Already being rocked by covid lockdowns…Lacklustre data coming out of the Chinese real estate sector shows a further weakening of the Chinese economy.China remains firm in its zero-tolerance policy for covid. And it’s leading to dozens of lockdowns in cities across China.

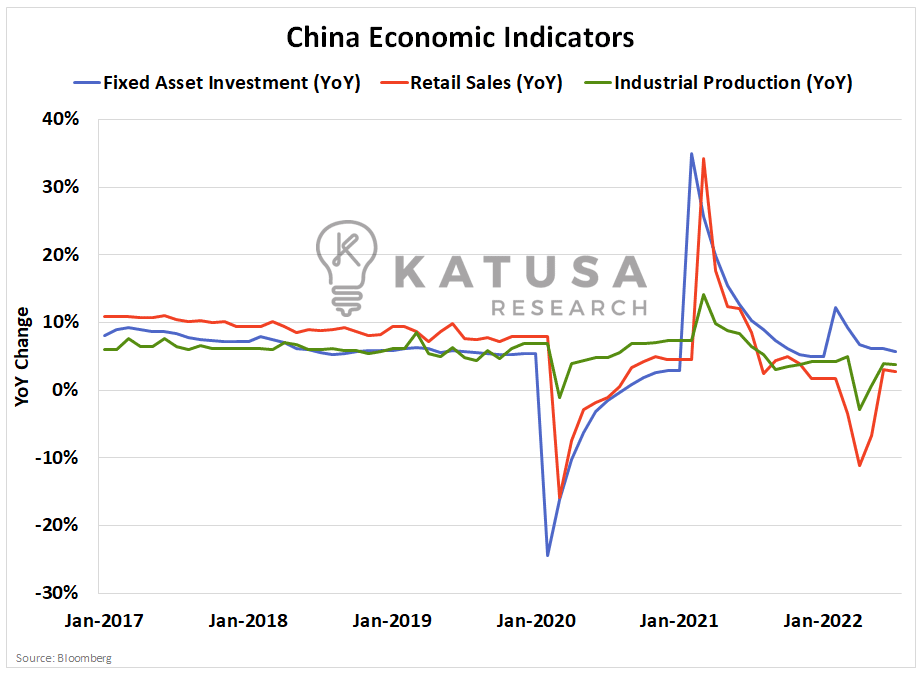

Sagging Indicators

Economic statistics released which include retail sales, industrial output, and fixed asset investment all slowed.AND missed economists’ estimates by wide margins in the July 2022 data release.This represents the weakest expansion of economic activity in China since the initial Coronavirus outbreak.

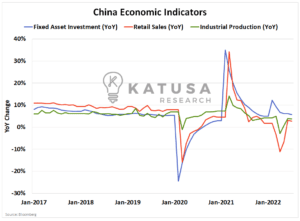

The Tik-Tok Employment Market is WEAK

In China, the government tracks a unique data point – the unemployment rate for individuals aged 16-24.

- This Gen Z demographic is working harder on their smartphones these days, as unemployment for them just surged to a record high of 19.9%.

Taking a more broad-brush approach using survey data from 31 Chinese cities, the overall unemployment rate across all demographics is 5.60%.It might feel low, but this is well above the historical national average…

In Private, Politicians Are Worried

The Chinese leadership brass privately acknowledged the country’s annual GDP growth target of 5.5% is not achievable.Mainstream economists are forecasting 4% or lower for this year.

- China has never missed its GDP target by such a large magnitude before.

The government didn’t set a target in 2020, during the first wave of the coronavirus outbreak, and only missed it slightly by 0.2 percentage points in 1998.A miss of this nature represents a major black eye for the CCP.

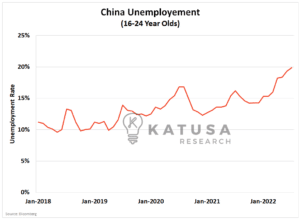

- To curb the economic slide, the PBOC (aka the Chinese Central Bank), unexpectedly cut interest rates this week.

This goes against the grain of many other nations that have seen here interest rates hiked considerably over the past 3 months.

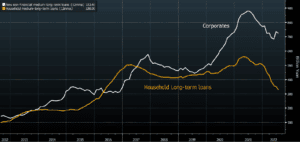

Chinese credit growth shows that monetary policy is pushing on a string…Last Friday’s data showed aggregate financing (a broad measure of credit) was almost half of what economists expected. Bank loan growth slowed to 11%, near the historical low.Below is a chart that shows the 12-month moving average for lending to non-financial corporations and households. Both averages have been trending down hard for months now.

