Three weeks ago, the United States government did something it hasn’t done since they built the atomic bomb.

The US Government wrote a check to buy direct equity in Lithium Americas.

This wasn’t a loan, nor a grant. It was a skin in the game-ownership stake.

Just two months ago, The Department of War also took a 15% equity stake in MP Materials (rare earth miner) in July 2025.

For decades, the U.S. stayed out of the mines. And just like during the Manhattan Project (which built an atomic bomb) saw the US government invested in enrichment plants, expect that also soon.

Now the signal is that the USA needs lithium secured. And the government just told you exactly how desperate they are.

The Lithium Technical “Golden Star” That Fired

Look what happened 72 hours after that check cleared.

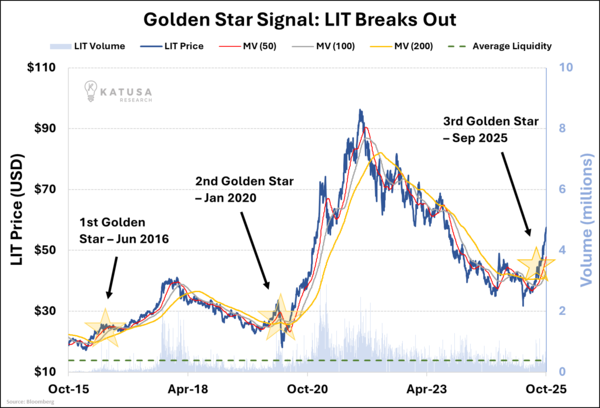

LIT, the lithium ETF that tracks the entire sector, did something it’s only done twice in history. It triggered what traders call a “Golden Star” signal, when price, volume, and three different moving averages converge simultaneously.

The first time it happened was June 2016, and LIT ran 64% in twelve months.

The Second time was January 2020. LIT ran 128%.

- Third time: September 5, 2025. Three weeks ago.

Look at that chart showing years of nothing and dead money, where a massive base formed. Then it explodes on big volume, 40% more than the average.

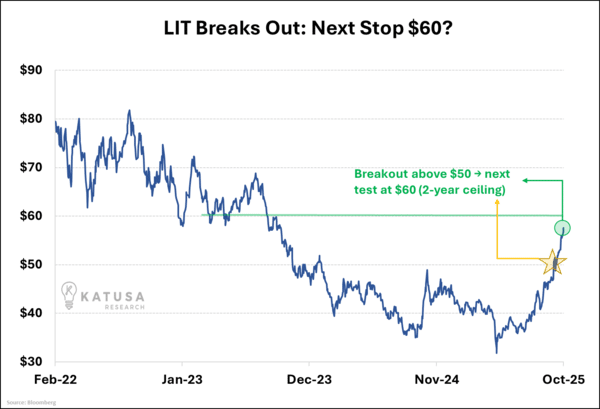

In twelve weeks, LIT ran from $38 to $57, moving 50% while you were reading about how lithium was dead, EVs were over, and sodium batteries would kill everything.

The ETF just broke above every single moving average, with the next technical target at $60. Then $70.

But here’s what created this setup we warned was coming months ago…

The 87% Collapse That Changed Everything

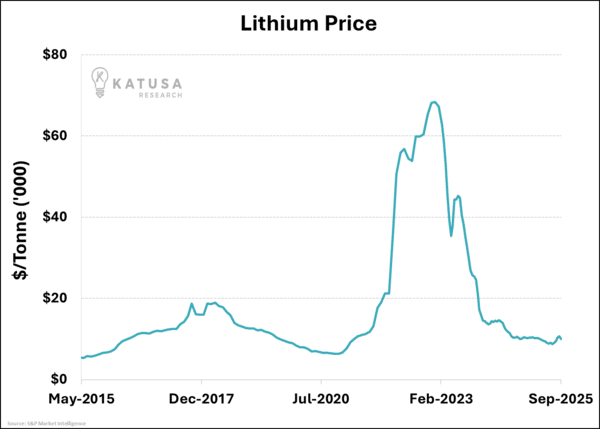

From October 2022 to May 2025, lithium prices fell 87%.

