|

In this week’s Investment Insights…

|

With the election countdown on, markets are bracing for a seismic shift.

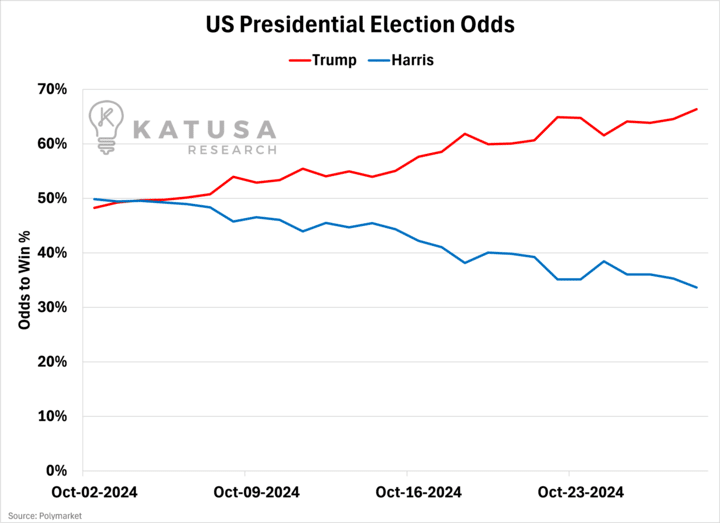

Betting markets put Trump’s chances at 66%, sparking expectations of GOP-driven, pro-business policies that could shake stocks, commodities, and send gold soaring again.

The chart below shows the odds of Trump and Harris winning the US Presidential election.

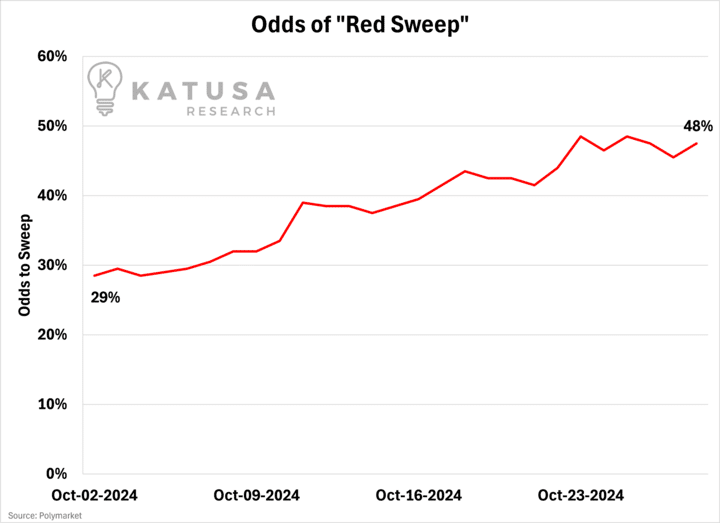

Views of a “red sweep” have taken hold, with odds of the GOP holding the Presidency, senate and house increasing to 48% over the past month.

Election Hype Is At An All-Time High, But Where’s The Volatility?

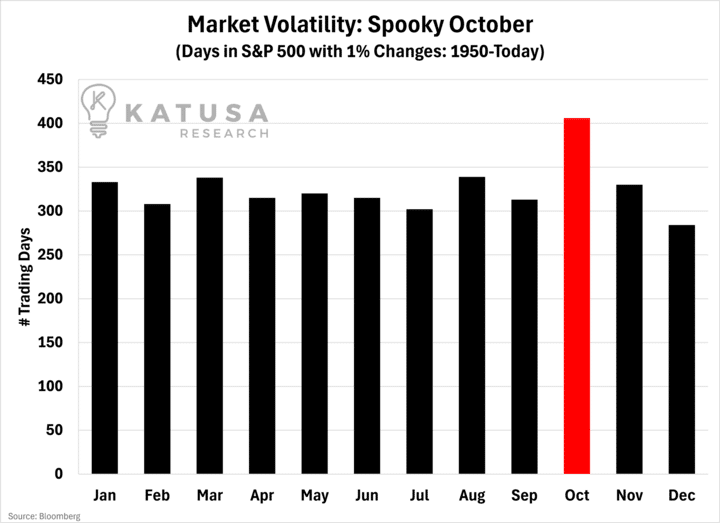

October, notorious for shaking up markets—think 1929, 1987, and 2008—has historically been a month of major crashes.

