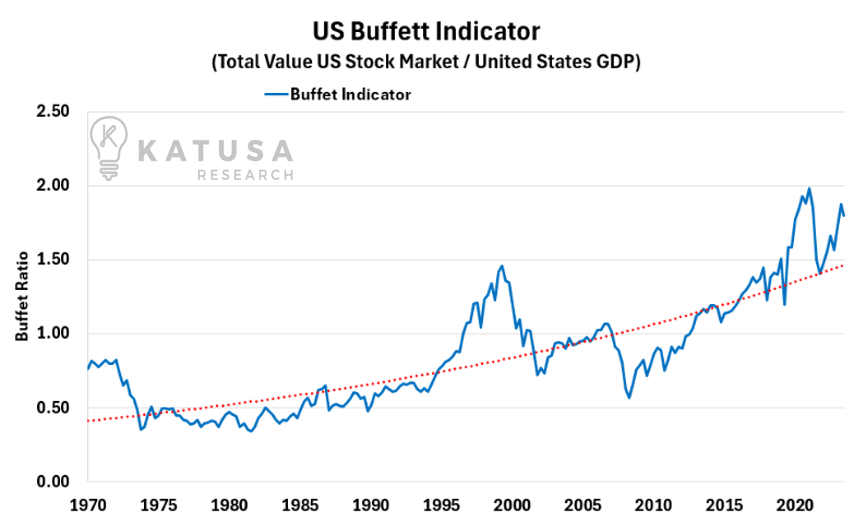

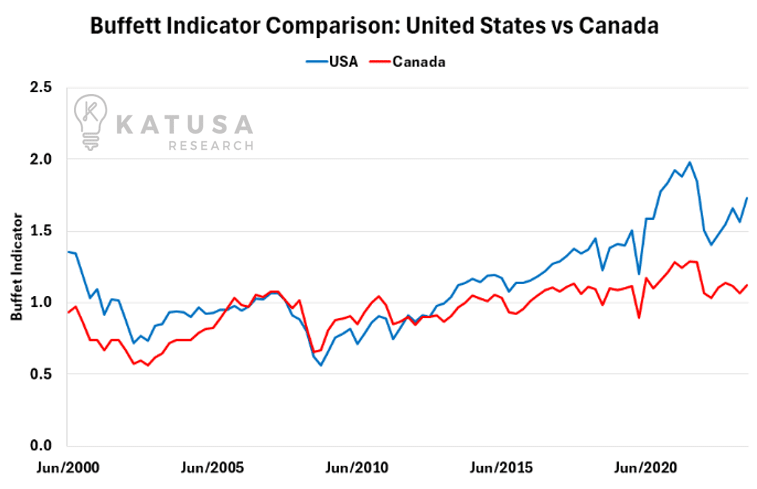

Let’s start with Warren’s indicator and apply it to Canada, total stock market value relative to GDP.

Now in the next chart, you can see up until 2015, the economies have trended similarly.

However, since 2015, the United States has begun to pull away and this was magnified in the post-pandemic recovery.

Ironically, 2015 is also when Justin Trudeau was elected Prime Minister of Canada, and the Federal government has been run by the Liberal Party since.

Today, US valuations remain steeply higher relative to Canadian valuations according to the Buffet Indicator.

Does that Mean Opportunity? Let’s Find Out

As we can see, using the Buffett Indicator, Canada is much cheaper relative to the United States.

- The United States is trading at 187% of GDP, whereas Canada is trading at 112% of GDP.

From a value proposition, this ticks the box.