You can always question the reliability of data, and it’s only 1 data set.

But for what it’s worth, using the July data financing and loan issuances are down a lot.

Here’s a summary of the destruction:

- In July, new aggregate social financing came in at just 756 billion yuan, declining from 5.1 trillion yuan in June. Representing -85% month-over-month change.

- New yuan-denominated loans slowed to 679 billion yuan from June’s 2.8 trillion yuan. Representing -76% month-over-month change.

- Corporates issued 86 billion yuan, down from 2.4 trillion yuan in June. Representing -96% month-over-month change.

- Bank lending to households came in at 122 billion yuan, down from 852 billion yuan in June. Representing -86% month-over-month change.

Negative Nancy: Re-Shoring China Is Just One Concern

China Inc.’s retreat from the US capital market is accelerating.

Five of China’s largest state-owned companies, including China Life Insurance and PetroChina, announced plans to delist from US exchanges.

This comes after US-China relations sank to new lows following House Speaker Nancy Pelosi’s visit to Taiwan.

The barrage of trading halts comes at a bad time for the city’s equity market, after the Hang Seng Index slid to a 10-year low last month.

Trading in 33 Hong Kong-listed stocks worth a combined $15 billion, was halted last week after firms missed a deadline to report annual results.

Troubled Chinese developers including Sunac China Holdings Ltd. and Shimao Group Holdings Ltd. were among the stocks suspended.

The high yield bond market continues its free fall, with an estimated $125 billion loss year to date.

Average junk bonds are trading at 56 cents on the dollar.

You can see there’s almost no end to the negative data.

But wait, there’s more…

Fire Sales in Chinese Real Estate

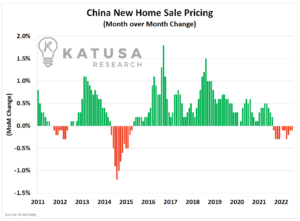

The housing slump worsened in July, with sales falling more than 28% on year and prices declining for an 11th consecutive month.

This is the worst streak for Chinese real estate since 2014.

The $90 Billion Wipeout

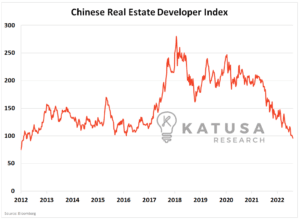

On the heels of price softening, the Chinese real estate developers index continues to plumb levels unseen since 2012.As I wrote in last week’s missive, Chinese developers are really hurting, with many facing major credit crunches this year.

- The median dollar-bond price of Chinese real estate firms was 16 cents on the dollar, versus 40 cents on the dollar in March.

- Nearly 80% of real estate debt is trading below 50 cents on the dollar.

At least $90 billion has been wiped out in China’s real-estate stocks and dollar bonds this year.And a bursting housing bubble and an intensifying debt crisis threaten to inflict even more pain.

Commodity Demand Sours

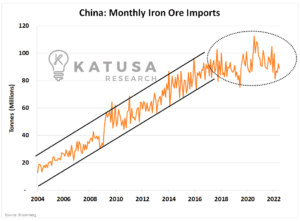

In China, the economic pain can be seen across sectors, with crude steel output dropping around 6% year-on-year last month.Iron Ore demand continues to trend lower and looks to be trending lower since the covid stimulus spike in late 2020.

Currency Devaluation on the Horizon

The PBOC will do everything in its power to orchestrate a “soft” economic landing.An expansive monetary policy, coupled with soft or declining economic growth typically would be faced with a depreciating currency.However, because the Yuan is pegged to the US dollar, this math goes out the window.The big issue for China altering its peg is that buying commodities in the international market becomes more expensive.

- Each Yuan buys fewer commodities under a devaluation scenario

Is one possible?Nothing should be ruled out, but it is not my base-case scenario.Macroeconomic risk is something that few investors truly understand or account for in their portfolio construction.I’ve outlined my entire game plan in real-time to my subscribers including an example of how devaluation works.If you want to see my premium research – consider becoming a subscriber to Katusa’s Resource Opportunities.It’s a bold strategy that some may not agree with. But fortune favors the bold.Regards,Marin