- In fact, 9 of the Dow’s 20 biggest single-day drops happened in October.

- Since the 1950s, the S&P 500 has seen over 400 wild 1% swings in this month alone.

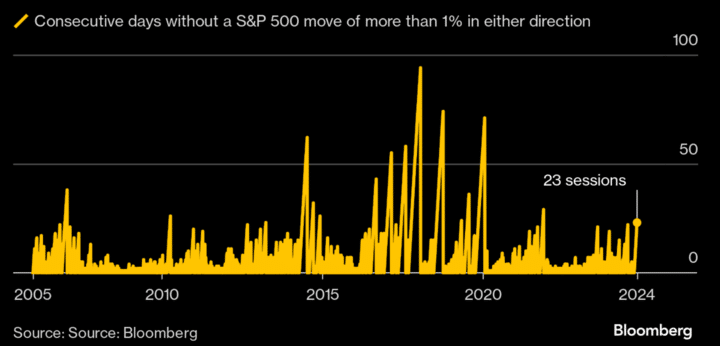

Yet this year, it’s been eerily calm… is this the calm before the storm?

This October has been eerily calm…

With 23 consecutive days without a 1% move in the S&P 500—a first in an election year since 1968.

Why the calm amidst the election buzz?

It might just be the ‘buy the dip’ mentality that’s taken hold of today’s investors, coupled with the Fed’s steady hand on interest rates.

With rate cuts on the horizon, market players are looking past immediate risks, betting on brighter days ahead.

Could Trump Make Gold Portfolios Great Again?

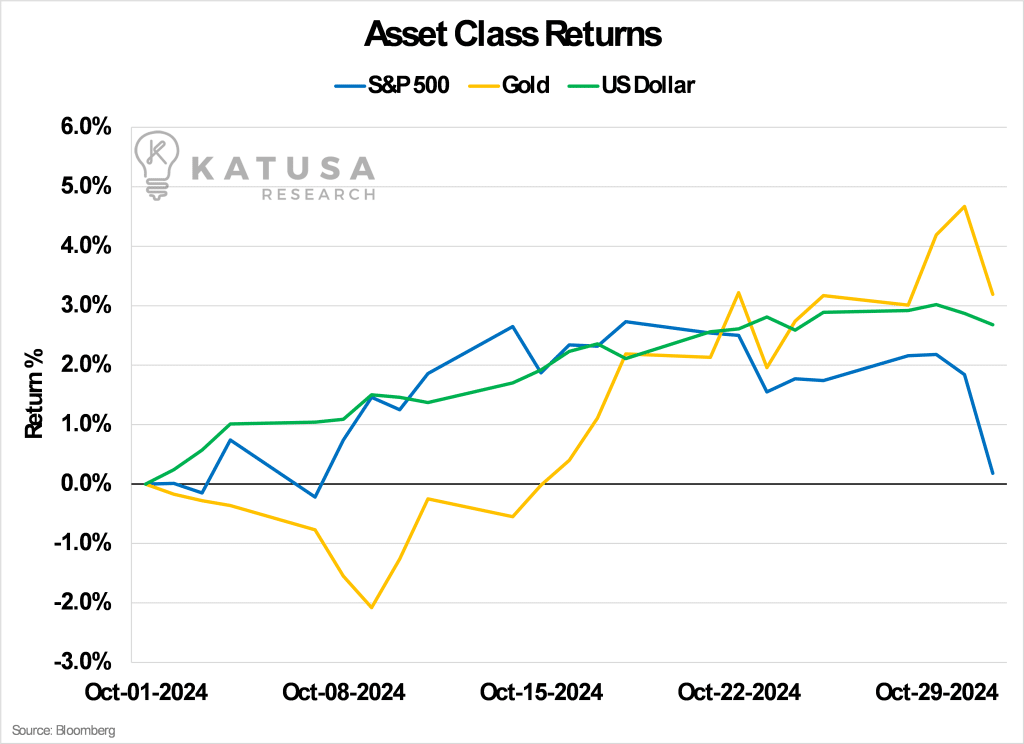

With odds shifting, many investors are preparing portfolios for a GOP-led market environment, triggering substantial moves in U.S. Treasury and currency markets.

The logic is GOP policies are typically more pro-business, while a Trump victory would likely mean new tariffs and potential economic uncertainty, with implications across every portfolio.

For gold investors, this election matters.