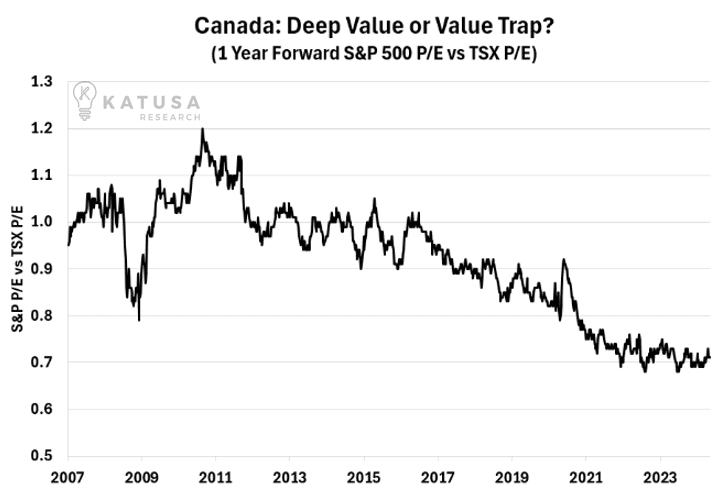

Now, looking just at the valuation of companies excluding the impact of GDP, we can see that US stocks have consistently seen valuations increase relative to Canadian equities.

The chart below shows the Price to Earnings ratio of S&P 500 companies relative to the TSX.

- If the ratio is less than 1, US equities are trading at a premium to Canadian equities.

- If the ratio is greater than 1, Canadian equities are trading at a premium to US equities.

Currently, Canadian valuations are hovering near the steepest discount since at least 2007.

Berkshire 2.0

Warren Buffet is 94 years old, and for the first time, he was up on stage without his most trusted business partner and friend Charlie Munger who passed away last year. Instead, he had his disciples up there, Greg Abel and Ajit Jain.

Warren is still actively involved in the decision-making process, but at 94 years old, the succession plan has been laid.

- The cash war chest that Warren and Charlie built over time has reached $189 billion at the end of March 2024.

- Combined with a $300 billion investment portfolio of public securities that represents nearly half a trillion dollars.

Buffet has long said he doesn’t want to do small deals and wants to focus on needle moving investments.

Given the portfolio size and cash position, this should indicate a position of at least $5B with the ability to scale to $25-$30B over time.

Complicating the situation further, is that when you own too much of something, it can be interpreted as having a monopoly on a sector.

This becomes subject of significant anti-trust issues and could lead to forced retreat from an acquisition.

It’s a difficult problem for Buffet because frankly not that many businesses require that much capital. Especially so in Canada.

What Warren Likes / Doesn’t Like

We know that Warren loves businesses he can understand.

His rule is, if the investment thesis cannot be explained in a single page, it’s too complicated.

- He wants simple businesses with strong margins and organic growth potential.

- He always has a long-term vision and rarely takes positions for quick trades.

- He is looking for generational cash flowing assets and wants to put large sums of capital to work.

In addition, we know that Warren isn’t a big fan of gold and is well positioned in the oil and gas space through investments in Chevron (which he has been reducing) and Occidental Petroleum and has owned companies like Kinder Morgan in the past.

In his 2023 annual letter to shareholders, Warren spent over a page on Berkshire Energy and the utility sector in general.

He cited concern over the staggering capex that lay ahead for the industry and the potential break from a regulatory system that created a stable fixed return environment.

“When the dust settles, America’s power needs and the consequent capital expenditure will be staggering.

I did not anticipate or even consider the adverse developments in regulatory returns and, along with Berkshire’s two partners at BHE, I made a costly mistake in not doing so.”

Looking at the Canadian electricity landscape, I am sure Warren would love to get his hands-on large-scale hydro in eastern Canada, but there simply is nothing available for sale at a decent price.

What is for sale in Canada that is in his wheelhouse?

Buffett’s interest in Canada is rooted in solid value propositions identified using the Buffett Indicator.

While US valuations are high, Canada offers an attractive discount, making it a prime market for future investments.

We believe there’s a clue right at the top of Berkshire that indicates where Buffett’s money could flow next.

And we shared it with subscribers in this past month’s edition of Katusa’s Resource Opportunities.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.