Six weeks ago, lithium carbonate was trading at $8,500 per tonne. One problem: it costs $12,000-15,000 per tonne to dig it up. So, producers did the only rational thing, they stopped digging.

The Australians shut down mines. Chinese lepidolite mines closed. Expansion plans died.

- Meanwhile, this year Tesla is projected to deliver 1.6 million cars including record Q3 delivery numbers and BYD delivered 3 million.

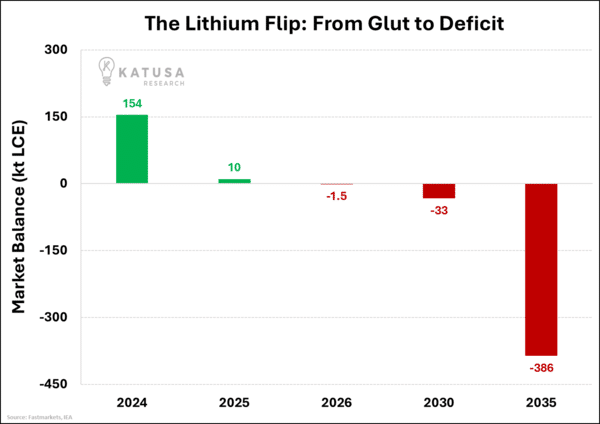

Every single EV needs 60-80 kilograms of lithium. The math was always going to break and the deficits are coming.

In 2024 the lithium market was swimming in a 154,000-tonne surplus. Next year you’re looking at the first deficit in four years.

According to the China Passenger Car Association (CPCA), new energy vehicle (NEV) retail sales in China reached a 58.5% penetration rate in September.

More than half of all new passenger cars sold in China were fully electric or plug-in hybrids.

The rapid shift to EVs in China is intensifying competition for lithium and straining supplies.

LIT is the tourist trade where you can click buy and own the major players in the sector. LIT is up 50%, but look at the actual producers:

- Albemarle: $86 (was $325)

- Piedmont: $7 (was $82)

- Standard Lithium: $3.86 (was $12.37)

The biggest lithium producer in the Americas is still down 78% while lithium prices are already recovering.

When lithium goes from $9,978 to Goldman’s $17,077 target, Albemarle doesn’t double, their margins go from negative to 40%. The stock goes up multiples. Maybe more.

The Three-Wave Pattern That Rhymes

I’ve invested in many commodity sector booms since 2003. Uranium, rare earths, lithium in 2016, lithium in 2020. There’s a familiar pattern every time:

Wave 1: The ETF moves. Institutions need exposure fast. (Now – LIT up 50%)

Wave 2: The producers recover. Real companies with real assets run 200-300% while the ETF goes up another 30%. (Starting now)

Wave 3: The small caps go supernova. Explorers become producers. $100 million companies become billions.

We’re 27 days into Wave 2.

Albemarle is the largest lithium producer outside China. They’re trading at Depression-era valuations while the US government is literally buying lithium mines.

Piedmont is a major lithium company in America. Last month, it merged with Sayona to form Elevra Lithium. The new entity now trades in the U.S. as depositary receipts.

These are real companies trading like the lithium market died. Except it didn’t die. The government just injected it with adrenaline.

The Golden Star signal has a timer. Historically, the biggest gains come in the first 90 days.

We’re just weeks in, which means it’s time to start paying attention to lithium.

Later this year or early in 2026, this will be on CNBC. Jim Cramer will be pounding the table about lithium. Reddit will have “discovered” lithium and the stealth phase of the market recovery will be gone.

Right now, you’re seeing what the government saw three weeks ago: America needs lithium, it doesn’t produce it, and the companies that do are priced for bankruptcy.

It solved part of their problem by buying into a mine.

The US government doesn’t buy equity stakes in sectors that are dying. They buy them in sectors they know are critical, strategic, and in demand. Look at what happened to Intel stock.

They just showed you their cards. And expect more money to come.

LIT is proof the sector just hit an inflection point.

Regards,

Marin Katusa

P.S. My top lithium stock is up over 100% from its lows just 3 months ago. Click here to join Katusa’s Resource Opportunities and get the name and ticker symbol.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.