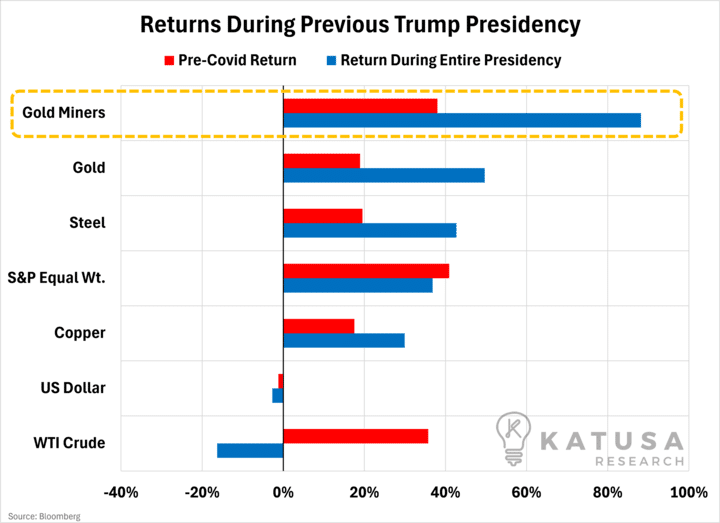

Under Trump’s previous term, both gold and the U.S. economy surged, even as the Fed hiked rates from 0.50% to 2.5%. Gold shot up over 50%, while GDP growth outpaced the 20-year average.

What about Gold Miners? They were on fire, soaring nearly 90% during Trump’s time in office.

Trump is taking a commanding lead in the polls with the backdrop of a loosening monetary policy and lower interest rates.

Combined with economic uncertainty from new tariffs, the stock market, gold, and the USD – all have strengthened in anticipation.

The chart below shows the return comparison since October 1, when Trump began to break away and gold again is leading the pack higher.

Trump’s pro-business agenda will look to extend the corporate tax rate he enacted back in 2017, while simultaneously pressing tariffs on nations who won’t play ball with the US.

Trump has no agenda to balance the budget, and current projections indicate his fiscal policy stance will lead to a deficit of $500 billion.

If Trump wins and inflation kicks back into the economy, expect gold to go a lot higher.

Rocket Fuel for Stock Markets

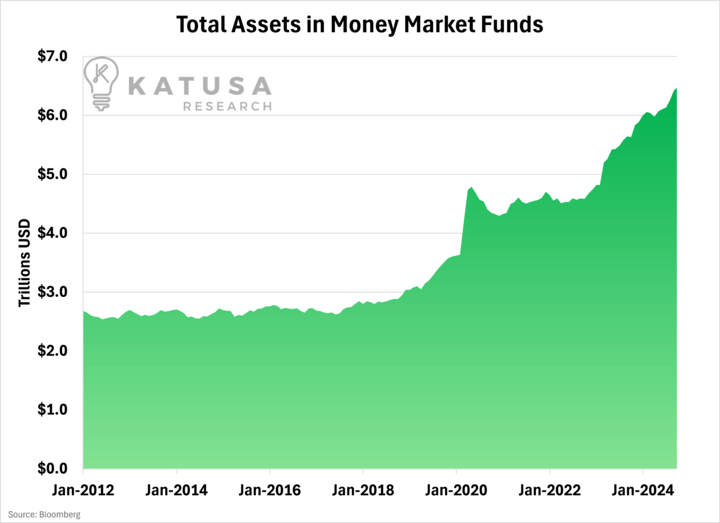

Adding fuel to the stock and gold markets is the massive amount of capital parked in U.S. money market funds. Currently, nearly $6.5 trillion sits in these accounts, collecting interest at rates over 4.5%.

As the Fed begins easing the Fed Funds rate, a flood of capital sitting in money markets could soon seek new opportunities…

Potentially creating a powerful tailwind for equities.

Back in 2016, when Trump first took office, I coined the term ‘quantum economics’ to describe an unusual phenomenon: gold and the U.S. dollar both rallying together

All the gold bugs laughed at my thesis at the time that both gold and the USD will rise. This theory has held up remarkably well, and with the current rate environment and economic backdrop, I see no reason to change course.

No matter who wins the Presidential election in November, I’ve positioned myself and my subscribers to capitalize on the bull market ahead. Click here to access my full Gold Preparation Report.

If you missed the explosive returns during Trump’s first term, now’s the time to get on board.

Regards,

Marin Katusa

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws. By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.